By Michael Nadeau, The DeFi Report

Compiled by: Deng Tong, Golden Finance

Cryptocurrency was supposed to be entering its “golden age.” But over the past few months, I have been unable to shake off this persistent feeling of worry.

This week, I’m sharing a report that explains why this is the case.

Why am I worried?

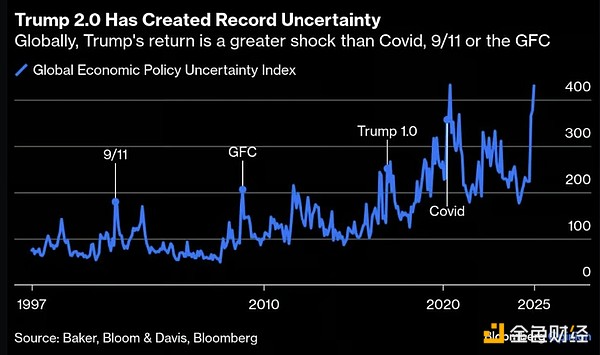

Previously, we shared our thoughts on the key themes for 2025. Namely, uncertainty related to inflation/tariffs, interest rates, fiscal spending/DOGE, the dollar, global liquidity, business cycles, etc.

Why? We want to have an argument. We want it to be rooted in data and game theory/incentives.

In other words, we want to have faith. It's like this.

However, when we sift through the data, we are unable to build up conviction pointing to favorable conditions for the cryptocurrency market in the short to medium term.

It’s just that my belief is moving in the other direction – that we are in the later stages of this cycle.

Of course, we shared the “Bear Case” with you on January 15th. At that time, we felt that the market was becoming quite frothy. Therefore, we started to build cash positions. But we were not ready to call it a “top” yet.

Seven weeks later, evidence is mounting that the “top” may have been reached.

So, let’s move on to why I can’t shake this “constant worry.” We’ll start with a crypto-specific perspective and then move on to the macro/economic issues.

Cryptocurrency specific questions

We are over 2 years into the bull market. Things that were unthinkable a few years ago (like government backing of cryptocurrencies) are happening now. But it feels bearish and “topped out.”

Trump. Is Trump’s memecoin launch the beginning of a new paradigm for the industry? Will we see new innovations in memecoins that add utility to novel new capital formation strategies? It seemed like we might be heading in that direction. But that is not the case. Instead, the President/his company has provided no communication or guidance to the public on Trump’s plans — to the great detriment of the industry. Why? Others are following his poor example (like Milei). Furthermore, the lack of any attempt to bring utility to Trump has emboldened the naysayers and critics of our industry. This looks like a flimsy scam. In my opinion, the fight back here hasn’t even begun.

Just last week, the SEC announced that it was dropping several cases against major crypto companies like Coinbase, Uniswap, and Consensys. That was cause for great optimism. But then Trump tweeted about the creation of a strategic cryptocurrency reserve that promised to include XRP, ADA, and SOL. There’s a reason we didn’t cover XRP or ADA in our DeFi report. They’re zombie chains. Also, Elon/DOGE is tasked with cleaning up excessive fiscal spending associated with fraud, waste, and abuse. But would we use taxpayer money to buy speculative centralized crypto tokens? There’s no ambiguity here — that’s just stupid. And it undermines the good work that Elon and DOGE have done (more on DOGE later in this report). Many crypto investors were cheering this over the weekend as a sign that “the cycle is still going.” We think it’s a fake-out.

David Sacks. He’s supposed to be the crypto czar. But do you think he knew Trump would tweet about the strategic reserve on Sunday? Not really, it seems. Also, it’s clear that the industry isn’t unified on which coins should be included in the reserve (or how regulation should work). It’s one thing to embark on a path of new regulation, and we’re optimistic about it. But it’s another to do it right, and that’s going to take some time.

Kanye. Dave Portnoy. Now Eric Trump won’t stop talking about crypto. When he does, he makes sure to use a lot of buzzwords like “revolutionary.” This is a red flag for anyone who has been through a few cycles. We saw a lot of these “cases” late in the cycle.

World Liberty Financial. I don't know if it's a scam or not. But it sure looks like it. If you want to try to distract people from the scam, you could call it "World Liberty Financial." All jokes aside, the website just offered a way to buy WLF tokens. Seriously. There was nothing there. No business model. No utility. Just a bunch of guys in suits and a link to buy WLF tokens. Revolutionary indeed.

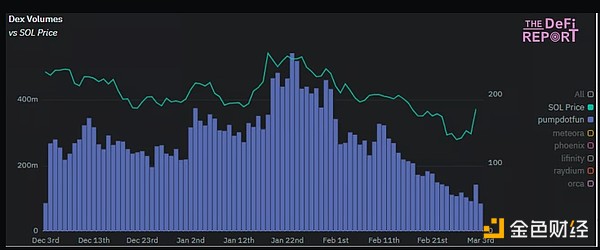

Pump.fun. It’s been a lot of fun. But it looks like the Solana speculation peak is over.

