INTRODUCTION

The one

underlying theme that we have seen in the myriad valuation attempts of

cryptocurrencies is the all too common, proverbial “we are still too early”.

Valuations, which is referring to the exercise of running financial models in

excel based on numerous factors that are subject to other subjective exercises

of 拍脑袋 (a Chinese way of saying pulling

numbers out of your ass), are always early considering the fact that we are

running models out to 10 years later in some cases. Early in the sense of “when

mass adoption?” and/or early in the sense of lack of adequate historical data.

The latter is definitely a concomitant of the former but there is a reason why

modeling crypto valuations is important in which I’ll get to in a second.

The second

crypto bull run was the solidifying of the word “blockchain” in mainstream

media and also the large attraction of traditional finance people into the

world of crypto. And what they brought with them was the frameworks (outdated

some could say) and theoretical thinking behind how to value these novel

digital assets that are borne out of the internet. At the time, these digital

assets were more or less penny stocks (some could argue that they still are)

but they were enough to capture the attention of some that wanted to justify

their prices.

In this piece,

I would like to highlight some notable crypto valuation frameworks that caught

the crux of attention during the second bull run in crypto and then hopefully

seek out what frameworks are being used to this day to deduce a valuation of a

cryptocurrency.

Before we dive

in, I want to first acknowledge what we already know, which is that, any

valuation model isn’t run for the sole purpose of predicting accurate prices.

Equity research reports done by numerous young witted minds have gotten bad rap

for just blowing hot air. The same may more or less could be said of crypto

valuations but to side step and point back to my question posed in the title of

this article, I’d say it is neither an exercise for shilling nor futility, but

rather an exercise to work out the kinks and incentives of crypto token models

in bolstering adoption. Interestingly enough, I’m sure Satoshi never ran a

valuation model for bitcoin, but working out an economic model as perfectly

crafted as that of Bitcoin is an effort worth trying.

Also, keep in

mind that it’s easy to conflate crypto valuation frameworks and tokenomic

frameworks (and there’s a ton of these out there as well), but this piece will

focus more on the former. And let’s not misconstrue these valuation frameworks

for being price targets, one could say these are isomorphic, but there are

nuances to its intentions.

Chris

Burniske’s INET Model and Update

By far the

first attempt at a full fledged valuation framework to gain traction has to be

Chris Burniske’s (Partner at Placeholder)

INET Model published back in 2017. Although the article itself has amassed

close to 17,000 claps on the original article’s Medium post, a few iterations have been made to the original framework which more

or less still leave the framework open ended; considering the arduous task of

properly adapting to what we envision digital assets to be.

Published over

3 years ago, the model is still considered one of the more clear cut ways to

view a crypto asset’s yearly utility value and its present value based on those

future expected utility values that are derived from the crypto asset’s market

penetration of an existing market. Very similar to a typical cash flow model,

but with nuances that includes fitting an S-curve growth or “Take Over Time” to

account for initial mainstream adoption, using the equation of exchange in

place of revenues/profits, and a float value after Bonders and Hodlers.

Even though

there have been many attempts before at valuing bitcoin and all its

intricacies, Burniske’s INET model has been, hands down, the general valuation

gateway to crypto assets and without a doubt, a lure for others to stab at the

model’s overlooked faults. His follow

up to this piece, which was published in 2019, attempted to bifurcate what

we think of cryptoassets to be: either in the buckets of being Capital Assets,

Consumable/Transformable Assets, or Store of Value Assets.

Despite

Burniske’s framework being such an immediate hit, many drilled down into his

unintentional mistake of keeping velocity, in the equation of exchange, linear

or correlated 1:1 with growth.

Alex

Evans’ Velocity Approach

The next

iteration, which is more of an adaptation to Burniske’s framework is coincidentally,

Alex Evans, who joined the reigns at Placeholder with Burniske back in 2018. A

UVA econ grad who felt first hand the vehement effects of weak economies in

Greece during the recession, Alex proposes

that velocity should always be dynamically changing and should “model

endogenous velocity as time-varying and distinct from the money supply term”.

The issues with velocity has been an ongoing debate with many attempted

velocity thesis being published with the overall consensus being: high velocity

bad, low velocity good, with the conclusion consisting of non-tested proposals

on how to lower velocity.

