Author: Nancy, PANews

With the continuous innovation and optimization of decentralized finance (DeFi), it is becoming one of the key drivers of the mass adoption narrative in the crypto market. Especially with the entry of traditional financial giants, the potential of DeFi has been further released. Although DeFi has made significant progress in the past few years, it still faces a series of challenges such as liquidity fragmentation, high entry barriers and poor user experience, which limit the further development of DeFi.

In order to promote the overall expansion of the market, many DeFi protocols have upgraded their mechanisms. Recently, the decentralized derivatives exchange dYdX officially launched dYdX Unlimited, which brings users a more efficient and flexible trading experience by launching a series of new features such as the automatic liquidity pool MegaVault , instant market listing and lifetime commissions, while unlocking more potential and vitality in the DeFi market.

Start the DEX liquidity flywheel effect and unlock passive income opportunities

Whether in traditional financial markets or crypto markets, liquidity is always the core driving force for maintaining active trading and market development. Especially in CEX (centralized exchanges), with a large user base, transaction scale and a complete market-making system, it can provide users with efficient asset liquidity.

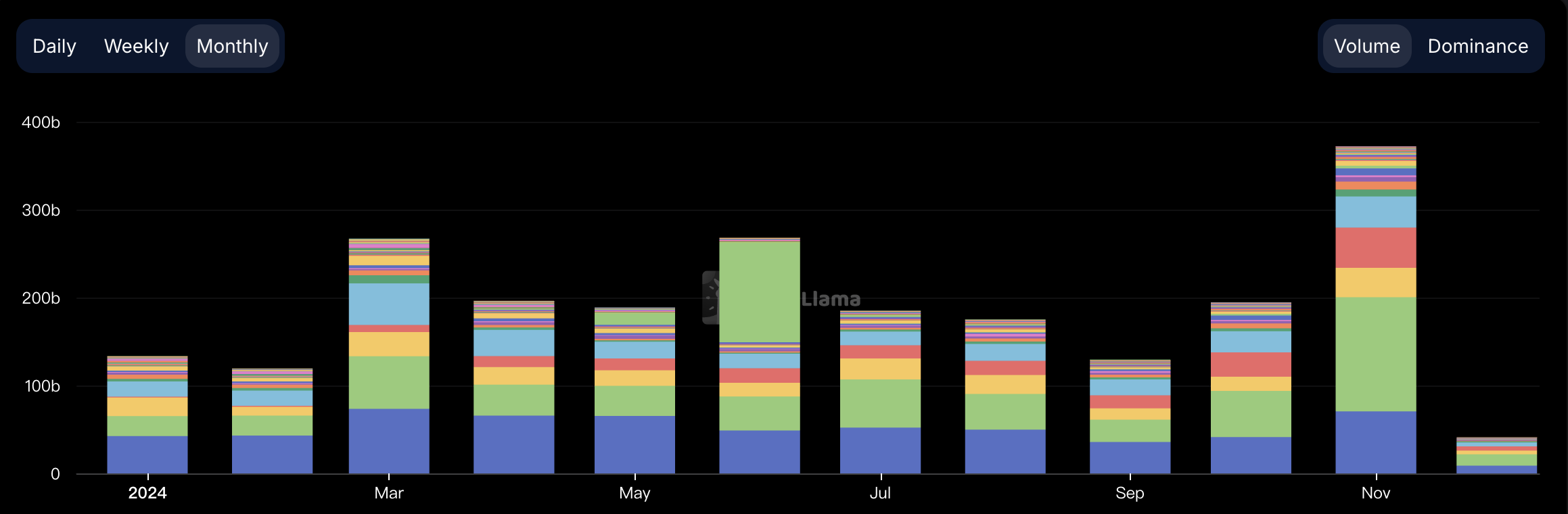

Liquidity has always been the core element for the survival and development of DeFi protocols, but it still faces certain challenges at this stage, especially the fragmentation of liquidity, which exacerbates this dilemma. However, with the increasing variety of on-chain assets and the continuous expansion of the market size, DEX has shown a trend of rapid growth in crypto transactions. DeFiLlama data shows that in November this year, the trading volume of multi-chain DEX reached 372 billion US dollars, a record high, nearly 3.8 times the trading volume of about 98.06 billion US dollars in the same period last year. This significant growth fully reflects the sharp increase in the market demand for on-chain transactions, and also means that on-chain liquidity urgently needs to be further optimized and enhanced.

Data source: DeFiLlama

To meet this challenge, dYdX Unlimited launched a core innovative product, MegaVault, which can provide automated market making support for dYdX by obtaining liquidity from users.

