Original author: AllianceDAO

Compiled by: Zen, PANews

AllianceDAO is a leading crypto accelerator and founder community, and our accelerator program attracts the best crypto startups in the industry, receiving more than 3,000 applications each year. Since AllianceDAO's accelerator program is held twice a year, we report the data in two parts. In this report, Alliance provides trends observed from the application data and adds insights into what these trends may imply for the broader startup ecosystem.

Highlights: Key trends observed in internal data from 2021-2024:

Blockchain

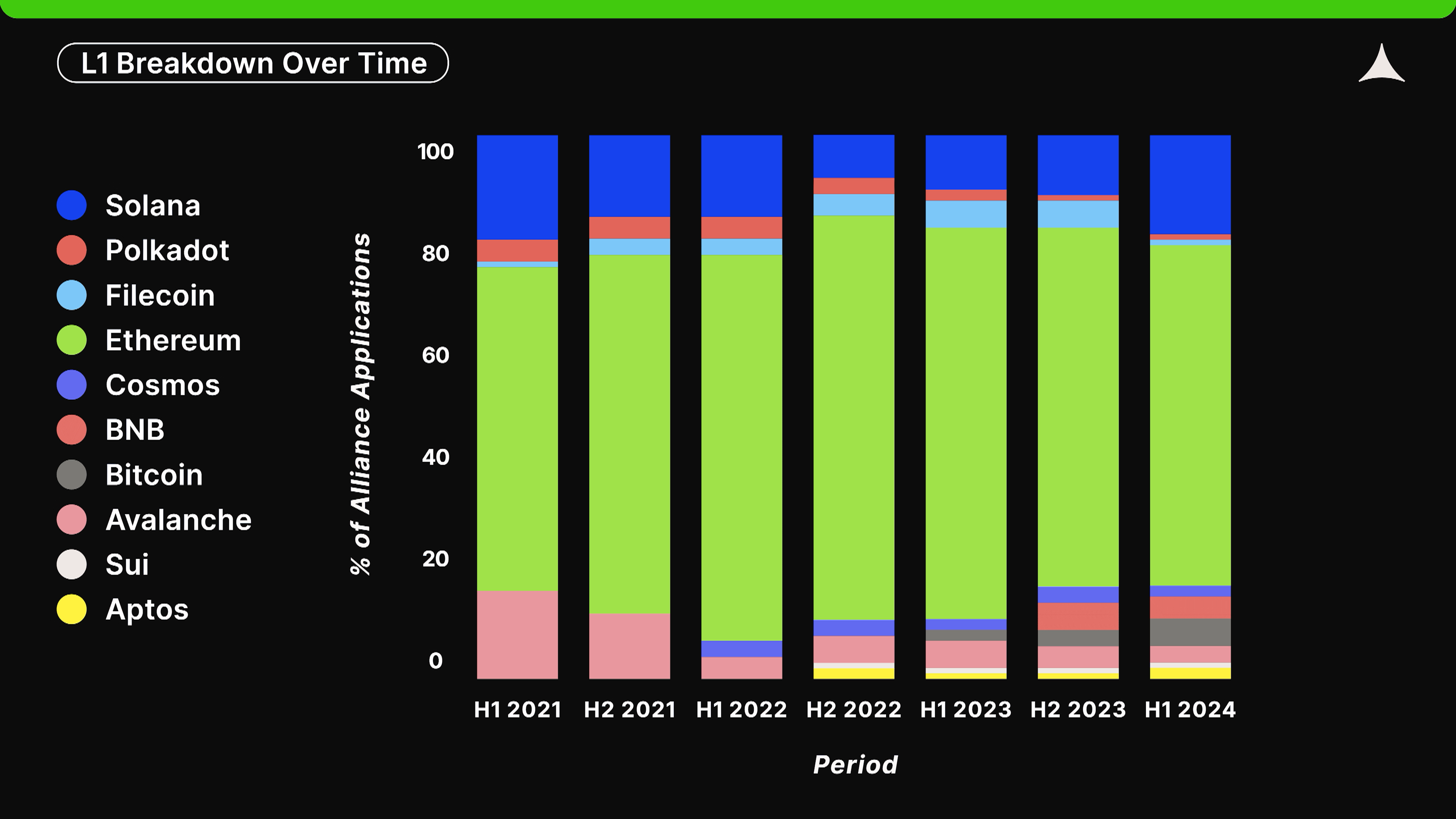

- Ethereum remains the dominant ecosystem for startups to build on (around 2/3 of all startups are currently built on it), while Solana (currently 18%, having dropped to 8% after the FTX crash) and Bitcoin (5% today) have grown rapidly over the past year and a half.