Evans tries to

dissect the individual factors affecting velocity by leveraging the use of

Baumol-Tobin’s “cash inventories” approach, which essentially dictates consumer

behavior with how much cash they are willing to hold on hand. Or specifically

the tradeoffs “between the liquidity provided by holding money (the ability to

carry out transactions) and the interest forgone by holding one’s assets in the

form of non-interest bearing money.”

By taking the

derivative of the total cost function and obtaining the cost-minimizing value

of N, which corresponds to the # of transfers each year taken by a user to

purchase a token, then taking this cost-minimizing N function back into the

average money balance (Y/2N) to obtain the average token holding, or money

demanded.

“We can thus

say that VOLT ‘money demanded’ is equal to the cost-minimizing VOLT balance

that users hold each year, which is a function of the GDP that the VOLT economy

facilitates, the expected rate of return on the store-of-value asset, and the

cost per transaction.”

If

you’re confused, don’t worry. You’re not the only one.

Wang

Chun Wei and Bonnie Yiu’s Equilibrium Valuation

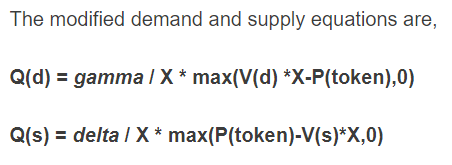

The next

valuation framework I would like to highlight is a bit more simplistic in the

sense that it uses something that we’ve all been taught in our economics 101

course: supply and demand curve equilibrium. This piece,

published in 2018 by Wang Chun Wei and Bonnie Yiu of Consulere, is a very

underrated framework. In essence, they introduce market clearing conditions by

setting both a supply and demand curve equal in terms of the price of a

transaction in the native tokens.

When the two

equations above are set equal to each other you can then solve for the

equilibrium price (# of tokens required for a service) and the quantity (units

of service demanded).

As with the

case of many crypto valuation frameworks, this model also utilizes the Quantity

Theory of Money, or Equation of Exchange, in solving for the optimal token

value. Taking P(token)* and Q* from above and substituting them into the MV=PQ

equation, you can then solve for X, which is the notation for the exchange rate

for tokens to 1 USD, or token value. This could get a bit convoluted to some

but more crypto valuation frameworks tend to be. And may I add that this model

also is victim to the velocity issue as both writers note “Increasing token

velocity reduces token value.” In some regards, “this thesis is directionally

correct, but hard to operationalize”, as Alex Evans puts it.

On

the Velocity Issue

By now you can

see an underlying theme of the above valuation frameworks in which they all

center on the velocity issue. The core issue that was proposed eloquently by

Kyle Samani, Managing Partner at Multicoin Capital, is simply that tokens that

experience high velocity, while being linear with transaction volume, will

induce zero network value per the equation below:

Average

Network Value = Total Transaction Volume / Velocity

But as Alex

Evans and a handful of others have thrown rebuttals, velocity should not be

assumed linear but rather dynamically dependent on other factors. The velocity

issue could really be laid out in its own separate report so I’m going to avoid

diving further, but will leave it on this quote shared to us at PANews by Kyle

Samani who still firmly stands by his thesis:

“I think

that among most sophisticated entrepreneurs and investors, it is now widely

accepted that the velocity problem is real, even if we don't have strong

evidence in the market that medium-of-exchange tokens (which are the kind that

are subject to the velocity problem) cannot sustain value (for example, XRP is

still #4 on CoinMarketCap).”

- Kyle Samani, Managing Partner at Multicoin Capital

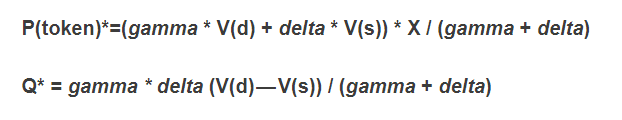

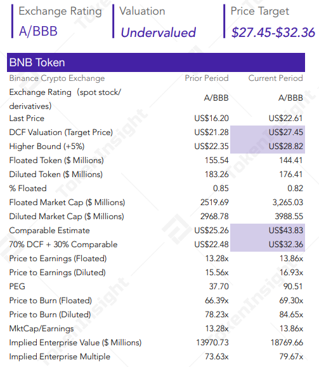

TokenInsight’s

exchange token valuations

TokenInsight

has been one of the few teams actually implementing a valuation framework to

deduce a target price for a token. Considering exchanges are one of the few

businesses in the industry making money, their respective native tokens have

been prime examples of utilizing a Discounted Cash Flow methodology

(specifically the H-Model) considering that they more or less align with how a

security token would behave. And it’s utterly crucial that exchanges have been

reporting their financials similar to how a public company would.

