Under the impact of the global wave of digitalization and informatization, the traditional business model of the telecommunications industry is facing unprecedented difficulties. The promotion and implementation of the next-generation 5G technology has brought huge initial investment pressure to operators, but their business revenue model has not been improved, and value-added services have not achieved effective breakthroughs. Instead, they are caught in a fight in the stock market.

According to the data, although the revenue of the leading listed telecom companies in the United States is 50% higher than that of the Internet giants, their profitability is only 30% of the latter. The profit margin of the telecom industry is only 20% of that of the Internet giants, and the net income can only be maintained at around 5%. The market value is only 30% of that of Internet companies. This situation reflects that investors have a serious lack of confidence in the heavy asset investment model and low growth potential of the telecom industry.

The telecommunications industry is also constantly changing. For those who participated in the virtual operator business in 2015/2016, the opening of the telecommunications operator industry to private enterprises did not solve practical problems. Whether it was fighting for existing stocks or deepening the industry, this was not an essential reform plan. We also explored going overseas at that time and tried to cooperate with Lebara Mobile, the largest virtual operator in Europe, but for various reasons, we did not move forward.

Looking back now, the eSIM global roaming scenario that was originally built is actually very suitable for implementation through Web3, and the blockchain value transmission network can be used to promote value-added services in the future. However, blockchain and Web3 technology did not rise at that time, otherwise it would be a different picture.

Based on the current status of the traditional telecommunications industry, this article will look at the solutions provided by blockchain technology and the Web3 operating model to the current situation. Through the case of Web3 decentralized telecommunications operator Roam, this article will further explore how blockchain and Web3 can reconstruct the telecommunications industry - upgrading communication networks to value exchange networks. What will this bring us?