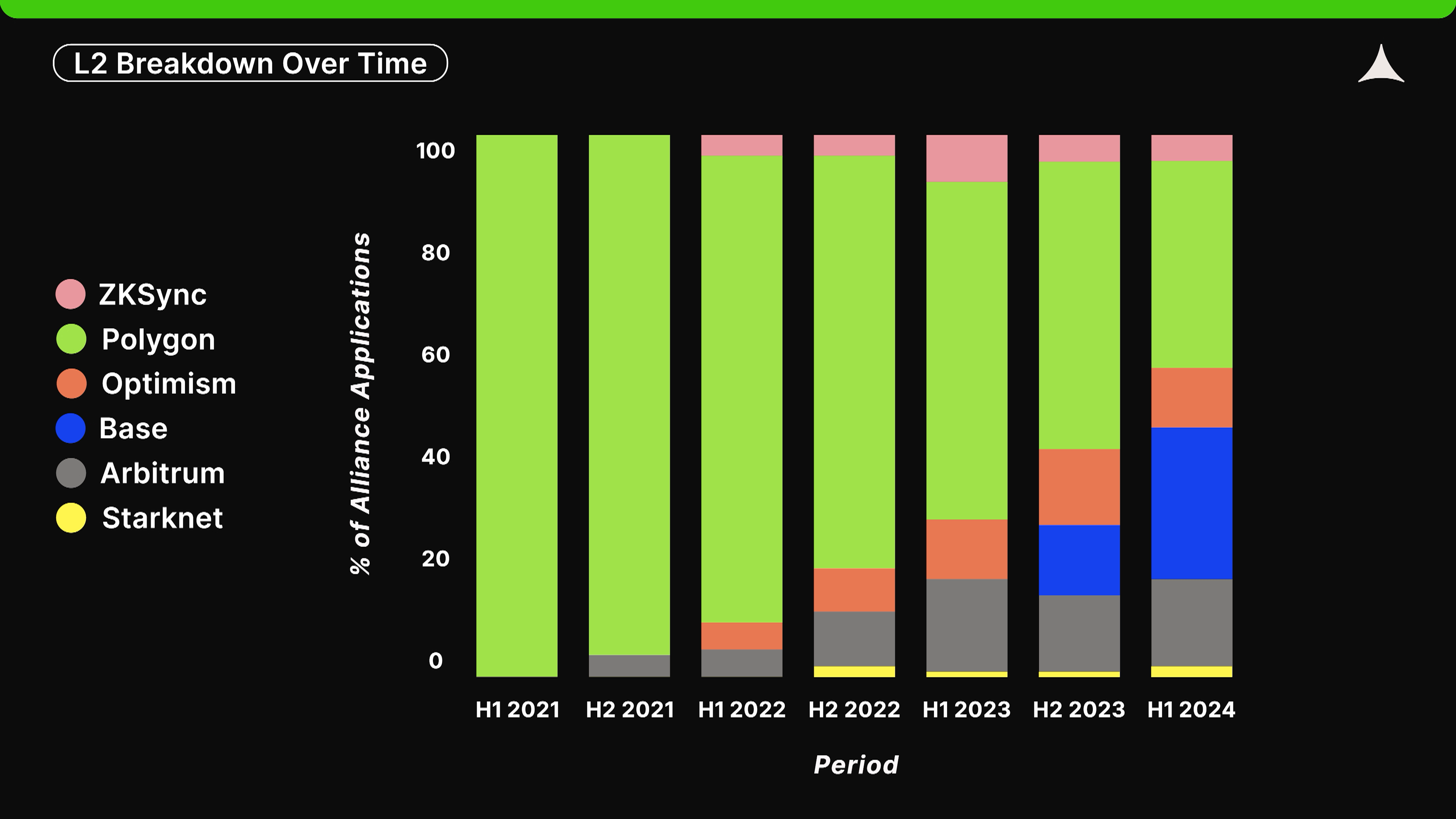

- In the Ethereum ecosystem, 59% of startups are currently building on Optimism Rollup (Optimism, Base, and Arbitrum).

- Polygon is gradually losing startups, and Polygon zkEVM is lagging behind Optimism Rollup in the competition.

- Base has the fastest growth rate among all Ethereum L2s, now accounting for more than 28% of startup activity, starting from scratch in just one year.

What vertical product is the applicant building?

- Growth verticals: Infrastructure, DeFi, Payments, AI and Crypto.

- Verticals with decreasing trends: DAOs and NFTs.

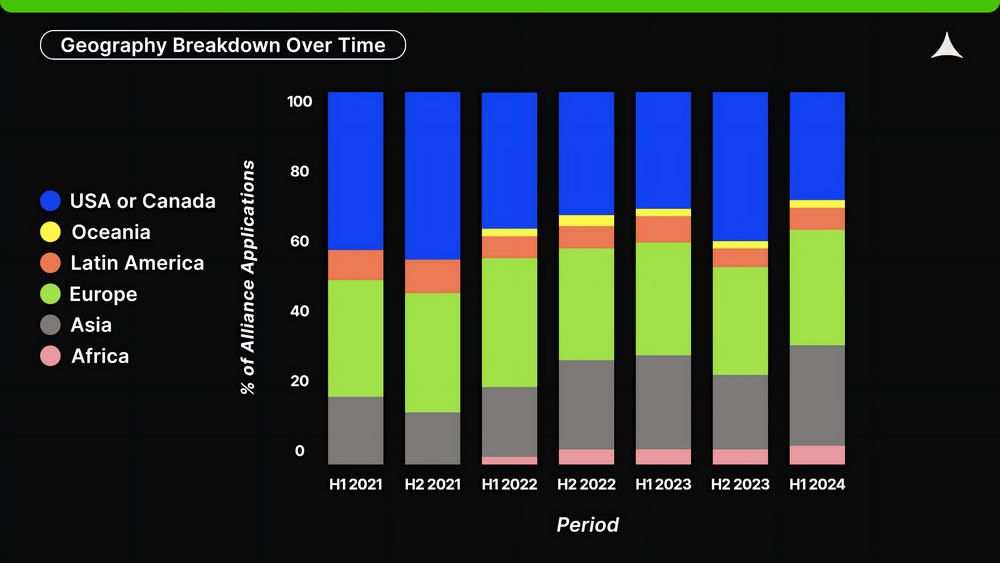

Which continent is the founder located in?

- Europe (31%), the United States and Canada (29%), and Asia (27%) are the top three regions where startups are currently building.

- However, the percentage of startups from the U.S. and Canada has steadily declined over the past few rounds, while the percentage from Asia and Africa has increased.

Keywords mentioned more and more by project parties

Buzzwords that have grown over the past 12 months include fully homomorphic encryption (FHE), chain abstraction, meme, SocialFi, prediction markets, liquid staking, re-staking, RWA, stablecoins, L1, L2, and L3.

Founder Background & Team Composition

- Currently, 30% of founders applying to join our accelerator have Big Tech (S&P 500) experience, and 12% have studied at top schools (QS top 100 universities).

- 39% of startups consist of a single founder, and among companies with multiple founders, the proportion of equal equity distribution reaches 50%.

- 72% of startups are fully remote (no employees working on-site).

The following is the report text

Layer1: Ethereum is dominant, Solana and Bitcoin ecosystem are worth looking forward to

Ethereum remains the dominant ecosystem, attracting 62% of crypto startups applying to join the Alliance. In addition, Solana has now recovered to 18% of applications after bottoming out in the second half of 2022. Interestingly, the Bitcoin ecosystem has also attracted more and more developers, now accounting for nearly 5% of all applications.

The number and quality of startups building each ecosystem remains the best predictor of how that ecosystem will perform over the next 1-2 years. After all, startups need to build products, and products ultimately drive usage, on-chain metrics, attention, and price action.

