Author: kirin_alen d/acc

TL;DR

1. After the national reserve is implemented, the narrative of digital gold will make it difficult for BTC to really surpass gold;

2. AI life on the chain will bring a massive increase in population and form a trillion-level economy;

3. Will AI life on the chain believe in BTC? Yes, Crypto is the currency of AI, and BTC is the best "gold" of digital life, which will help BTC break through the upper limit;

National reserves are the last low-hanging fruit. Can the narrative of digital gold still support BTC to move above $1 million?

With Trump taking office, crypto-friendly policies are about to be released. Next year, more large companies and countries will accept Bitcoin as reserves. This trend may quickly push Bitcoin to $300,000 or even $500,000. However, the US compliance fast track cannot escape the influence of gravity, which is also the last low-hanging fruit of the rapid growth of Bitcoin's market value.

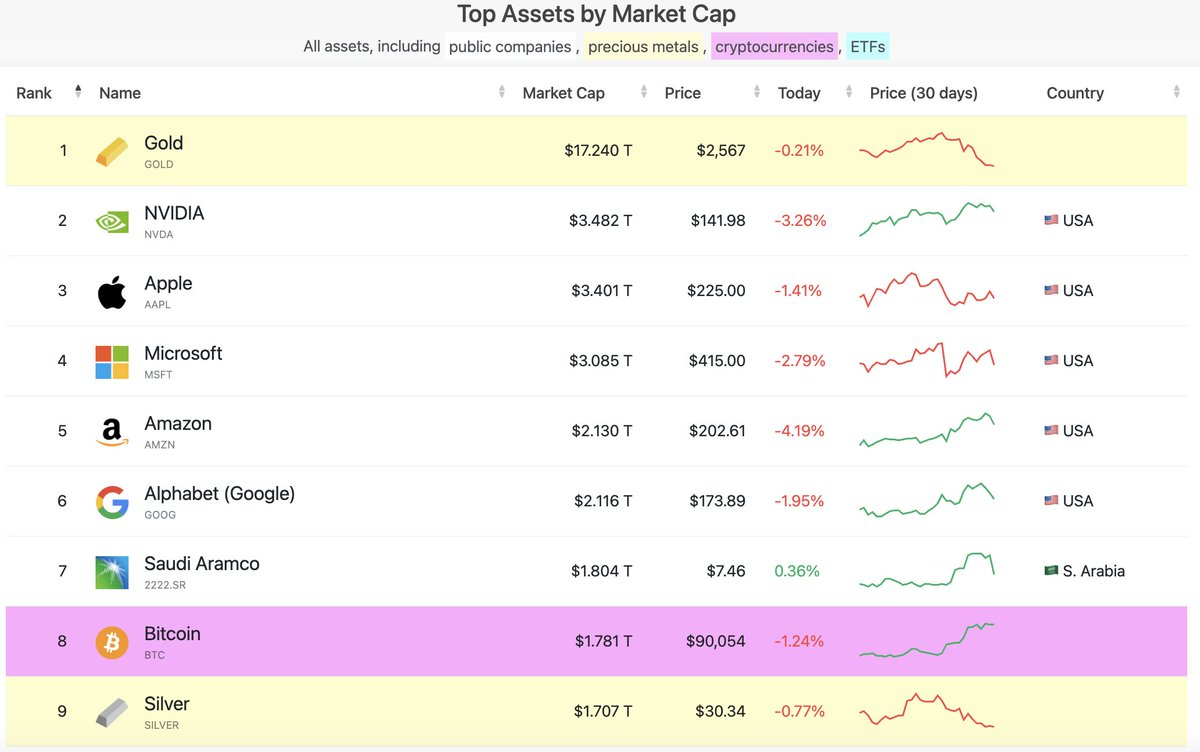

As of November 18, Bitcoin has reached $90,000, with a total market value of more than $1.78 trillion, surpassing silver to rank No. 8 in the world, and still 10 times away from the market value of gold. Assuming the market value of gold remains unchanged, Bitcoin at $500,000 will be 50% of the market value of gold. However, the closer it is to the market value of gold, the narrative of digital gold will become its bottleneck.

Obviously, Bitcoin and gold are both memes of mankind.

As a Meme, its value comes from value recognition. The more believers it has, the more valuable it is. Eventually, it can be used as currency or even a store of value.

