Last night, a piece of news about Movement’s upcoming $100 million financing set off a wave in the cryptocurrency circle. According to reports, Movement Labs will complete a $100 million Series B financing, with a valuation of approximately $3 billion.

This round of financing is jointly led by CoinFund and Brevan Howard's Nova Fund and is expected to be completed by the end of January. Investors will receive a combination of equity and $MOVE tokens, with tokens as the main component.

After the news broke, many group members were discussing: Is OTC selling coins at a discount? Will it affect the airdrop share? Based on my understanding, let me help you sort it out:

① Financing after the TGE of a crypto project is a routine operation. The purpose is to introduce more institutions that accompany the project for a long time. On the surface, the valuations of new institutions are lower, but their tokens are locked for a long time and will not break the original token release rules.

② The chips purchased by new institutions usually come from the team or foundation, not from the established community shares, so Movement’s operation will not affect the interests of the community at all, let alone the airdrop distribution.

In summary, Movement chose to continue raising funds after TGE, most likely to introduce more powerful resource-based partners to the Move ecosystem. They will work together to create things in the future, rather than just making money out of nothing.

At present, the lead investors of the B round of financing are CoinFund and Nova Fund under Brevan Howard. As for whether these two institutions are awesome, just look at their backgrounds and investment portfolios:

CoinFund : Founded in 2015, it has invested in more than 100 companies, including Polygon, Near, L0, Flow, Worldcoin, Ondo, etc. It not only provides them with funds, but also helps them achieve long-term development through strategic guidance and industry resources.

Nova Fund : Part of the digital asset division of the hedge fund Brevan Howard, which is one of the world's top hedge funds, managing tens of billions of dollars in assets, covering sovereign wealth funds, corporate and public pension funds, endowment funds, etc.

In summary, the Series B financing that Movement is about to complete is a complete big game: on the one hand, it will obtain support from Web3 resource-based institutions such as CoinFund to jointly expand the ecological pie; on the other hand, it will seek support from Old Money to prepare for entering the traditional financial market in the future.

For us, all of the above are good news. So, continue to ambush Movement Phase II airdrop and wait for the blessing:

①0 Galaxy Mission

Although Galaxy Points were not included in the first phase of $MOVE airdrops, they are proof of community users’ persistence in signing in and participating in various activities. The official has long stated that they will be useful in the future, and I guess they will be linked to the second phase of airdrops.

Participate in the tutorial:https://x.com/wenxue600/status/1870257637667025179

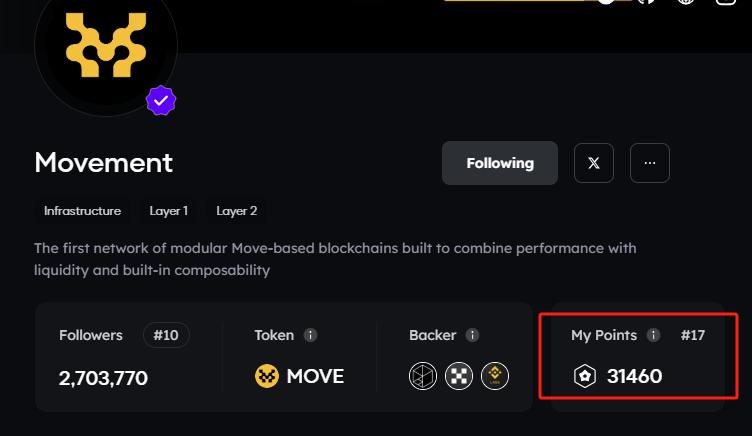

②Brush up on the Kaito-MOVE list

A few days ago, Movement officially settled in Kaito+ and announced an airdrop to Kaito users. The rules will be announced in the next few weeks. If you are interested, get started now.

Keep a few points in mind: produce more original Move content + interact more with the official account, founder @rushimanche and teachers ranked high on the list.