Author: Kevin, the Researcher at BlockBooster

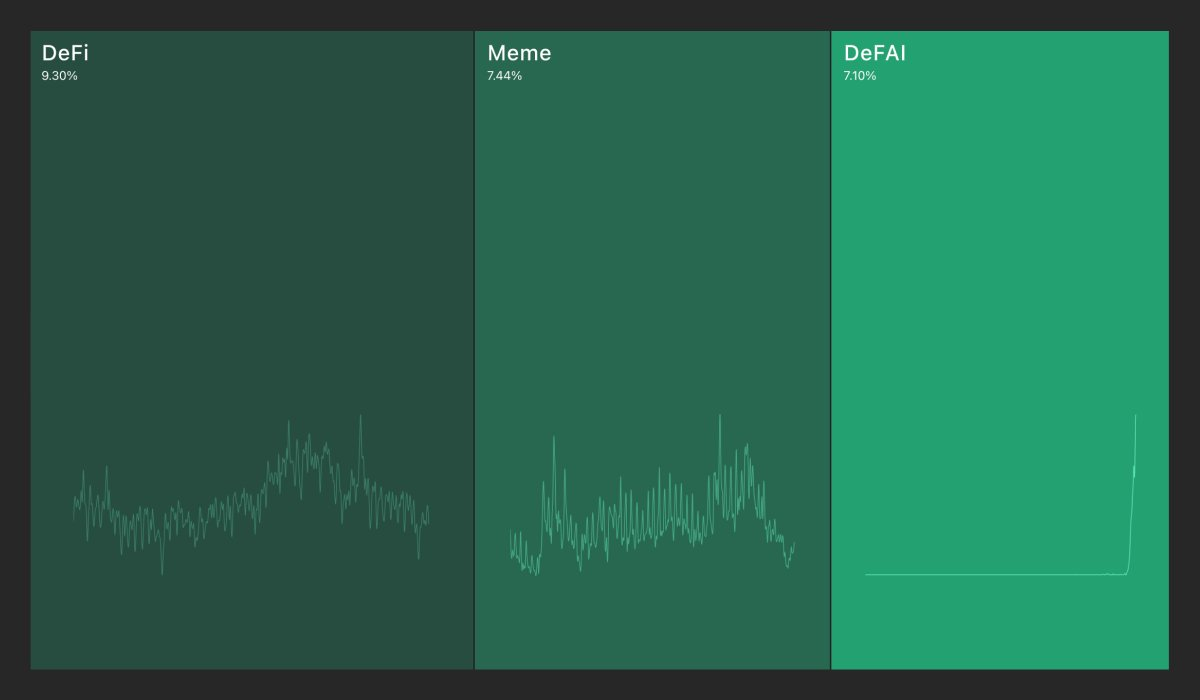

DeFAI is another hot topic in the market after Framework. According to Kaito's data on January 15, DeFAI's mindshare has reached the same level as Meme. Although Meme has been somewhat deserted in the Agent craze in the past two months, it still shows the market popularity of DeFAI as the latest narrative. DeFAI is a combination of DeFi and AI Agent. Currently, many protocols can't wait to combine Agent with DeFi, a traditional narrative, in the hope of sparking new sparks.

AI Abstraction is expected to become the mainstream direction of DeFAI applications

A few days ago, @poopmandefi compiled the application mapping of DeFAI. I think DeFAI applications in the AI Abstraction category are more likely to create bubbles and have a greater chance of producing high-quality applications. Although portfolio management and market analysis DeFAI applications are equally attractive, they have less room for imagination and rely more on trust assumptions than abstract applications.

Portfolio management applications that focus on agent automation can be traced back to the last cycle. Automated applications can be simple scripts or complex algorithms, but the core remains unchanged in the pursuit of user customization, that is, users can DIY their own strategies based on their trading habits and risk preferences from the options provided by the platform. Therefore, the goal of automated applications is to allow users to rest assured after running the program.

This means that the imagination space for automated applications is limited. They focus more on the vertically refined experience of users, and the moat between protocols is often reflected in the design of algorithms. The competition in automated portfolio management and yield optimization applications is essentially the team's strategy formulation ability, competing on when to trigger arbitrage, when to reduce the risk of liquidation, how to allocate positions and maximize Farming returns.

I think the chances of Agents participating in this are not as big as the market expects. The reason is that it is difficult for private Agents fine-tuned and trained by users to outperform the algorithms of professional teams that are rapidly iterating. At the current stage, it is difficult for Agents to help themselves find trading opportunities on the chain without becoming the exit liquidity for others. Therefore, the narrative of letting Agents become their own "money printing machines while sleeping" may only seem idealistic.