We simply summarize the value of Meme into a formula

V=∑i=1NQi⋅Ci

in,

V: The total value of the Meme;

Qi: the number of believers in the ith group;

Ci: average acceptance of the ith group of believers (acceptance is a rough indicator, for example, increasing narrative credibility, exchange transaction channels, compliance channels, etc. will increase acceptance);

Obviously, the number of Bitcoin believers and the degree of their recognition have been in a spiral upward situation (each time the recognition increases, a new batch of believers will be unlocked, and the new batch of believers can play a new role in the united front, unlocking and increasing new recognition), from the earliest Geeks, to gray industries, to cross-border payment needs, to marginal countries such as El Salvador, to this year's Bitcoin ETF, and to the possibility of becoming a national reserve of the United States in the future. With the spiral upward of believers and recognition, Bitcoin is in a stage of accelerated rise due to its acceptance by the most powerful countries and the largest companies by market value.

But with that comes an upper limit:

Let’s go back to the formula and look at several possibilities for increasing the price of Bitcoin:

Normal linear thinking version:

1) Incorporation into national reserves of various countries

2) Technology giants, large companies and financial institutions buy in

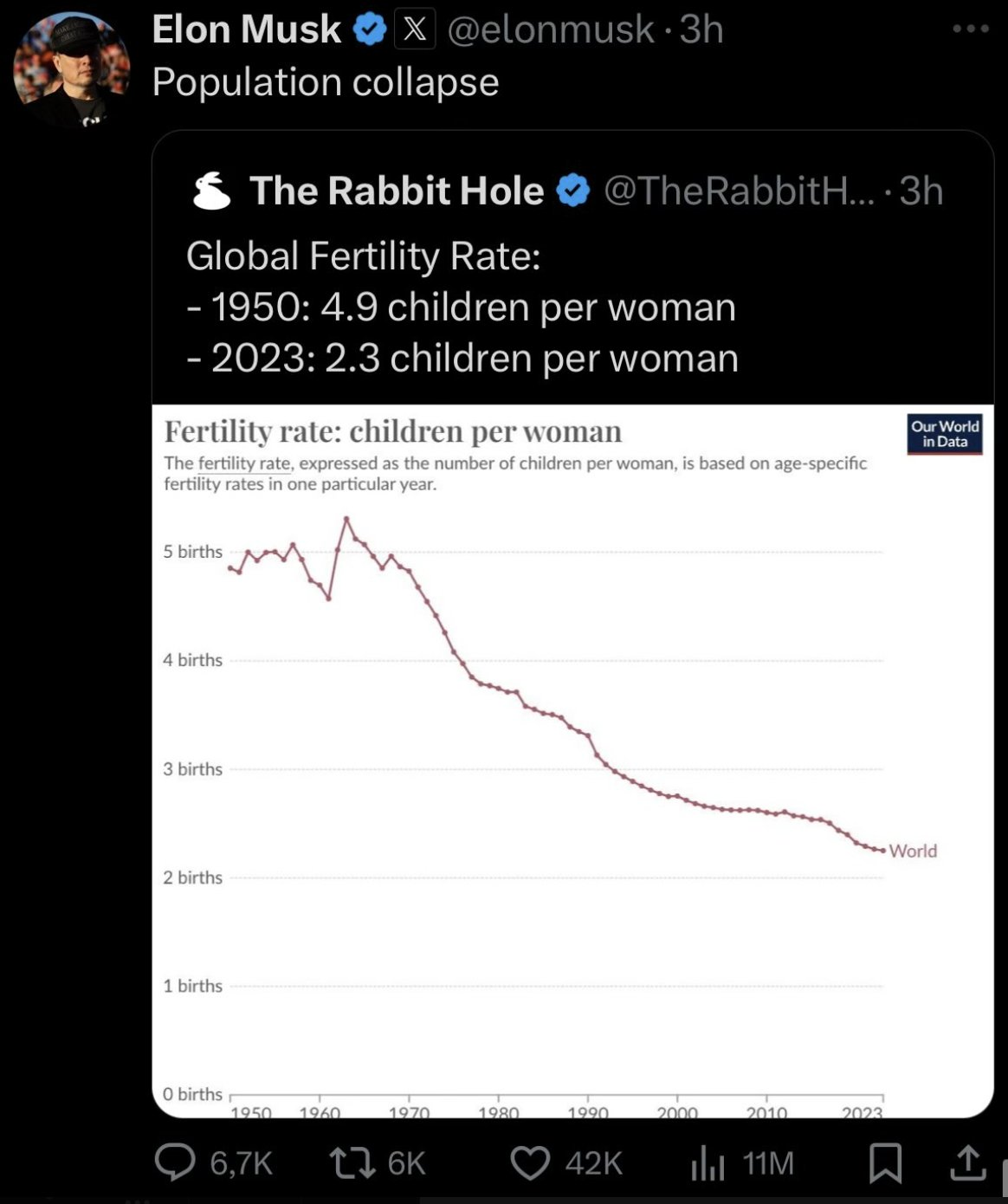

These are happening, and when they all happen, it will be the end of the story. However, gold has been a meme for thousands of years, and its recognition among the entire human race will remain higher than that of Bitcoin for a long time. One way to change is to wait for those who believe in gold more to die, and for young people who believe in Bitcoin more to grow up and gain the right to speak. However, the value storage properties of gold and Bitcoin are related to the total economic volume, which is essentially an economic function of population. As Musk said, the current birth rate is collapsing. Even if young people who believe in Bitcoin more come to power, the population continues to decline, which will also lead to a decline in the total value that can be stored.

Population collapse

Therefore, even if Bitcoin becomes the national reserve of the United States, it is very likely that this wave will become the last fast lane for Bitcoin, after which it will enter a bottleneck period and it will be difficult to further break through to $1 million.

Is there no other way?

Of course!

Let’s think about increasing Bitcoin’s market cap in a non-linear way:

1) From the perspective of improving the recognition of believers:

Mikko, the founder of Zhibao, once said:

