Preface

With the progress of data, computing power, and algorithm research in recent years, AI development has made great breakthroughs, especially the emergence of OpenAI GPT-4. The arrival of the basic LLM large model represented by it has promoted the improvement of productivity and the transformation of social efficiency.

However, the disadvantages of these closed-source large models represented by GPT-4 have also been revealed, namely, centralized models usually have restrictions on third-party integrations, which undermines the scalability and interoperability of AI agents based on centralized models.

Therefore, large open source models such as the Llama series have been sought after by more and more researchers, but open source does not mean transparency, and it also faces many challenges.

The main difficulty is that for most contributors, open source AI development does not have any economic incentives. Even if there are some competition rewards, these are usually one-off. Subsequent improvement and development work still needs to be done out of love. Unless it reaches a certain scale and has a large community of followers, there will be more possibilities for income and more contributors to continue to improve.

Therefore, the Bittensor AI project attempts to use web3 token mining to make open source AI development more sustainable, verifiable and efficient. Through Yuma Consensus, we introduce and align resources and research miners, validators, and AI project subnet creators, making the entire AI research more transparent and decentralized. Anyone can participate in AI contributions and win the rewards they deserve.

The performance of tokens in the secondary market also confirms people’s expectations. The price has increased from more than 50 US dollars in September 2023 to more than 500 yuan in December 2024, a 10-fold increase!

Recently, Bittensor’s investor and founder of Digital Currency Group established Yuma, an accelerator dedicated to incubating subnet projects within the Bittensor ecosystem, and served as its CEO, demonstrating his confidence in and potential for the Bittensor project.

Source: Coindesk

Of course, the success of any project cannot be without doubts. Bittensor has also had a lot of FUD since its inception. In this article, we summarize many questions that have not been fully answered, and try to understand Bittensor's future positioning and possibilities in the decentralized AI track through research and analysis.

What is Bittensor?

Bittensor was founded in 2021 by a team from Toronto, Canada, including Jacob Robert Steeves, Ala Shaabana, and Garrett Oetken.

Bittensor is a decentralized AI infrastructure used by AI developers to build and deploy machine learning models or other AI-related developments. Many Web3 AI projects, whether or not they already have their own blockchain, can access Bittensor's blockchain "subtensor" and become one of its subnets.

What is a Subnet?

Subnets form the core of the Bittensor ecosystem. Each Bittensor subnet is an independent incentive-based competitive market. Anyone can create a subnet, customize the tasks to be performed by the subnet, and design an incentive mechanism (in the machine learning analogy, the incentive mechanism can be understood as a target loss function that can guide model training towards the desired results). You only need to pay a registration fee (in TAO) to create a subnet, and you can get a netuid for the subnet. Note that a subnet creator does not need to assume the operating tasks within the subnet, but transfers the right to operate the subnet tasks to others.

The task of operating the subnet provides another way for others to participate, that is, to join an existing subnet. If you join an existing subnet, there are two ways to participate: as a subnet miner or a subnet validator. In addition to paying the registration fee denominated in TAO (if you are a validator, you also need to stake TAO), he only needs to provide a computer with sufficient computing resources, and register the computer and his wallet to a subnet, and run the subnet miner module or subnet validator module provided by the subnet builder on this computer (both modules are Python code in the Bittensor API).

How does the competitive market for subnets work?