It is understood that MegaVault is dYdX's next-generation liquidity management tool, which provides automated liquidity for the dYdX market and provides depositors with a way to earn USDC income. It will be officially launched in the next few months. Specifically, users only need to deposit USDC into MegaVault, and the platform will distribute liquidity to various sub-funds pools of dYdX through automated market making to enhance the depth and stability of the market.

Since each pool has a specific market-making strategy, users can easily earn income through market transactions and protocol rewards without having to directly participate in transactions or master complex trading skills. This part of the income mainly comes from the profit of the fund pool position, the sharing of dYdX transaction income, the payment of funding rate and other protocol rewards. According to the dYdX Foundation’s disclosure in November, the dYdX community has passed the proposal of “distributing 50% of the income to MegaVault and 10% of the income to Treasury SubDAO”.

In a sense, this mechanism not only brings a flywheel effect to dYdX - the larger the liquidity pool, the better the liquidity, the more income, and the greater the returns users receive, but also further promotes the popularization of the DeFi concept, especially helping to democratize financial services.

In addition, MegaVault's fund security and governance are also a highlight. In terms of fund management, MegaVault allows users to deposit or withdraw funds at any time, with extremely high flexibility and control, and users can track their portfolio performance in real time; in terms of governance, MegaVault adopts a decentralized governance model, and community members can manage the allocation and tuning of funds between different sub-fund pools by voting for "operators", and can adjust market-making strategies according to market demand to optimize returns and liquidity stability. This governance mechanism ensures the transparency of the platform and users' control over funds, while reducing the impact of potential market fluctuations on returns through reasonable risk management.

It can be said that the launch of MegaVault not only provides users with an efficient and flexible way to earn passive income, but also provides a sustainable liquidity solution for DEX. It is also regarded by the community as dYdx's killer weapon in competing in the current decentralized contract market.

From asset issuance to user incentives, the "unlimited" function solves pain points

After the early stage of financial experimentation, DeFi has been exploring the frontier of financial innovation in the past few years, and has gradually become one of the few segments in the crypto market with practical application scenarios and real adoption. In particular, with the continuous improvement of infrastructure, the continuous optimization of user experience (increased transaction speed and reduced transaction fees, etc.) and the increasing security, DeFi is laying a solid foundation for its entry into the mainstream market.

In order to inject more momentum into the DeFi ecosystem, dYdX Unlimited has also launched a number of innovative features, including instant market listing, trading reward program and affiliate program.

