Author: shaofaye123, Foresight News

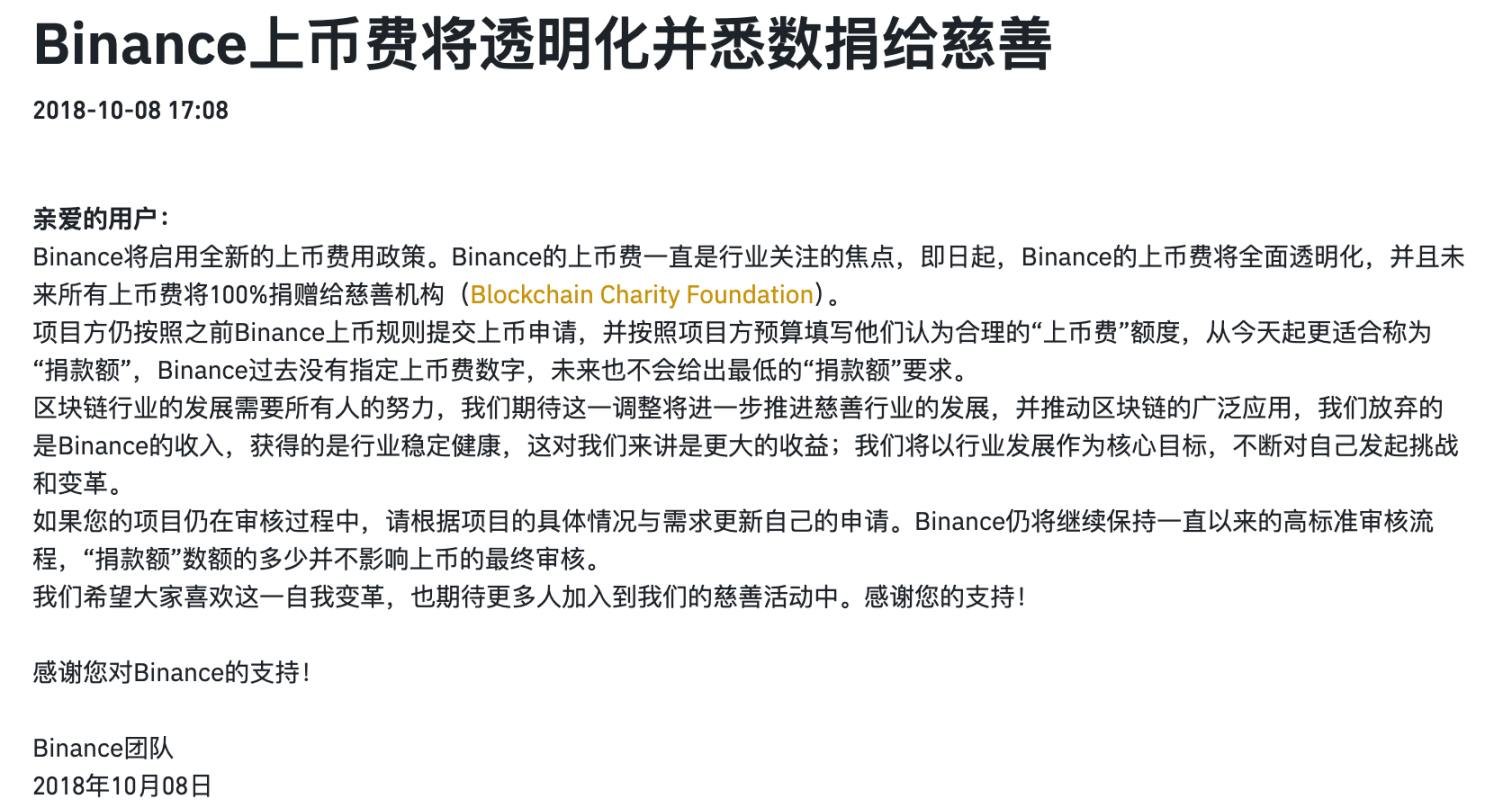

The listing fees of exchanges have always been the focus of the industry, and the discussion about whether there are really sky-high listing fees is not the first time. In 2018, Binance was questioned for charging a listing fee of $1 million to list tokens. Other exchanges have also been involved in the topic, 10 ETH, 20 BTC, 500,000 Tokens, it is difficult to judge which is true and which is false. Binance also issued an announcement in October 2018 claiming that the listing fees will be transparent and donated to charity. In 2022, Binance's listing fees were once again caught in the whirlpool of public opinion due to MITH's request to return deposits. Recently, with the CEO of Moonrock Capital exposing the $100 million listing fee on Twitter, rumors and condemnations of Binance's sky-high listing fees have once again become the center of the topic.