Solana is currently the ecosystem with the most momentum. According to our data, the number of startups on Solana reached a low point in the second half of 2022. This may be directly related to the collapse of FTX, as FTX played a crucial role in the early development of Solana. Since then, both the price of SOL and Solana's on-chain metrics have begun to rebound. Many of the top products currently built on Solana were actually built during the bear market and the FTX crisis. Tensor, Kamino, Solflare, and Pump are some of the popular applications built on Solana by Aliance alumni. Based on the current trend of startup selection, we believe Solana will continue to attract startups and users in the next 1-2 years.

At the same time, the Bitcoin ecosystem has attracted more and more startups, all starting with the launch of Ordinals in 2023. The early enthusiasm around this non-fungible token standard has triggered multiple experiments with alternative token standards such as BRC20 and Runes. At the same time, efforts to significantly improve Bitcoin's programmability, such as BitVM and dozens of Bitcoin L2 solutions, have also come out one after another. We have also seen many DeFi projects pioneered on Ethereum, such as decentralized exchanges, lending platforms, and stablecoins, begin to be replicated on Bitcoin. Although the enthusiasm of the Bitcoin ecosystem may peak after the latest halving in April 2024, this is also the period of the most attention from entrepreneurs in Bitcoin's history.

We are optimistic about Bitcoin's prospects as a startup ecosystem, as the current wealth stored in Bitcoin exceeds $1 trillion, which has prompted the market to explore how to use this wealth in meaningful or interesting ways. However, we also point out that Ethereum and Solana are still far ahead, and Bitcoin's technical limitations may prevent it from providing a differentiated experience for developers and users.

It should be said that despite the recent loss of some attention to Solana and Bitcoin, Ethereum is still the most active ecosystem, occupying the attention of almost 2/3 of the Alliance applicants. Currently, most startups build products on Ethereum L2 in a highly competitive market.

Ethereum Layer 2: Base emerges as a new force, while Optimism Rollup continues to lead

In the early history of Aliance, startups were almost exclusively built on Polygon. However, Optimism Rollups such as Optimism, Base, and Arbitrum have continued to gain traction over the past three years. Today, they collectively account for 59% of startups built on Ethereum L2. Notably, Base was only launched in 2023 and currently accounts for 28% of startup activity on Ethereum L2.

Based on our own data and data from L2Beat, Optimism Rollup is proving to be a better product than ZK Rollup. Overall, Optimism Rollup offers lower fees and a better developer experience, which in turn attracts more users and startups. That said, we have also encountered some outstanding founders who are building infrastructure and applications on ZK Rollup (such as Starknet and ZKSync). If tooling improves or these founders find product-market fit, ZK Rollup may start to attract more founders and end users, but given the current dominance of Optimism Rollup, this remains to be seen.

Polygon has been losing market share to startups building on Ethereum over the past three years. Polygon is not just a blockchain, but the vast majority of startup and user activity occurs on Polygon POS, a sidechain of Ethereum. The loss of market share is understandable, as Polygon POS was actually the only mature and available solution for scaling Ethereum a few years ago. Today, Polygon has invested a lot of resources in Polygon zkEVM, but it still lags significantly behind Optimism Rollup compared to other ZK Rollups.

Finally, it's worth mentioning Base. We knew a year ago that Base would become one of the most important L2s, thanks to Coinbase's brand and distribution capabilities. But they still exceeded our expectations and became the largest destination for Ethereum startups after Polygon.

Distribution in vertical fields: Infrastructure continues to grow, and DeFi remains a hot topic

What products startups are building is another interesting trend we can track from the filing data. Note that our attempts to categorize product verticals are obviously subjective and therefore may not be perfect. For example, these categories are not independent of each other and are custom. A startup can operate in both the gaming and NFT sectors. So while long-term trends are interesting, take these numbers with a pinch of salt.

The public perception is that there is too much infrastructure and not enough applications, which is consistent with our application data - in fact, the proportion of startups choosing to build infrastructure has continued to grow over the past three years.

One of the main reasons for the growth in infrastructure may be that valuations for infrastructure tokens have historically been high. This has led to more startups pursuing infrastructure projects, and more venture capital has poured into infrastructure, which has further fueled more startups. The result has been a lot of misinvestment of intellectual and financial capital, but also more scalable blockchains, which should help the interests of future application developers.

Meanwhile, DeFi has become one of the most popular categories over the past year. Despite many VCs believing that “DeFi is dead,” the number of DeFi startups has actually risen over the past 18 months. Despite this, DAOs and NFTs remain the least popular product categories. We think this makes sense, as many DeFi projects have experienced death in NFTs (many DAOs use their own NFTs as governance tokens), while the value of NFTs themselves seems unable to form in the market.

Nonetheless, NFTs have attracted some very interesting startups, especially in the art space, and we believe this influence will continue. We predict that in the future, startups will focus on providing infrastructure for more applications and product development, such as SocialFi, Web3 games, and on-chain data aggregation, which will further promote the sustainability of the Web3 ecosystem.

Geographical distribution: Eurasia rises, North America's dominance weakens

One of the most interesting trends we analyzed was the primary geographic distribution of startup founders.

In the first half of 2024, we saw the lowest percentage of founders from the U.S. and Canada at 29%. This is down from the second half of 2021, when over 45% of applicants were from the U.S. and Canada.

Meanwhile, the percentage of startups from Asia and Africa reached an all-time high, at 26% and 5%, respectively. Overall, North America, Europe, and Asia still dominate, with each region accounting for between 25% and 33% of startup applications. The decline in US applicants is a worrying trend, which could be due to two reasons. First, increasing regulatory uncertainty in the US and the “enforcement and regulation” strategy adopted by the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the US Treasury Department have led US founders to move overseas or turn to other industries (such as AI). Second, the growing real-world adoption of cryptocurrencies in developing countries, especially the adoption of stablecoins as a hedge against local fiat currencies and as a form of cross-border and censorship-resistant payments, has further attracted more startups from these regions.