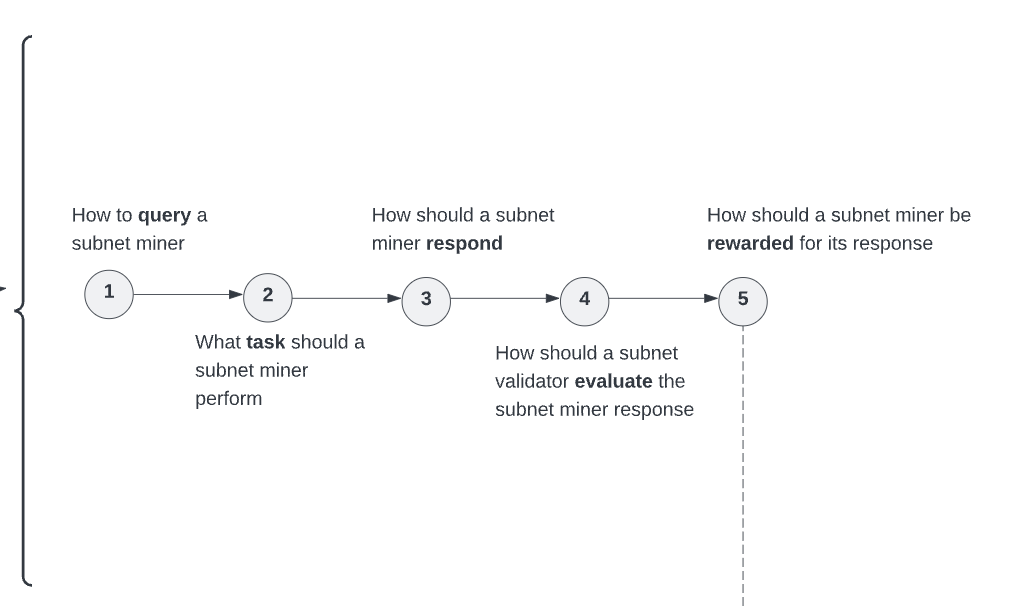

Here’s how the subnet competition works: Let’s say you decide to become a subnet miner. The subnet validator will assign you some tasks to complete. Other miners in the subnet will also receive tasks of the same type. After all subnet miners complete their tasks, they submit the results to the subnet validator.

Subnet validators will then evaluate and rank the quality of the tasks submitted by the subnet miners. As a subnet miner, you will be rewarded (in TAO) based on the quality of your work. Similarly, other subnet miners will also receive corresponding rewards based on their performance. At the same time, subnet validators will also be rewarded for ensuring that high-quality subnet miners receive better rewards, thereby promoting the continuous improvement of the overall quality of the subnet. All of these competition processes are automated based on the code incentive mechanism written by the subnet creator.

Source: Steps on how Subnet Creator defines Incentive Mechanism

The incentive mechanism is ultimately a judgement on the performance of the subnet miners. When the incentive mechanism is well calibrated, a virtuous cycle can be formed, and the subnet miners continue to improve the required tasks in the competition.

Conversely, poorly designed incentive mechanisms can lead to exploits and shortcuts that adversely affect the overall quality of the subnet and discourage fair miners.

The specific work of each subnet miner depends on the original purpose of the subnet creator, which can be variable or specific. For example, the miner task of subnet 1 is to respond to the text prompt sent by the subnet validator and give the best prompt completion result, or the miner task of subnet 47 is to provide storage.