1. Challenges in the business model of traditional telecom operators

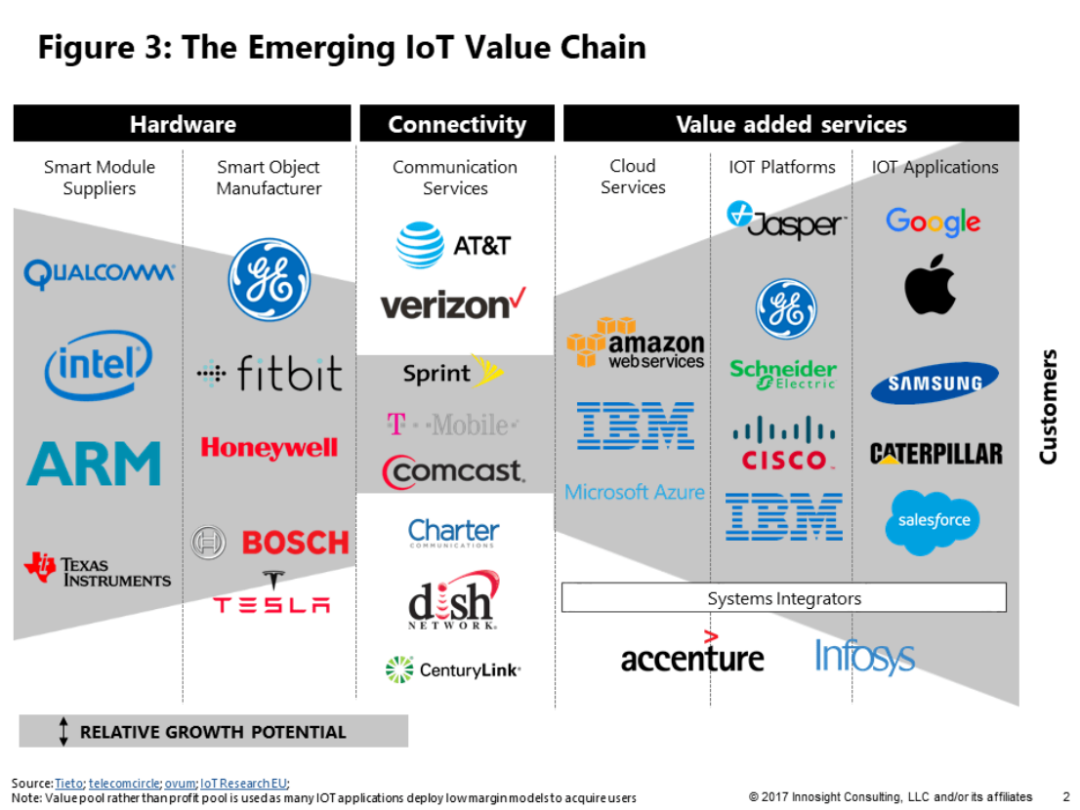

The business model of traditional telecom operators is centered on communication network infrastructure. They achieve profitability by providing 1) telecom connectivity services, 2) value-added services, and 3) industry digital solutions, and continue to transform amid technological iterations and market changes. Their core logic can be summarized as a three-layer architecture of communications: “connection + ecology + service”.

Basic communication services remain the mainstay of revenue, including traditional businesses such as mobile data, home broadband, and enterprise dedicated lines. For example, the popularity of 5G packages and gigabit fiber has driven the growth of data traffic revenue, but traditional voice and SMS revenue has shrunk significantly due to the replacement of OTT applications such as WeChat. In response to this trend, operators have increased user stickiness through bundled sales (such as "broadband + IPTV + smart home"), and China Mobile's converged package user penetration rate has exceeded 60%. At the same time, value-added services have become a growth engine, covering cloud services, the Internet of Things, financial technology and other fields. Taking the Internet of Things as an example, there are more than 2 billion smart devices connected by operators worldwide, and China Mobile's cloud computing revenue has increased 25 times in three years, showing the potential of digital transformation.

In terms of cost structure, operators face the dual pressures of 1) heavy asset investment and 2) refined operation. 5G base station construction, spectrum auctions (such as the US C-band auction costing $81 billion) and data center investment have pushed up capital expenditures, with global operators investing more than $300 billion annually. In order to reduce costs, the industry generally adopts co-construction and sharing (such as China Radio and Television and China Mobile’s cooperation on 5G base stations), AI energy-saving technology (Huawei’s solution helps China Unicom save 10% of electricity) and network virtualization (Open RAN saves 30% of equipment costs). However, the cost of competing for users in the existing red ocean market remains high, and terminal subsidies and channel commissions account for more than half of marketing expenses, forcing operators to turn to digital direct sales, with App subscription packages accounting for more than 60%.

Industry challenges mainly come from technology iteration and cross-border competition. Traditional businesses have declined significantly, with global voice revenue falling by 7% annually, SMS revenue shrinking by 90%, and per capita ARPU falling by 40% in ten years. Despite the rapid growth of 5G users, the payback cycle is long (estimated to be 8-10 years), and it is necessary to cope with the impact of emerging competitors such as Starlink satellite broadband and cloud vendor edge computing. For example, SpaceX Starlink has covered 500,000 rural users, and AWS has seized the enterprise low-latency market through Local Zones, forcing operators to accelerate transformation.

The transformation path of traditional telecom operators focuses on technology upgrades and ecological reconstruction. On the technical level, network slicing, edge computing and Open RAN open architecture have become key. For example, Deutsche Telekom provides automakers with an autonomous driving network with a latency of 1 millisecond, and AT&T customizes a dedicated channel for remote surgery for hospitals. In terms of ecological construction, operators are shifting from "traffic pipelines" to "digital service engines": South Korea's SKT launched the metaverse platform Ifland, Jio integrated e-commerce and payment to create a super app, and China Mobile entered the content ecosystem through Migu Video. ESG strategy has also become a differentiation tool. Vodafone plans to achieve 100% renewable energy power supply by 2030, and Verizon has promised to reduce carbon emissions by 40% in ten years, which not only reduces policy risks but also attracts socially responsible investment.