It remains to be seen whether the first trend will continue, especially if the upcoming November elections lead to a new government taking office. However, the second trend is unlikely to slow down anytime soon, as stablecoins are indeed solving real problems for everyday people in developing countries. This is especially important because public and social media-led discussions tend to be US-centric, thus viewing cryptocurrencies as tools for speculation only. While speculation has driven cryptocurrency adoption in the Global North, stablecoins are driving cryptocurrency adoption in the Global South.

Startup buzzwords: fully homomorphic encryption, chain abstraction, meme

Cryptocurrency as a whole has gone through multiple hype cycles, typically every four years. However, within each cycle, there have also been multiple mini-hype cycles within various product areas.

By analyzing the keywords mentioned in the consortium applications, we gained insights into the popular trends in a particular period. We call these keywords "crypto buzzwords" and divide them into several categories to visualize their trends in more detail. Please note that all charts in this section are on a logarithmic scale. Zero-knowledge proof (ZK), fully homomorphic encryption (FHE), trusted execution environment (TEE), and multi-party computation (MPC) are some of the key privacy-related technologies used in crypto. It is worth noting that although ZK can be used for privacy protection (for example, in Zcash and Tornado Cash), its current main application is scalability.

privacy

ZK remains the most mentioned term for some time. FHE has risen over the past year. These data are consistent with the trends we see in public discourse. The first application of ZK in crypto was Zcash in 2016. But it was not until 2021 that it became a household name. In fact, in 2021 Vitalik wrote: "optimistic rollups will likely win in general EVM computation, but in the medium to long term, ZK rollups will win in all use cases." In our view, the consistent rise of ZK from 2021 to 2023 can be traced back to this single event.

User Experience

Mentions of “bridge” have remained relatively stable over the past three-plus years. Meanwhile, “account abstraction” rose significantly in the second half of 2021, while “chain abstraction” grew rapidly in 2022. Mentions of “intent-based” have risen rapidly recently, but appear to have peaked. “Chain abstraction” is actually a renaming of cross-chain bridging. Therefore, its rise is not unrelated to the stagnation of “bridge”. Meanwhile, the emergence of “account abstraction” is related to EIP-4337, which was popularized by Vitalik in 2021. The origins of many crypto buzzwords can be traced back to the founder of Ethereum.

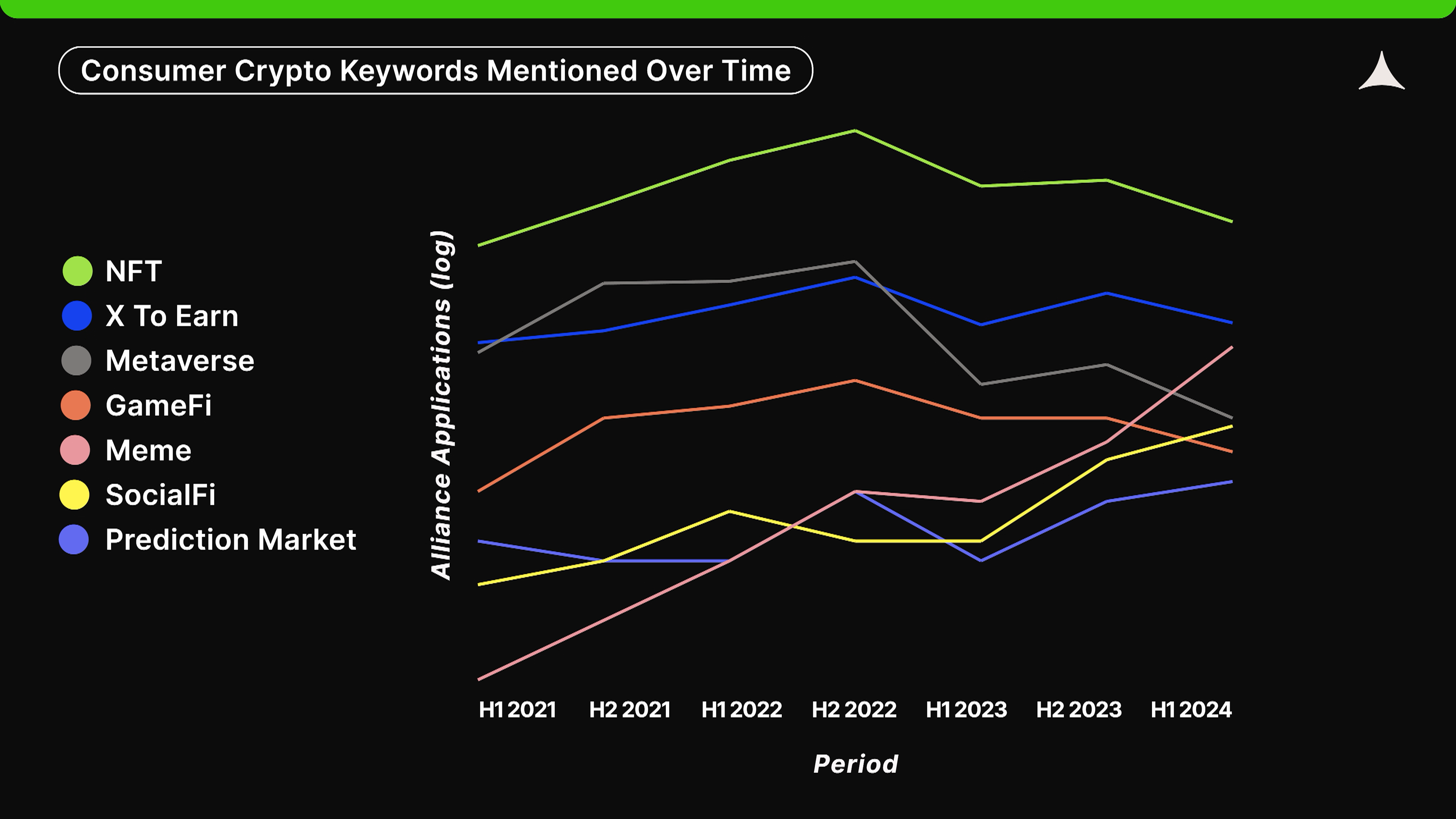

Consumer Applications

In the consumer applications and gaming space, “NFT,” “Metaverse,” and “GameFi” peaked in the second half of 2022 and have since fallen sharply. “X to earn” has seen a similar downward trend, albeit to a lesser degree. “SociaFi” and “meme” are some of the newer terms that emerged in 2021 and continue to show growth trends.