The whole incident

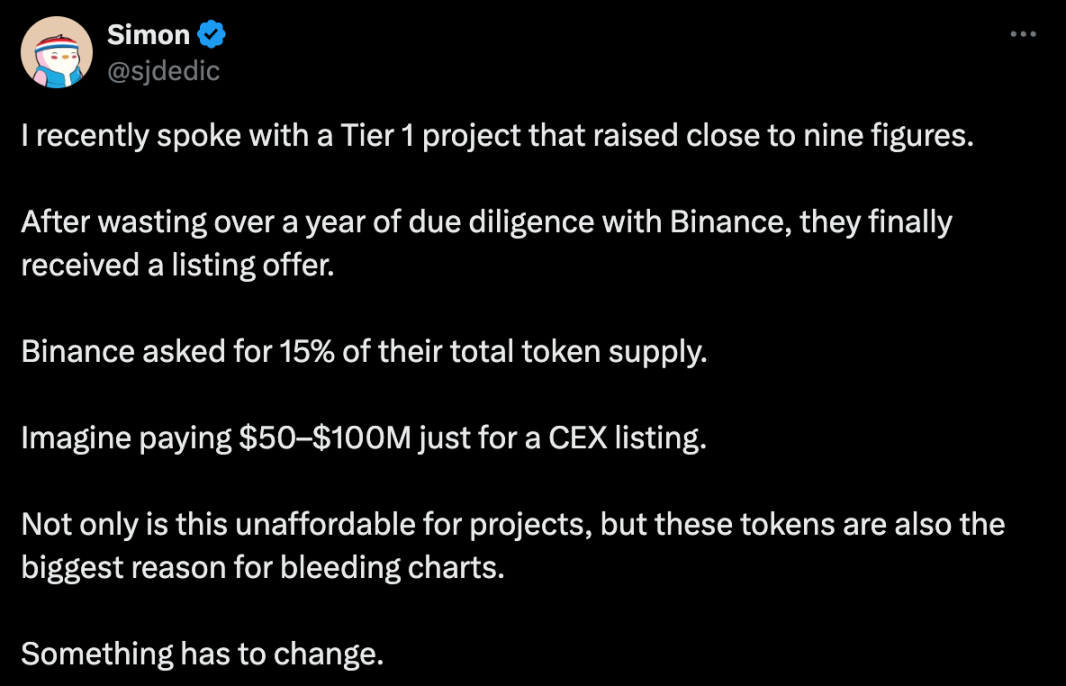

On November 1, the CEO of Moonrock Capital, a cryptocurrency-native consulting and investment company, spoke on Twitter. He claimed that Binance required a potential project to provide 15% of its total token supply to ensure its listing on a centralized exchange, which accounted for 15% of the total token supply, worth about $50 million to $100 million.

The incident then began to ferment, with the post being viewed over a million times, and more and more KOLs starting to voice their condemnation or support.