2. Fighting in the stock market and exploring the unknown in overseas markets

The previous wildly growing business model - huge stock market x basic communication service fees - can no longer support the current huge 5G capital investment and heavy operating costs. The market has entered a stage where several operators are fighting in the stock market and deeply integrating their respective market segments.

This is not only a dilemma for the telecom operators, but also a microcosm of the overall market economy. I remember listening to Luo Zhenyu’s New Year’s Eve speech a few years ago (he was very pessimistic about the market at the time, and it still applies now). The summary of the speech can be summed up in two words: go overseas. However, for telecom operators, going overseas is not easy.

Since communications is a very sensitive industry in every country, it will be extremely difficult for telecom operators to go overseas:

1) Market access restrictions: Most countries have passed legislation to limit foreign investment (e.g., India’s 50% limit on foreign investment in telecoms), require local operations (e.g., Indonesia’s “Data Sovereignty Law”), or even directly prohibit foreign investment (e.g., North Korea and Cuba);

2) Different spectrum allocation rules: Different countries have different 5G frequency bands (for example, China mainly uses 3.5 GHz, while Europe focuses on 700 MHz). Operators need to customize equipment, which increases the cost of cross-border deployment.

3) Strict requirements for data localization: The EU General Data Protection Regulation (GDPR) and Russia's Data Localization Law require data to be stored within the country, restricting cross-border data flows;

4) Local monopolistic market structure: Most countries are dominated by 2-3 local operators (e.g. SKT, KT, and LG U+ in South Korea account for 98% of the market share), and it is difficult for outsiders to break user inertia;

5) Price war and subsidy culture: Emerging markets (such as Southeast Asia) rely on low-priced packages and mobile phone subsidies, and multinational operators are under high cost pressure (for example, Vodafone withdrew from India due to losses caused by low-price competition).

In response to the above difficulties, whether through equity investment (for example, Singapore's Singtel indirectly penetrates the Asian market by holding local companies such as India's Airtel and Indonesia's Telkomsel), or through a joint venture model (for example, China Unicom and Telefónica established a joint venture to share Latin American market resources), or a virtual operator (MVNO) model (for example, Britain's Virgin Mobile entered markets such as Australia and South Africa by leasing networks to reduce infrastructure investment), it will still return to the origin of the problem - fighting for existing stocks in a limited market, huge investment in capital costs, and how to respond to the confusion of "where is the return".

Therefore, when it comes to going overseas, we see that telecom operators cannot completely get rid of geographical restrictions, but can achieve "limited globalization" through capital cooperation, technology alliances and vertical services. Based on this, telecom operators "going overseas" will present the characteristics of "global capabilities, local delivery":

- Core network layer: Build a global backbone network through submarine optical cables, satellites, and cloud services, but must comply with the data sovereignty rules of each country.

- Technical standards layer: 6G research and development has shown a "technical camp" of China, the United States and Europe, and operators need to choose sides in the standard split.

- Service application layer: highly localized, relying on joint venture partners or local teams for operation, such as Orange's launch of M-Pesa mobile payment in Africa.

3. How to use Web3 to reconstruct the telecommunications industry?

Obviously, limited globalization and survival in the crack market are not the answers we want. We can completely reconstruct the telecommunications industry through blockchain technology and Web3's operating model. The Web3 reconstruction of the telecommunications industry is by no means a simple "blockchain +", but through globalization, token economy, distributed governance and open protocols, the communication network is upgraded to a basic value exchange layer to support the future digital civilization. If operators refuse to change, they may become "plumbers"; if they embrace reconstruction, they may become the routing hub of the next generation of value Internet.

