In the past 24 hours, the price of XRP has exceeded $3 for the first time since 2018, continuing to lead the cryptocurrency market in 2025. The 15-day increase reached 41%, leading the top 10 cryptocurrencies.

According to Coinmarkcap data, the current XRP price is only 17% away from its all-time high of $3.84. Based on the current market value of $170 billion, the token's market value has surpassed that of asset management giant BlackRock.

The rally was driven by expectations of crypto-friendly policies and regulatory reforms for digital assets in the United States, where the Securities and Exchange Commission (SEC) and Ripple have been engaged in a years-long legal battle over the sale of XRP tokens.

“The surge was driven by a growing number of partnerships, the launch of Ripple’s stablecoin RLUSD, and speculation about a potential spot XRP ETF,” Diego Cardenas, an over-the-counter trader at digital asset platform Abra, said in a note.

Ripple President Monica Long said in an interview last week that she expects the spot ETF to be approved "soon" as approval from the new administration will speed up the process. In addition, Ripple's leadership has been in direct contact with the incoming US government, with CEO Brad Garlinghouse and Chief Legal Officer Stuart Alderoty recently meeting with Trump, indicating that the two sides may cooperate on shaping a regulatory environment that is favorable to digital assets.

Furthermore, the current surge in XRP prices coincides with the continued accumulation of “whales” holding between 1 million and 10 million coins.

Analysis firm Santiment noted that addresses holding between 1 million and 10 million tokens have accumulated 1.4 billion XRP, worth approximately $3.8 billion, since November 12, and have continued to accumulate even during price consolidation following the early December 2024 high.

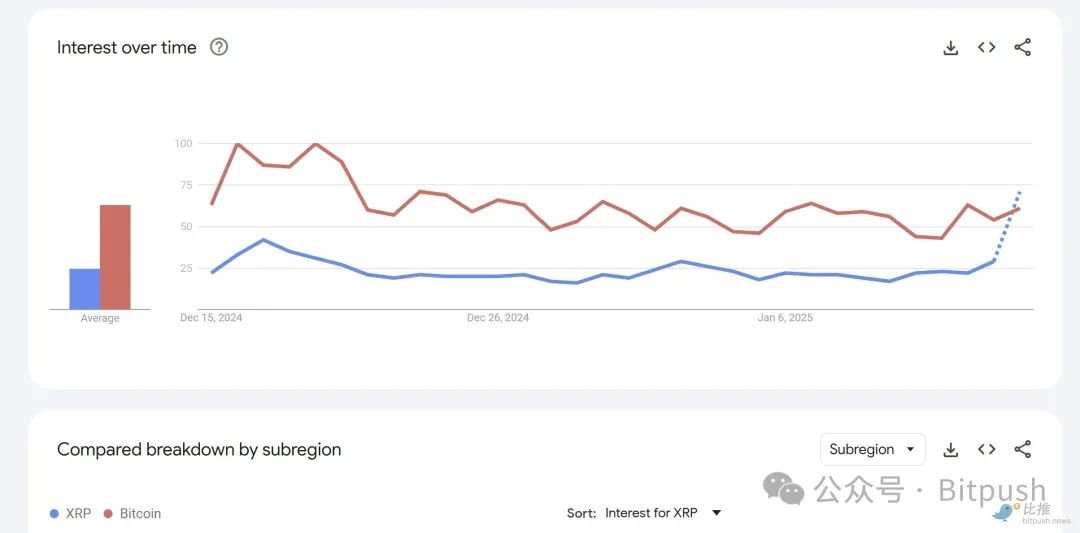

XRP surpasses Bitcoin in Google searches

XRP prices and its holders have shown strong resilience in the past few weeks. Google Trends data shows that on January 15, global Google searches for XRP surpassed Bitcoin. In the past year, XRP has led Bitcoin in search volume twice, most recently in November 2024.

Analyst: XRP's rise is driven by spot investors

Open interest in futures contracts for major assets such as Bitcoin and Ethereum hit all-time highs in 2024, highlighting the importance of derivatives markets during bull markets. However, XRP's recent gains have been driven primarily by spot investors.

Dom, an order flow analyst, said that XRP's retest of $3 was driven entirely by spot buying. He pointed out that during the period when XRP's weekly increase reached 15%, XRP's funding rate and spot buying premium did not rise significantly. Dom said: "If this happened to Bitcoin, I would directly say that we are about to see a big rise."

At the same time, some industry insiders also pointed out that if the two assets continue to rise at the same price ratio, XRP will have the potential to outperform Ethereum.

At the same time, some industry insiders also pointed out that if the two assets continue to rise at the same price ratio, XRP will have the potential to outperform Ethereum.

Sovrun co-founder Jeth said there is “no reason” to hold Ethereum right now. While Ethereum has better “fundamentals,” XRP has positive regulatory support as the first pro-cryptocurrency U.S. government is set to take office on January 20.

From a technical perspective, XRP shows strong growth indicators, having broken out of its bull flag pattern after rising 105% by the end of 2024. However, its relative strength index (RSI) of 79.5 suggests that the coin is overbought, which could lead to a short-term pullback or consolidation.

Technical analyst Dark Defender on the X platform highlighted an “upward breakout” on XRP’s monthly chart, drawing an analogy with the 2017 bull run, when XRP rallied 1,022%.

The analyst believes that based on the Fibonacci retracement level of the 2017 increase, the XRP price may rise to $10.23 or even $18.23 in the short term. Whether it is "landing on the moon" or "landing on Mars", both target values are likely to be achieved in 2025.