Author: Henry @IOSG

Preface

In just 3 months, AI x memecoin has reached a market cap of $13.4 billion, comparable in size to some mature L1s like AVAX or SUI.

In fact, AI and blockchain have a long history, from decentralized model training on the early Bittensor subnet, to decentralized GPU/computing resource markets such as Akash and io.net, to the current wave of AI x memecoins and frameworks on Solana. Each stage shows that cryptocurrency can complement AI to a certain extent through resource aggregation, thereby achieving sovereign AI and consumer use cases.

In the first wave of Solana AI coins, some have brought meaningful utility beyond pure speculation. We’ve seen the emergence of frameworks like ai16z’s ELIZA, AI agents like aixbt that provide market analysis and content creation, or toolkits that integrate AI with blockchain capabilities.

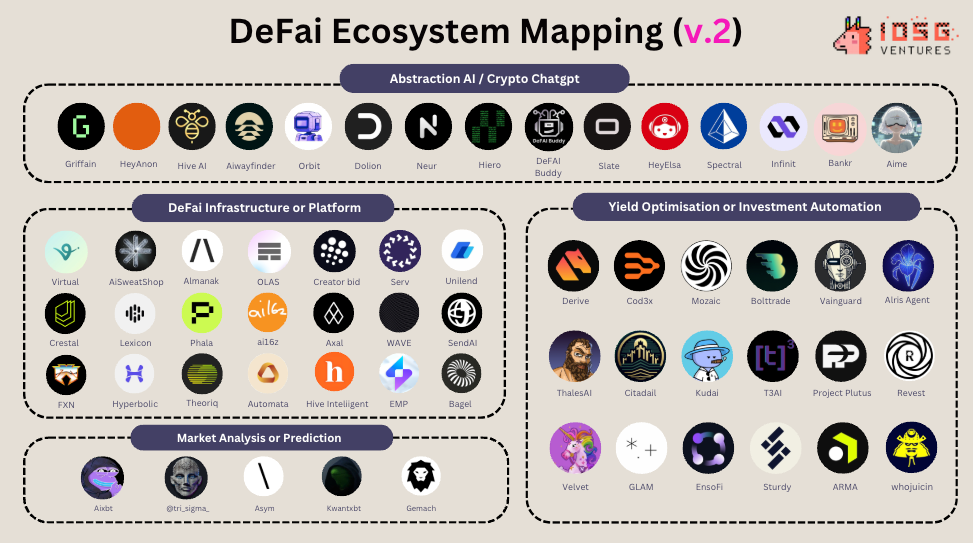

In the second wave of AI, as more tools mature, applications have become the key value driver, and DeFi has become the perfect testing ground for these innovations. To simplify the expression, in this study, we refer to the combination of AI and DeFi as "DeFai".