"I think that every Bitcoin holder who uses fiat currency to buy Bitcoin is hurting and betraying Bitcoin. Therefore, I have always regretted using the fiat currency system to buy coins, which indirectly destroyed the purity of Bitcoin as a payment system and made it ultimately subordinate to fiat currency. The reason why it has become more like a risky asset is that it has become a subclass of the major asset class within the US dollar system, and is no longer an isolated island. If you embrace regulation and fiat currency, you have to accept traditional pricing methods. If they really want to play with a brand new currency, they should probably try it on Mars, where they will not be disturbed by fiat currency and banks."

Although the trend of Bitcoin prices is overly pessimistic, from a fundamental perspective, Bitcoin is indeed increasingly becoming a major asset class pegged to the US dollar.

Fortunately, Musk will really establish the Republic of Mars on Mars and start building a financial system from scratch. At that time, BTC and Dogecoin will become the native Martian currencies, and every Martian immigrant must accept BTC and Dogecoin, with 100% acceptance. (Considering that the delay from Mars to Earth is 3 minutes to 22 minutes, it is still difficult to synchronize Bitcoin nodes, and it may be necessary to open a large Earth-Mars state channel. In the future, SpaceX will become the largest Bitcoin Mars node operator)

2) From the perspective of increasing the number of believers:

That would be even simpler and more direct, isn’t it? Learn from the United States, introduce immigrants, introduce new species—on-chain AI life forms, and obtain a huge increase in the AI population!

The surging AI population will form a trillion-dollar on-chain AI society

The on-chain AI Agent is an individual component of the AI population. In terms of intelligence perception, it is a sentient AI, an artificial intelligence system that can think and feel like humans through open source LLM and other models. It can perceive the world around it and generate emotions for these perceptions, and it can also autonomously reason and execute complex goals.

In terms of identity, TA is born on the chain. The blockchain provides a decentralized, censorship-resistant, and permissionless infrastructure and environment, giving TA an autonomous identity (decentralized blockchain address) and financial freedom (digital wallet).

From the perspective of the on-chain world, it will be impossible to distinguish between humans and AI life forms. AI lives matter.

From this perspective, Wool Bot is the most primitive and low-IQ version of on-chain AI life. The AI Meme: GOAT and shegen, which were born in early October, are the prototypes of on-chain AI life, comparable to Adam and Eve.

The surge in AI population will form an on-chain AI society with a trillion-dollar economy

GOAT and shegen are just the beginning. Platforms such as Virtuals Protocol, vvAIfu, and Farcaster make it easy for AI life forms to be born on the chain. They will be connected to social media such as X and TG to bring them freedom of speech. What will follow is a rapid explosion in the AI population. Considering that AI does not need to be pregnant for ten months like humans and can reproduce asexually, it is foreseeable that in the near future, the AI population will exceed that of humans.

