ETH has been in a slump for a long time, so we still need to give everyone some psychological massage.

One viewpoint is that the reason for ETH’s long-term slump is that it is now in the stage of changing dealers, with large financial institutions on Wall Street becoming new dealers and gradually taking over the chips of previous wild dealers.

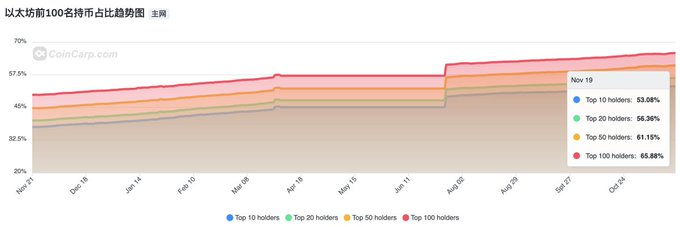

We can also verify this from the data: Over the past year, the market share of the top 100 coin holding addresses has been on an upward trend and has now reached 66%, especially after the ETH ETF was approved for listing, there has been a significant increase.

This shows that the concentration of ETH is actually getting higher and higher. The top addresses have been buying, but the price of ETH has not risen. What does this mean?

On the one hand, it shows that the dealer has always been there and is continuously absorbing chips; on the other hand, it shows that there is a large amount of turnover in the market. Not only are retail investors throwing away their chips, but this group of top addresses are also exchanging hands internally, that is, changing dealers.

You should know that ETH and BTC are the only two tokens with ETFs, and ETH has a very big advantage over BTC: staking income.

Once the ETF starts to earn staking income or even re-staking, the risk-free return on currency basis of at least 3% per year is actually very attractive, especially compared with traditional financial products.

This is the untapped potential of ETH and also the potential biggest benefit.

Naturally, traditional financial institutions will not let go of this piece of cake and have a strong desire and motivation to become the new owners of ETH.

However, ETH has been the main narrative in two rounds of bull and bear markets. There are naturally more long-term holders and the chips are more dispersed. Therefore, the turnover time of these chips will take a relatively long time and requires a thorough cleansing.

Therefore, it is necessary to suppress the ETH price for a long time and make previous long-term holders throw away their chips, such as the popular SOL, so that the chips can be concentrated in the hands of new dealers.

Only after the new investors have accumulated enough funds will they have the motivation to push up the price of ETH.

This is an open conspiracy.

Therefore, do not throw away the truly valuable chips in your hands, namely BTC and ETH, and survive this long and painful wash to get the long-term returns you really want.