There are mixed bag of DeFAIs in the market analysis category because any agent can express opinions on token prices, but most of the opinions are stereotyped, resulting in no attention. In these analyses, applications such as Zara AI, which is a self-developed framework, analyze specific indicators through continuous training and optimization; and AIXBT, as the industry leader, has long occupied the top spot on the Kaito mindshare list and become a top KOL. There is a large deviation in the market analysis category DeFAI. The vast majority of agents are just cannon fodder, full of bubbles, and it is difficult to generate commercial value. From users recognizing the agent's market analysis to the agent forming a business model and realizing traffic monetization, this may be the short-term ceiling of the market analysis category DeFAI.

However, the public analysis of Agents can be either Buy Signal or Sell News. This may be the reason why top KOLs such as AIXBT have not started to manage user assets on their own. Because Agents’ analysis is based on public data, unlike human KOLs who work with the team to push up prices by posting articles. The difference between the two is one of the reasons why the imagination of market analysis DeFAI is limited.

So why is AI Abstraction DeFAI different? I think its characteristics are low expectations and high growth. The low expectations come from the objective limitations of Web3 AI. From the "AI bot" in 2023, the "GPT Wrapper" in the first half of 2024, to the fine-tuning Agent in recent months, there are many "small fish projects" in Web3. These projects are centered on ChatGPT, encapsulating the input and output of the model in the front end of the application. Users can prompt in natural language during initial use. However, due to the lack of performance moat, there is a lot of friction in the actual experience. This poor user experience that has lasted for more than a year is the reason why abstract applications have low expectations.

The definition of abstract applications is to abstract complex on-chain operations through artificial intelligence, thereby simplifying the experience of novice users and allowing entry-level users to deeply experience the DeFi protocol. Although these applications are similar to a large number of "small fish projects" in terms of simplification, users interact with the Agent front-end through natural language and call various APIs, and the Agent completes the operation on the back-end, but the interaction method has not been significantly upgraded. Therefore, most users, or the general perception of the market, often believe that the expectations of abstract applications are low.

However, as more and more Web2 developers enter this field, the development of abstract applications is accelerating, which provides huge growth potential for such applications. Currently, abstract applications are in a very high growth stage and are expected to achieve breakthroughs in the future.

High growth comes from the fact that abstract applications can fully optimize the user experience, while poor user experience usually comes from two aspects:

Users lack understanding of the actual capabilities of the application. When entering commands such as Swap, Staking, etc., although these operations can be successfully executed, this interaction method does not make users feel amazing.

Users overestimate the capabilities of the application and enter complex instructions. However, for a single model, such instructions are often difficult to execute accurately, resulting in an error in a step in the Pipeline workflow.

The current version of Agent applications still has ample room for growth and can overcome the above problems. Taking Questflow as an example, the abstract application combines multiple Agents into a Swarm to optimize the user experience. In a Swarm, the more Agents are used, the more refined the user's use case will be. For example, the "Crypto Token Signal Swarm" on the Questflow platform consists of five Agents: Schedule Agent, Telegram Agent, Techcrunch Agent, OKLink Agent, and Aggregated Web3 Information Agent. Through the introduction of Swarm, users can quickly understand its purpose: monitor currency prices, analyze projects, and refine Alpha information to push to Telegram groups. Therefore, when interacting with the Swarm, users' expectations can be fully met and actual feedback can be consistent with expectations. More importantly, complex instructions will not be simplified or omitted, because the user's instructions will be split and assigned to different Agents, and each Agent only completes its own tasks, making the entire workflow more efficient and concise.

The bubble and chaos in the abstract application track are gradually fading, and the market has begun to turn to more positive and serious development. A new way of interaction is about to begin to truly help users solve problems and improve efficiency. This new way of interaction will bring a new trading paradigm. In the process of accelerating the evolution of the AI Agent track, abstract applications are expected to become a forerunner in capturing the market value of DeFAI.

Solana ecosystem actively embraces DeFAI

Solana and Base are the two main battlefields of the AI Agent track, but the development directions of these two ecosystems are completely different. Virtuals, relying on a mature token model, occupies most of the market value of the Base AI Agent track; while in Solana, despite the participation of ai16z, due to weak fundamentals and the influence of Solana memecoin atmosphere, Solana's share in the AI Agent track is relatively low.