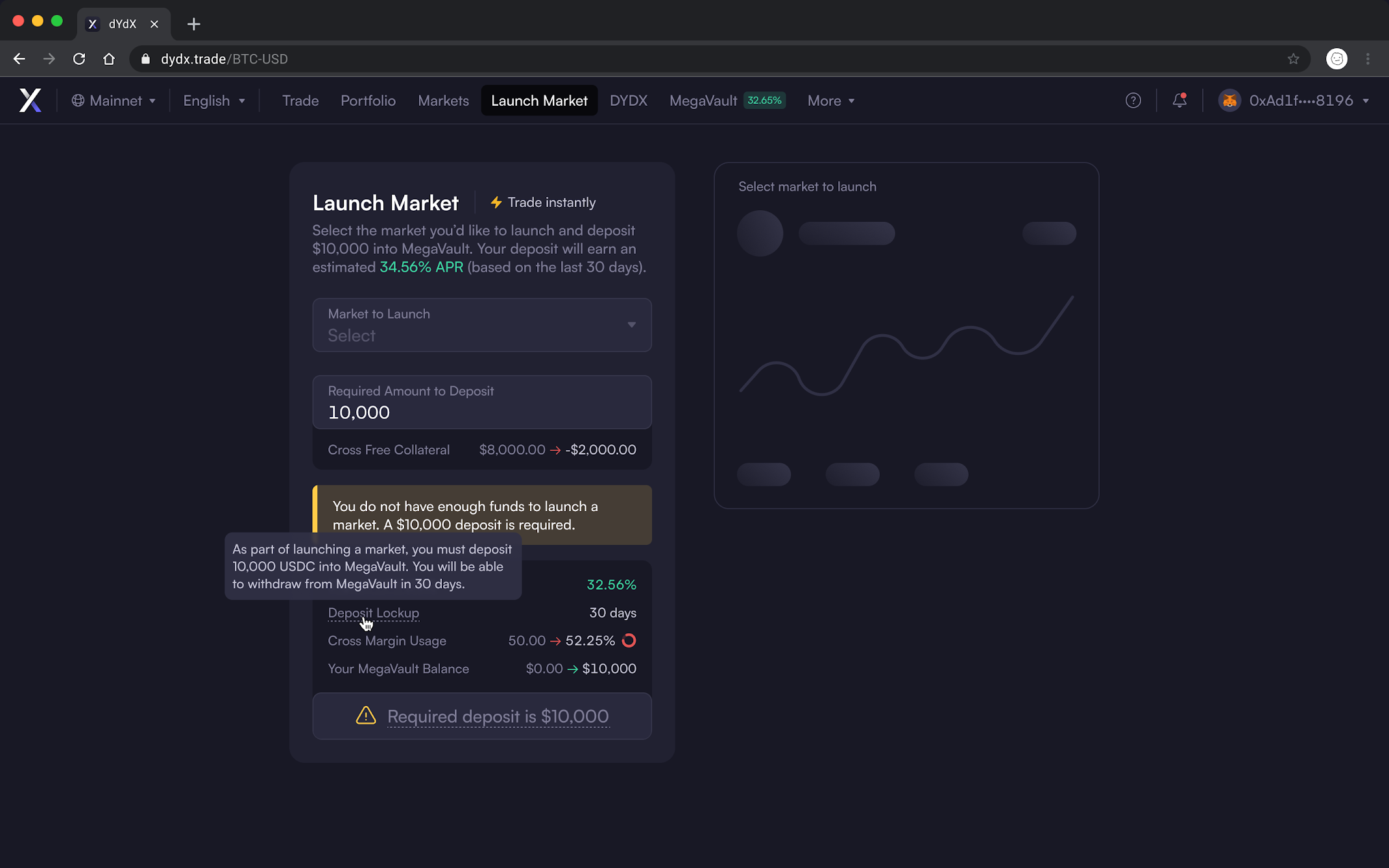

Instant Market Listings: Instant Market Listings allow users to easily and quickly create and trade new markets without governance approval and provide instant liquidity for these trading pairs.

Unlike CEX, which usually requires high listing fees and lengthy application processes, dYdXUnlimited's instant market listing function allows users to list markets and try various assets at any time and freely. At the same time, users can also obtain automatic liquidity support from MegaVault to provide strong impetus for the launch of these new markets, ensuring that the market can quickly enter an active trading state.

The introduction of this function will allow more assets to quickly enter the dYdX platform for trading, breaking the high voice of CEX in asset listing and providing more experimental and innovative space for more diverse crypto assets. What is more worth mentioning is that dYdX, by providing a more flexible and open market access method, has further consolidated its market competitiveness while also accelerating the development of DEX, and brought new opportunities to more projects and users, thus bringing greater diversity and vitality to the entire DeFi market.

Of course, in order to ensure the stability of the initial liquidity of the market, dYdX has set a reasonable deposit requirement (currently 10,000 USDC) and requires users to lock their deposits for 30 days after the market is listed. This mechanism not only effectively reduces the risk of market launch and creates a reliable and open trading environment for users, but also creates more potential profit opportunities for liquidity providers.

· Trading Rewards Program: In order to encourage more traders and market makers to actively participate in platform trading, dYdX Unlimited has redesigned the reward structure and launched a new trading reward program. Users can get DYDX token rewards through trading, and can also get corresponding trading reward points. These points will be distributed based on the monthly trading reward pool of US$1.5 million. The higher the trading volume and participation, the more generous the rewards will be.

Unlike traditional trading platforms that require high transaction fees, dYdX's trading reward plan converts users' transaction fees into rewards, which will significantly reduce users' transaction costs and increase the attractiveness of the platform.

This trading incentive mechanism can not only encourage users to increase trading frequency and increase market activity, but also improve users' long-term participation and enhance their stickiness and loyalty to the platform. In this virtuous cycle, it will continue to provide liquidity for the dYdX platform and enhance its market competitiveness.

Affiliate Program: The Affiliate Program allows users to earn commissions by inviting new members to participate in platform transactions. The program provides lifetime commissions and is paid in real time in the form of USDC. This means that dYdX affiliates can not only continue to receive commission rewards for the transactions of recommended users, but also the commissions are settled instantly every time a transaction occurs, and there is no longer waiting period for payment compared to other commission rebate programs. In addition, VIP affiliates can earn up to 100,000 USDC in rewards per month. Through this incentive program, dYdX not only increased user engagement, but also effectively expanded the platform's user base with the help of viral marketing strategies.

In addition, dYdX Unlimited will introduce more enhanced features in the future, such as popular wallet integration, license keys, instant deposits, etc., to continuously promote the innovation of platform functions and improve user experience.

From this point of view, dYdX Unlimited is not only a major functional upgrade and user experience optimization of the dYdX platform, but also, as the Chinese meaning of Unlimited means "unlimited", through unlimited products such as liquidity tools, market creation functions and new reward mechanisms, it may further promote user growth and activity in the DeFi market, providing a strong impetus for the maturity and popularization of the entire DeFi ecosystem.