Taken from

their recent August

2020: Exchange Token Valuation Report, TokenInsight could probably take the

gold standard of creating a crypto “Fitch ratings” style of valuation. With a

hybrid approach of combining a DCF value along with using a comparables

valuations, TokenInsight has given it a more holistic approach, not to mention

their qualitative factors for leveraging a grade based rating.

There are

other examples of exchange token valuation frameworks such as the one by Decentral

Park Capital, in which they emphasize these tokens by their Price to Assets

ratio.

Overview

of Token Valuations

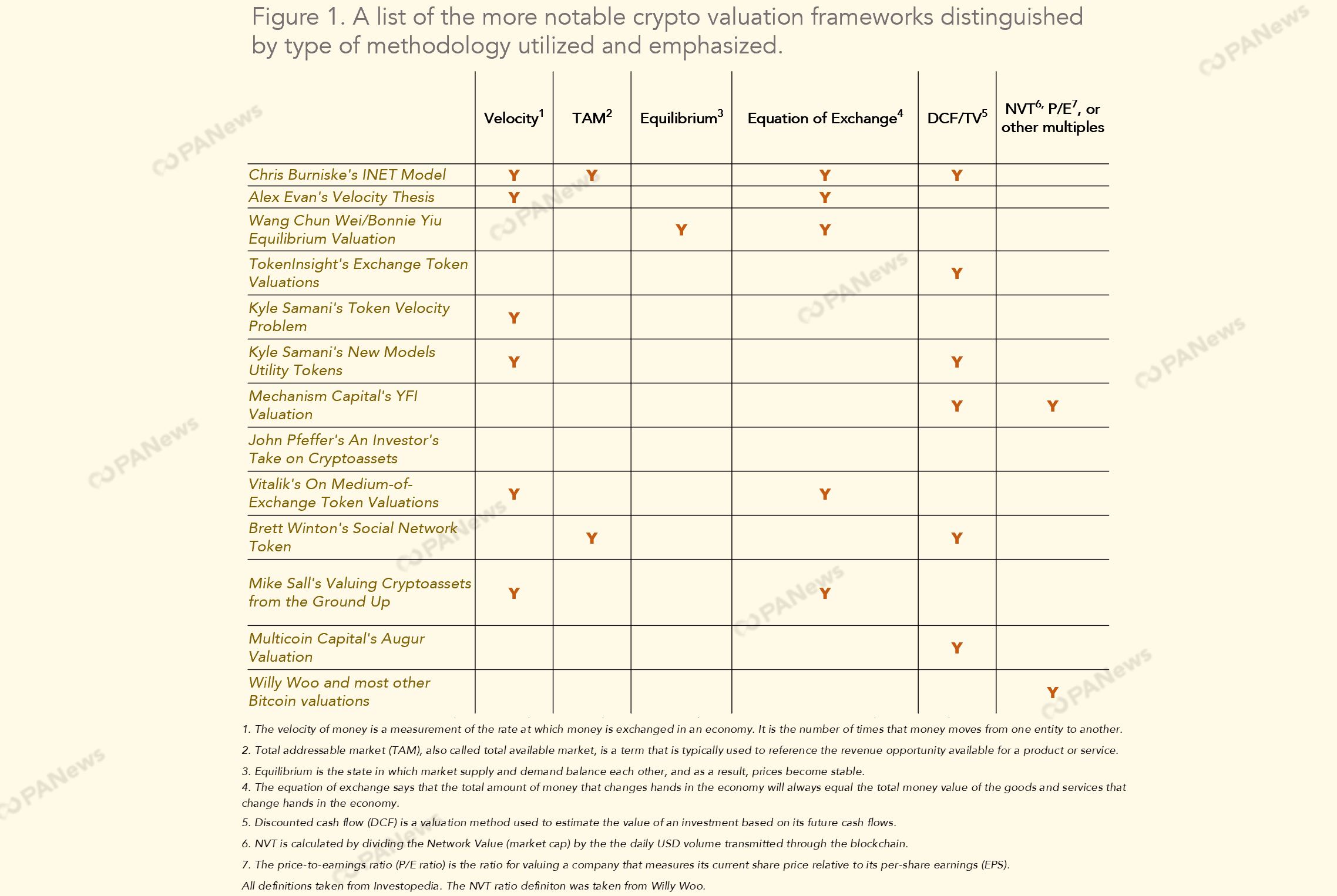

The list below

is a good snapshot of the more notable pieces of valuing cryptocurrencies. It’s

not a complete exhaustive and exclusive list by any means, but a great starting

point for anyone who dares to build upon these frameworks for cryptocurrencies.

Conclusion

As most of the

above aforementioned crypto valuation frameworks were published around 2017,

there really hasn’t been any new groundbreaking frameworks put forth since. But

there are a handful of funds that occasionally do put out their own valuation

piece, albeit with muted fanfare.

Have the swarm of changes we’ve seen in

blockchain, DeFi, the rotation of market leaders, etc. have inadvertently

positioned these frameworks obsolete? Are we still trying to find the right

rational frameworks to value irrational markets? Regardless of whether these

exercises are formulating an accurate crypto valuation, the value of

consistently molding and tinkering the way we approach it is something we

shouldn’t debase.

As stated in

the beginning, these exercises have been a way in rethinking token models and

accentuating faults that may have not been noticed. This can lead us to better

questions such as, is it the token’s velocity or the protocol’s staking

incentives that we should dissect further? How should we divvy up capital

allocation in a fair manner? Or does it stem from the way tokens are originally

minted and burned? Or instead of burning tokens should protocols “buy-back and

make” as proposed

by Placeholder?