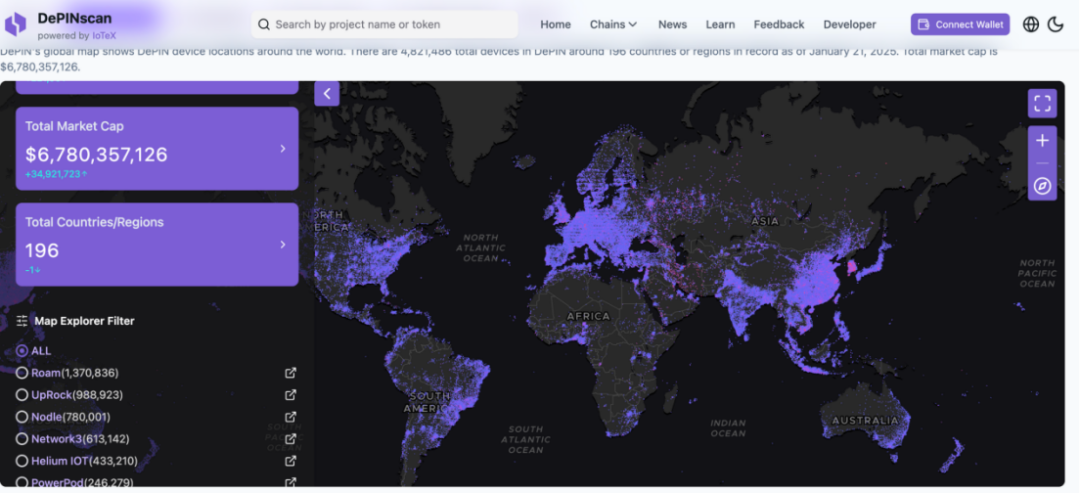

At the infrastructure level, physical network resources are shared in a distributed manner through tokenization. The Web3 decentralized telecom operator Roam model has verified the feasibility of users contributing Wi-Fi hotspots to receive token incentives, and has built a decentralized communication network covering one million nodes and more than two million users, challenging the traditional operator base station monopoly model. The DAO governance of spectrum resources (such as the "5G spectrum NFT" tested by British Telecom) allows idle frequency bands to be auctioned on demand, improving utilization and creating shared benefits through smart contracts. User identity management is also being innovated. The decentralized identity (DID) solution developed by Telefonica and Evernym allows users to independently control SIM card data, and operators only serve as verification nodes to reduce the risk of privacy leakage. Data sovereignty is further returned to users. South Korea's SK Telecom's blockchain data market allows users to trade desensitized behavioral data and obtain token benefits, while operators transform into transaction matchmakers.

The automation of cross-border services and settlements has become another breakthrough. The CBSG Alliance, in which AT&T, Orange and others participate, uses blockchain to reconstruct international roaming settlements, compressing the settlement cycle from 30 days to real-time account sharing, reducing costs by 40%; the DeFi model has been introduced into the tariff system, and users can obtain communication discounts by staking stablecoins, while operators issuing special tokens (such as the envisioned Verizon VZW Token) may reshape the payment ecosystem. In the field of the Internet of Things, the combination of blockchain and edge computing has spawned an autonomous network of devices - the Internet of Vehicles protocol developed by Deutsche Telekom and Fetch.ai allows smart cars to automatically bid for roadside base station resources to achieve low-latency communication; Ericsson uses blockchain to track the source of 5G base station parts to enhance the credibility of the supply chain.

In addition, in terms of economic models, communications and finance have achieved atomic-level integration: while users pay for services with cryptocurrencies, they can earn income by sharing bandwidth, data, and even motion (such as Telefónica's "motion mining"), forming a "consumption-production" closed loop; the DeFi mechanism has also spawned innovative services such as communications insurance and cross-chain roaming, and on-chain smart contracts automatically execute cross-border settlements, reducing costs by more than 40%.

Case: Web3 decentralized telecom operator Roam

Roam is committed to building a global open wireless network to ensure that people and smart devices can achieve free, seamless and secure network connections whether they are stationary or mobile. Compared with the geographical limitations and homogeneous services of traditional telecom operators, Roam, based on the inherent global advantages of blockchain, builds a decentralized communication network based on the OpenRoaming™ Wi-Fi framework and accesses eSIM services to build a global open and free wireless network.