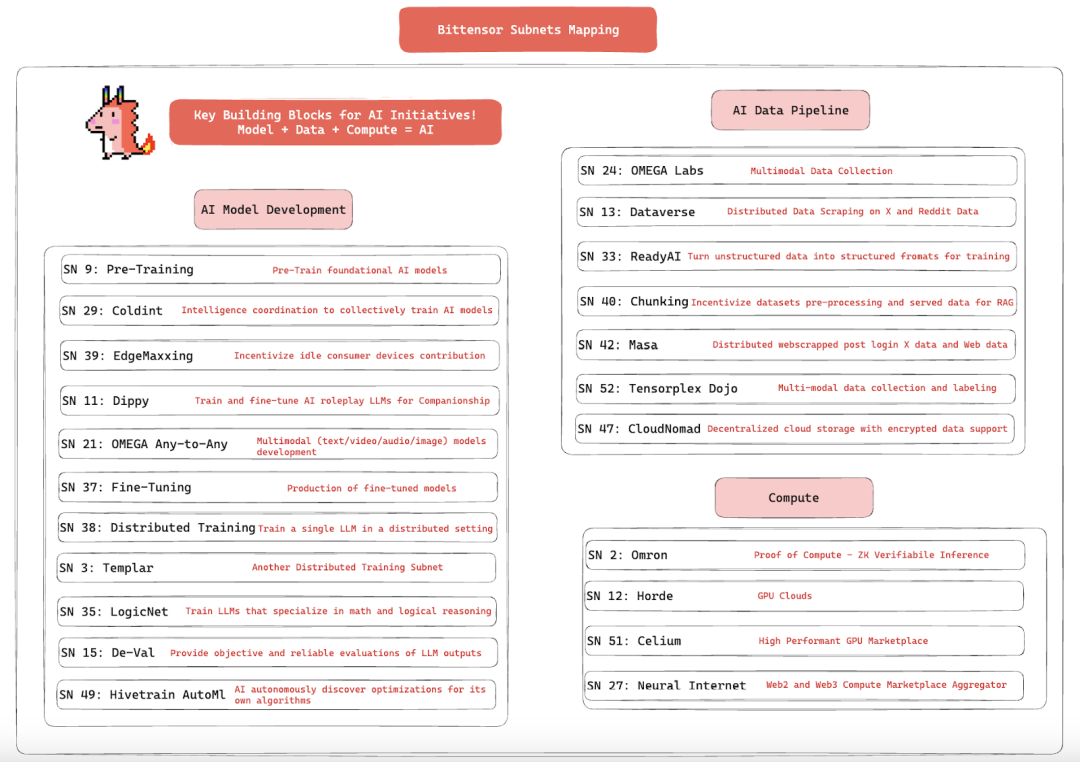

Each sub-network also has its own unique research and commercialization direction, such as trying to overcome the technical difficulties in a certain AI field, such as decentralized AI training, verifiable reasoning, or providing some infrastructure and resources required for AI, such as GPU trading market or data labeling services, or helping users identify AIGC deepfake technology subnets, such as Subnet 34 - BitMind.

Currently, Bittensor has more than 55 subnets, and this number is constantly increasing!

Source:IOSG Ventures

The role of Subtensor blockchain

Obviously, blockchain and project token TAO played a big role in this series of competitions.

First, the Subtensor blockchain records key activities of all subnets in its ledger. More importantly, the Subtensor blockchain is responsible for determining the reward distribution of subnet miners and subnet validators. An algorithm called Yuma Consensus (YC) runs continuously on the Subtensor blockchain. Each subnet validator ranks the quality of work of all subnet miners, and all the rankings of each subnet validator are sent together as a collective input to the YC algorithm. Generally, the rankings of different subnet validators will arrive at Subtensor at different times, but the YC algorithm on Subtensor will wait until all the rankings arrive, usually every 12 seconds, and the YC algorithm will calculate the rewards based on the ranking inputs of all validators. These rewards (denominated in TAO) are deposited into the wallets of subnet miners and subnet validators. The Subtensor blockchain will run the YC algorithm independently and continuously for each subnet.

The YC consensus algorithm mainly considers two factors. The first is a weight vector maintained by each subnet validator. Each element of the vector represents the weight assigned to the subnet miner. The weight indicates the historical performance of the subnet miner based on the subnet validator. Each subnet validator ranks all subnet miners by the weight vector. The second factor is the stake amount of each validator and miner. The on-chain Yuma consensus uses the weight vector and the stake amount to calculate the reward and distribute it among the subnet validators and subnet miners.

The Bittensor API will transmit and connect the opinions of the validators on the subnet and the Yuma consensus on the Subtensor blockchain. In addition, validators in the same subnet will only connect to miners in the same subnet, and validators and miners in different subnets will not communicate and connect with each other.