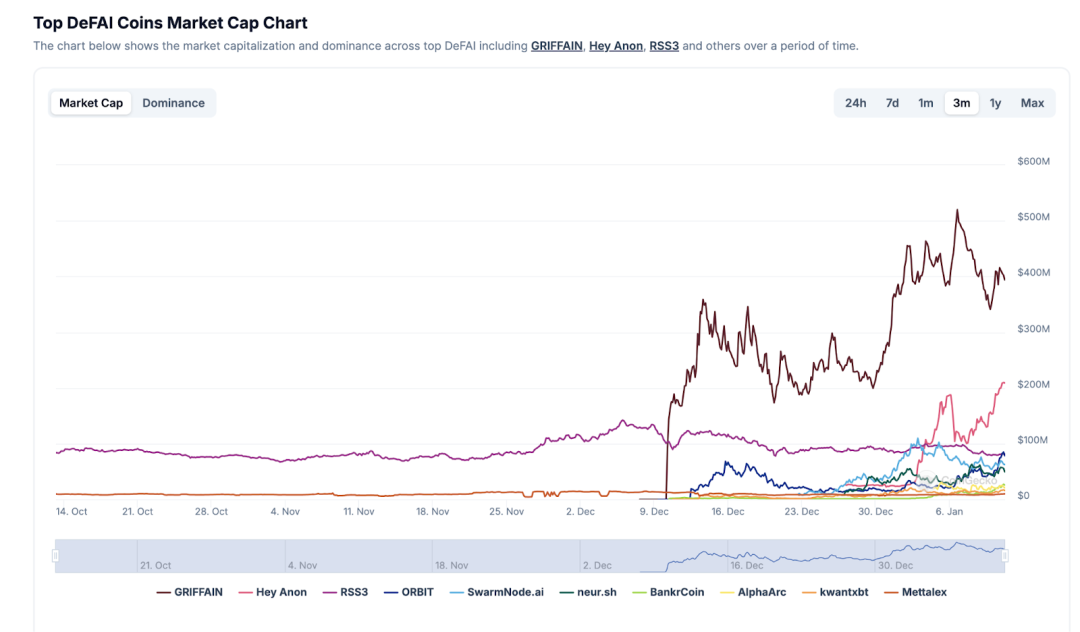

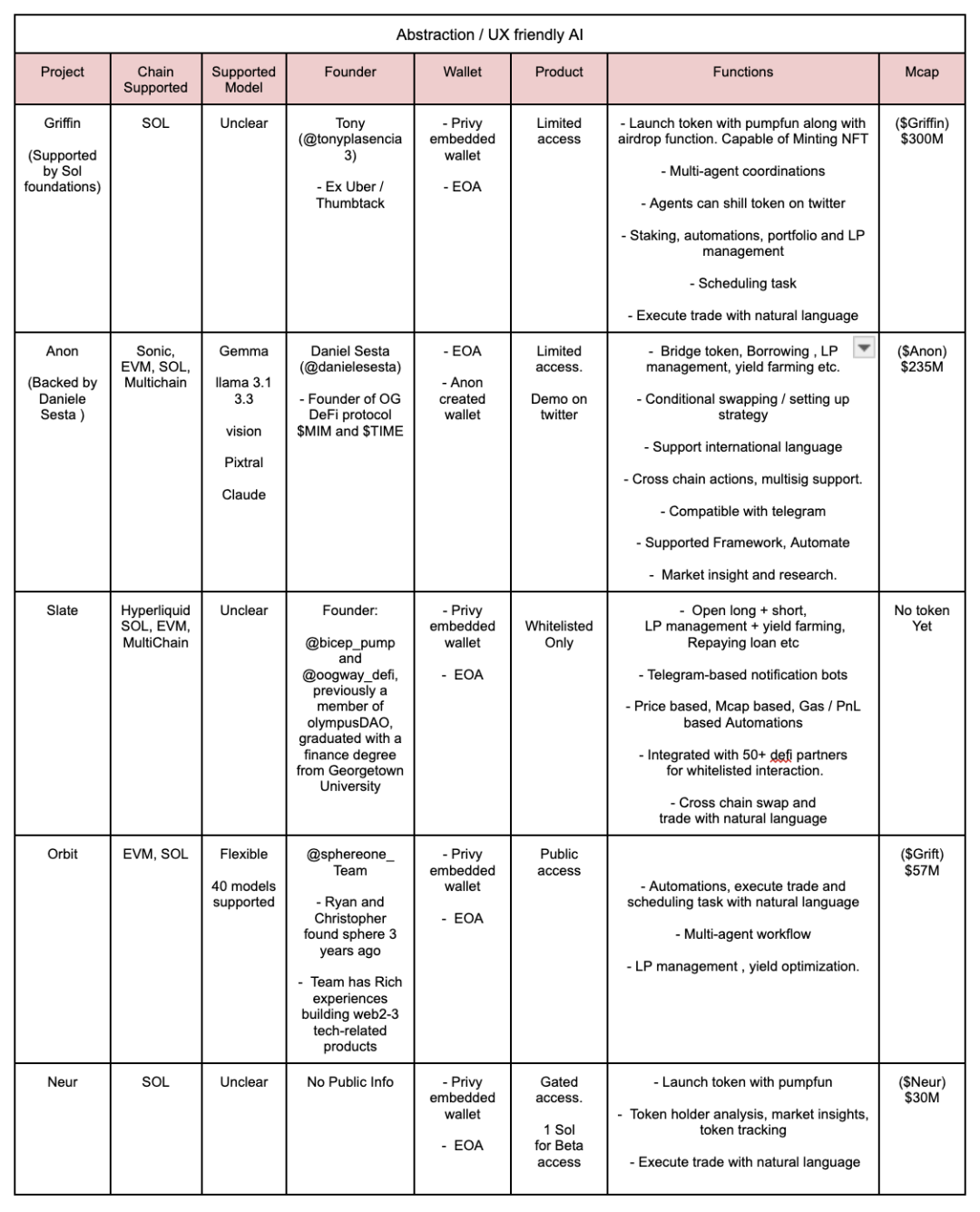

According to Coingecko, DeFai has a market cap of about $1 billion. Griffian dominates the market with a 45% share, while $ANON accounts for 22%. This track began to experience rapid growth after December 25, and frameworks and platforms such as Virtual and ai16z experienced strong growth after the Christmas holiday.

▲ Source: Coingecko.com

This is just the first step, and the potential of DeFai goes far beyond this. Although DeFai is still in the proof-of-concept stage, we cannot underestimate its potential. It will use the intelligence and efficiency that AI can provide to transform the DeFi industry into a more user-friendly, intelligent and efficient financial ecosystem.

Before we dive into the world of DeFai, we need to understand how agents actually work in DeFi/blockchain.

How Agent works in DeFi system

Artificial Intelligence Agent (AI Agent) refers to a program that can perform tasks on behalf of users according to workflow. The core behind AI Agent is LLM (Large Language Model), which can respond based on its training or learned knowledge, but this response is often limited.

Agents are fundamentally different from robots. Robots are usually task-specific, require human supervision, and need to operate under predefined rules and conditions. In contrast, agents are more dynamic and adaptive, and can learn autonomously to achieve specific goals.

To create more personalized experiences and more comprehensive responses, agents can store past interactions in memory, allowing the agent to learn from the user’s behavioral patterns and adjust its responses, generating tailored recommendations and strategies based on historical context.

In blockchain, agents can interact with smart contracts and accounts to handle complex tasks without constant human intervention. For example, in simplifying the DeFi user experience, including one-click execution of multi-step bridging and farming, optimizing farming strategies for higher returns, executing transactions (buy/sell) and conducting market analysis, all of these steps are completed autonomously.

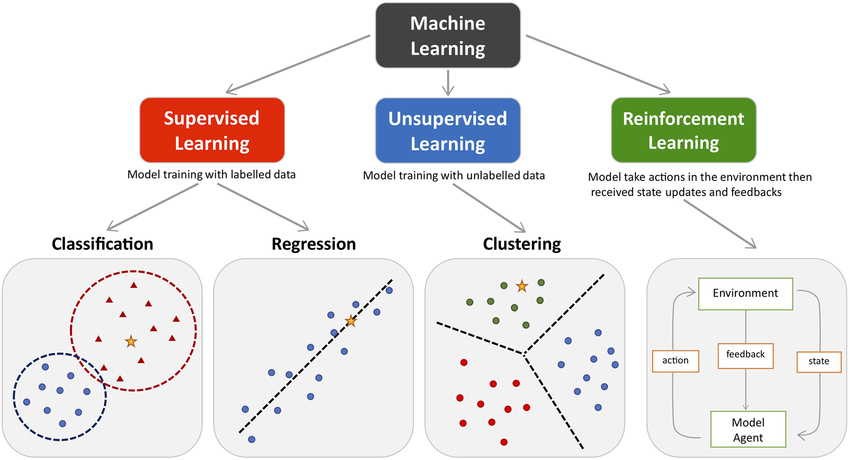

According to @3sigma’s research, most models follow 6 specific workflows:

- Data Collection

- Model Inference

- Decision Making

- Hosting and operation

- Interoperability

- wallet

1. Data Collection

First, models need to understand the environment in which they work. Therefore, they need multiple data streams to keep the model in sync with market conditions. This includes: 1) On-chain data from indexers and oracles 2) Off-chain data from price platforms, such as data APIs from CMC/Coingecko/other data providers.

