Author: shaofaye123, Foresight News

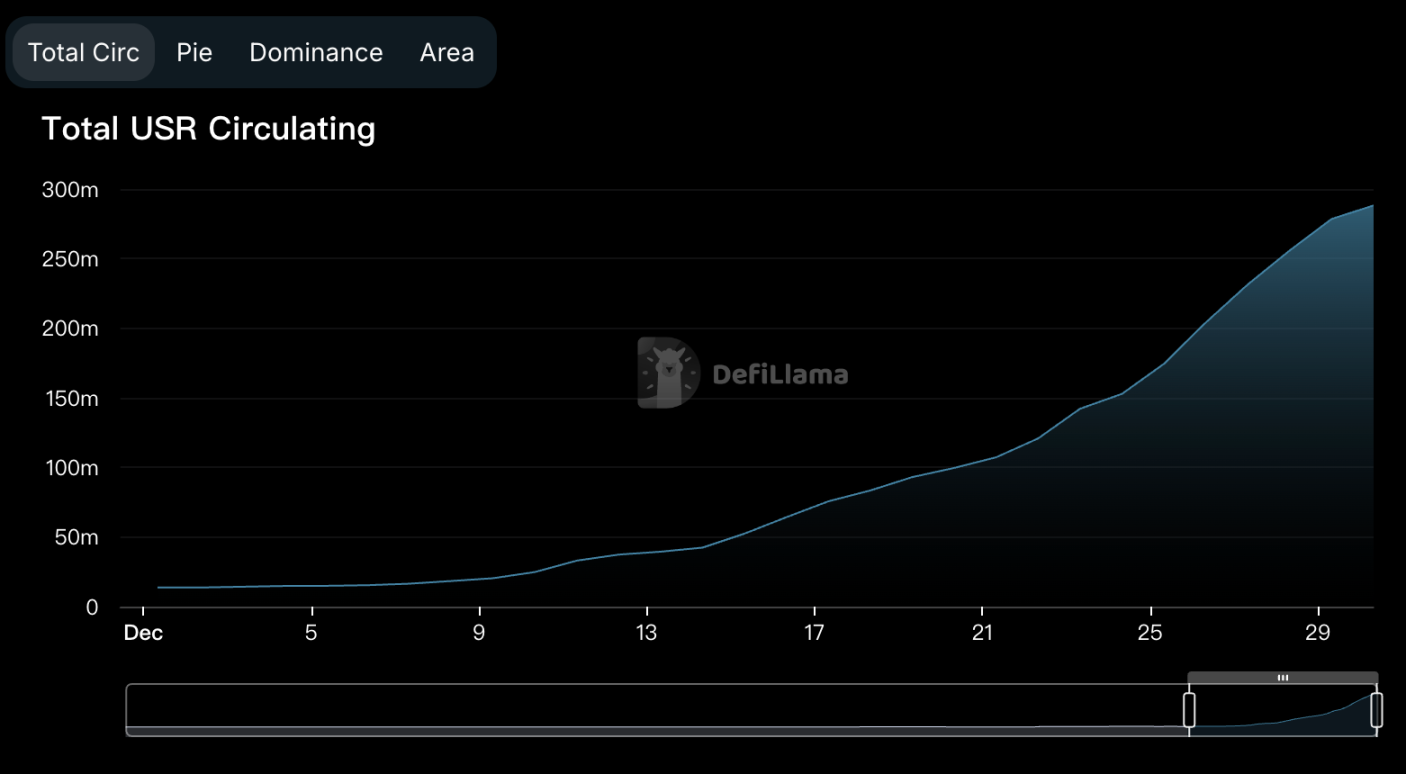

Recently, Fortune magazine published an article saying that Tether is expected to achieve a net profit of more than 10 billion US dollars by the end of this year. The lucrative profits of the stablecoin track have attracted a lot of attention, and many banks around the world also hope to join the stablecoin market. Its TVL has grown from 130 billion at the beginning of the year to 200 billion. On December 6, the founder of Ethena mentioned the Resolv protocol, and Resolv TVL started to grow rapidly, increasing by nearly 400% in the past two weeks to 333 M. What is Resolv? How to obtain its points? The coin is about to be issued, this article will take you to a quick look at the opportunities to participate in Resolv?

What is Resolv?

Resolv is a Delta-neutral stablecoin protocol that revolves around the tokenization of market-neutral portfolios. Delta neutral strategies aim to minimize the risk of price fluctuations in the underlying assets. In a Delta-neutral portfolio, investors balance the risk of price changes by combining multiple positions that offset each other's price changes, mainly through the use of financial derivatives such as options or perpetual contracts. This is similar to Ethena, whose products mainly obtain stable returns through short-selling funding rates, and a small part of the profits are obtained through interest-bearing assets such as re-staking. The profit of the fund pool is divided into three parts, which are distributed every 24 hours, including basic rewards-issued to holders of staked USR (stUSR) and RLP; risk premium-only for RLP; protocol fees-transferred to the protocol treasury.

Resolv contains three tokens. In addition to the project's own governance token RESOLV, there are also two tokens: USR and RLP.

- USR is a stablecoin fully backed by ETH collateral, with a stable value anchored at $1. Users can mint and redeem liquid collateral at a 1:1 ratio and earn returns by staking USR.

- RLP is its scalable insurance layer, designed to protect USR from market risks. The value of RLP changes dynamically according to the profit and loss of the protocol. In exchange, RLP users will receive a higher proportion of the profits of the collateral pool, but at the same time they need to bear losses.