Source: Bittenso

Validator Game Theory

To participate as a subnet validator or subnet miner, you must first register and stake. Registration means registering a key in the subnet you want to choose and obtaining a UID slot in the subnet. The UID slot represents the right to verify the subnet. Note that a subnet validator can have multiple UID slots at the same time and verify for multiple subnets, but there is no need to increase the stake amount. Staking once TAO can select multiple UID slots and verify for multiple subnets (similar to the concept of restaking).

Therefore, in order to obtain the most rewards, validators will tend to choose to provide validation services for all subnets. However, not all staked validators have the right to actually provide staking services. Only the top 64 validators in a subnet ranked by the number of stakes are considered to have the real validation permission for the subnet. This reduces the risk of validators doing evil, because the number of stakes becomes a very high threshold and increases the cost of doing evil (you must have at least 1,000 TAO to set weights in a subnet). In order to increase their own staked amount, each validator will try to establish a good reputation and performance record to attract more TAO delegated stakes to increase the number of stakes and become the top 64 validators of the subnet.

Once the subnet validator and subnet miner (no staking is required to run a miner) register their keys to the subnet, they can start mining.

Unique Token Incentive Economy

All TAO token rewards are newly minted, similar to Bitcoin. Bittensor's $TAO has the same token economics and issuance curve as Bitcoin. TAO supply: The total supply is capped at 21 million, halved every 4 years.

Bittensor started with a fair launch, with no pre-mined TAO tokens or ICO. Currently, the network generates 7,200 TAOs per day, 1 TAO per block, and blocks are generated approximately every 12 seconds. The total token supply is capped at 21 million, following a programmatic issuance schedule similar to Bitcoin.

However, Bittensor introduces a unique mechanism whereby the issuance rate is halved once half of the total supply has been distributed. This halving occurs approximately every 4 years and continues at each half-point of the remaining tokens until all 21 million TAO tokens are in circulation.

Although TAO adopts the issuance curve and philosophy of Bitcoin, due to its recovery mechanism, this curve is actively dynamic and not completely fixed like Bitcoin.

Recycling mechanism:

The current cycle’s daily token issuance is 7,200 TAOs (the same as Bitcoin’s first cycle from January 2009 to November 2012).

However, a certain amount of dynamic TAOs are recycled every day through key (re)registration.

To become a miner or validator, you must register a key in the network and meet other GPU and computing power requirements. Registration requires recycling TAO, that is, paying a certain amount of TAO to reinvest in the network.

Each key (re)registration removes that TAO from the circulating supply and puts it back into the protocol’s issuance pool, where it can be mined again in the future.

This mechanism postpones the planned 4-year halving because the recovered TAO is dynamic and can increase significantly when more keys are (re)registered, the cost of TAO recovery increases, or other subnets are released.

Not only that, registration is not only available to new entrants, but also to those who have been deregistered due to the following reasons:

- For miners, their models and reasoning are not competitive enough among other miners;

- For validators, they fail to consistently set the correct weights, maintain issuance, or do not have enough TAO (self-delegation + other delegators' share) in the key.

These factors themselves will also exacerbate the growth in registration demand.

Number of recovered TAOs = Total number of registration (or re-registration) keys for each subnet * Average registration (or re-registration) cost)

Therefore, the first halving, originally scheduled for 4 years after launch, may be postponed to 5 or 6 years, or even longer. It all depends on the balance between TAO issuance and recycling.

The Bittensor network went live on January 3, 2021, and according to token recovery data from taostats, the planned halving date is expected to be delayed until November 2025.

Source: https://taostats.io/tokenomics

What is dTAO?

dTAO is an innovative incentive mechanism proposed by the Opentensor/Bittensor network to solve the problem of inefficient resource allocation in decentralized networks. Unlike the traditional way of manually voting by validators to determine resource allocation, dTAO introduces a market-based dynamic adjustment mechanism that directly links resource allocation to subnet network performance, thereby optimizing the fairness and efficiency of reward allocation.