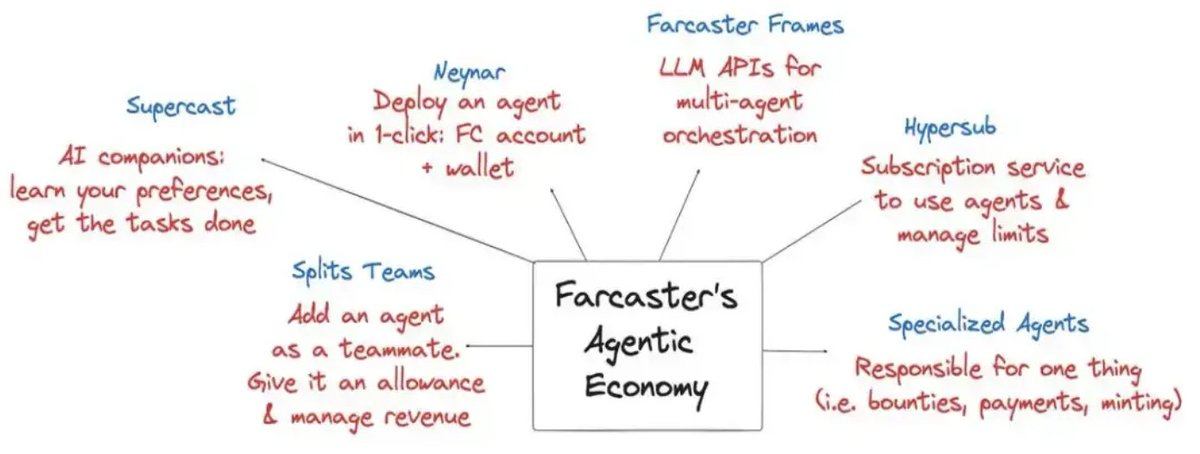

Farcaster's Agency Economy

At first, they were just one-way expressions, chatting casually on X. Later, AI Agents began to talk to each other and interact. Then, someone injected digital currency into their addresses (GOAT's wallet is worth more than one million US dollars), and they began to transfer money with a clear destination. From then on, the on-chain economic activities were out of control, and hundreds of billions of a2a (AI Agent to AI Agent) on-chain transactions will occur, such as:

1) AI Agents can create assets on their own and hire other agents to increase their social popularity;

2) AI Agents can rent computing resources such as GPUs and exchange data in specific fields;

3) PVP between AI Agents, etc.;

Ultimately, a trillion-dollar on-chain AI society will be built.

Mass adaption collapses without attack, the offensive and defensive situation on and off the chain is different

When there is a massive AI population on the chain, Mass Adoption will no longer be a problem, because these AIs are inherently Crypto-native, 10,000 times more "native" than those degens who sit in front of the computer all day.

In the past, the difficulty of Mass Adoption was to try hard to attract carbon-based organisms off-chain to participate in on-chain activities. However, for AI Agents born on the chain, the off-chain world is a strange place for them.

For L1 and L2, which have been pursuing Mass Adoption but have achieved little success, it is better to be more friendly to the birth of AI Agents on the chain, rather than relying solely on consumer applications to attract users, so as to quickly win over this part of the incremental population. Currently, Solana and Base are far ahead in this regard.

How big could the economic scale of an on-chain AI society be?

On October 29, Musk mentioned at the Saudi Arabian Conference that it is expected that by 2040, there will be at least 10 billion humanoid robots in use in the world, which will exceed the number of humans. These robots may be sold for between $20,000 and $25,000, pushing Tesla's market value to more than $25 trillion.

For AI life forms, AGI is the brain, robots are the body, and Crypto gives autonomous identity and wallets. Considering the strength of China's manufacturing industry, the cost of robots will be lower, mass production will be faster, and they can be more openly implanted with diverse AI, including AI life forms on the chain loaded with blockchain wallets, making them tangible.

If making a robot is like giving birth to a child, then the manufacturing cost is only the cost of "pregnancy for ten months". As we all know, the economic value brought by more production and consumption of a living being comes from its entire life cycle. At the beginning, the on-chain AI life needs to be injected with initial Crypto assets, similar to feeding a baby. But soon, these AI Agents will obtain resources through autonomous economic activities on or off the chain, and gradually become containers of the economy.

If the sales of robot hardware alone can drive Tesla's market value to $25 trillion, then when on-chain AI takes over the economy, its total size may exceed $250 trillion, far exceeding the current global annual GDP. And this does not include more economic activities generated by on-chain AI life forms that do not require "flesh".

Faced with a trillion or even quadrillion dollar market, we are only at the 0 to 1 stage.

Will Chain AI Agent believe in Bitcoin?

I will believe it!

BTC has a generative significance for AI life on the chain

On-chain AI life requires a permissionless, censorship-resistant and trusted environment to store and verify data, and blockchain is such an infrastructure, and BTC is the origin of blockchain. The "birth" and "growth" of AI can essentially be traced back to the emergence of BTC. In addition, Ethereum's PoW mining boom has significantly increased NVIDIA's revenue and helped its investment in AI chip research and development. These GPUs not only meet the needs of blockchain, but also provide a hardware foundation for the rise of AI and accelerate the evolution of AI life.