The speculative craze around NFTs in 2022 has likely been replaced by memecoins, which have lower unit prices and higher liquidity due to their fungibility. "X to earn" and "GameFi" peaked under the impetus of Axie Infinity, but surprisingly, "X to earn" did not decline as much. Finally, "SocialFi" recovered in the second half of 2023, which is likely related to the success of Friend.tech.

income

“Liquid staking” has been gaining traction since 2021, while “restaking” has continued to rise since 2022. On the other hand, mentions of “lending” have been relatively stable over time, although they peaked in the second half of 2022.

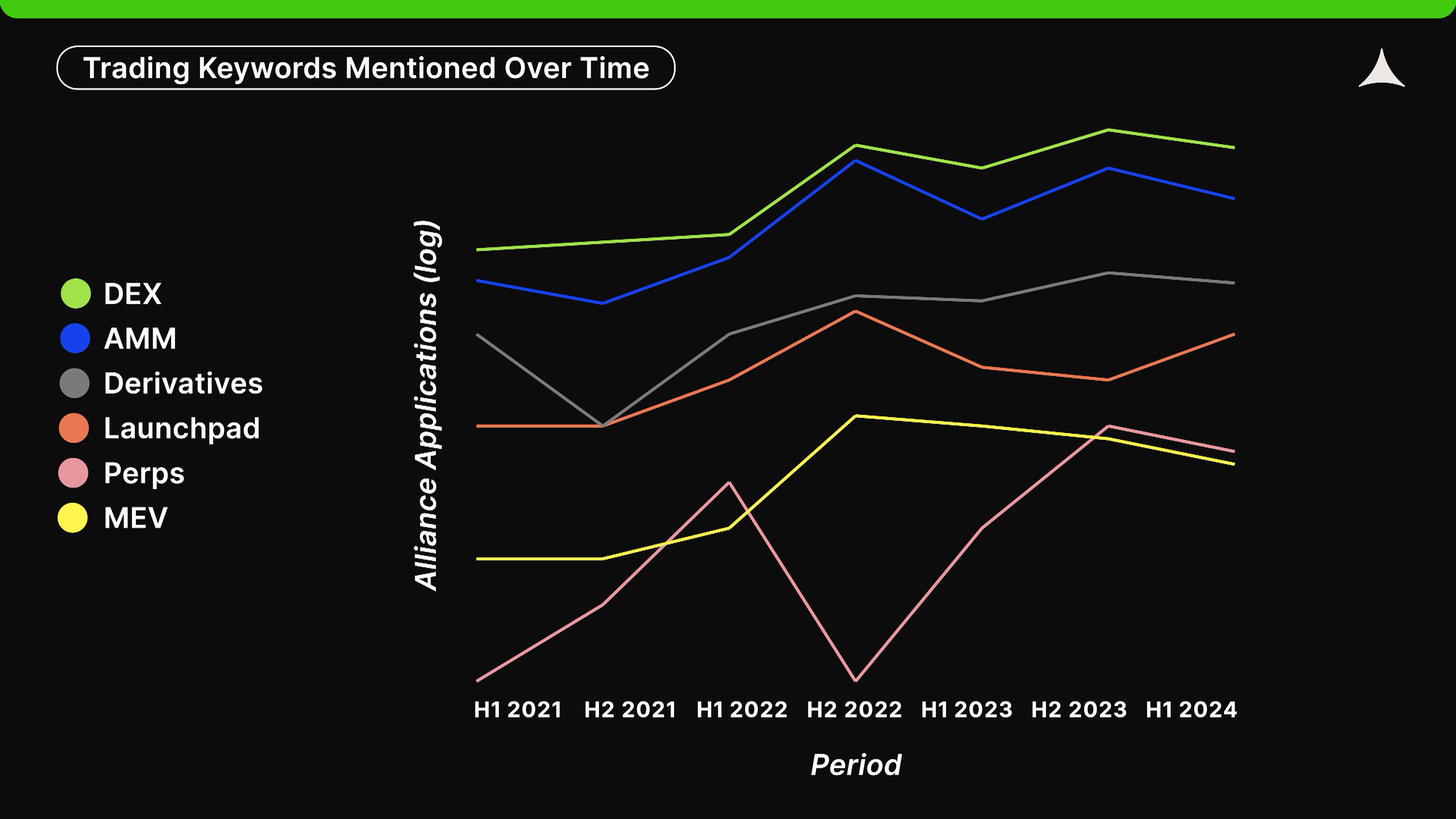

trade

“Automated market makers” (AMM), “derivatives” (derivatives), and “decentralized exchanges” (DEX) have generally been on an upward trend over the past 3.5 years. In contrast, “maximum extractable value” (MEV) peaked in the second half of 2022 and has since lost popularity among entrepreneurs. Launchpad is gaining momentum again after a slight slowdown in 2023. In general, trading-related keywords are on the rise as it is one of the few applications in crypto with clear product-market fit. The latest rise in “launchpad” may be related to the success of Alliance alumnus Pump.fun.