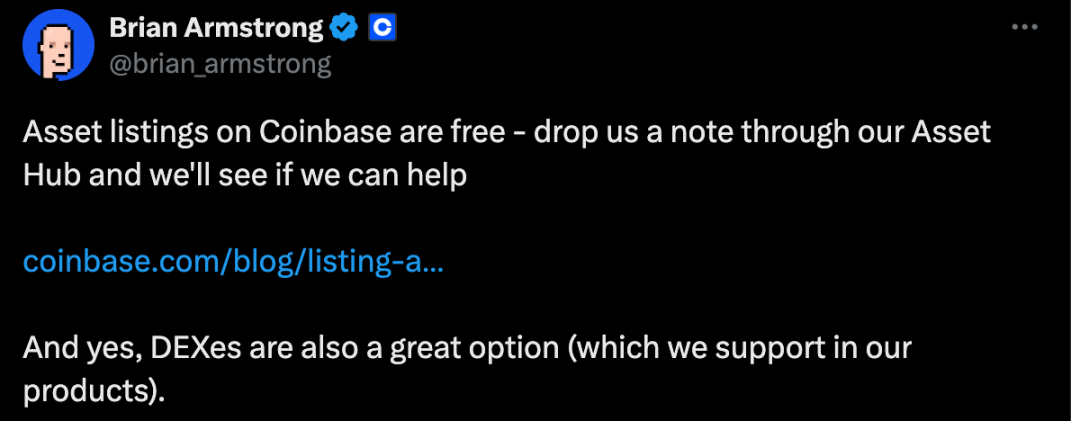

Coinbase co-founder Brian Armstrong also issued a statement on the matter, claiming: "Coinbase's coin listing is free."

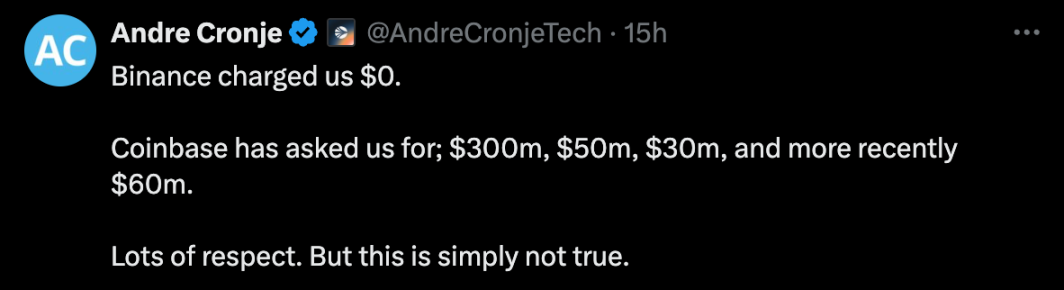

However, Coinbase, which wanted to use this incident to demonstrate the spirit of decentralization and fairness, was quickly exposed for not only charging a listing fee, but also a considerable amount.

Sonic Labs co-founder Andre Cronje claimed on Twitter that "Binance does not charge listing fees, but Coinbase has repeatedly asked for fees and quoted $300 million, $50 million, $30 million, and the most recent offer is $60 million." This response has sparked widespread discussion, and the incident has intensified. Some people questioned that Andre may have contacted fake Coinbase listing workers, and Andre said that he could provide all the evidence for public identification. "I did not sign a confidentiality agreement, so I am very happy to provide relevant evidence (the price request came from multiple employees/departments of Coinbase, through email, Telegram and Slack for many years). Coinbase can argue that this is not a listing fee, but an Earn Fee, but this will still be converted into the listing cost of the project."

