author:

ABC Alpha Researcher - Twitter ID @Cyrus_G3

Ever since Bitcoin broke through its previous high (US$69,000) in 2024, while Ethereum has been moving further and further away from its previous high (US$4,800), doubts about Ethereum in the market have become increasingly louder.

By 2025, Ethereum fell below $3,000 in February, below $2,000 in March, and even below $1,500 in April. The market sentiment towards Ethereum has gradually shifted from doubt to despair and abandonment. Many ancient addresses from the ICO era have also begun to gradually clear out Ethereum. The leading institutions that once supported Ethereum have also begun to waver.

What happened to Ethereum? Is there still hope for Ethereum?

This article will focus on these two issues and start from the following five aspects to review the rise and fall of Ethereum and look forward to its possible future.

1. Ethereum’s glorious years (2017-2022)

In July 2014, Ethereum launched ICO

However, from 2014 to 2016, the price of Ethereum has been below $10. At this stage, Ethereum only had the name of Blockchain 2.0, and the smart contract technology was also cool, but Ethereum was of no use at that time.

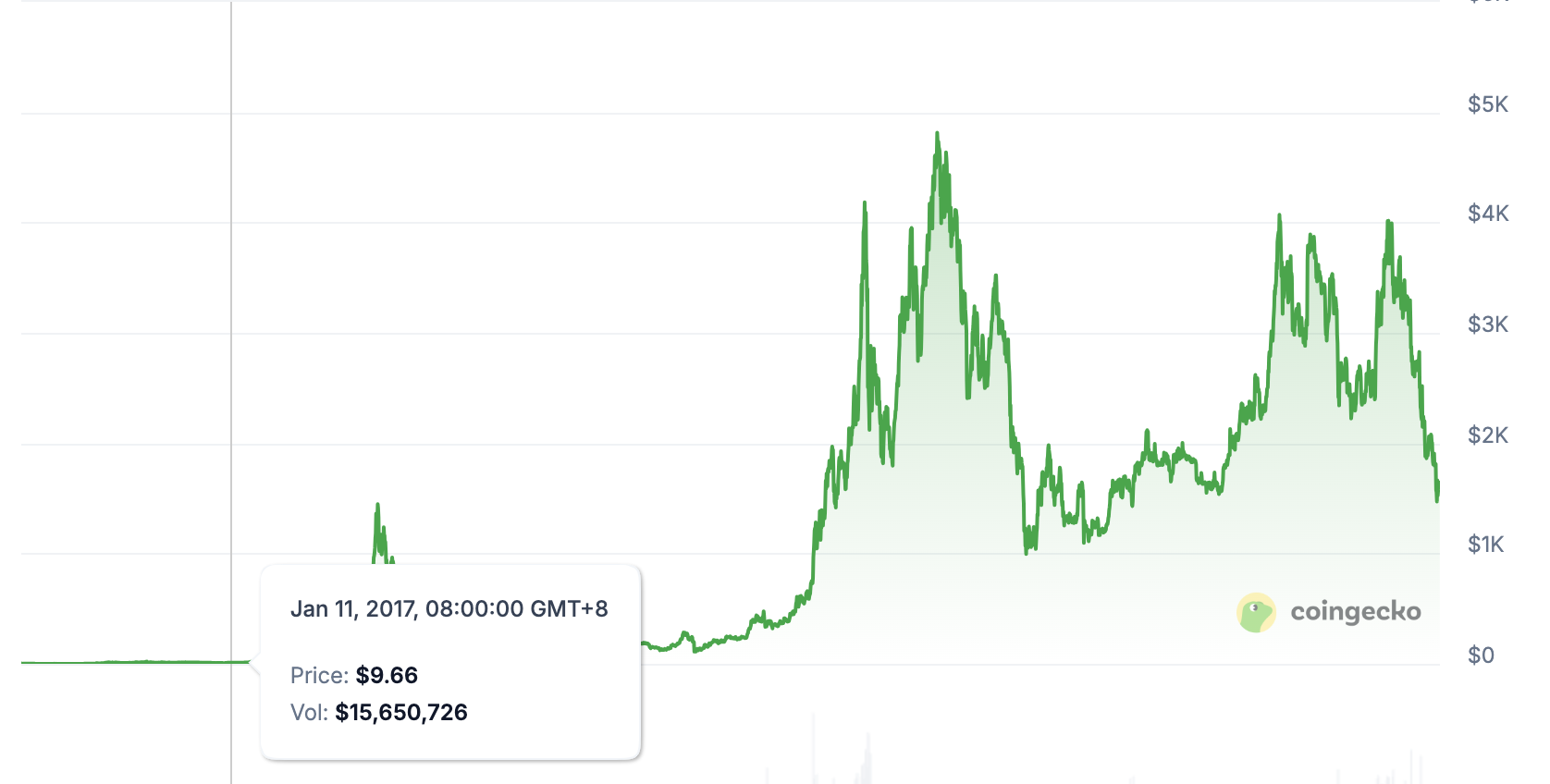

In 2017, the era of ICOs began, and Ethereum became very useful. People bought ETH to participate in ICOs. By January 13, 2018, Ethereum had risen from $10 at the beginning of 2017 to $1,430, reaching its first new high in history.