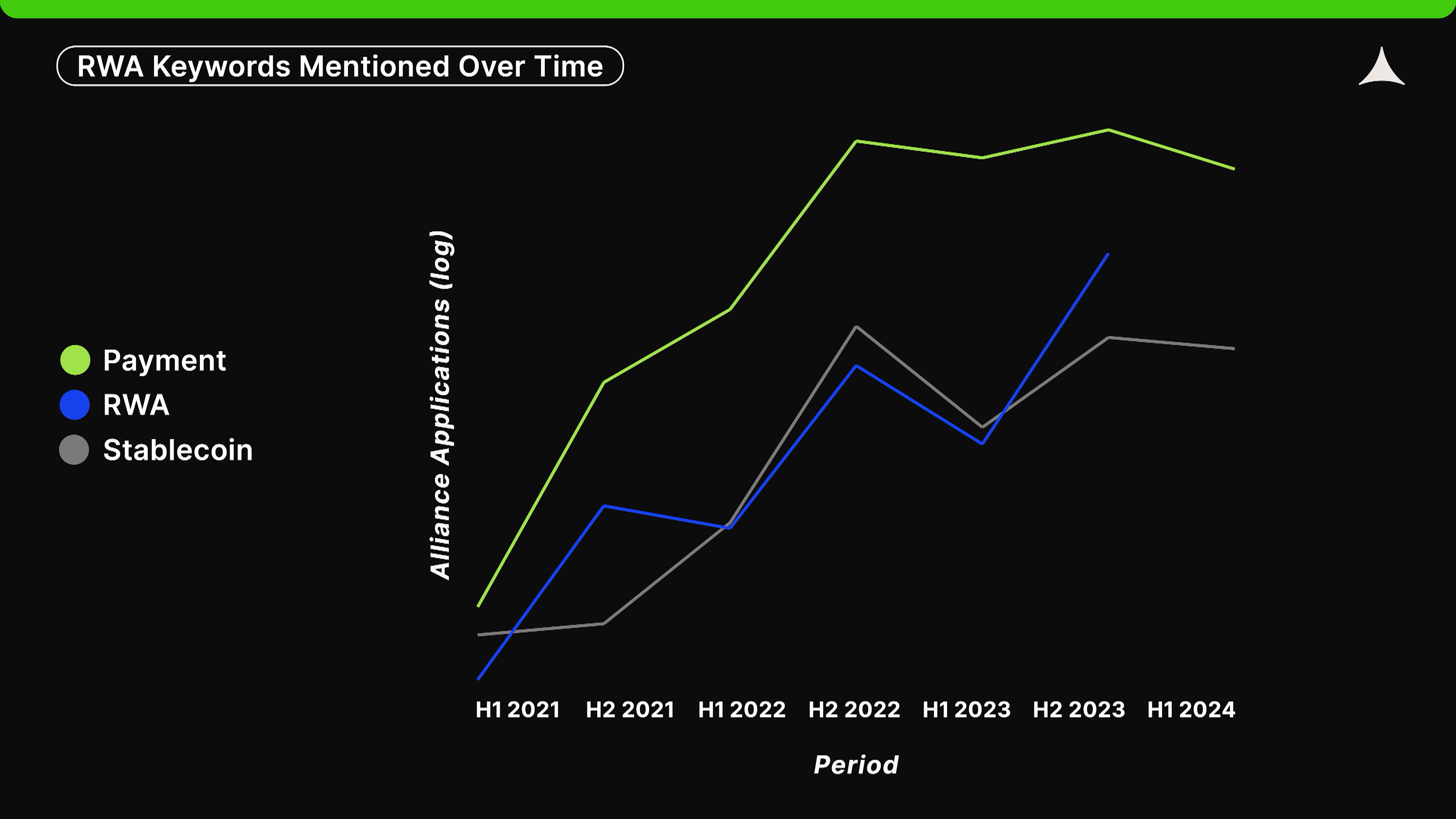

RWA

The trend of startups applying for the alliance mentioning "payment", "stablecoin" and "RWA" continues to rise. As mentioned earlier, stablecoin-based payments are one of the few applications in crypto that have proven product-market fit, especially in emerging markets.

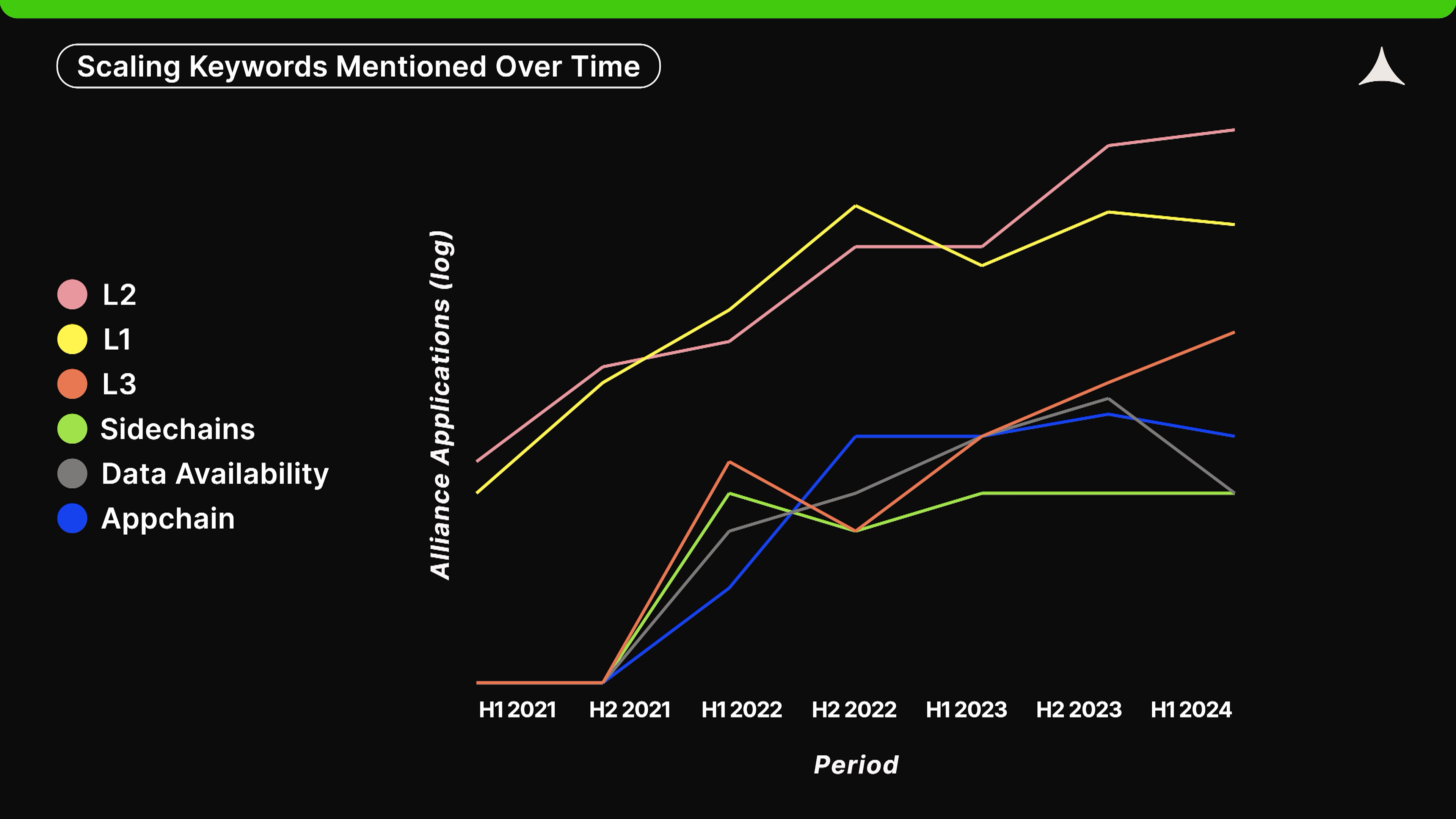

Scalability

In the field of scalability, "L2" and "L3" showed a strong growth trend, while "L1" began to stagnate after reaching its peak in the second half of 2022. Since the second half of 2021, new buzzwords have emerged including "data availability", "appchain" and "sidechains".