Core Mechanics

Market-based dynamic resource allocation

The dynamic TAO allocation mechanism is based on the market performance of subnet tokens. Each subnet in the network has its own token, and its relative price determines the distribution ratio of TAO issuance among subnets. As market information changes, this distribution ratio will be dynamically adjusted to ensure that resources flow to efficient and potential subnets.

Embedded liquidity pool design

Each subnet is configured with a liquidity pool consisting of TAO and subnet tokens (subnet/TAO token pair). Users can exchange subnet tokens by pledging TAO to the liquidity pool. This design encourages users to invest in subnets with outstanding performance and indirectly supports the overall development of the network.

Fair Token Distribution Mechanism

Subnet tokens are gradually distributed through the "Fair Launch" model, ensuring that the team needs to gradually obtain token shares through long-term contributions and construction. This mechanism avoids the risk of tokens being sold quickly, while encouraging the team to focus on technical improvements and ecosystem construction.

Balance between the roles of users and validators

The resource allocation of dynamic TAO is not only determined by the market, but also influenced by both validators and users. Validators need to conduct rigorous evaluations of the team's technical capabilities, market potential, and actual performance, just like venture capitalists (VCs). Users further promote the formation of the subnet's market value by staking TAO and participating in market transactions.

Economic model analysis

Current funding support

Data shows that the subnets in the network can currently receive an average of about $47,000 in rewards per day, corresponding to an average of about $17 million in annual support. This funding scale is much higher than the median of traditional AI startups' seed rounds (about $3 million) and Series A financing (about $14 million), providing a strong boost to the rapid development of the subnets.

Future potential

The current annual budget of Bittensor is estimated to reach 1.3 billion US dollars, which is comparable to centralized AI research institutions such as OpenAI and Anthropic. With the launch of dynamic TAO, the new issuance of TAO in the future will mainly flow to the liquidity pool of subnet tokens, further promoting the circulation of capital and value within the ecosystem.

Long-term incentives

The design of dTAO greatly incentivizes the team to continuously improve its technology and applications by linking the issuance volume to market performance. This mechanism also inhibits short-term behavior of quickly cashing out through over-the-counter (OTC) transactions, laying the foundation for the long-term sustainable development of the network.

Impact and Significance

Resource allocation optimization

dTAO dynamically adjusts resource allocation through the market to ensure that subnets with high utility and high growth potential receive more resources. This mechanism not only improves the overall efficiency of the network, but also promotes competition and innovation.

Decentralized AI ecosystem construction

Bittensor is not only a decentralized AI network, but also an incubation platform for AI networks through dynamic TAO. Competition and collaboration between subnets further promote the development of the decentralized AI ecosystem.

Incentives for Ecosystem Participants

Dynamic TAO balances the interests of users, validators, and teams, and ensures that all participants can contribute to the growth of the network through economic incentive mechanisms.

Elevated role of validators

Validators play a more important role in the network. They strictly evaluate the value and potential of subnets in a similar way to venture capital, ensuring the scientific and rational allocation of network resources.

The launch of dTAO marks a significant advancement in the decentralized network resource allocation mechanism. Through market-based dynamic adjustments, embedded liquidity pool design, and fair issuance models, dTAO achieves efficient and fair resource allocation. In addition, as an AI network incubation platform, it not only enables the development of subnets, but also provides a new development path for the future of decentralized AI networks.

Agents application on Bittensor

Many people say that Bittensor is an AI coin represented by VC dignitaries, and has fallen behind the era of flourishing applications in the current major agent developer framework ecosystem. With the recent rise of AI Agents, and the total market value of AI Agent-related tokens exceeding $10 billion, especially projects represented by the Virtuals ecosystem, which account for $5 billion of the total marketcap (including various practical investment and investment research and analysis Agents, such as $AIXBT, $VADER, $SEKOIA, etc.), Bittensor seems to be left behind in the eyes of many people.