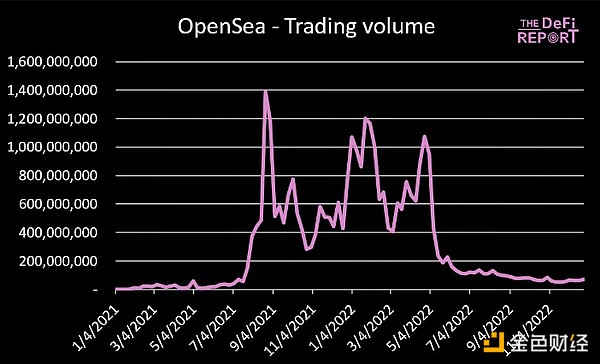

This is starting to look more and more like OpenSea in the last cycle (the chart below never rebounded).

In both cases, transaction volume/on-chain activity is clearly tied to the price of the L1 asset. So, what will spark the next wave of activity on Solana and keep the casino busy?

If you can see it coming, let us know.

Hope on the timeline. I continue to see people talking about why we are still early in the cycle: regulation and SBR. What’s wrong with that? It’s already priced in. When people make that argument, I want to cash out.

Sentiment. Notice how few people are saying the market has peaked right now? But people like Eric Trump are optimistic.

Hacks and scams. The Bybit hack + memecoin trenches were exposed, which shows that the ratio of fraudsters/scammers to actual builders is getting out of balance - just like the situation at the end of the last cycle. We think it's time for a much-needed cleanup (bear market).

Cryptocurrencies in general feel a bit “dirty” right now. At the same time, speculation is waning. We look for this trend in the late stages of the cycle.

Macro-specific issues

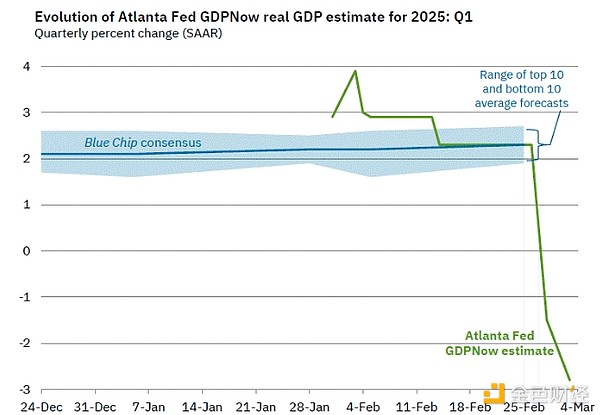

In addition to the unique “top” signals we are seeing in the cryptocurrency market, we are also seeing growing concerns about the economy in the short to medium term. We believe the risk of a recession is increasing. According to Scott Bessent in a recent interview with Bloomberg, he said that a recession will dominate “our economy” in 6-12 months.

DOGE. Our view is evolving. The original thought was that Musk can’t have a significant impact on government spending. We’ve updated that view based on what we’re seeing now, as Musk’s disruptive behavior appears to have the full support of Trump. This is bad for growth. Regardless of your stance on cutting government spending, the huge deficits of the past few years have been driving the economy while the Fed has engaged in quantitative tightening. Eliminating “fraud, waste, and abuse” is a good thing — but we also need to acknowledge that this is spending for some in the economy and income for others. So we have to ask the question: what growth catalysts will offset this? We think deregulation will help, but it will take some time for policy changes + it to work its way through the economy. In short, balanced budget = contraction in the near term. Note that the 25-year budget forecasts a deficit decline of about $300 billion. Meanwhile, the recent plunge in GDP growth is largely due to slower growth in consumer spending and a choke on net exports (import preemption effects associated with tariffs).

Inflation/Tariffs. Our view is that inflation concerns and worries about the impact of tariffs are largely exaggerated. That being said, as the facts change, so will our view. Trump confirmed that 25% tariffs on all Canadian and Mexican goods will take effect today. He also doubled the tariff on Chinese imports from 10% to 20%. This will certainly impact inflation and market uncertainty.

Rate Cuts/Yields/USD. Our view is that there will be more rate cuts this year than the market expects and the USD will fall (due to growth concerns). Our conviction on this remains strong - largely because of what we've seen with Elon and DOGE. That being said, this could be a negative for risk assets. More on this below.

Fed/Liquidity. If fiscal spending falls and markets sell off, the Fed will need to ease. We think they will, but they may wait too long to react (inflation concerns will come into play). In this scenario, rate cuts may not be enough to offset the slowdown. Even if the Fed cuts, risk assets may suffer. This was not the case when the Fed cut rates late last year. Some have pointed out that TGA will be the next driver of liquidity since the reverse repo has run out. This may provide some short-term relief, but will need to be refilled immediately once the debt ceiling debate is over.