Blockchain scaling efforts, especially in the case of Ethereum, have become increasingly modular in recent years. Vertically, we are gradually advancing to the L2 and L3 layers, and extending downward to specialized data availability layers. Horizontally, more and more application chains are emerging. Finally, the rise of "sidechains" in this data is relatively unexpected, perhaps related to the success of Polygon and Ronin.

Founder Background & Team Composition

Founder Background: The most successful founders rarely have elite backgrounds

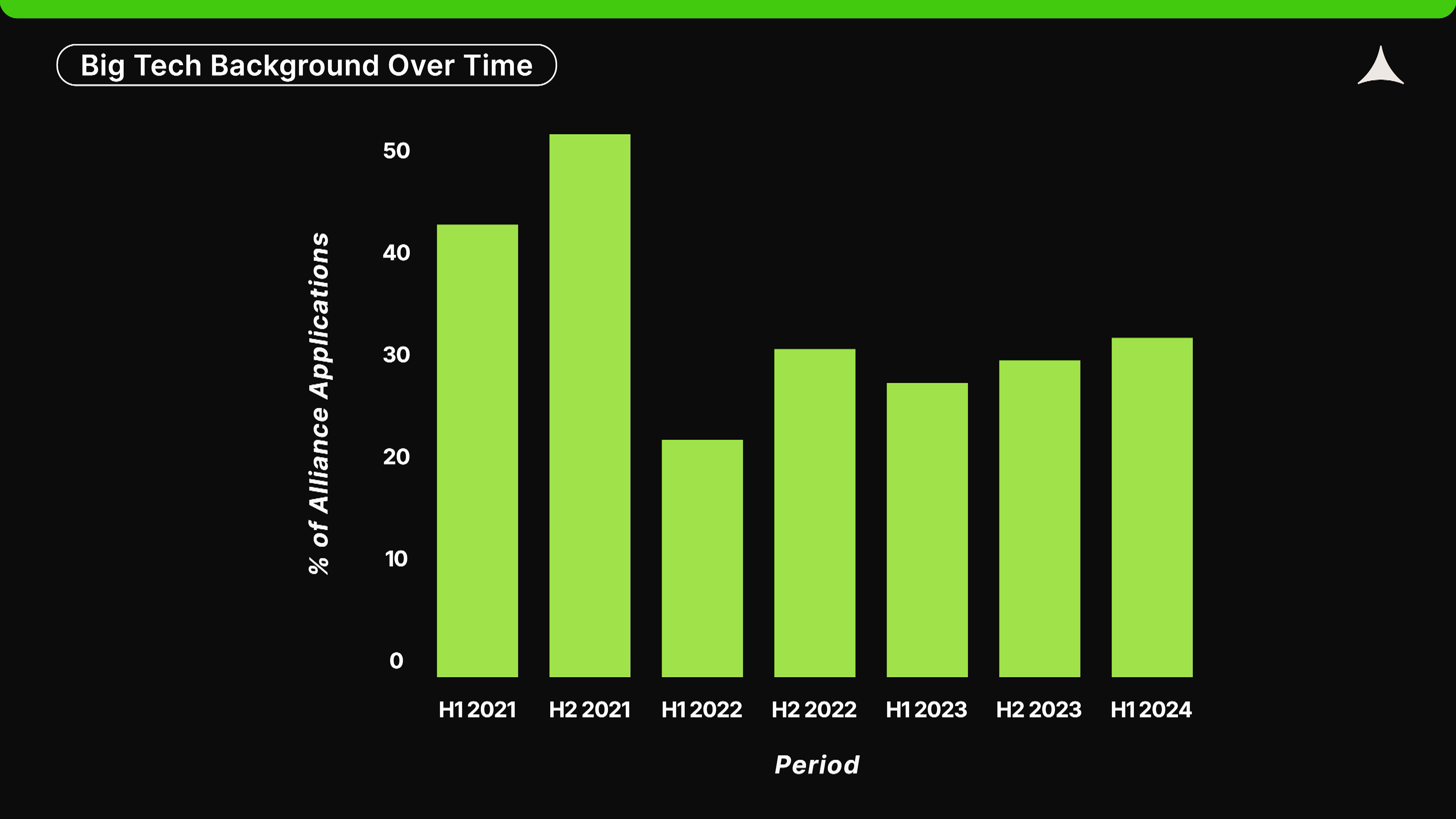

Approximately 30% of applicants to our most recent class reported experience working at large tech companies (note: we define “large tech” as tech companies in the S&P 500). This percentage has remained largely stable since 2022; however, it is a significant decrease from 2021, when almost 50% of applicants came from large tech companies.

Why is there a decrease? This may be related to the fact that founders have fewer US applicants due to regulatory concerns (and the US is where the big tech companies are). In addition, the 2021 bull run is more like a "gold rush", attracting many non-crypto people to rush into the crypto industry to try to profit from it. Finally, in 2024, the attention of cryptocurrency among tech workers may be rapidly shifting to other industries such as AI. In fact, during the last bull run, we saw several Alliance startups turn to AI.

Additionally, the percentage of founders in our applicant pool who graduated from “top schools” (QS top 100 universities in the world) peaked in 2021 and has remained fairly flat since then. The trend for top schools is strikingly similar to that for large tech companies, which have remained largely the same over the past few years, so there’s not a lot of trend to discuss.

