Highlights of this issue

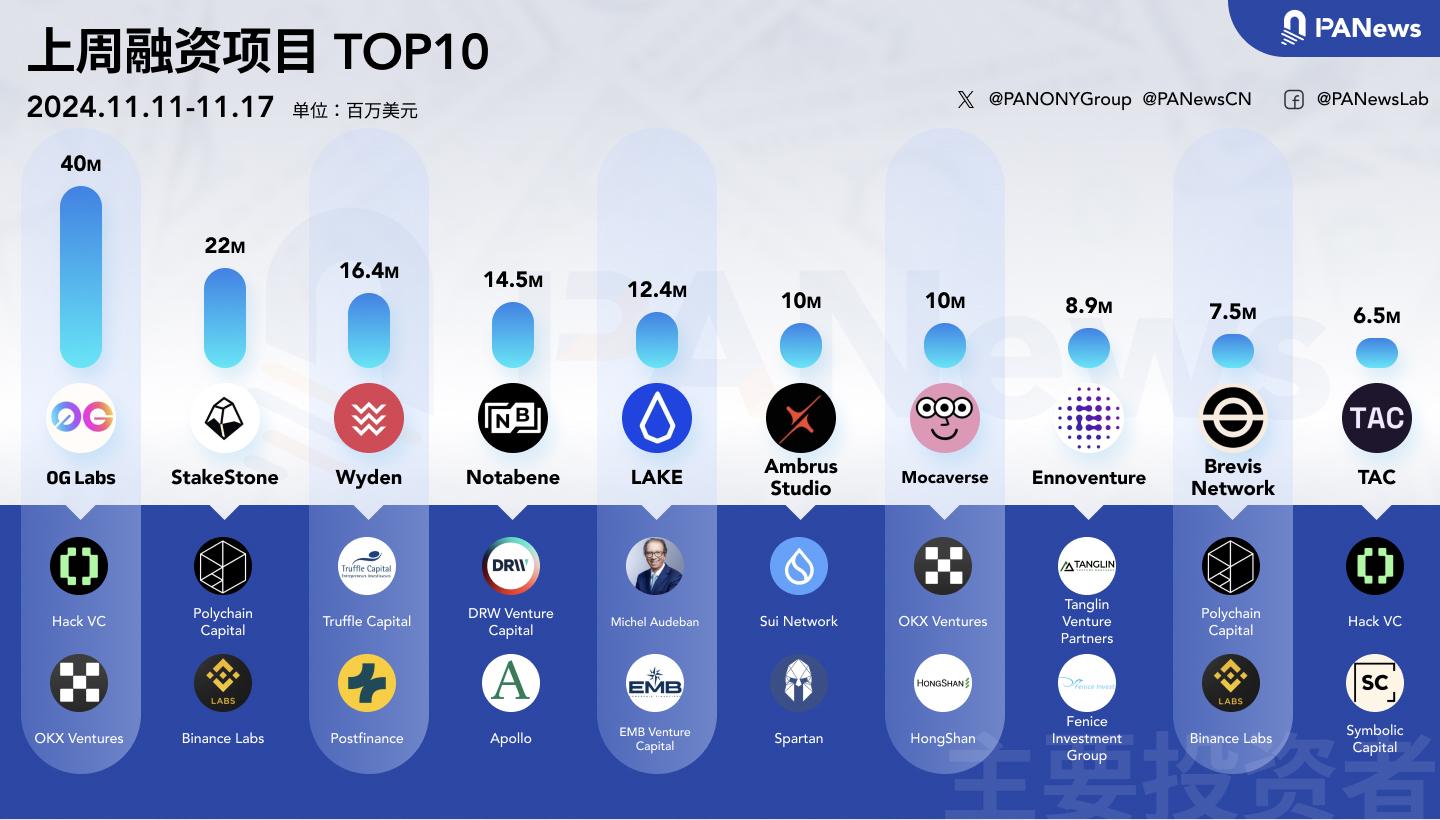

According to incomplete statistics from PANews, there were 28 blockchain investment and financing events around the world last week (11.11-11.17), with a total funding of over 190 million USD, which is a significant increase compared to the previous week. The overview is as follows:

