Although the 2024 Ethereum Bangkok Devcon Conference is regarded as the largest in history, its market enthusiasm seems dull. The sharing content at the venue lacks highlights, which contrasts with the sluggish performance of the secondary market. ETH, the "engine" of the bull market in previous years, seems particularly sluggish this year. The ETH/BTC exchange rate has repeatedly hit new lows. When BTC broke through $93,000, ETH still hovered around $3,000.

Ethereum’s lack of innovation and shrinking ecosystem

In this round of bull market, it is not difficult to find that Ethereum is facing the dilemma of lack of innovation and shrinking ecology. The ICO boom in 2017 and the DeFi Summer in 2020 have injected strong momentum into the Ethereum ecology, but in this round of bull market, Ethereum has not led the trend of technological innovation, and there is no phenomenal application narrative to drive new funds and new users, resulting in gwei remaining in single digits for a long time even in the bull market.

In PoW, the value support of Ethereum comes from the computing power of mining machines and energy consumption. After the transformation to PoS, it is deeply bound to the ecosystem. The prosperity of the ecosystem can attract popularity, which in turn drives capital inflows, drives up prices, and ultimately promotes pledges and maintains the stability of the blockchain. On the contrary, without an ecosystem, demand decreases, prices fall, and the destruction speed is slower than expected, which leads to inflation and directly weakens its value storage potential. This is a fatal challenge for Ethereum with the PoS mechanism.

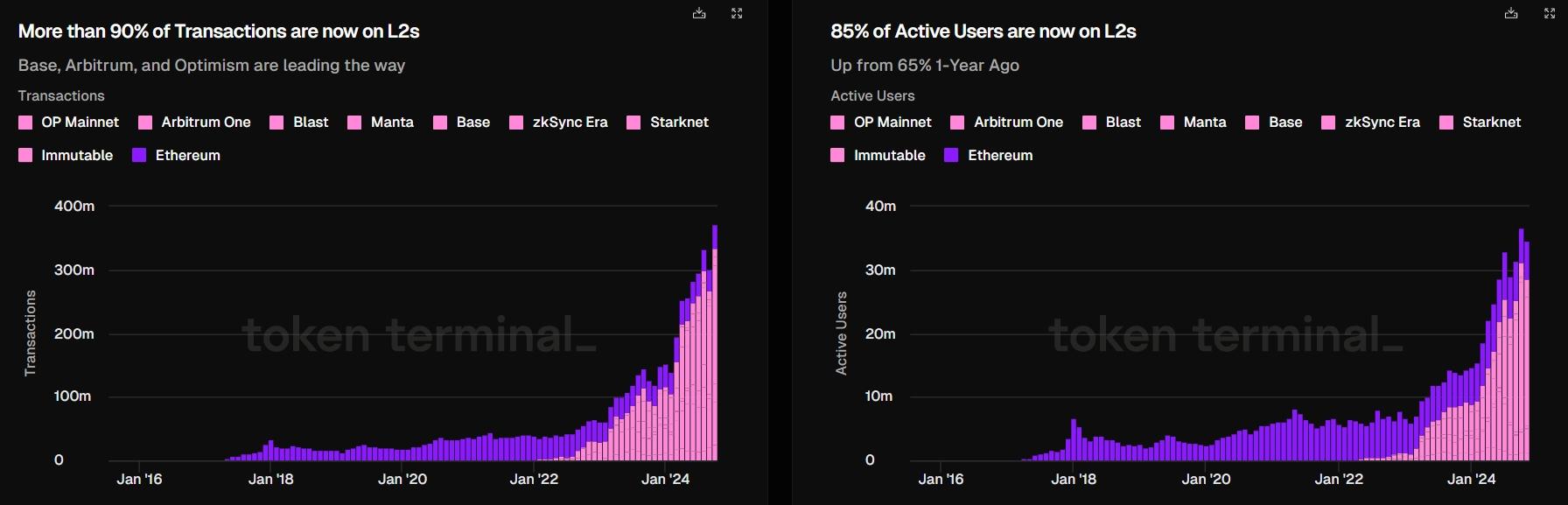

High-speed and low-cost blockchain experience is the pursuit of all public chains. A key strategy of Ethereum in the past two years in terms of scalability is to vigorously develop L2, but the functions of L2 and the main chain are highly overlapped. When the ETH ecological cake has not been further expanded or even the ecology is lost, hundreds of L2s have become "parasitic and bloodsucking" on Ethereum. There are L2 princes fighting for power internally and new and old public chains swallowing up and eroding externally, which has led to the gradual weakening of ETH's voice and competitiveness.