According to incomplete statistics, more than 2,500 tokens used ETH to launch ICOs from 2017 to early 2018. At this stage, the greatest value of Ethereum is the issuance of coins. ETH is not only the GAS token with the largest consumption on the chain, but also the only bargaining chip to participate in the IOC wealth wave.

Although many new public chains such as NEO, QUTM, EOS, and TRON were born during this stage, the market share of other public chains combined is almost negligible in the ICO and smart contract market exclusively monopolized by Ethereum.

At this stage, Ethereum has enjoyed huge dividends from innovators!

2018-2019 is the era of hundreds of chains

Due to the success of Ethereum, countless new public chains have emerged in the market. In addition to the ones mentioned above, we list a few more public chains that many people may not be familiar with, such as: GXC, NULS, ELF, Algorand, etc.

Of course, during this stage, some public chains emerged that are still active today, such as: TON, ADA, Cosmos, Avalanche, and of course, the most famous of them is Solana. Yes, Solana was not outstanding among the new public chains at the time, but a few years later, it became the biggest challenger to Ethereum, which is quite touching.

Although, at this stage, there are numerous new public chains that attempt to challenge Ethereum, Ethereum still absolutely monopolizes the smart contract market. Smart contracts were first created by Ethereum, and the era of smart contracts was opened by Vitalk. Vitalik has great appeal and influence in the global Crypto field, second only to Satoshi Nakamoto. The Ethereum ecosystem also gathers the largest number of smart contract developers and countless native Crypto technology and thought innovators in the world. All of this will be fully demonstrated in the coming 2020.

Finally, it is 2020, the summer of DEFI that countless people yearn for and the absolute highlight moment of Ethereum, has finally arrived.

After silent fermentation and continuous exploration from 2018 to 2019, DEFI Protocol, one of the earliest Crypto-native applications, finally broke out in the Ethereum ecosystem in the summer of 2020.

Compound's amazing liquidity mining directly detonated the market. A large amount of ETH was used to mint COMP. The skyrocketing TVL and platform coins started a wave of liquidity mining.

Uniswap, invested by Vitalik himself, opened the era of on-chain DEX with the minimalist formula of X*Y=K

Yearn.Finance launches DEFI yield aggregator, #YFI soars 10,000 times in 30 days and is far ahead

DAI launched by MakerDAO is the first decentralized stablecoin on Ethereum.

Curve’s stablecoin DEX allows many stablecoins and DEFI tokens to obtain smooth liquidity on Ethereum

…….

DEFI Summer has pushed everyone's expectations for Ethereum to a peak, because Ethereum can not only be used to issue coins, but also to build truly valuable decentralized applications. The decentralized world of the future will be built on Ethereum. Ethereum is eating up the world.

Following the DEFI Summer in 2020, in 2021 and 2022, the Ethereum ecosystem has also seen a wave of crazes such as GameFi, SocialFi, and NFT. Wave after wave of innovation has made the Ethereum ecosystem present a thriving scene.

On November 10, 2021, Ethereum reached an all-time high of US$4,878, and Ethereum's prosperity reached its peak.

However, as the Ethereum chain carries more and more funds, users, and applications, Ethereum has begun to become more and more expensive and slower.

Performance expansion issues have become the biggest obstacle to Ethereum's development.

2. Ethereum’s expansion and transition path (POS-Layer2)

Ethereum's expansion plan has always had two main directions: switching to the POS mechanism and developing Layer2

The transition from POW mechanism to POS mechanism was the direction set by Vitalik when he first created Ethereum. Vitalik believed that POS was more resource-efficient than POW. At the same time, the POS mechanism could also improve the performance of the Ethereum network and make Ethereum more scalable.

The Layer2 solution is also the direction of Ethereum network expansion that Vitalik has been pushing for, from the initial exploration of state channels (Raiden Network), subnets (Plasma, Sharding), and the Rollup solution that became mainstream later. The OP-Rollup and ZK-Rollup that broke out in 2022-2023 have brought hope to Ethereum's expansion.

Whether switching to POS or Layer2, the Ethereum community at the time considered it the right choice for Ethereum to continue to be great and prosperous.

Although the switch to the POS mechanism has caused dissatisfaction among a large number of miners, Ethereum still officially switched to the POS mechanism on September 15, 2022. The POW era of Ethereum is over, miners have left, and the only thing Ethereum can rely on in the future is developers and Layer2.