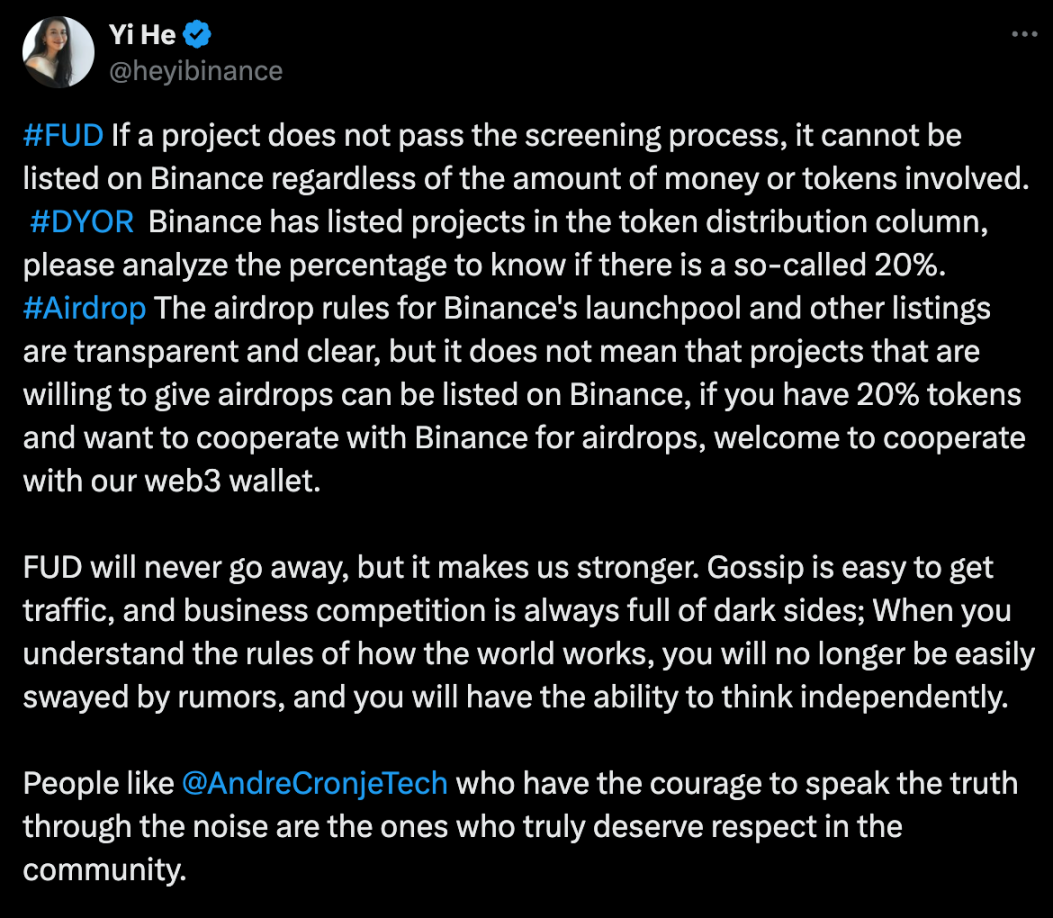

He Yi responded

The discussion was very heated, and Binance co-founder He Yi also responded to it, claiming that there is no so-called listing fee, and the airdrop ratio and rules for cooperating with the project party are clear and transparent, and the project party’s listing qualification will not be determined by whether it gives tokens. In addition, Binance has a strict listing screening mechanism.

He Yi said on Twitter,

- FUD If a project does not pass the screening process, no matter how much money or percentage of coins it has, it cannot be listed on Binance.

- DYOR The projects that have been listed on Binance are clearly introduced in the token allocation column. Please analyze the percentages yourself to see if there is a so-called 20%, 15% or something like that.

- The airdrop rules on Binance's launchpool and other listed coins are transparent and clear, but it does not mean that all projects willing to give airdrops can be listed on Binance. If you have 20% of tokens and want to cooperate with Binance for airdrops, you are welcome to cooperate with our web3 wallet.

FUD will never disappear, but it makes us stronger. Gossip can easily gain traffic, and business competition is always full of dark sides; when you understand the rules of how the world works, you will no longer be easily swayed by rumors, and you will have the ability to think independently.

People like AC who have the courage to speak the truth amid the noise are the ones that the community truly respects.”