After just over two years of construction, Roam currently has 1,729,536 nodes in 190 countries around the world, 2,349,778 application users, and 500,000 network verification activities per day, making it the world's largest decentralized wireless network. In addition, Roam users can also get free eSIM data when building and verifying Wi-Fi nodes, making Roam a telecommunications service provider that can operate in an Internet model.

Globally, although traditional Wi-Fi still carries more than 70% of data traffic, its outdated infrastructure and privacy and data security issues limit the exploration of its potential. To address these challenges, Roam worked with the Wi-Fi Alliance and the Wireless Broadband Alliance (WBA) to build a decentralized communication network by combining traditional OpenRoaming™ technology with Web3's DID+VC technology. This not only reduces the high upfront cost of global network construction, but also enables seamless login and end-to-end encryption similar to cellular networks. Users do not need to log in repeatedly and can connect to Wi-Fi as seamlessly as using cellular data, which greatly improves user experience and connection stability.

Roam's decentralized deployment solution provides an innovative solution for the industrial upgrade of OpenRoaming™ Wi-Fi. With the natural entry attribute of Wi-Fi, Roam bridges the gap between Web2 and Web3 ecosystems and redefines the industry norms of telecommunications services in terms of user experience and data standards through decentralized technology.

Roam encourages users to participate in network co-building through the Roam App, share Wi-Fi nodes or upgrade to the more secure and convenient OpenRoaming™ Wi-Fi. Users can not only enjoy seamless connections between four million OpenRoaming™ hotspots around the world, but also find Roam's self-built network nodes in inaccessible areas such as Siberia and northern Canada, thereby greatly expanding network coverage and improving user experience.

At the same time, Roam's eSIM provides key support for its vision of a global open wireless network. Users can activate data plans directly on their devices without using a physical SIM card, greatly simplifying the usage process. Roam eSIM covers more than 160 countries around the world, providing travelers and business people with a flexible and cost-effective network connection solution.

Roam promotes the rapid development of decentralized networks through free global access to Wi-Fi+eSIM and a diverse incentive mechanism. At the same time, through innovative mechanisms, users can earn global data traffic or Roam points tokens by signing in, inviting friends or interacting with Roam social media, providing users with a continuous and stable income channel.