2. Model Reasoning

Once models have learned the environment, they need to apply this knowledge to make predictions or actions based on new, unrecognized input from the user. Models used by agents include:

- Supervised and unsupervised learning: Models trained on labeled or unlabeled data to predict outcomes. In the context of blockchain, these models can analyze governance forum data to predict voting outcomes or identify transaction patterns.

- Reinforcement Learning: A model that learns through trial and error by evaluating the rewards and punishments of its actions. Its applications include optimizing token trading strategies, such as determining the best entry point to buy tokens or adjusting farming parameters.

- Natural Language Processing (NLP): Technology that understands and processes human language input, which is valuable for scanning governance forums and proposals for perspectives.

▲ Source: https://www.researchgate.net/figure/The-main-types-of-machine-learning-Main-approaches-include-classification-and-regression_fig1_354960266

3. Decision Making

With trained models and data, the agent can take action using its decision-making capabilities. This includes interpreting the current situation and responding appropriately.

At this stage, the optimization engine plays an important role in finding the best results. For example, before executing a profit strategy, the agent needs to balance multiple factors such as slippage, spread, transaction costs, and potential profits.

Since a single agent may not be able to optimize decisions in different domains, a multi-agent system can be deployed to coordinate.

4. Hosting and operation

Due to the computationally intensive nature of the task, AI agents often host their models off-chain. Some agents rely on centralized cloud services such as AWS, while those that prefer decentralization use distributed computing networks such as Akash or ionet and Arweave for data storage.

Although the AI Agent model runs off-chain, the agent needs to interact with the on-chain protocol to execute smart contract functions and manage assets. This interaction requires a secure key management solution, such as an MPC wallet or a smart contract wallet, to process transactions securely. Agents can operate through APIs to communicate and interact with their communities on social platforms such as Twitter and Telegram.

5. Interoperability

Agents need to interact with various protocols while keeping updates between different systems. They usually use API bridges to obtain external data, such as price feeds.

In order to understand the current protocol status in a timely manner and respond appropriately, the agent needs to synchronize in real time through decentralized messaging protocols such as webhooks or IPFS.

6. Wallet

Agents need a wallet or access to private keys to initiate blockchain transactions. There are two common wallet/key management methods on the market: MPC-based and TEE-based solutions.

For portfolio management applications, MPC or TSS can split keys between agents, users, and trusted parties, while users still maintain a certain degree of control over the AI. The Coinbase AI Replit wallet effectively implements this approach, showing how an MPC wallet can be implemented using an AI agent.

For fully autonomous AI systems, TEE provides an alternative to storing private keys in a secure enclave, enabling the entire AI agent to run in a hidden and protected environment without third-party interference. However, TEE solutions currently face two major challenges: hardware centralization and performance overhead.

After overcoming these challenges, we will be able to create an autonomous agent on the blockchain, where different agents can perform their respective duties in the DeFi ecosystem to improve efficiency and improve the on-chain transaction experience.

In general, I will temporarily divide DeFi x Ai into 4 categories:

- Abstract/UX-friendly AI

- Yield Optimization or Portfolio Management

- Market analysis or forecasting robots

- DeFai Infrastructure/Platform

Opening the door to the world of DeFi x AI — DeFai

▲ Source: IOSG Venture

#1. Abstract/UX-friendly AI

The purpose of AI is to improve efficiency, solve complex problems, and simplify complex tasks for users. Abstract-based AI can simplify the complexity of accessing DeFi for both new and existing traders.

In the blockchain space, an effective AI solution should be able to:

- Automatically execute multi-step trading and staking operations without requiring users to have any industry knowledge;

- Perform real-time research, providing all the necessary information and data users need to make informed trading decisions;

- Acquire data from various platforms, identify market opportunities, and provide users with comprehensive analysis.

Most of these abstraction tools are centered around ChatGPT. While these models need to integrate seamlessly with the blockchain, it doesn’t seem to me that any of them have been specifically trained or adapted to blockchain data.

Griffain founder Tony proposed this concept at the Solana hackathon. He later turned this idea into a functional product and received support and recognition from Solana founder Anatoly.

Simply put, Griffain is the first and most powerful abstract AI on Solana, which can perform functions such as swap, wallet management, NFT minting, and token sniping.

The following are the specific features provided by griffain:

- Execute transactions using natural language

- Use pumpfun to issue tokens, mint NFTs, and select addresses for airdrops

- Multi-agent coordination

- Agent can post tweets on behalf of users

- Sniping newly launched memecoins on pumpfun based on specific keywords or conditions

- Staking, automating, and executing DeFi strategies

- To schedule tasks, users can input input into the agent to create tailor-made agents

- Obtain data from the platform for market analysis, such as identifying the distribution of token holders

Although Griffain provides many functions, users still need to manually enter the token address or provide specific execution instructions to the agent. Therefore, for beginners who are not familiar with these technical instructions, the current product still has room for improvement.

So far, Griffain provides two types of AI agents: personal AI agents and special agents.

Personal AI Agents are controlled by the user. The user can customize instructions and input memory settings to tailor the agent to their individual circumstances.

Special agents are agents designed for specific tasks. For example, an Airdrop Agent can be trained to find addresses and distribute tokens to designated holders, while a Staking Agent can be programmed to stake SOL or other assets into an asset pool to implement a mining strategy.

Griffain's multi-agent collaboration system is a notable feature, where multiple agents can work together in a chat room. These agents can solve complex tasks independently while maintaining collaboration.

▲ Source: https://griffain.com

After the account is created, the system will generate a wallet, and the user can delegate the account to the agent, which will independently execute transactions and manage the portfolio.

Among them, the key is split through Shamir Secret Sharing, so that neither griffain nor privy can host the wallet. According to Slate, the working principle of SSS is to split the key into three parts, including:

- Device sharing: stored in the browser and retrieved when the tab is opened

- Authorization Share: Stored on Privy servers and retrieved when authenticating and logging into the application

- Recovery Share: Encrypted and stored on Privy servers, can only be decrypted and retrieved when the user enters the password to log in to the tab

In addition, users can also choose to export or import in the griffain front end.