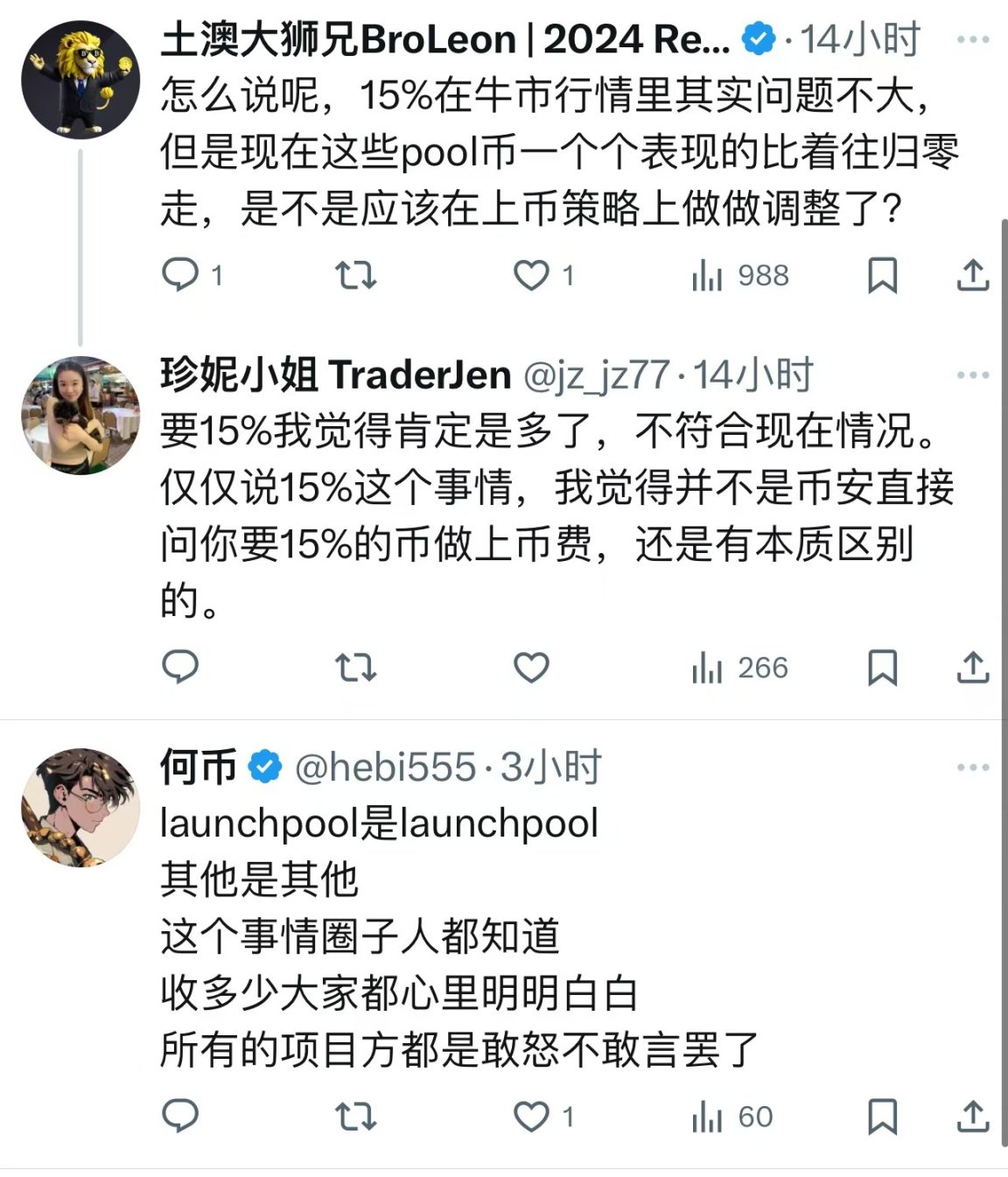

As for the listing fee, KOLs and the public have different views. Some believe that the listing fee is part of the exchange's operation and can be used as a way to screen the quality of projects. Others believe that the listing fee may hinder some potential but underfunded projects from listing, thus affecting the diversity and competitiveness of the market.

Looking at Industry Development from the Perspective of Listing Fees

In 2018, 2022, 2024, it seems that the controversy over listing fees is brought up again every once in a while. Cryptocurrency is centered on the spirit of decentralization, but the listing fees of centralized exchanges are always shrouded in mystery. From a business perspective, it may be reasonable for exchanges to charge certain listing fees, as they need to invest resources to evaluate projects, ensure compliance, and maintain platform operations. However, the collection of fees should be transparent and fair, and excessive fees should not become an obstacle to innovation.

The controversy over listing fees continues, and what we see is a strong demand for transparency and fairness from practitioners. Binance's positive response has alleviated market concerns to a certain extent, which further highlights the need for exchanges to be more transparent and fair in their listing policies. However, the development of the industry should not only stop at listing, and project parties should pay more attention to the quality and sustainability of their projects. The focus on listing fees at each stage is a demand for a fairer and more transparent market environment. This often means the emergence of a new turning point, and the industry needs truly valuable projects to stand out.