- DeFi announced four investment and financing events, among which the full-chain liquidity asset agreement StakeStone completed a $22 million financing, led by Polychain Capital;

- The Web3 game track announced 6 investment and financing events, among which the blockchain game developer Ambrus Studio raised a total of US$10 million, with Sui Network and others participating in the investment;

- Three investment and financing events were announced in the AI field, among which 0G Labs completed a seed round of financing of US$40 million, with participation from OKX Ventures and others;

- The Infrastructure and Tools track announced 9 financings, among which the crypto anti-money laundering company Notabene completed a $14.5 million Series B financing, led by DRW Venture Capital;

- In other blockchain/crypto applications, 5 financings were announced, among which Web3 education platform Academic Labs announced the completion of a new round of financing of US$3.2 million, with UOB Ventures participating in the investment;

- Centralized finance sector announces 1 investment and financing event: Wyden, a digital asset trading infrastructure provider, completes $16.4 million in Series B financing

DeFi

StakeStone, a full-chain liquidity asset protocol, announced the completion of a $22 million financing led by Polychain Capital, with Binance Labs and OKX Ventures participating in strategic investment, and the seed round led by SevenX. Other investors include Nomad Capital, HashKey Capital, Amber Group, etc. StakeStone is committed to building a liquid ETH/BTC asset standard based on a highly scalable staking network, launching a liquidity index BTC (SBTC) and interest-bearing liquidity BTC (STONEBTC) to enhance the application of native BTC in the EVM ecosystem and other blockchain networks. StakeStone plans to provide efficient liquidity support for ecological partners such as Berachain, AAVE DAO and DeFi protocols to promote the implementation of practical applications.

Water Resources RWA Project LAKE Announces Closure of US$12.4 Million in Financing

The water resources RWA project LAKE announced that it has completed $12.4 million in financing, including $3 million in private equity financing and $9.4 million in the ongoing second round of financing. Investors include Artaize Invest, EMB Venture Capital, Michel Audeban-Business Angel and MSM Family Office. The new funds are intended to promote its construction of an innovative Web3 ecosystem, promote fair and decentralized access to water resources worldwide, and explore the launch of LAK3 tokens. Since the end of August, LAKE's second round of financing has raised $9.4 million, exceeding the soft cap of $6.5 million and moving towards the hard cap of $12 million. According to reports, LAKE is an RWA project that uses blockchain technology to promote fair and decentralized access to water resources worldwide. It plans to change the way users interact with water, from buying, selling, acquiring, donating and even becoming shareholders of water resources.

Tranched, a blockchain embedded asset financing platform headquartered in London, announced the completion of a $3.4 million Pre-Seed round of financing, led by Speedinvest, with participation from Andressen Horowitz's crypto startup accelerator (CSX) program, Blockwall, Kima and OVNI Capital. The specific valuation information has not been disclosed. According to reports, Tranched aims to simplify the asset financing process through blockchain technology and eliminate the structural complexity and high fees involved in securitization. The new funds will support its business scope to expand from Europe to lenders, credit funds, asset management companies and banks.

Cross-chain DeFi platform Folks Finance completes $3.2 million Series A financing

Cross-chain decentralized finance (DeFi) platform Folks Finance has raised $3.2 million in Series A funding at a valuation of $75 million. Borderless Capital led the round, with participation from Algorand Ventures, Mapleblock Capital, Sovo Ventures, and others. The first $2 million of this round was raised in February, and the remaining $1.2 million was raised recently. With the completion of Series A, Folks Finance has raised a total of $6.2 million.

Web3 Games

Blockchain game developer Ambrus Studio has raised a total of US$10 million, with Sui Network and others participating in the investment

Ambrus Studio, the developer of the MOBA game E4C: Final Salvation, announced that it has completed a total of US$10 million in financing, with participation from institutions such as Sui Network, Spartan, IVC, Red Building, 6th Man Ventures, CVP NOLIMIT, Good Water and M13. According to previous news, blockchain game developer Ambrus Studio completed millions of dollars in financing in September this year, led by The Spartan Group.

BetHog, built on Solana blockchain, completes $6 million seed round

BetHog, a crypto gambling platform launched by the founder of FanDuel, has officially launched and received $6 million in seed round financing, led by 6MV, with participation from Will Ventures, Bullpen Capital, etc. BetHog was founded by Nigel Eccles and Rob Jones, co-founders of FanDuel. The platform is built on the Solana blockchain, with SOL as the supporting token for PvP games. In addition, BetHog also supports betting on Bitcoin, Ethereum, and USDT. BetHog includes original games such as HODL (Crash game for memecoin) and Thermonuclear Boars (Mines game), as well as innovative PvP gameplay, where users can play games with well-known anchors.

Sports Metaverse Platform Bitball Announces $5 Million Series A Funding

Sports metaverse platform Bitball announced the completion of a $5 million Series A financing, led by IntelligentCricket and Neon Eight Group, bringing the total financing to $7 million. The funds will be used to expand its AI-driven sports game ecosystem and develop a 3D cricket game based on real-time sports data, which is expected to be launched in the second quarter of 2025. Since its launch in December 2023, Bitball has attracted more than 5 million users and plans to hold a BALL token generation event (TGE) in the fourth quarter of 2024.

Web3 game company Monster League Studios raises over 3.7 million euros

Monster League Studios, a Barcelona-based Web3 gaming company, has raised over €3.7 million to expand its gaming ecosystem for the Mokens League, covering in-game purchases, player rewards, and the use of $MOKA utility tokens. Monster League Studios currently has over 50,000 monthly active users and is committed to creating an interconnected gaming experience where assets can be transferred across games. The flagship product currently offered by the platform is football games, and plans to add new games such as tennis and racing in the future to expand the functionality of $MOKA. This year, the company also received incubation support from Google, which optimized its gaming metrics and enhanced its industry competitiveness.

iGaming platform Betski completes $345,000 Pre-Seed round of financing

iGaming platform Betski announced the completion of a $345,000 Pre-Seed round of financing. It is reported that this round of financing was completed by a combination of 2% equity and 2.25% token supply from early supporters and global participants in Panama, but the specific investor information has not been disclosed. The new funds intend to support the platform to expand its marketing strategy, enhance its product offerings and rapidly expand its scale.

Social competition platform MiniTon completes seed round financing, with participation from Waterdrip Capital and other institutions

Social competitive platform MiniTon announced the completion of its seed round of financing. This round of financing was participated by Waterdrip Capital, Alchemy Pay, CGV, Web3Port Foundation, PangDAO Head Ricky, OGBC Innovation Hub Founder Jayden Wei and other parties. MiniTon is a project initiated with the support of TON Foundation. MiniTon provides developers with an on-chain profit solution of "Tournaments as a Service (TaaS)" to help casual games build their commercialization capabilities after entering Web3. At the same time, MiniTon reconstructs the supply relationship of liquidity in the game to solve the problem of the sustainability of GameFi's business model. Based on the BondingCurve price curve, investors can establish connections with players by predicting the results of the event.

AI

Crypto-AI startup 0G Labs announced that it has received $290 million in new financing, including $40 million in seed round financing and $250 million in token purchase commitments. The project aims to build a decentralized AI operating system (dAIOS) to support the development of on-chain AI applications. Investors in 0G Labs include Hack VC, Delphi Digital, OKX Ventures, Samsung Next, Bankless Ventures, Animoca Brands and its co-founder Yat Siu, Polygon and its co-founder Sandeep Nailwal, Stanford Blockchain Fund, Abstract VC, Alchemy, Blockdaemon, Foresight Ventures, etc. 0G Labs co-founder and CEO Michael Heinrich said that the token commitment will be used for the ecological development of the 0G protocol, and the token is expected to be listed on the exchange next year. The current total financing amount has reached $325 million. The new funds will support the team to expand to 80 people and promote ecological projects such as developer incentives, hackathons and community building.

Web3 AI company Eidon AI completes $3.5 million seed round led by Framework Ventures

Web3 artificial intelligence company Eidon AI has completed a $3.5 million seed round led by Framework Ventures and participated by Cayman Islands venture capital company cyber.Fund. This is all the financing Eidon has raised so far. Eidon encourages users to provide data for training AI models through an incentive mechanism, with the goal of building a decentralized AI network. Users can submit new data including fine hand movements or object interactions, and other users can verify the authenticity of the data through the upcoming blockchain. This round of financing will be used for team expansion and network infrastructure construction.

According to reports, the decentralized AI-as-a-service cloud project Heurist has completed a $2 million Pre-Seed round of financing, with participation from Amber Group, Contango Digital Assets, Manifold, Selini Capital, Sharding Capital, X Ventures, Zephyrus Capital, Mozaik Capital, Steroids Capital and other institutions as well as multiple angel investors. It is reported that Heurist is solving key AI infrastructure challenges based on the ZK stack, making it as accessible as the Internet, that is, serverless deployment, elastic resource expansion, and a computing network owned by the community.

Infrastructure & Tools

Crypto AML Company Notabene Completes $14.5 Million Series B Funding, Led by DRW Venture Capital

Crypto anti-money laundering (AML) startup Notabene has completed a $14.5 million Series B funding round, led by DRW Venture Capital, with participation from Apollo, Nextblock, ParaFi Capital and Wintermute. Notabene aims to help cryptocurrency trading companies comply with AML regulations and provide a SWIFT-like crypto transaction information network for virtual asset service providers (VASPs). 165 companies, including Copper, OKX and Ramp, have used its platform. As Europe incorporates updated funds transfer regulations (TFR) into crypto transactions, Notabene CEO Pelle Braendgaard expects the platform's trading volume to increase significantly, currently processing an average of about $2 billion in transactions per day. He noted that Europe's compliance requirements will push the global crypto industry into a stricter regulatory framework. Braendgaard predicts that the United States, under the future Trump administration, may follow Europe's TFR and MiCA policies to attract crypto transactions back to the United States.

Animoca Brands announced that it has raised an additional $10 million for its Web3 project Mocaverse, following an investment of $31.88 million announced last year. The investment comes with a free additional warrant for the MOCA Coin utility token, with an implied fully diluted value (FDV) of $1 billion, and its structure is similar to the two parts announced previously. Participants in this round of financing include OKX Ventures, CMCC Global, HongShan (formerly Sequoia China), Republic Crypto, Decima Fund, Kingsway Capital, etc.

The company will use the new funds to advance its goal of accelerating Web3 mass adoption and interoperability by continuing to expand and build the Mocaverse, an interoperable infrastructure layer for account, identity and reputation systems for consumer cryptocurrency adoption. This includes Realm SDK, an interoperable software development kit (SDK) that allows partners to create their own reputation-based ecosystems and provide corresponding application experiences that are interoperable with all ecosystems built on top of the Moca network.

Ennoventure, a provider of AI-based blockchain encryption signature solutions, announced the completion of a $8.9 million Series A financing round, led by Tanglin Venture Partners, with participation from Fenice Investment Group and other SAFE investors. The specific valuation information has not yet been disclosed. It is reported that the Ennoventure platform uses technologies such as artificial intelligence and blockchain to track product packaging through application scanning information for product authentication and supply chain management. Its patented invisible signature technology has been expanded to industries such as fast-moving consumer goods, automobiles and industrial parts.

Brevis Network Completes $7.5 Million Seed Round Led by Polychain Capital and Binance Labs

ZK coprocessor Brevis Network has completed a $7.5 million seed round of financing, led by Polychain Capital and Binance Labs, with participation from IOSG Ventures, Nomad Capital, Bankless Ventures, Hashkey, and several undisclosed angel investors. Brevis began raising funds for this round in June and completed it in September; this round of financing was conducted in the form of a token issuance, but declined to disclose the valuation after financing. Brevis is a ZK coprocessor or computing network that aims to improve the scalability of blockchains using ZK proofs. By enabling complex tasks (such as data processing) to be completed off-chain and only verified proofs to be sent back to the blockchain, Brevis aims to reduce the workload of the blockchain, increase speed, and reduce costs. Brevis' ZK coprocessor is currently in the Beta mainnet stage; Brevis' "SpaZK Verifiable AI" product is still under active development and will be released in future stages.

TAC Completes $6.5 Million Funding and Will Provide EVM In-App Access for TON and Telegram Users

TAC, a TON network expansion project, has completed a $6.5 million seed round of financing, led by Hack VC and Symbolic Capital, with participation from Primitive, Paper Ventures, Karatage, Animoca Ventures, etc. TAC will provide seamless access to Solidity applications for TON and Telegram users, and plans to launch a test network this week, with the main network expected to be launched in the first quarter of 2025. TAC aims to connect Ethereum developers and the TON blockchain ecosystem to simplify the development process on TON. The financing will be used for marketing, developer relations and technology research and development.

Filecoin L2 project Akave completes $3.45 million in financing and launches Yucca testnet

The decentralized data storage project Akave has successfully completed a $3.45 million financing round, with participation from Protocol Labs, Blockchange VC, Lightshift, and Blockchain Builders Fund. The financing will be used to accelerate Akave's development in on-chain data management. Akave has launched the Yucca testnet, which is open to early testers to explore on-chain data storage and programmability. As Filecoin's hot storage Layer 2 solution, Akave provides tools for enterprises, AI companies, and DePIN developers to help them go beyond traditional cloud storage, build on-chain data lakes, and promote the development of data ownership and new data monetization models. In addition, the Filecoin L2 project Storacha also announced the launch of its Alpha version network for the Filecoin ecosystem, focusing on high-performance hot storage, mainly for high-demand application scenarios such as games, AI, and DePIN. Founded by core developers of IPFS and Filecoin, Storacha is committed to providing a distributed storage experience comparable to traditional S3.

OKX Ventures announces investment in Corn, an Ethereum Layer 2 network built for BTCfi

OKX Ventures announced its investment in Corn, marking an important step in introducing Bitcoin applications in the Ethereum ecosystem. Corn is based on Arbitrum and integrates support from Coinbase, enabling BTC holders to access the Ethereum DeFi ecosystem. Through a unique, secure and sustainable approach, Corn is reported to maximize the potential of Bitcoin and has achieved several important milestones, such as becoming the first Ethereum L2 network to use hybrid tokenized Bitcoin (BTCN) as gas fees, and the first network to achieve Bitcoin security through Babylon and support BTC LST liquidity. The core of Corn's innovation is BTCN, a hybrid tokenized Bitcoin backed 1:1 by native BTC. This unique model allows BTC holders to use BTC to pay gas fees in the Ethereum DeFi ecosystem, maintaining the core value of Bitcoin.

Web3 infrastructure platform Caldera acquires Hook team

Caldera, a Web3 infrastructure platform backed by Founders Fund, has acquired the Hook team to jointly build Metalayer, an Ethereum Rollup infrastructure platform. The acquisition, for an undisclosed amount, comes on the heels of Caldera’s $15 million Series A funding round in July . The Hook Odyssey protocol, originally developed by the Hook team, focused on perpetual futures markets for Meme coins and NFTs, built on the Arbitrum Orbit framework, but has been shut down so the team can focus on Metalayer development. Caldera is a Rollup-as-a-Service platform that has assisted more than 50 projects in creating application-specific chains, including Manta Pacific, Injective, and ApeChain. The Metalayer platform aims to optimize the development experience of multiple Rollup applications and strengthen the synergy between the Optimistic and ZK Rollup frameworks to unify Ethereum’s scaling ecosystem.

Zerion completes new round of financing and launches gas-free second-layer network ZERO Network

Zerion has launched the “free” Ethereum second-layer network ZERO Network, which allows Zerion Wallet users to trade, mint, exchange, and bridge without paying gas fees, using native account abstraction with smart accounts and payers to provide free transactions for Zerion wallet users. Zerion also announced that it has received an undisclosed amount of financing support from angel investors.

other

Web3 education platform Academic Labs completes $3.2 million in financing

Web3 education platform Academic Labs announced the completion of a new round of financing of US$3.2 million, with participation from UOB Ventures Management, Signum Capital, HTX Ventures, Web Master, WIDUSPartners, DWF Ventures, Blockchain for Good Alliance, Citystate Group, etc. According to reports, Academic Labs is an EduFi ecosystem that enhances the personalization and ownership of knowledge and skills sharing. The team revealed that information about new products, token airdrops, and token listings will be released in the coming weeks.

❜mbd completes $3 million pre-seed round of financing, led by Mask Network and Polymorphic Capital

❜mbd, a company developing an intelligent recommendation system for Web3 social applications, has completed a $3 million pre-seed round of financing. This round of financing was jointly led by Mask Network and Polymorphic Capital, with participation from a16z crypto, CSX, Forward Research, Social Graph Ventures, and WAGMI. ❜mbd is committed to improving the content personalization and interactivity of Web3 social applications through AI-driven recommendation systems, and has integrated AWS and Google Cloud AI startup support programs. ❜mbd focuses on developing decentralized content recommendation and review protocols, providing low-latency, real-time updated machine learning APIs, and providing Web3 developers with a personalized experience similar to Web2 social platforms.

Web3 health tech startup Pulse completes $1.8 million in Pre-Seed funding

Web3 health technology startup Pulse announced the completion of a $1.8 million Pre-Seed round of financing, led by Collab+Currency and Lemniscap, with participation from Delphi Digital, Lattice Fund, and Solana co-founders Anatoly Yakovenko and Santiago R Santos. According to reports, Pulse's platform aims to solve the healthcare trilemma of balancing privacy, personalization, and prevention, while giving users full control over their data. Pulse's digital twin technology aggregates wearable devices, electronic health records, and diagnostic data into a comprehensive, unified health profile. Pulse wearables integrated with the platform track basic health indicators such as heart rate variability, sleep patterns, and blood oxygen levels in more than 50 activities.

Shipfinex, a maritime asset tokenization fintech platform, completes $1.5 million seed round of financing, led by Best Oasis Limited and others

Shipfinex, a maritime asset tokenization financial technology platform, announced the completion of a $1.5 million seed round of financing, led by Gaurav Mehta, Chairman of Best Oasis Limited and SPM Shipping DMCC, and participated by Vivek Seth, Senior Vice President of ADNOC Logistics & Services, and Yasovardhan Chinn, founder of Nanlian Ship Management LLC. The specific valuation information has not been disclosed. The new funds will support its partial ownership of maritime assets through blockchain, thereby realizing the democratization of maritime finance, and cooperating with the supervision of the Dubai Virtual Asset Regulatory Authority (VARA) to develop a safe and compliant maritime asset token (MAT) market.

Brazilian blockchain startup Multiledgers completes $1 million in financing, led by Indicator Capital and others

Brazilian blockchain startup Multiledgers announced the completion of a new round of financing of US$1 million, led by Oxygea Ventures and Indicator Capital (invested US$475,000 each), and participated by Koyamaki Ventures (invested approximately US$50,000). The company plans to use the new funds to help companies create, manage and integrate networks to manage and authenticate information and assets. Its main use case is to manage environmental certificates on-chain to ensure compliance.

Centralized Finance

Digital asset trading infrastructure provider Wyden completes $16.4 million Series B financing

Wyden, a digital asset trading infrastructure provider, announced the completion of a $16.4 million (CHF 14.5 million) Series B funding round led by French fintech investment firm Truffle Capital, with participation from new investors such as Postfinance, SBI-Sygnum-Azimut Digital Asset Opportunity Fund and Fivet Fintech. Existing investor C3 Venture Capital also participated in the financing.

Wyden said it plans to use the investment to accelerate sell-side expansion among banks, brokers and exchanges. It also plans to enter markets where digital asset operations are regulated like traditional financial services. In addition to integrating another 20 banks, brokers and exchanges, Wyden also plans to strengthen its functions and development center in Poland. Wyden has been expanding its customer base, especially among regulated banks and brokers in Europe. It is actively seeking to cooperate with more banks and brokers in its quest to obtain crypto licenses in various European countries.

Investment institutions

Portal Ventures' Second Fund Closes at $90 Million Oversubscribed

Portal Ventures, an early-stage cryptocurrency investment fund, is about to complete the second fund raising, with a scale of US$75 million, oversubscribed to US$90 million. Chris Dixon and Marc Andreessen of a16z, Henry Kravis of KKR, and several managing directors of Insight Partners participated in the investment. The fund was founded by Evan Fisher and focuses on first-round investments in cryptocurrency startups. Its first US$40 million fund was raised in early 2022, and the main investment was completed during the bear market in 2023. It has been fully deployed and is expected to distribute income next year.