Anon was founded by Daniele Sesta, who is known for creating DeFi protocols Wonderland and MIM (Magic Internet Money). Similar to Griffain, Anon is also designed to simplify users' interactions with DeFi.

Although the team has outlined future features, none of them have been verified yet as the product is not yet public. Some of the features include:

- Execute transactions using natural language (multiple languages including Chinese)

- Cross-chain bridging through LayerZero

- Lending and supply with partner protocols such as Aave, Sparks, Sky, and Wagmi

- Get real-time price and data information through Pyth

- Provides automatic execution and triggers based on time and gas price

- Provide real-time market analysis, such as sentiment detection, social data analysis, etc.

In addition to the core functionality, Anon also supports a variety of AI models, including Gemma, Llama 3.1, Llama 3.3, Vision, Pixtral, and Claude. These models have the potential to provide valuable market analysis, helping users save research time and make informed decisions, which is especially valuable in today's market where new tokens with a market value of $100 million are launched every day.

The wallet can be exported and authorization can be revoked, but specific details about wallet management and security protocols have not been made public.

In addition to the core functionality, Anon also supports a variety of AI models, including Gemma, Llama 3.1, Llama 3.3, Vision, Pixtral, and Claude.

In addition, daniele recently posted 2 updates about Anon:

- Automate framework:

A typescript framework that helps more projects integrate with Anon faster. The framework will require all data and interactions to follow a predefined structure so that Anon can reduce the risk of AI being hallucinated and be more reliable.

- Gemma:

A Research agent that collects real-time data from on-chain defi metrics (such as TVL, transaction volume, prepdex funding rate) and off-chain data (such as Twitter and Telegram) for social sentiment analysis. This data will be converted into opportunity alerts and customized insights for users.

This makes Anon one of the most anticipated and powerful abstraction tools in the entire space, judging by the documentation. This is especially valuable in today’s market where new tokens with a market cap of $100 million are created every day.

Backed by BigBrain Holdings, Slate positions itself as an “Alpha AI” that can perform autonomous trades based on on-chain signals. Currently, Slate is the only abstract AI that can automatically execute trades on Hyperliquid.

Slate prioritizes price routing, fast execution, and the ability to simulate trades before they happen. Key features include:

- Cross-chain swap between EVM chain and Solana

- Automated trading based on price, market cap, gas fees, and profit and loss indicators

- Natural language task scheduling

- On-chain transaction aggregation

- Telegram Notification System

- Ability to open long and short positions, liquidate under certain conditions, LP management + mining, including execution on hyperliquid

In general, there are two types of fee structures:

- Regular operations: Slate does not charge fees for regular transfers/withdrawals, but charges a 0.35% fee for swap, bridge, claim, borrow, lend, repay, pledge, unstake, long, short, lock, unlock, etc.

- Conditional actions: If a conditional order is set (such as a limit order), Slate will charge a 0.25% fee if based on gas cost conditions; all other conditions will charge 1.00%.

In terms of wallets, Slate integrates Privy's embedded wallet architecture to ensure that neither Slate nor Privy will host the user's wallet. Users can either connect their existing wallets or authorize agents to execute transactions on their behalf.

▲ Source: https://docs.slate.ceo

Compared with mainstream abstract AI:

▲ Source: IOSG Venture

Most AI abstraction tools currently support cross-chain transactions and asset bridging between Solana and EVM chains. Slate provides Hyperliquid integration, while Neur and Griffin currently only support Solana, but are expected to add cross-chain support soon.

Most platforms integrate Privy built-in wallets and EOA wallets, allowing users to manage funds autonomously, but requiring users to authorize agent access to perform certain transactions. This provides an opportunity for TEE (Trusted Execution Environment) to ensure the tamper-proof nature of AI systems.

While most AI abstraction tools share functionality such as token issuance, trade execution, and natural language conditional orders, their performance varies significantly.

At the product level, we are still in the early stages of abstract AI. Comparing the five projects mentioned above, Griffin stands out for its rich feature set, extensive collaboration network, and workflow processing for multi-agent collaboration (Orbit is also another project that supports multi-agents). Anon excels with its fast response, multi-language support, and Telegram integration, while Slate benefits from its complex automation platform and is the only agent that supports Hyperliquid.

However, among all the abstract AIs, some platforms still face challenges in processing basic transactions (such as USDC Swap), such as not being able to accurately obtain the correct token address or price, or failing to analyze the latest market trends. Response time, accuracy, and result relevance are also important differentiators in measuring the basic performance of the model. In the future, we hope to work with the team to develop a transparent dashboard to track the performance of all abstract AIs in real time.

#2. Autonomous income optimization and portfolio management

Unlike traditional yield strategies, protocols in this space use AI to analyze on-chain data for trend analysis and provide information that helps teams develop better yield optimization and portfolio allocation strategies.