Over 90% of transactions and 85% of active users now use L2

There is an "impossible triangle" in blockchain. Ethereum focuses too much on technical narrative and idealistic governance structure, sacrificing performance, which is far from the current market expectations. Nowadays, even Bitcoin, which is regarded as the spiritual belief of the industry, has gradually been tamed by regulators and settled in the hands of more and more Wall Street institutions. This makes people wonder whether the concept of decentralization is still important in the face of price?

When the spirit of encryption cannot be converted into profits, the power of the market will undermine all beliefs and investors will choose to vote with their feet.

Meme Economy and Solana’s Counterattack

In stark contrast to Ethereum’s downturn, Solana has returned to center stage thanks to the rise of Meme culture.

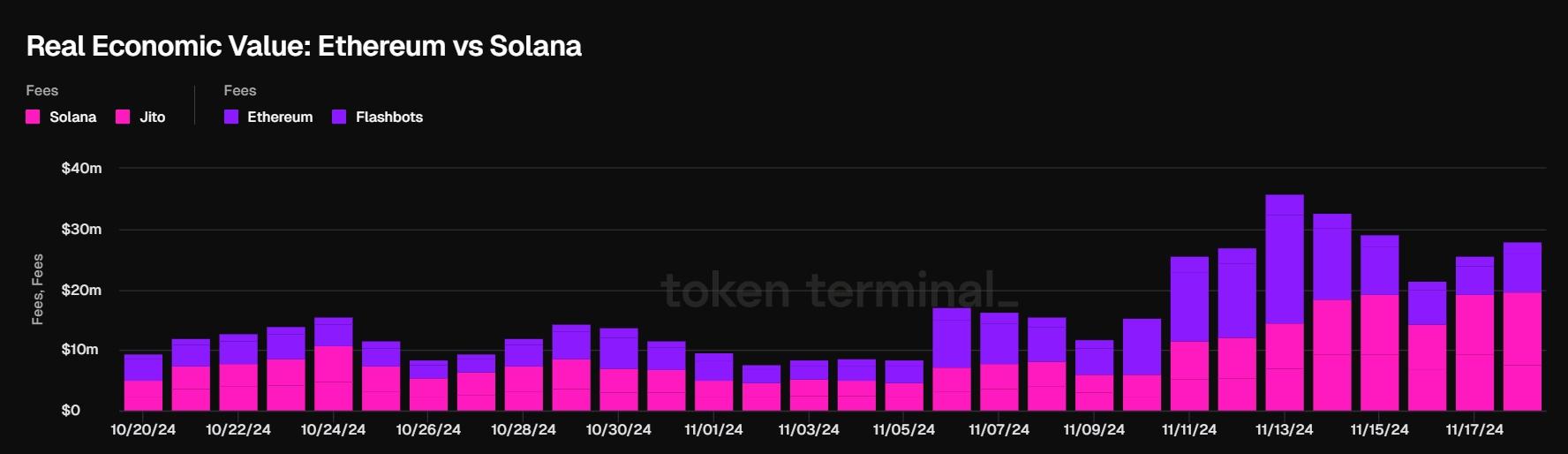

In the case of abundant liquidity and lack of application narratives, memes, which are free from the inherent narrative constraints of the currency circle, have become the best carrier of liquidity. Most of the Meme community is on Solana. The phenomenal meme culture has attracted a large number of gold diggers, driving a significant increase in the activity of on-chain transactions. Data shows that since late October, Solana's on-chain daily fees have exceeded Ethereum for many consecutive days. The popularity of the Meme track has allowed various funds to continue to enter the Solana ecosystem, making it the hottest ecosystem in the circle.

This round of bull market is regarded as a BTC and meme bull market. Solana has become the center of new meme coins through its low fees and high throughput, which is very similar to the grand occasion of Ethereum ICO in 2017. SOL benefits from the accumulation of Meme coin value, which is analogous to Ethereum ICO and ETH in 2017.

Solana has come back to life after the collapse of FTX. Low fees, low latency and high throughput are naturally beneficial to various applications. When the overall market heats up, its ecology is not left behind and has performed well. The current Meme craze has driven the popularity of the entire Solana ecology, with a trend of "my flowers bloom and all other flowers die". Previously, "ETH killer" was the pursuit of many public chains, but now the goal has changed. The market is now competing on whether Sui can become the Solana killer.

Conclusion

The decline of Ethereum and the rise of Solana are a contrast that cannot be ignored in this round of bull market. On one side, the old aristocracy is struggling and adjusting itself, while on the other side, the emerging forces are rising rapidly and being sought after by the market. This clash between the old and new forces reflects the transformation of the crypto market from technological idealism to pragmatism.

Although Ethereum's performance in this round of bull market is disappointing, its strong developer community, continuous technological iteration capabilities, and adaptability to emerging market needs still provide hope for its future development. Ethereum needs to strike a balance between long-term technological innovation and application implementation, and promote ecological development with practical applications. Only by finding an ecosystem that balances technology and market demand can it not fall behind in the competition.