4. Value exchange network based on communication

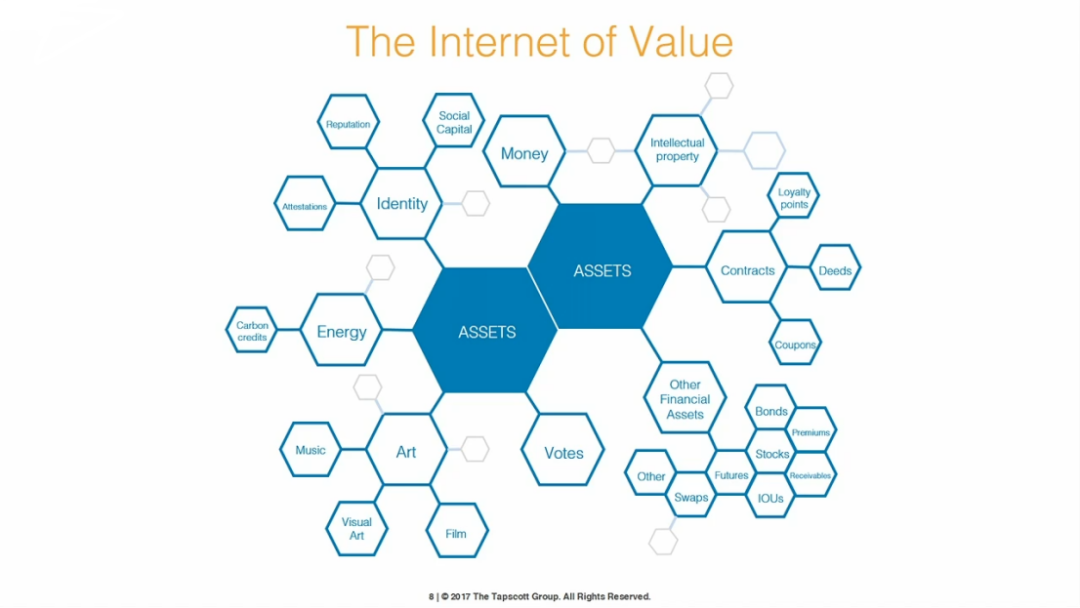

In fact, in addition to reconstructing the business model through Web3, the transformation of blockchain communication networks can be a major breakthrough. The reconstruction of the telecommunications industry based on blockchain and Web3 is essentially to upgrade the communication network to a value exchange network, from "transmitting information" to a "transmitting information + value + trust" trinity network, becoming the next generation of digital society foundation integrating value transmission, data rights confirmation and trust collaboration.

Web2's Internet infrastructure has achieved frictionless and nearly free information flow, but the value in it has not circulated. Web3's value Internet can provide a carrier for these values, allowing value to circulate frictionlessly and nearly freely like information. In this, the essence of payment is the transfer of value (Exchange of Value).

From a historical perspective, the evolution of communication technology has profoundly reconstructed the development trajectory of the financial payment system, and each technological breakthrough has brought a qualitative leap in the form of payment. From the ticking sound of Morse code in the 19th century to the instant settlement of modern blockchain payments, communication technology continues to promote revolutionary changes in the field of financial payments by improving information transmission efficiency, expanding connection boundaries, and reconstructing trust mechanisms.

4.1 Information transmission efficiency: deconstructing the value transmission barriers of time and space

The emergence of the earliest telegraph technology enabled the first cross-time and space value transfer. After the opening of the transatlantic telegraph cable in 1858, the time for interbank remittances was shortened from weeks to hours, and the time and space barriers of the financial market were broken for the first time. The electronic message communication system established by the SWIFT system in 1973 shortened the cross-border payment cycle of the traditional telex (Telex) from 3-5 days to T+1, and the communication capacity of processing 42 million payment instructions per day globally built the infrastructure of modern cross-border payments. The real-time communication capability created by the TCP/IP protocol in the Internet era has compressed the completion time of electronic payments to milliseconds. The blockchain uses a P2P (peer-to-peer) communication network to replace the centralized communication architecture of traditional finance, and builds a value transmission channel without an intermediary. Compared with the centralized message exchange relied on by the SWIFT system, the communication efficiency is increased by hundreds of times. The communication network based on blockchain Web3 can also achieve a significant improvement in the efficiency of value exchange.

4.2 Expanding the connection boundary: Building the nerve endings of inclusive finance

Cellular mobile communication technology extends payment nodes to every corner of the physical world. SMS payments supported by 2G networks have given rise to a financial inclusion revolution in Africa. HelloCash of Ethiopia Telecom has achieved financial service penetration in areas where base station coverage is less than 40% through USSD channels. Similarly, the global network built on Roam can provide bank-level financial services on the blockchain to all people who can access the Internet (especially the 1.4 billion people who cannot access banking financial services), whether they are in the Amazon rainforest or in the heart of Africa, truly achieving financial inclusion and financial equality.

In addition to the expansion of geographical boundaries, communication networks can also connect silicon-based civilizations. IoT communication technology is creating new payment scenarios. Smart meters supported by NB-IoT realize automatic meter reading and deduction at ENEL in Italy, and vending machines connected by LoRaWAN complete more than 2 million unmanned payments per month at Lawson convenience stores in Japan. The ultra-low latency of 1 ms and the ability to connect millions of devices on the 5G network support the automatic charging and deduction system realized by Tesla's V2X communication. Similarly, with the outbreak of AI Agents, the interaction between AI Agents or between AI Agents and humans requires communication networks and value transmission on the network.