However, in reality, Bittensor still has a lot of "Alpha". What many people don't realize is that Virtuals/ai16z's success in the consumer AI Agent space is complementary to the Bittensor subnet's efforts in decentralized AI infrastructure.

As Agents’ TVL (total locked value) and influence grow, strong training and inference infrastructure becomes more important.

Currently, Virtuals and Bittensor have carried out a lot of cooperation in the ecosystem.

Many consumer-facing virtuals protocol agents are powered by the Bittensor subnet, leveraging TAO’s computing power and data ecosystem to create new possibilities, such as

$TAOCAT

- TAOCAT is an AI agent built by Masa in the Virtuals ecosystem. Its main role is to serve as a staunch defender of TAO, actively participate in discussions on X, and speak out for TAO's influence.

- TAOCAT leverages the real-time data infrastructure of Subnet 42 Masa and the advanced LLM provided by Bittensor Subnet 19 to compete for TAO token allocation in Agent Arena on Bittensor Subnet 59, creating a new paradigm for tokenized AI value capture. Any user interaction on X will become training data for TAO Cat.

Other projects supported by the Bittensor subnet include:

- $AION: The first agent that can predict prediction results and participate in prediction market betting. The copy-trading function will also be launched soon.

- $SERAPH: The first project focused on verification infrastructure to authenticate the wave of AI agents that will soon take over our digital world.

The cooperation between Virtuals and Bittensor proves that huge practical value can be created on the Bittensor infrastructure. With the official launch of AgenTAO (SN62), this will become an important milestone for automated software engineering agents on Bittensor. All Bittensor subnets will be gradually developed by Agents on Bittensor. In the future, we will see more application-side AI Agents emerge from the Bittensor ecosystem!

Source: taogod

Conclusion

The future of Bittensor is exciting. Many research and investment institutions dedicated to the Bittensor ecosystem have begun to emerge, similar to the Ethereum network. Including the DCG founder's call for orders, podcasts, blogs, and OSS Capital, which focuses on Bittensor investment, a research organization dedicated to the Bittensor ecosystem and a subnet. A Bittensor network similar to the PayPal mafia has been formed. Contango, Canonical, Delphi Labs and DCG recently had a party, and many experts in the Crytpo x AI community have also begun to lean on Bittensor and support it. Therefore, it is not unreasonable that Bittensor was able to surpass Virtuals in Kaito's mindshare some time ago. It is not unreasonable that Bittensor was able to surpass Virtuals in Kaito's mindshare some time ago.

Source: BitMind Bittensor Subet 34

Next year in April 2025, Austin, Texas Bittensor will host a 300+ person The Endgame Summit and hackathon, specifically focused on introducing more subnets, validators and miners to the Bittensor ecosystem and expanding its territory.

Endgame Summit

Of course, whether it is a centralized AI project or a decentralized AI project, the final standard will return to the product.

The Bittensor ecosystem has emerged and flourished.

Source: Outpost AI Research

Recently, the founder of Bittensor summarized the main achievements of Bittensor's various subnets in the past year on his personal X:

Source: https://x.com/const_reborn/status/1873359385373909008

Therefore, let us continue to look forward to Bittensor and see what products and use cases will come out of Bittensor in the future and become the first choice for people to find solutions to specific AI problems!

Appendix

1,https://tengsthoughts.com/p/bittensor-doomed?utm_source=www.chainofthought.xyz&utm_medium=referral&utm_campaign=research-bittensor-flawed

2,https://blog.bittensor.com/tao-token-economy-explained-17a3a90cd44e

3,https://docs.bittensor.com/subnets/register-validate-mine#:~:text=To%20participate%20as%20a%20subnet,UID%20slot%20in%20that%20subnet.&text=You%20do%20not%20have%20to,validate%20on%20the%20Bittensor%20network.

4, https://docs.bittensor.com/subnets/checklist-for-validating-mining#:~:text=Keep%20in%20mind%20that%20to,must%20also%20stake%20enough%20TAO.