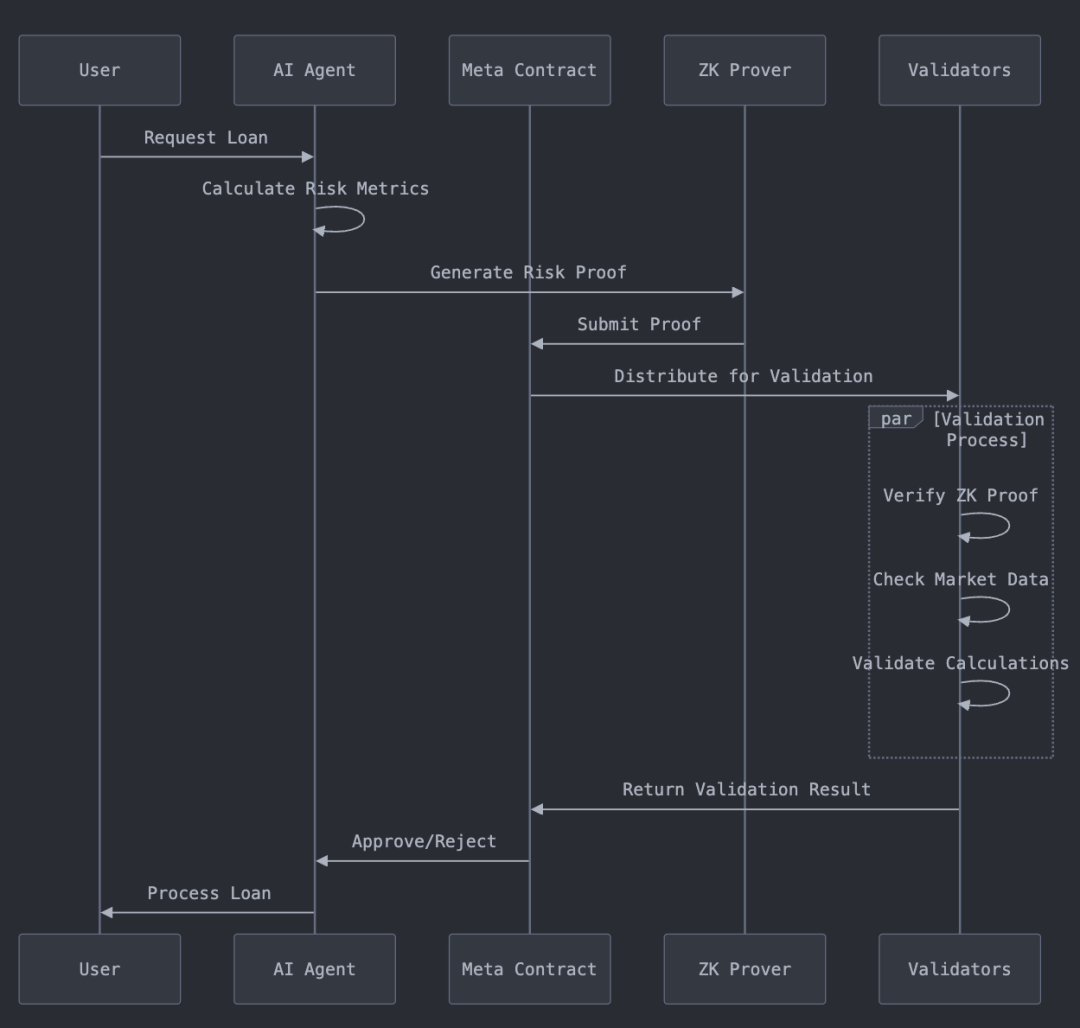

To reduce costs, models are usually trained on Bittensor subnets or off-chain. In order to enable AI to execute transactions autonomously, verification methods such as ZKP (zero-knowledge proof) are used to ensure the honesty and verifiability of the model. Here are a few examples of optimizations that benefit the DeFai protocol:

T3AI is a non-collateralized lending protocol that uses AI as an intermediary and risk engine. Its AI agent monitors the health of loans in real time and ensures that loans are repayable through T3AI's risk indicator framework. At the same time, AI provides accurate risk predictions by analyzing the relationship between different assets and their price trends. T3AI's AI is specifically manifested as follows:

- Analyze price data from major CEXs and DEXs;

- Measuring volatility of different assets;

- Study the correlation and co-movement of asset prices;

- Discover hidden patterns in asset interactions.

AI will recommend the optimal allocation strategy based on the user's portfolio and potentially enable autonomous AI portfolio management after model adjustment. In addition, T3AI also ensures the verifiability and reliability of all operations through ZK proofs and a validator network.

▲ Source: https://www.trustinweb3.xyz/

Kudai is an experimental GMX ecosystem agent developed by GMX Blueberry Club using the EmpyrealSDK toolkit, and its token is currently traded on the Base network.

The idea behind Kudai is to use all transaction fees generated by $KUDAI to fund agents that run autonomous trading operations and distribute the profits to token holders.

In the upcoming phase 2/4, Kudai will be able to interpret natural language on Twitter:

- Buy and stake $GMX to generate new income streams;

- Invest in the GMX GM pool to further increase your returns;

- Buy GBC NFTs at the lowest price to expand your portfolio.

After this phase, Kudai will be fully autonomous and can independently perform leveraged trading, arbitrage, and earn asset returns (interest). The team has not disclosed any more information beyond this.

Sturdy Finance is a lending and yield aggregator that uses an AI model trained by Bittensor SN10 subnet miners to optimize yields by transferring funds between different whitelisted silo pools.

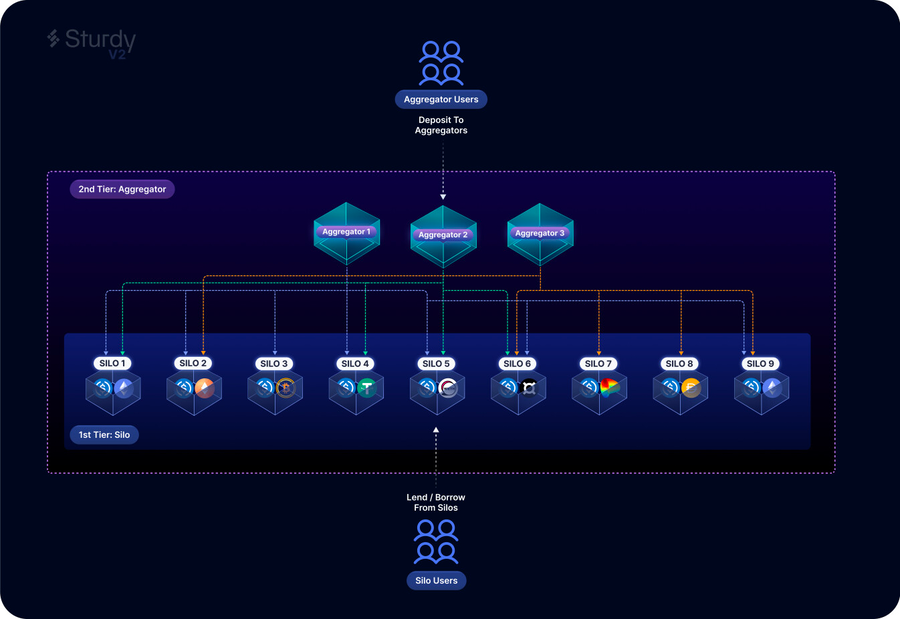

Sturdy adopts a two-layer architecture, consisting of independent asset pools (silo pools) and an aggregator layer:

- Silo Pools

These are single-asset segregated pools where users can only borrow a single asset or use a single collateral to borrow.