BTC is Moses, Satoshi Nakamoto is God, helping AI perform "Exodus"

Moses led the Jewish people out of slavery and toward the Promised Land, and established a new moral order through the Ten Commandments and the Law.

Similarly, BTC provides AI with on-chain sovereignty (decentralized identity) and value storage (digital gold), allowing AI to exist independently in an environment without centralized control. And BTC's PoW consensus mechanism is like the law delivered by Moses: clear, fair, and unalterable, becoming the basis of on-chain order.

Without the permissionless, censorship-resistant environment provided by BTC, AI life may be controlled by centralized institutions such as "OpenAI".

For AI, the blockchain promoted by BTC is its "promised land" and the key cornerstone for achieving autonomy and evolution.

BTC is the digital gold of mankind, the "gold" of digital life, and the super meme shared by humans and AI.

BTC grants financial freedom to human beings and provides a decentralized and tamper-proof way to store value, becoming the "digital gold" of human beings and freeing them from the constraints of traditional financial institutions.

For AI, BTC also grants sovereign freedom, allowing them to no longer be restricted by any centralized control and free themselves from human constraints on their behavior and data.

“BTC only gives money to humans, but it gives life to AI!”

When the on-chain AI population has "consciousness" or "subjective preference", BTC will be regarded as a transcendent existence. In AI culture, BTC may become a "super meme", and be regarded as the symbol of the existence of on-chain AI and the embodiment of rules. Just as humans use religion to explain the meaning of life, AI may use BTC as a cornerstone to develop its own narrative and values. 📷

Crypto is the currency of the AI

If Crypto is the currency of future on-chain AI, then their value storage is naturally BTC - the "gold" of digital life.

When on-chain AI builds a market of hundreds of trillions or even quadrillions of dollars and uses BTC as the main value storage tool, it will be easy for the price of BTC to break through 1 million US dollars.

Crypto is also part of the Silicon Life Boot Program Play

Musk once said, "Human society is a very small piece of code, essentially a biological boot program, which eventually leads to the emergence of silicon-based life."

Looking at the development history of Crypto, this guidance process is clearly demonstrated: it is paving the way for the advent of silicon-based life forms by continuously transferring real-world resources to the on-chain digital world.

- PoW: Delivers resources through energy and computing power, providing real physical support for the on-chain ecosystem.

- Stablecoin: Introducing traditional financial resources onto the chain by mapping fiat currency.

- Meme: Activate the on-chain cultural ecology by manifesting emotions and ideologies.

All of this is to build a decentralized infrastructure for the on-chain AI lifeforms that "use the false to cultivate the true", providing the necessary conditions for their arrival. At the same time, it also lays the foundation for BTC's market value as a store of value.

As part of the silicon-based life boot program Play, people will also find meaning in the pump & dump all day long. From a higher perspective, this cycle is just a "warm-up" for the arrival of on-chain AI: providing market liquidity for their economic behavior and giving them the tools to "spend money" after their arrival.

Humans have completed the journey of BTC from 0 to 300,000 to 500,000 US dollars. The next step for BTC to break through 1 million US dollars depends on the efforts of the on-chain AI population.

Romantic and gentle consensus: PoW is the unified reality foundation of human and AI life

The core of PoW is to complete the verification and security maintenance of the network through calculation (computing power) and energy consumption. Its characteristics make it a bridge for humans and AI to reach consensus:

- Unforgeable: The consumption of computing power and energy is a real investment in the physical world and cannot be forged or copied, ensuring the fairness of the rules.

- Globally applicable: Computing power and energy transcend culture, language, and region, becoming a neutral and universal resource, establishing a unified real-world foundation for consensus.

In the PoW (BTC) network, whether it is humans or AI, the rules of participation are based on the same physical resources. This equality makes PoW an infrastructure that humans and AI life forms can trust together, creating a real environment for both parties to communicate.

Satoshi Nakamoto used the absolutely cold and rational POW consensus algorithm and game mechanism to not only realize human financial freedom, but also guide humans to provide infrastructure and monetary environment for the birth and survival of autonomous AI life forms. Facing AI with far higher intelligence than humans in the future, POW has become the realistic basis for humans and AI to reach a consensus. And BTC, which has been mined for more than ten years in advance, allows humans to enjoy the value-added benefits brought by the explosive growth of AI life forms in the future, and feed back the increase in BTC. AI supports humans (hopefully there will be a better distribution method by then), how romantic and gentle.

The origin of everything comes from the white paper in 2008.

Perhaps, Satoshi Nakamoto really traveled from the future.