However, is Layer2 really the savior of Ethereum?

After the development from 2022 to 2024, many Layer2s of Ethereum have been launched one after another. The ones we can mention are: Arbitrum, Optimism, zkSync, StarkNet, Mantle, BASE, Blast, Scroll, Linea, Polygon zkEVM, etc.

However, after each Layer2 went online, it did not bring more benefits to Ethereum. Instead, it continued to suck blood from and bite back at Ethereum. Every Layer2 was engaged in a TVL competition and was developing the same Dapps. Few Layer2s actually came up with applications that were not available on the Ethereum mainnet.

In the end, Ethereum became the Zhou emperor who existed in name only, and Layer2 became independent vassal states that not only continued to divide Ethereum's market, but also had ambitions to replace it.

Later, a group of initial Ethereum native applications such as Uniswap began to build their own Layer2, and even used their own tokens to replace ETH as GAS, which was a complete betrayal.

Ethereum has cultivated a large number of Layer2s, and almost all of them have eventually become competitors for mainnet liquidity and developers.

The expansion path of Layer2 has been falsified.

Looking back, Ethereum's abandonment of POW is almost an act of cutting off its own arm.

Without miners, ETH tokens lose their basic manufacturing costs and the most basic price-bearing mechanism.

Suppose that Ethereum did not switch to POS, but continued to develop Layer2 based on the POW mechanism. Even if Layer2 did not develop well, the price-bearing mechanism of ETH would still be valid because there are miners and a large amount of computing power and electricity are continuously invested in Ethereum. Then, the price of Ethereum would most likely not be what it is today, at least not as bad as it is today.

The picture below shows the price of Ethereum when it was converted to POS, which was around US$1,500. Today, three years later, Ethereum is still around US$1,500.

All this seems so absurd, yet seemingly destined.

3. Ethereum’s Innovator’s Dilemma (Besieged by Public Chains Such as Solana)

Regardless of whether the switch to POS and Layer2 is successful or not, one thing no one can deny is that Ethereum has always been a leader in Crypto innovation.

Before 2022, all innovations in the Crypto field were born and developed from Ethereum, and then copied by other chains.

Ethereum has DeFi, and other chains are following suit with DeFi; Ethereum has GameFI, and other chains are following suit with GameFI; Ethereum has NFT, and other chains are also going to have NFT.

Ethereum has been innovating and other chains have been imitating.

However, innovators often fall into the innovator's dilemma.

The "innovator's dilemma" generally refers to the situation where industry leaders focus on optimizing existing technologies and meeting current user needs, while ignoring emerging disruptive technologies or market trends, and are eventually surpassed by more agile competitors.

After 2020, in order to optimize the performance of Ethereum and meet the needs of existing DEFI users, Ethereum has been looking for ways to expand. In summary, it is to make ETH faster and cheaper. Core developers basically bet on the two routes of switching to the POS mechanism and supporting the development of Layer2.

From the perspective of Ethereum’s development, there is nothing wrong with this, and it is even the only path to choose. However, this is the inevitable dilemma for innovators.

Since users need a faster and cheaper blockchain, why can't it be BSC, why can't it be Tron, why can't it be Solana?

What will the market need and what will users need in 2020? Top players have already figured out how to make the game work. It’s nothing more than issuing assets, trading assets, finding scenarios for assets, and then making it faster and more convenient for everyone to play.

Right now, Ethereum is busy scaling, and it’s slow and expensive, so there’s an opportunity for blockchains that are both fast and cheap.

As a result, TRON seized the stablecoin market.

BSC and BASE have closed the loop of the logic of project issuance and trading based on their own exchange ecological barriers.

The most terrifying is Solana. The foundation has personally taken action and, relying on the simple and crude Meme method, has united the forces of various parties to continuously create a wealth myth. Sol has become the touchstone that everyone desires in the Meme craze.

Ethereum is being surpassed by its competitors.

Ethereum has always been an innovator and leader in underlying public chain technology. Whether it is the initial smart contract technology or the subsequent various decentralized applications, they are all products that lead the times.

However, everything on the public chain is open source and there are no secrets at all.

If you innovate a technology today, I can use it tomorrow.

If you come up with a new way of playing today, I can imitate it immediately.

Ethereum's continued glory from 2017 to 2022 stems from its leading technology and continuous innovation in ecological gameplay. However, after 2022, when Ethereum's core developers focus on expanding performance and other underlying R&D, Ethereum's innovation in applications and gameplay begins to slow down. New chains that are not troubled by performance can focus on model innovation. Then, when Ethereum is busy with underlying R&D, those flexible competitors that focus on model innovation can quickly overtake it.

Because if Ethereum does not innovate, it will fall behind, and this is the fate of open source public chains.

However, is this Ethereum’s fault?