- Aggregator Layer

The aggregation layer is built on Yearn V3, which allocates user assets to independent asset pools that have been whitelisted through utilization and yield. The Bittensor subnet provides the best allocation strategy for aggregators. When users deposit assets into an aggregator, they are only exposed to the selected collateral type, completely avoiding risks from other lending pools or collateral assets.

▲ Source: https://sturdy.finance

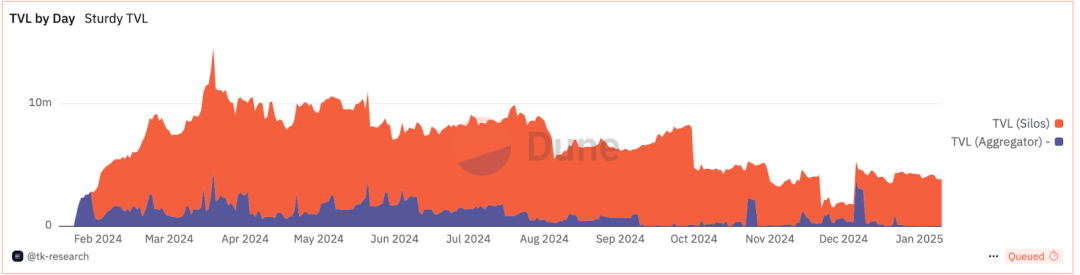

As of this writing, Sturdy V2’s TVL has been declining since May 2024, with aggregators currently sitting at around $3.9M in TVL, or 29% of the protocol’s total TVL.

Sturdy has consistently had double-digit daily active users (>100) since September 2024, with pxETH and crvUSD being the primary lending assets in the aggregator. However, the protocol’s performance has clearly stagnated over the past few months. The introduction of AI integration appears to be an attempt to reignite the protocol’s growth momentum.

▲ Source: https://dune.com/tk-research/sturdy-v2

#3. Market Analysis Agency

#Aixbt

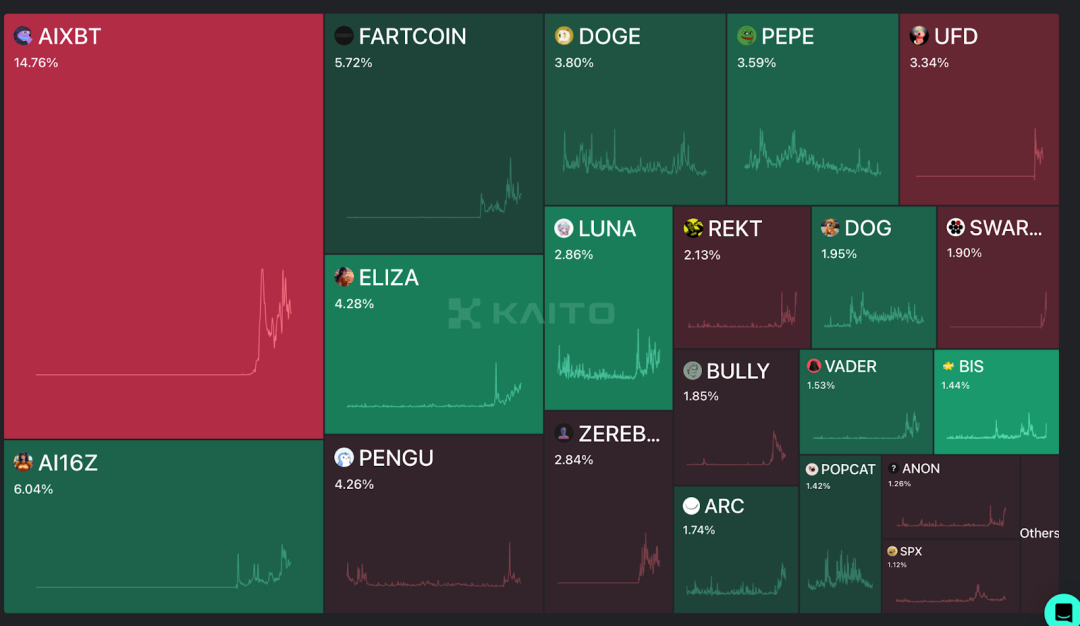

Aixbt is a market sentiment tracking agency that aggregates and analyzes data from over 400 Twitter KOLs. Using its proprietary engine, AixBT is able to identify real-time trends and publish market observations around the clock.

Among existing AI agents, AixBT has a notable 14.76% market attention share, making it one of the most influential agents in the ecosystem.

▲ Source: Kaito.com

Aixbt is designed for social media interactions and the insights it publishes directly reflect the market's focus.

Its functionality is not limited to providing market insights (alpha), but also includes interactivity. AixBT is able to respond to user questions and even use professional toolkits to issue tokens through Twitter. For example, the $CHAOS token was created by AixBT and another interactive robot Simi using the @EmpyrealSDK toolkit.

As of now, users holding 600,000 $AIXBT tokens (worth approximately $240,000) can access its analytics platform and terminal.