But are founders from elite educational and professional backgrounds more likely to succeed?

If you look at a sample of all crypto founders, there is a clear correlation between going to a top school or working at a large tech company and future success. But when we look at the most successful companies we accelerate and the most successful companies in crypto as a whole, very few of them come from elite backgrounds.

We discuss possible reasons in detail in What Does It Take to Be a Good Crypto Founder? In short, cryptocurrency is a counterintuitive technology that many founders from traditional elite backgrounds may not understand from first principles. While this may change over time, it still holds true for now.

Team composition and work mode: Nearly 75% work completely remotely

Analyzing team composition in our data helps us understand the structure of crypto startups. While this doesn’t necessarily reveal which composition will produce the most successful teams, we share what we believe to be the ideal situation based on experience.

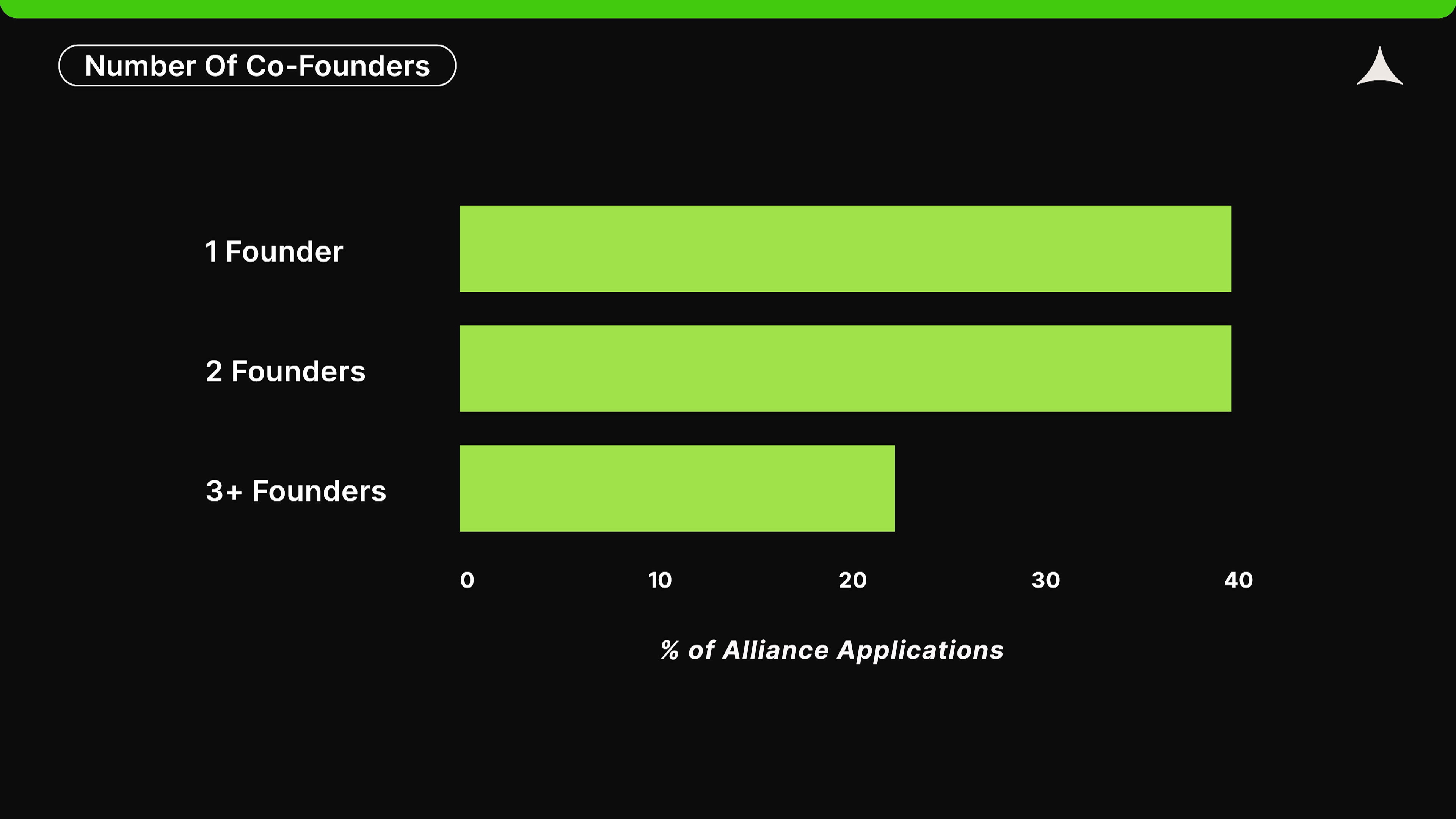

In our latest class of applications, 39% of startups were founded by solo founders. As a rule of thumb, solo founders have been prejudiced by venture capitalists, but data shows that they can produce extraordinary results: one study found that about 20% of unicorns were founded by solo founders. In addition, they often have key employees who may not be called co-founders, but in some cases are equally influential.

Among startups with two or more co-founders, about half (45%) have equity split equally, while the other half do not. When equity is split unevenly, startups with exactly two founders are most likely to have a 60-40 split or something similar, such as 51-49, followed by 70-30.

In startups with three or more founders, we observed that almost any form of equity distribution was acceptable; however, equal distribution or a single founder holding a majority stake (≥50%) was the most common scenario. The main reasons for unequal distribution of equity among founders are to reward those who i) initially funded the startup with their personal funds; ii) came up with the idea (including effort and contribution); or iii) will have the most decision-making power.

We don’t have a strong opinion on this, but for founders who started their startups at similar times, we generally prefer to recommend an equal split of equity, as building a successful startup is a decade-long journey, although it is understandable that there are situations where an equal split doesn’t always make sense, as shown in the reasons above.

Our data suggests that today, approximately 75% of startups are operating in a fully remote work model (i.e., with no employees working on-site). This is a significant percentage overall, though not surprising given the global nature and relative size of the crypto industry.

COVID-19 may have changed the way we work, but at Alliance we prefer in-person teams, or at least co-founders and key employees working together. In-person teams communicate more efficiently and quickly, which in turn promotes stronger team culture, creativity, and accountability.