4.3 Trust Mechanism Reconstruction: InTrustlessWeTrust

The Bitcoin white paper depicts a world without trusting intermediaries, and cryptography and code provide us with a trustless foundation. However, when this idealistic encrypted world intersects with the extremely realistic real world, compromise is not the only option. How to build a trust mechanism on the blockchain network is something we need to think about.

The "on-chain bank" based on blockchain technology and Web3 can already realize many functions of banking services in developed countries, such as savings (self-custody), investment and financial management (DeFi Stacking or RWA Product), transfers (blockchain peer-to-peer network), consumer payments (stablecoin payment and collection), and so on.

For users, these bank-level services can be realized by anyone who just needs to be connected to the Internet. This can be a further derivative of the Roam project. With the reconstruction of the mechanism, more financial services based on blockchain communication networks will be built. In the future, new forms combining communication and payment such as "global instant settlement network" and "AI autonomous financial body" may be born.

Case: Orange Money's mobile payment layout in Africa

The Orange Money case profoundly reflects the path of telecom operators to deepen their localization strategy through financial technology. Although this is a path for traditional telecom operators, it can provide a reference for the new transformation of Web3 telecom.

The African market has become a blue ocean for mobile payments due to its low penetration rate of traditional banks (only 34% of adults in sub-Saharan Africa have bank accounts) but high penetration rate of mobile phones (80%). Relying on its 130 million African user base, Orange has launched Orange Money in 17 countries with over 40 million users, and adopted a differentiated competition strategy: it competes for market share with low fees and high commissions in East Africa dominated by M-Pesa (such as Kenya), but occupies more than 60% of the market share in French-speaking West Africa (such as Senegal) by virtue of language adaptability and village-level agent networks, and cooperates with M-Pesa in the field of cross-border payments. The key to its success lies in vertical scenario binding - linking with agricultural cooperatives to issue procurement funds, accessing government public service payment, and innovatively launching microcredit (OKash instant loans) and low-cost cross-border remittances (30% reduction in fees), forming an "communication + payment + finance" ecosystem. However, the market is significantly fragmented: M-Pesa monopolizes East Africa (monthly transaction volume of US$12 billion), MTN occupies West Africa, and local giants are in a melee with international players such as PayPal. Orange has increased its user ARPU by 20% through payment services and optimized risk control (bad debt rate < 5%) using transaction data, but faces profit pressure (net profit margin is only 3-5%), network security investment (accounting for 30% of the IT budget) and the risk of political instability in the French-speaking region. In the future, Orange plans to integrate payment, e-commerce, and content to build a super app, and explore the West African digital currency "Eco" pilot. Its model verifies that operators need to deeply integrate local scenarios, channels and culture in underdeveloped markets, but sustained growth depends on the balance between ecological synergy and compliance.

5. Final Thoughts

The transformation of the telecom operator industry is ongoing. In the future, a hybrid model of "centralized facilities + decentralized services" may be formed: one type of basic communication operators will continue to serve as "plumbers" and control the physical layer such as optical fiber and spectrum, but open network capabilities through APIs for DePIN projects to call, such as Vodafone tokenizing network slices, and enterprises can use cryptocurrencies to purchase exclusive channels. Another type of service operator, similar to Roam, will reconstruct itself as a value routing hub in an open protocol based on communication networks and blockchain technology. This is not limited to local areas, but to carry out communication-based ecological businesses around the world. Similarly, the user layer needs to shift from "passive consumers" to "eco-co-builders" in order to further promote the development of the entire Web3 communication ecosystem.

The ideal country of Network State needs to be built on the communication network. Web3 decentralized telecommunications operators like Roam may become the digital foundation of the ideal country.