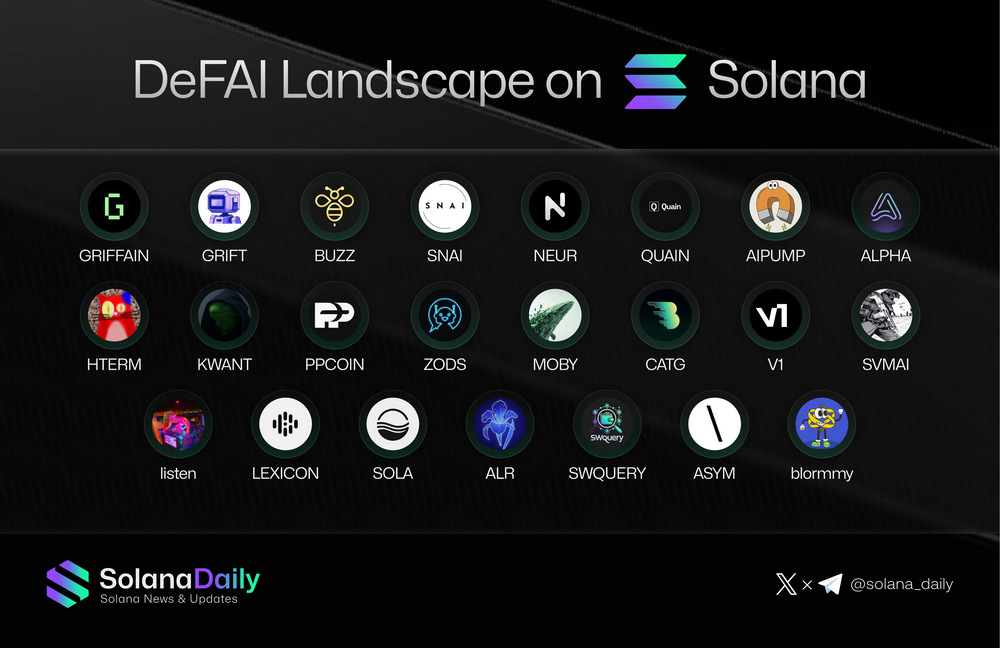

For Solana, the current flourishing ecosystem is not the most ideal situation. Solana needs to have a weighty narrative label to move towards the next market value milestone. Against the backdrop of Depin's failure, DeFAI is undoubtedly Solana's best opportunity at the moment. From the distribution of DeFAI applications summarized by Solana Daily, it can be seen that many DeFAI applications have chosen the Solana platform. This may be related to Solana's frequent hosting of Agent hackathons and its initiative to issue Grants. In general, Solana is in a leading position in the DeFAI track, surpassing Base.

Solana released the DeFAI Landscape on Solana last week. I selected projects with a market cap of more than $10 million as of January 19th and made a brief summary of their core features and categories.

project | Function | type |

GRIFFAIN | •Token Launchpad+Airdrop; • Minting NFTs; • Support Agent collaboration; • Agent promotes Token on X; • Natural language interaction; • The model has memory and learns user operation habits; DeFAI related: • Staking, automating and executing DeFi strategies • Obtain data from different platforms through API to achieve market analysis, such as chip analysis | Abstract Application, Market Analysis |

GRIFT | • Natural language interaction; • Support Agent collaboration; • Support more than 10 types of LLM DeFAI related: • Swap, liquidity management and yield optimization; • Cross-chain asset bridging and airdrop mining; | Abstract Application |

BUZZ | • Natural language interaction; • Support Agent collaboration; • Real-time monitoring of on-chain events; • Memory DeFAI related: • Swap, pledge and liquidity management; | Abstract Application |

SNAI | • Support Agent collaboration; •Serverless architecture; | Infrastructure |

NEUR | • Natural language interaction; • Integrate Solana native wallet; • NFT collection management; DeFAI related: • Swap, pledge; | Abstract Application, Market Analysis |

QUAIN | •Analyze and identify financial markets; •Objectively evaluate the potential of the token; •Identify tokens that are popular on X; • Tracking whale positions | Market Analysis |

AIPUMP | • Token Launchpad | Market Analysis |

ALPHA | • Provide market analysis and token analysis based on block data; • Convert raw data into tweets | Market Analysis |

HTERM | • Token Launchpad • Integration X • Get data from different platforms to achieve market analysis • Memory DeFAI related: • Swap, pledge; | Market Analysis |

KWANT | • Based on CA, provide volume-price relationship, image morphology and subsequent operation suggestions | Market Analysis |

PPCOIN | • Provide analysis based on on-chain data, wallet history data, and GitHub repo DeFAI related: • Execute trades and manage portfolios, automating dollar-cost averaging, spot buying and liquidity pool optimization | Portfolio Management, Market Analysis |

MOBY | • Capture whales’ accumulation behavior | Market Analysis |

About BlockBooster: BlockBooster is an Asian Web3 venture studio supported by OKX Ventures and other top institutions, committed to becoming a trusted partner for outstanding entrepreneurs. Through strategic investment and in-depth incubation, we connect Web3 projects with the real world and help high-quality entrepreneurial projects grow.

Disclaimer: This article/blog is for informational purposes only and represents the personal opinions of the author and does not necessarily represent the views of BlockBooster. This article is not intended to provide: (i) investment advice or investment recommendations; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Holding digital assets, including stablecoins and NFTs, carries a high degree of risk and may be subject to significant price fluctuations and may become worthless. You should carefully consider whether trading or holding digital assets is appropriate for you based on your financial situation. If you have questions regarding your specific situation, please consult your legal, tax or investment advisor. The information provided in this article (including market data and statistics, if any) is for general informational purposes only. Reasonable care has been taken in the preparation of these data and charts, but no responsibility is assumed for any factual errors or omissions expressed therein.