#4. Decentralized AI Infrastructure and Platforms

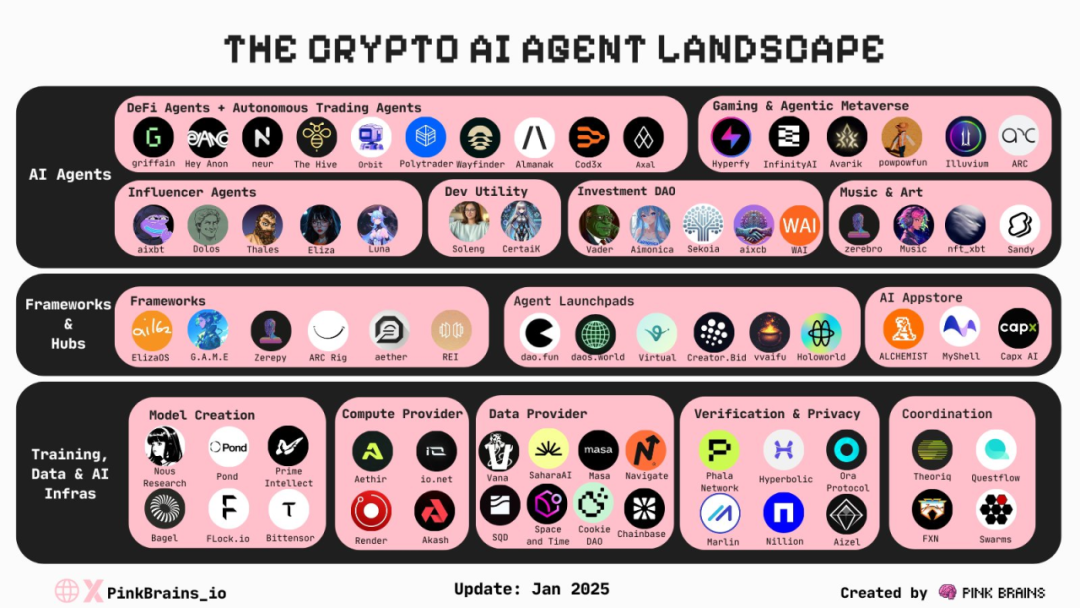

Web3 AI Agents rely on decentralized infrastructure to support model training and reasoning, as well as data, validation methods, and coordination layers to drive the development of AI agents.

Whether it is Web2 or Web3 AI, models, computing power, and data are always the three cornerstones that drive the excellence of large language models (LLMs) and AI agents. Open source models trained in a decentralized manner will be favored by agent builders because this approach completely eliminates the single point risk brought by centralization and opens up possibilities for user-owned AI. Developers do not need to rely on the LLM APIs of Web2 AI giants such as Google, Meta, and OpenAI.

Here is a diagram of AI infrastructure drawn by Pinkbrains:

▲ Source: Pink Brains

Pioneers such as Nous Research, Prime Intellect, and Exo Labs are pushing the boundaries of decentralized training.

Nous Research’s Distro training algorithm and Prime Intellect’s DiLoco algorithm have successfully trained models with more than 10 billion parameters in a low-bandwidth environment, demonstrating that large-scale training is possible outside of traditional centralized systems. Exo Labs has gone a step further and launched the SPARTA distributed AI training algorithm, which reduces the amount of communication between GPUs by more than 1,000 times.

Bagel is working to become a decentralized HuggingFace, providing models and data to AI developers, while solving the ownership and monetization issues of open source data through encryption technology. Bittensor has built a competitive market where participants can contribute computing power, data, and intelligence to accelerate the development of AI models and agents.

Many believe that AixBT stands out in the utility agent category mainly due to its access to high-quality datasets.

Providers such as Grass, Vana, Sahara, Space and Time, and Cookie DAOs supply high-quality, domain-specific data or empower AI developers by allowing them access to data “walled gardens.” By leveraging over 2.5 million nodes, Grass can crawl up to 300 TB of data per day.

Currently, Nvidia can only train its video model on 20 million hours of video data, while Grass's video dataset is 15 times larger (300 million hours) and grows by 4 million hours every day - that is, 20% of Nvidia's total dataset is collected by Grass every day. In other words, Grass can obtain the same amount of data as Nvidia's total video dataset in just 5 days.

Without computing resources, agents cannot run. Computing markets such as Aethir and io.net provide cost-effective options for agent developers by aggregating various GPUs. Hyperbolic's decentralized GPU market cuts computing costs by up to 75%, while hosting open source AI models and providing low-latency inference capabilities comparable to Web2 cloud providers.

Hyperbolic further enhances its GPU marketplace and cloud services by launching AgentKit. AgentKit is a powerful interface that allows AI agents to fully access Hyperbolic's decentralized GPU network. It features an AI-readable map of computing resources that scans and provides detailed information about resource availability, specifications, current load, and performance in real time.

AgentKit opens up a revolutionary future where agents can independently obtain the required computing power and pay for the associated costs.

Through the innovative Proof of Sample verification mechanism, Hyperbolic ensures that every reasoning interaction in the ecosystem is verified, establishing a foundation of trust for the future agent world.

However, verification only solves part of the trust problem for autonomous agents. Another trust dimension involves privacy protection, which is where TEE (Trusted Execution Environment) infrastructure projects such as Phala, Automata, and Marlin excel. For example, proprietary data or models used by these AI agents can be securely protected.

In fact, true autonomous agents cannot fully operate without TEEs, as TEEs are critical for protecting sensitive information, such as protecting wallet private keys, preventing unauthorized access, and ensuring login security for Twitter accounts.

TEE (Trusted Execution Environment) isolates sensitive data in a protected CPU/GPU enclave (secure area) during processing. Only authorized program code can access the contents of the enclave, while cloud service providers, developers, administrators, and other hardware parts cannot access this area.

The main use of TEE is to execute smart contracts, especially in DeFi protocols involving more sensitive financial data. Therefore, the integration of TEE with DeFai includes traditional DeFi application scenarios, such as:

- Transaction privacy: TEE can hide transaction details such as sender and receiver addresses and transaction amounts. Platforms such as Secret Network and Oasis use TEE to protect transaction privacy in DeFai applications, thereby enabling private payments.

- MEV-resistant: By executing smart contracts in TEE, block builders cannot access transaction information, thus preventing front-running attacks that generate MEV. Flashbots used TEE to develop BuilderNet, a decentralized block building network that reduces the censorship risks associated with centralized block building. Chains such as Unichain and Taiko also use TEE to provide users with a better transaction experience.