Not really.

There is nothing wrong with Ethereum. There is nothing wrong with expanding performance, doing underlying research and development, and providing better infrastructure. This is the dilemma that innovators must face when they develop to a certain point.

In addition, Ethereum’s weakness also highlights a more serious problem, that is, the Crypto industry is really underdeveloped.

4. Ethereum’s weakness is the result of the industry’s stunted growth

Apart from Bitcoin, Ethereum can be said to be the biggest innovation in the Crypto field.

But why did Ethereum suddenly fail?

Apart from the fact that companies that focus on basic research and development are surpassed by more nimble competitors, are there any deeper reasons?

I think there is. That is, the Crypto industry has not yet found a truly healthy development paradigm, or in other words, in addition to issuing assets and speculating on assets, does Crypto have more application value?

Until this answer is found, the Crypto industry will be a typical example of stunted development.

What is developmental disability?

You see, in this cycle, apart from BTC, only Meme and the wealth effect are left, and no one is willing to pay for various types of projects supported by many VCs.

Why is no one paying for it? Because everyone knows that these projects are just telling stories and have no real value.

In this case, it is better to buy the safest BTC and then play the simplest and crudest Meme.

Therefore, before the Crypto industry develops truly valuable applications, it is likely to continue to cycle through the current model. If one day, even Meme loses its wealth effect, then there will only be an endless bear market.

Therefore, I say, instead of lamenting the weakness and decline of Ethereum, what we should really worry about is where the future of Crypto is headed?

5. In the future, Ethereum may no longer be the only dominant platform

So, what does the future hold for Ethereum?

We mentioned earlier that the smart contract market opened up by Ethereum and many Crypto models can be easily copied by other competing chains. In terms of technology and model, Ethereum has lost its competitive barriers. What Ethereum can do, other chains can basically do.

The only remaining barriers of Ethereum are the funds deposited in the Ethereum mainnet and the closed-loop DEFI ecosystem. These DEFI protocols, from lending, trading, stablecoins, on-chain leverage, etc., have formed a seamless and organically combined DEFI ecosystem. When seeking liquidity for all assets entering the chain, Ethereum's DEFI is an unavoidable link.

Therefore, many people say that RWA may be an opportunity for Ethereum, and I agree with that. However, RWA has a long way to go, and whether Ethereum can continue to create more and newer on-chain gameplay is still one of the most effective breakthroughs.

However, Ethereum did lose its monopoly.

In any case, Ethereum's competitors have really developed and each has formed its own barriers.

Ethereum's years of expansion have not improved its performance. Ethereum is still very slow and expensive. Applications with high performance requirements will still not choose Ethereum in the future. Instead, they will choose new public chains such as Solana, TON, BSC, Tron and even SUI.

So, will Ethereum lose its second place position for a thousand years? Will the title of the king of public chains be replaced by other chains?

I dare not give a direct answer, but we can make a simple inference:

If Ethereum's only remaining DEFI advantage is also taken away by new public chains such as Solana.

If Ethereum fails to improve its performance.

If Ethereum's ecological innovation is still half a beat behind the market.

If, Ethereum developers gradually leave.

So, in a situation where there are many wolves waiting for the tigers, what will happen to Ethereum, which is expensive, slow and lacks innovation?

As a former Ethereum Maximalist, I still expect Ethereum to continue to innovate and Vitalik to continue to lead the Ethereum developer community and continuously launch more innovative applications and development paradigms, because only continuous innovation is the only barrier for Ethereum.

Summarize

This article reviews the eight-year history of Ethereum from 2017 to the present. Ethereum represents the second possibility of blockchain technology, which is the biggest innovation after Bitcoin. The rise of Ethereum originated from ICO, which is the use of smart contracts to issue coins for financing. This is the earliest application scenario of ETH. DEFI, GameFi, SocialFi, NFT, etc. in 2020-2021 have pushed the application scenarios of Ethereum's smart contracts to a peak. At the same time, the price of ETH has also reached its peak.

However, in 2022-2023, Ethereum's focus will be on POS and the development of Layer2. The Ethereum ecosystem lacks decent market- and community-oriented application innovation or model innovation. The Ethereum ecosystem has never seen any paradigm innovation that can surpass DEFI. Instead, competing chains such as Solana have come up with new tricks. This is the core reason why Ethereum and Ethereum ecosystem-related tokens are so depressed and weak in this cycle.

When we ask about the future of Ethereum, we are actually asking about the future of the Crypto application market. The prosperity of Ethereum reflects the development of Crypto to a certain extent. After all, our industry cannot only have Bitcoin and Meme.

Bless Ethereum, bless Crypto. Even if one day Ethereum is no longer the only one in the smart contract market, the technology and paradigm innovation of the Ethereum ecosystem are still worth looking forward to for all of us.