💡 QE & QT: The truth about market liquidity

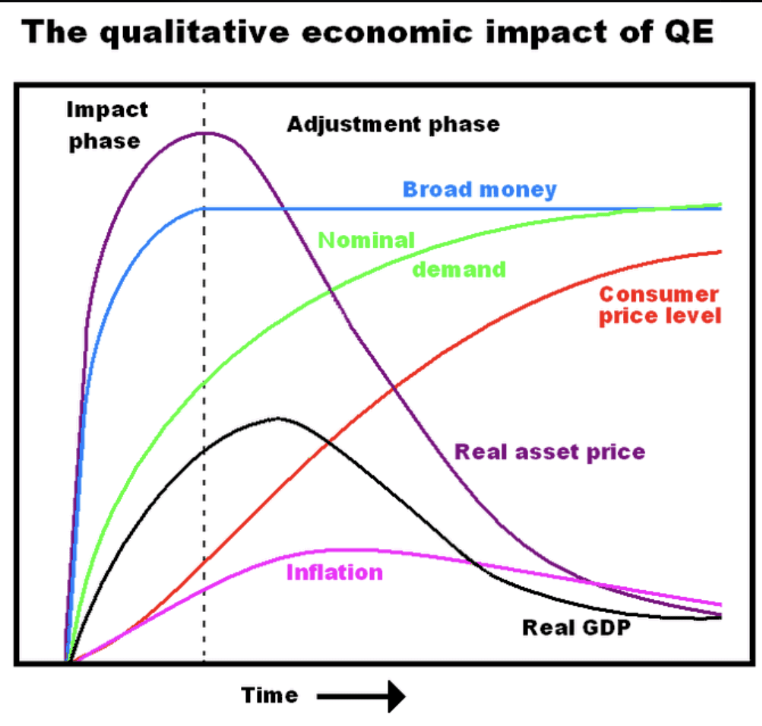

✅ Quantitative Easing (QE)

Central banks print money and inject liquidity, which is usually good for cryptocurrencies.

✅ Quantitative Tightening (QT)

The central bank's balance sheet reduction and reduction of market funds are traditionally considered to be unfavorable to the crypto market.

Fact: The crypto market can explode without QE!

🔹 Data shows that bull markets do not only occur during QE periods.

📈 Bull market case: outbreak not dependent on QE

🔍 Case 1: Altcoin bull run

The market value of altcoins soared from $400 billion to $1.7 trillion. During this period, the global market was in the QT stage.

🔍 Case 2: 2017 Bull Market

Driven by market sentiment, technological innovation and capital inflows. Not entirely dependent on loose monetary policy.

🚀 Key factors for the altcoin bull market

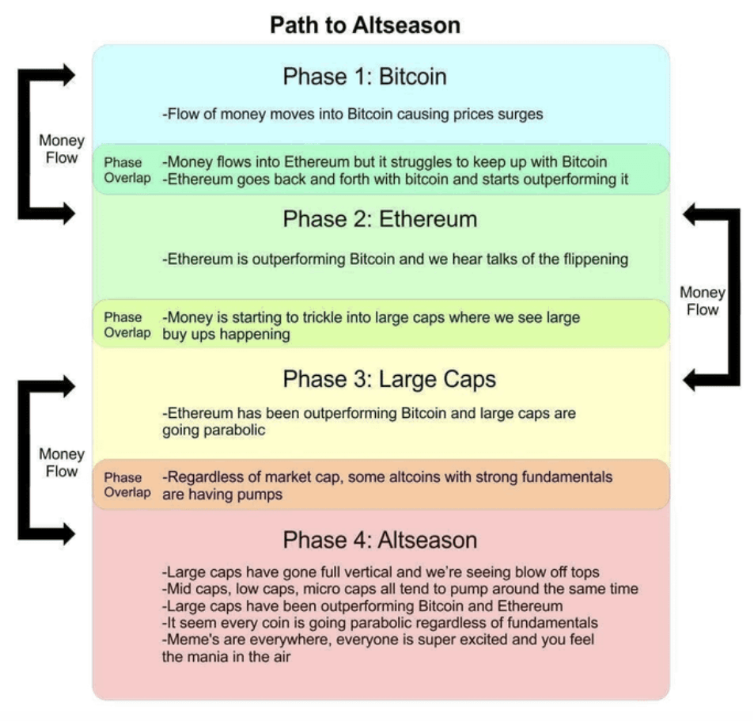

1️⃣ Market Cycles & Bitcoin Trends

2️⃣ Sources of liquidity (not limited to central banks)

3️⃣ New narrative & sector rotation

💡 Capital Flow Sequence Forecast:

- Bitcoin First $BTC

-Major altcoins ( $ETH , $BTC )

- Large-cap and mid-cap stocks

- Low market cap tokens

📊 Observation indicators:

🔹 BTC Price & Dominance Rate - When BTC consolidates, funds tend to flow into alts.

🔹 ETH and L2 ecosystem growth- When the ecosystem is strong, it indicates the start of the altcoin season.

🔹 The rise of new narratives (such as DeFi, RWA) - funds are gradually flowing into hot areas.

🔥 Conclusion: Bull market does not mean global economic recovery!

✅ QE & QT are not the decisive factors, market capital flows, sentiment and innovation are the key!

✅ Altcoin bull markets often break out during BTC consolidation periods rather than relying on macroeconomic recovery.

✅ Plan ahead for new hot spots, don’t wait until the market “looks better” before taking action!

🎯 Want to catch the next bull market? Pay attention to the flow of funds & key narratives, the bull market may have quietly arrived! 🚀