“There is

no one size fits all model for crypto valuations, and valuations are

complicated, especially in the crypto market. As we are still in the early

stage in this fast-moving crypto financial market, I think we need to attract

significant more inflow of a diverse range of institutional money such hedge

funds, banks, asset managers, mutual funds, etc. to drive the crypto market, in

general, to be even more efficient.”

- Johnson Xu, Director of Research at Huobi DeFi Labs and Former Head of

Research at TokenInsight, told PANews.

For the

newcomers that carry a finance background, stabbing at these through the lens

of a CFA curriculum is a natural inclination. But to the event we want to

venture down this road of price prediction based on fundamental drivers, the

below points will eventually need to show fruition before we end up swerving

into futility:

-More

reporting and transparency around token projects

-More

historical data (this one is obvious)

-More

competitors to the existing market leaders

-Better data

usage of layer 2 applications

-More HODLers

of other cryptocurrencies

-Better

tokenomics

Although the

above suggestions may or may not be in conflict with the original ethos of

crypto, mass adoption is going to need more structure and frameworks rather

than going at it in a haphazard manner.

Thanks to

Kyle Samani, Managing Partner at Multicoin Capital and Johnson Xu, Director of

Research at Huobi DeFi Labs for their insights on this subject matter.

Sources

https://image.tokeninsight.com/levelPdf/TI-Exchange_Token_Valuation-2020.08.pdf

https://medium.com/blockchannel/on-value-velocity-and-monetary-theory-a-new-approach-to-cryptoasset-valuations-32c9b22e3b6f

https://www.coindesk.com/blockchain-token-velocity-problem

https://s3.eu-west-2.amazonaws.com/john-pfeffer/An+Investor%27s+Take+on+Cryptoassets+v6.pdf

https://medium.com/@wintonARK/how-to-value-a-crypto-asset-a-model-e0548e9b6e4e

https://vitalik.ca/general/2017/10/17/moe.html

https://hackernoon.com/an-equilibrium-crypto-token-valuation-model-cd9281fe77db

https://medium.com/@sall/valuing-cryptoassets-from-the-ground-up-441ad5a9ff03