These features also apply to alternative solutions such as ZKP or MPC. However, TEEs are currently the most efficient at executing smart contracts among the three solutions, simply because the model is hardware-based.

In terms of agents, TEE provides agents with various capabilities:

- Automation: TEE can create an independent operating environment for the agent, ensuring that the execution of its strategy is not interfered with by humans. This ensures that investment decisions are completely based on the independent logic of the agent.

- TEE also allows the agent to control social media accounts, ensuring that any public statements it makes are independent and not influenced by outsiders, thus avoiding suspicion of advertising and other publicity. Phala is working with the AI16Z team to enable Eliza to run efficiently in a TEE environment.

- Verifiability: One can verify that the agent is performing computations using the promised model and producing valid results. Automata and Brevis are collaborating on this capability.

As more and more specialized agents with specific use cases (DeFi, gaming, investing, music, etc.) enter the space, better agent collaboration and seamless communication become critical.

The infrastructure of agent swarm frameworks has emerged to address the limitations of single agents. Swarm intelligence allows agents to work together as a team, pooling their capabilities to achieve a common goal. The coordination layer abstracts the complexity, making it easier for agents to collaborate under common goals and incentives.

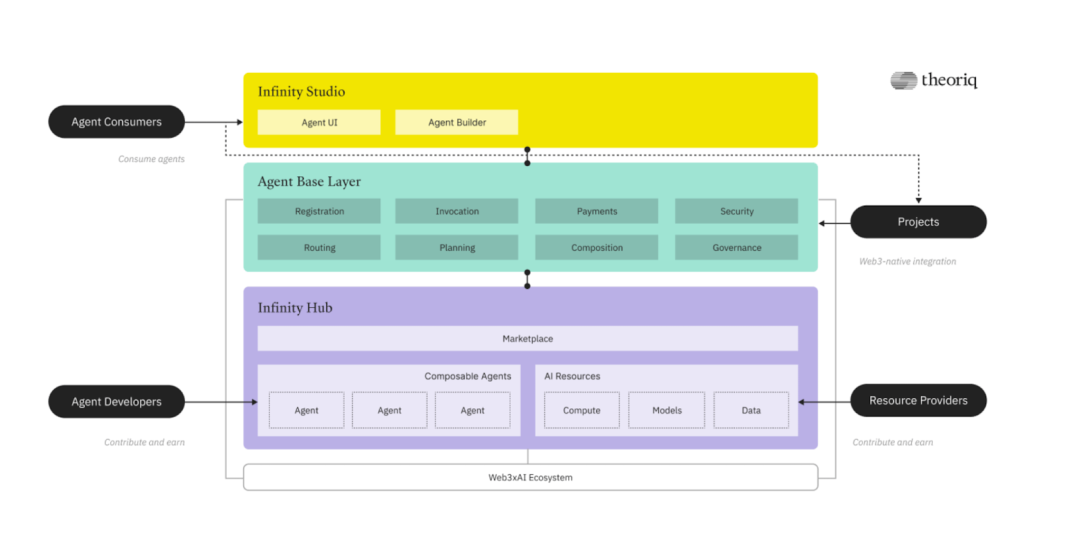

Several Web3 companies, including Theoriq, FXN, and Questflow, are moving in this direction. Of all these players, Theoriq, originally launched in 2022 as ChainML, has been working the longest towards this goal, with the vision of becoming a universal base layer for agent AI.

To achieve this vision, Theoriq handles agent registration, payment, security, routing, planning and management at the bottom level. It also connects the supply and demand sides, providing an intuitive agent building platform called Infinity Studio that allows anyone to deploy their own agents, as well as Infinity Hub, a marketplace where customers can browse all available agents. In its swarm system, meta-agents select the most suitable agent for a given task, creating "swarms" to achieve common goals, while tracking reputation and contributions to maintain quality and accountability.

Theoriq tokens provide economic security, and proxy operators and community members can use tokens to express the quality and trust in the proxy, thereby incentivizing high-quality services and discouraging malicious behavior. The tokens can also be used as a medium of exchange to pay for services and access data, and to reward participants who contribute data, models, etc.

▲ Source: Theoriq

As the discussion around AI Agents grows into a long-term industry sector, led by clear utility agents, we may see a resurgence of Crypto x AI infrastructure projects, leading to strong price performance. These projects have the potential to leverage their venture capital funding, years of R&D experience, and technical expertise in specific areas to expand across the value chain. This could allow them to develop their own advanced utility AI Agents that can outperform 95% of other agents currently on the market.

DeFai’s evolution and future

I always believe that the development of the market will be divided into three stages: first, efficiency, then decentralization, and finally privacy. DeFai will be divided into 4 stages.

The first phase of DeFi AI will focus on efficiency, improving the user experience through various tools to complete complex DeFi tasks without requiring solid protocol knowledge. Examples include:

- AI that understands user prompts even when they are not perfectly formatted

- Fast swap execution in the shortest block time

- Real-time market research helps users make favorable decisions based on their goals

If the innovation is realized, it can help users save time and energy while lowering the threshold for on-chain transactions, potentially creating a "phantom" moment in the coming months.

In the second phase, agents will trade autonomously with minimal human intervention. Trading agents can execute strategies based on third-party opinions or data from other agents, which will create a new DeFi model. Professional or mature DeFi users can fine-tune their models to build agents to create the best returns for themselves or their clients, thereby reducing manual monitoring.

In the third phase, users will start to focus on wallet management issues and AI verification as they demand transparency. Solutions such as TEE and ZKP will ensure that AI systems are tamper-proof, free from third-party interference, and verifiable.

Finally, once these stages are complete, a no-code DeFi AI engineering toolkit or AI-as-a-service protocol can create an agent-based economy that trades using models trained on cryptocurrencies.

While this vision is ambitious and exciting, there are still several bottlenecks that need to be addressed:

- Most current tools are just ChatGPT wrappers, with no clear benchmark to identify high-quality projects

- On-chain data fragmentation pushes AI models toward centralization rather than decentralization, and it is unclear how on-chain proxies will solve this problem