Business cycle. In our report published on February 14, we shared some data (ISM, CAPEX spending, small business confidence, bank lending) that suggested that a new business cycle was about to start. We think this is true. But we are concerned that slower growth could lead to a larger market correction/recession before the recovery begins. Without DOGE/fiscal spending and tariff reductions, we prefer to predict a smoother transition.

Overall, fear levels are pretty high. From a contrarian perspective, this could be a sign that things are going to improve. We still think it’s time to be cautious. Despite the recent correction in crypto markets (BTC down 30%, SOL down 50%, other altcoins down more), we don’t strongly believe that crypto markets have bottomed. Why? Because traditional markets are only just beginning to correct. It’s important to note that traditional financial markets lead the economy. Therefore, further selling could eventually push us into a recession. If that were to happen (likely in Q2), we’d expect a significant response from the Fed/Treasury, but don’t feel the need to chase the sword of the decline at this point.

Portfolio Management

As mentioned above, in addition to long-term holdings of BTC, we have also been moving into cash. We are looking for opportunities to deploy into our favorite assets. The problem is, we haven’t seen any “fat contracts” yet.

We think they will come. So now is the time to do some deep research and make a shopping list.

Remember, we have been riding the current bull run since late '22.

If you’ve only started to get involved in cryptocurrencies in the last 6 months or so, here’s what we recommend:

Be careful when chasing the falling blade. If you missed a pump, don’t think it was a “buy” after a big pullback. It could be. But the market could also turn against you. Crypto attention is fickle. Most coins never come back. If you’re going to make this mistake, it’s better to make it with BTC.

If you “bought the top,” don’t beat yourself up. This happens to many new market participants. You are learning. What you learn today may well come true in the future — but you need to stay interested in the space. The key is to invest in assets you want to hold for the long term.

Many retail investors get into crypto late in a cycle, leave during a bear market (missing out on all the best opportunities), and then come back late in the next cycle. Don’t do this.

Watch your psychology. If you find yourself blindly agreeing with those who are bullish and getting riled up by those who are bearish, you are more likely to make mistakes. Remember, people like Raoul Pal (who usually does a good job) called for ETH to hit $30k at a similar stage in the last cycle. Influential VCs may have portfolio projects that have not yet launched tokens. They have an incentive to tell you that the cycle is still strong. Try not to outsource your beliefs to others who may have competing incentives.

Focus on your income/job. Make sure you have some funds to weather a correction/bear market.

Summarize

Note that my preference is to move to cash. If consensus starts to emerge that prices will go lower, it could be a sign that those market participants have also sold. This would point to higher bottoms/lows. It is worth noting that there is record cash in the currency markets right now:

Ultimately, my job as an investor is to make the best decisions based on the best information available - and that information is always evolving.

Some on-chain indicators point to a medium-term cycle - so there is a case for a bull run. But we have been irresponsibly long since late 2022. The risk/reward at this stage is simply not worth staying in the market or deploying new capital. We believe it is wiser to take profits, enter the market in cash and wait for the "fat contract".

Furthermore, in the future, thinking in “cycles” may not be so important anymore.

From here, we can see a possible scenario of a further correction (BTC down to $65,000-70,000, possibly lower depending on how quickly the Fed reacts), followed by a few months of consolidation and another wave higher by the end of the year, into 2026. If we see a significant Fed response, BTC could move much higher in this scenario. This would follow the 21st century cycle - the market peaked in Q1 after Coinbase went public.

Since then, NFTs have burst onto the scene, driving increased activity on Ethereum - which has ushered in an intense "altcoin season". The problem with this altcoin prediction is that we've already seen some of the "meta" play out (Meme coins, AI tokens). So, what's the next thing that will bring about a "frenzy" of on-chain activity?

If the market has peaked, then this is a disappointing cycle in our opinion. Our bull case scenario is $10 trillion market cap ($200k per BTC). Base case is $7.5 trillion ($150k per BTC). Not to mention ETH's underperformance. Our sense is that many professional investors are struggling - because you really had to be early in BTC and SOL to do well over the past few years.

Despite the sober nature of this report, we remain very optimistic for the long term. Infrastructure is ready for prime time, which was not the case in the last cycle.

The reality is that cryptocurrency as an industry is indeed entering an “inflection point.” Regulation and policy development highlight “inflection points” — marking the end of the “installation period” of new technologies and the beginning of the “deployment period.”

At this point, it seems inevitable that cryptocurrencies will go mainstream and BTC will reach a $10 trillion market cap. But it may take longer than we think.

Finally, you may be wondering, at what price would we turn bullish again? That’s hard to say. We will reassess as we go along. Generally speaking, we look to buy BTC when the MVRV is near or below 1 and buy discounted altcoins.