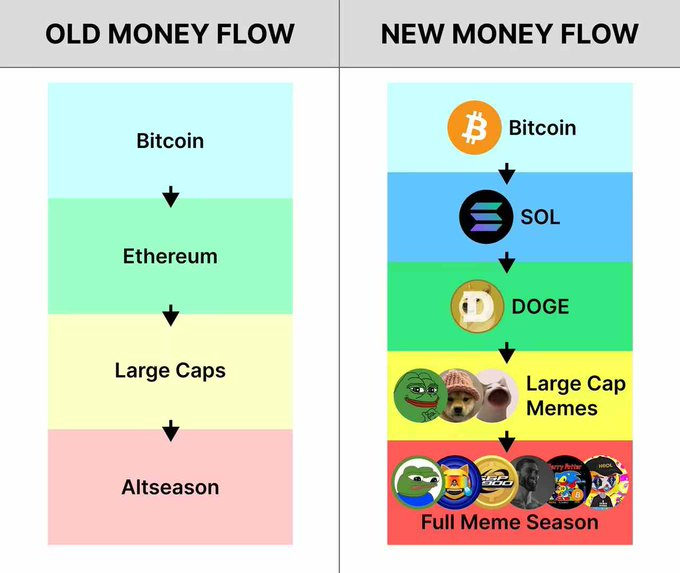

The previous rotation pattern of asset sectors in the market was: when external incremental funds entered this industry, they would first start with Bitcoin and then flow to Ethereum. The DeFi infrastructure of the Ethereum ecosystem would fully leverage the incremental funds and amplify the utilization effect of the funds, and finally flow to the popular tokens in various new tracks.

However, this round of bull market is quite special, and the rotation of asset sectors has changed: Bitcoin skyrocketed first, then Solana, then Doge, then mainstream meme coins, and finally various meme coins on each chain.

Why did this change occur?

First of all, Bitcoin is generally very strong in the early stages of a bull market, especially with the support of this round of ETFs, which has led the entire industry.

The external incremental funds for Bitcoin mainly enter through ETFs, which results in the funds not actually entering the cryptocurrency circle, but being isolated in the U.S. stock market.

Ethereum also has an ETF, but external incremental funds are currently focusing on Bitcoin, so Ethereum is naturally very weak and lacks liquidity.

The surge in Bitcoin has brought unexpected effects to the industry.

Bitcoin is the biggest meme coin, a symbol of a decentralized world whose symbolic significance far exceeds its actual technical use.

As the "world computer", the value of Ethereum depends more on the development and practical application of its ecosystem.

Now it has become two major factions, meme coins represented by BTC and VC coins represented by ETH.

The market has gradually split into two major factions, some of which prefer Bitcoin as a speculative asset or a store of value, while others value the practicality and innovation potential of Ethereum and its ecosystem.

Then, the unexpected effect of BTC’s surge is the meme coin craze, with speculators currently dominating the market; while ETH’s weakness has led to the temporary suppression of various practical “value coins”.

Meme coins are very short, flat and fast, with large fluctuations, and have a strong sense of participation and excitement.

The market's attention is limited. Since utility coins represented by ETH or VC coins (generally have investment logic and such tokens have value support) are lying idle, then just rush into the meme coin casino to play.

The simplicity and entertaining nature of meme coins make it easier for novice investors to participate.

Coupled with the support of top KOL Musk for Doge, the popularity of meme coins has been greatly promoted.

The right time (bull market cycle), the right place (the new US government has loosened the policy environment), and the right people (Musk's promotion) are a variety of factors that have jointly driven the popularity of this round of meme coins.

However, assets without value support will not go far, so after the meme craze, when people return to rationality, funds will still look for assets with narratives and imagination, as these assets have more room to blow bubbles.

So don’t be discouraged by VC coins represented by ETH. Funds should still flow to tokens with bigger narratives.