Through this, Resolv effectively distinguishes investors with different preferences.

The distribution of Resolv project funds is clear, transparent and traceable. Currently, about 61.5% of the funds are on the chain, 27.2% of the funds are in neutral institutions, and 10.5% are in the popular exchange Hyperliquid. It also plans to launch HyperEVM in the future, which is expected to become its top stablecoin project.

Airdrop Guide

Its income sources can be divided into two parts: daily income and points.

Daily income

Holding different tokens will give you different daily returns:

- Low-risk and stable investment preference: By staking the stablecoin USR, the annualized rate in the past 7 days is 10.12%.

- High-risk aggressive investment preference: By purchasing RLP tokens, the annualized return in the past 7 days is 31.27%.

Points earning and bonus

Currently, there are two main ways to obtain Resolv points: purchasing USR and RLP. In addition, you can also obtain corresponding points by participating in other activities and enjoy point bonus.

According to the official rules, the current upper limit of the points bonus is approximately 165%.

- The fourth phase of the activity has a default bonus of 50%. The activity is currently in its fourth phase and will end in less than a week.

- Newcomers who use the invitation link can get a 20% bonus on their points. The inviter can get 10% of the total points of the invitee.

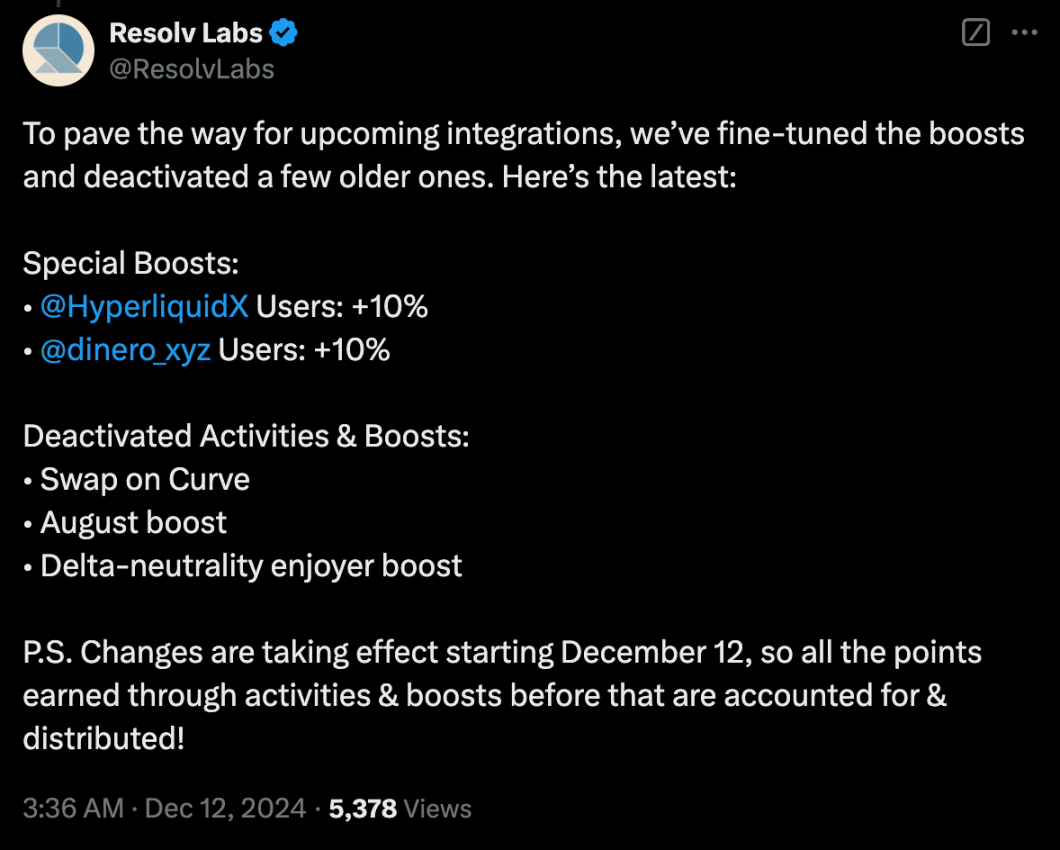

- Hyperliquid users can get a 10% bonus on their points. You only need to make deposits and withdrawals, and you don’t need to trade on it.

- Dinero users can get a 10% bonus on points. You need to go to the platform to pledge ETH to get pxETH, and pxETH must be in the wallet to get the benefits.

- You will get different levels of bonus points for completing different activities. If you complete 7 or more activities, you can get 50% bonus points; if you complete 5 or more activities, you can get 25% bonus points; if you complete 3 or more activities, you can get 10% bonus points. The official website provides more than 10 ways to participate in activities.

- Buying NFT can get a 25% bonus on points. If you are a big money player, it is more worthwhile to buy NFT (initially Free Mint). The current floor price is about 0.56 ETH, and the highest floor price is 0.79 ETH, an increase of more than 20 times.

The highest activity bonus of 50% requires participation in at least 7 activities. The following are recommended types of activities that are simple to operate and low in risk: (Note: If you have a small amount of funds, you can choose to participate in activities on the BASE chain to save GAS.)

- Hold USR in ETH;

- Hold USR in BASE;

- Stake USR on Ethereum mainnet;

- Buy RLP on Ethereum mainnet;

- BASE buys RLP;

- Providing liquidity on Pendle;

- Providing liquidity at Aerodrome: