Summary of key points

- Backpack is committed to solving the inefficiencies of today's complex financial system by integrating compliant exchanges and digital wallets into a unified platform.

- An innovative perpetual futures trading system has recently been launched, which includes breakthrough features such as "interest-bearing perpetual contracts", "automatic lending", "cross-collateralized sub-accounts" and "automatic profit and loss settlement".

- With a capable team, Backpack achieved rapid growth through the success of the Mad Lads NFT project and exchange, and completed a US$17 million Series A financing in February 2024.

1. Financial innovation continues to evolve

Bitcoin's promise to revolutionize finance through borderless, instant transactions without intermediaries faces many challenges in practice.

The complexity of the cryptocurrency ecosystem remains a major barrier to mainstream adoption. Users must navigate complex processes such as exchange registration and wallet management. The risk of permanent fund loss due to transfer errors combined with technical barriers have limited cryptocurrency to senior user groups, forming a closed ecosystem.

Backpack solves these limitations by integrating exchange and wallet functions into a unified platform. This innovative approach is similar to the breakthrough of Apple iPhone in integrating independent technologies such as communication, music, and Internet access into a seamless user experience.

Web3 finance faces three core challenges: complex user experience, regulatory uncertainty, and solidified industry practices. Just as Apple achieves comprehensive innovation through integration, Backpack is breaking through these obstacles one by one. This report will analyze these financial innovation challenges and Backpack's solutions in detail.

2. Backpack: All-in-one platform

Source: Backpack

Web3’s potential to revolutionize finance has yet to be fully unleashed. Three major obstacles continue to hinder the industry’s development: high barriers to entry due to complex interfaces, regulatory pressure forcing exchanges to withdraw from multiple jurisdictions, and homogeneous competition due to a lack of innovative service products.

Source: Backpack

Backpack's strategy addresses these challenges through three core paths: the platform prioritizes simplifying the user experience through intuitive interface design; establishes a comprehensive compliance system including Dubai and Japan licenses, and becomes the only exchange in the EU approved for cryptocurrency perpetual futures trading through the acquisition of FTX EU; and drives innovation with the help of top industry talents from FTX, Citibank, Coinbase and Stripe.

2.1. Reshaping the user experience: a new transaction paradigm

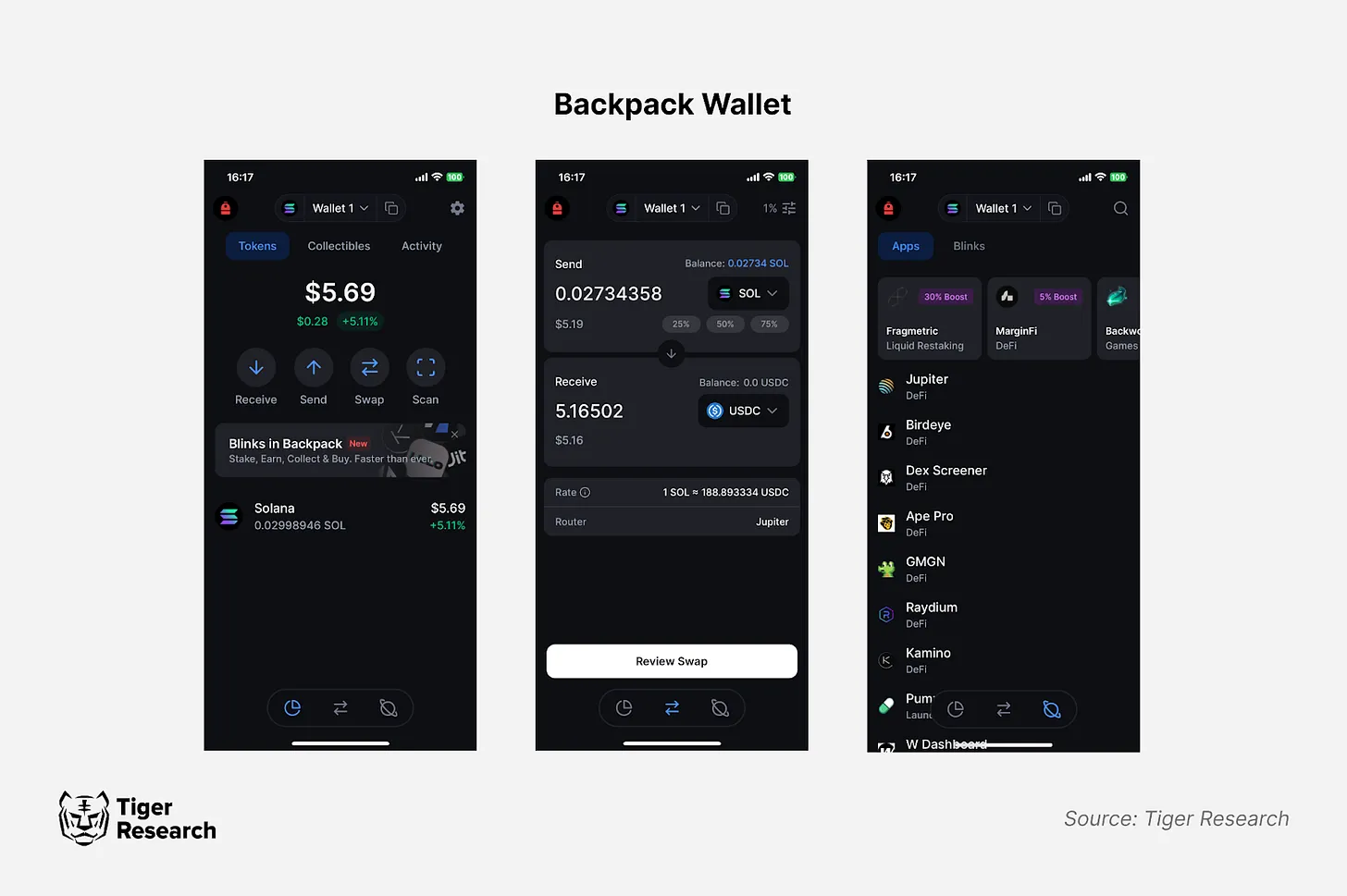

Cryptocurrency investors often switch from basic exchange trading to DeFi services in pursuit of higher returns. Traditional platforms make this process cumbersome by separating exchange and wallet functions or building complex interfaces with redundant functions.

Backpack simplifies the crypto investment process through a unified platform, allowing users to complete currency transactions and DeFi protocol interactions in a single application. The platform adopts a layered design, with the main interface providing basic trading functions, and advanced functions such as yield farming and liquidity provision placed in the "exploration" module, taking into account the needs of both novice and professional users.

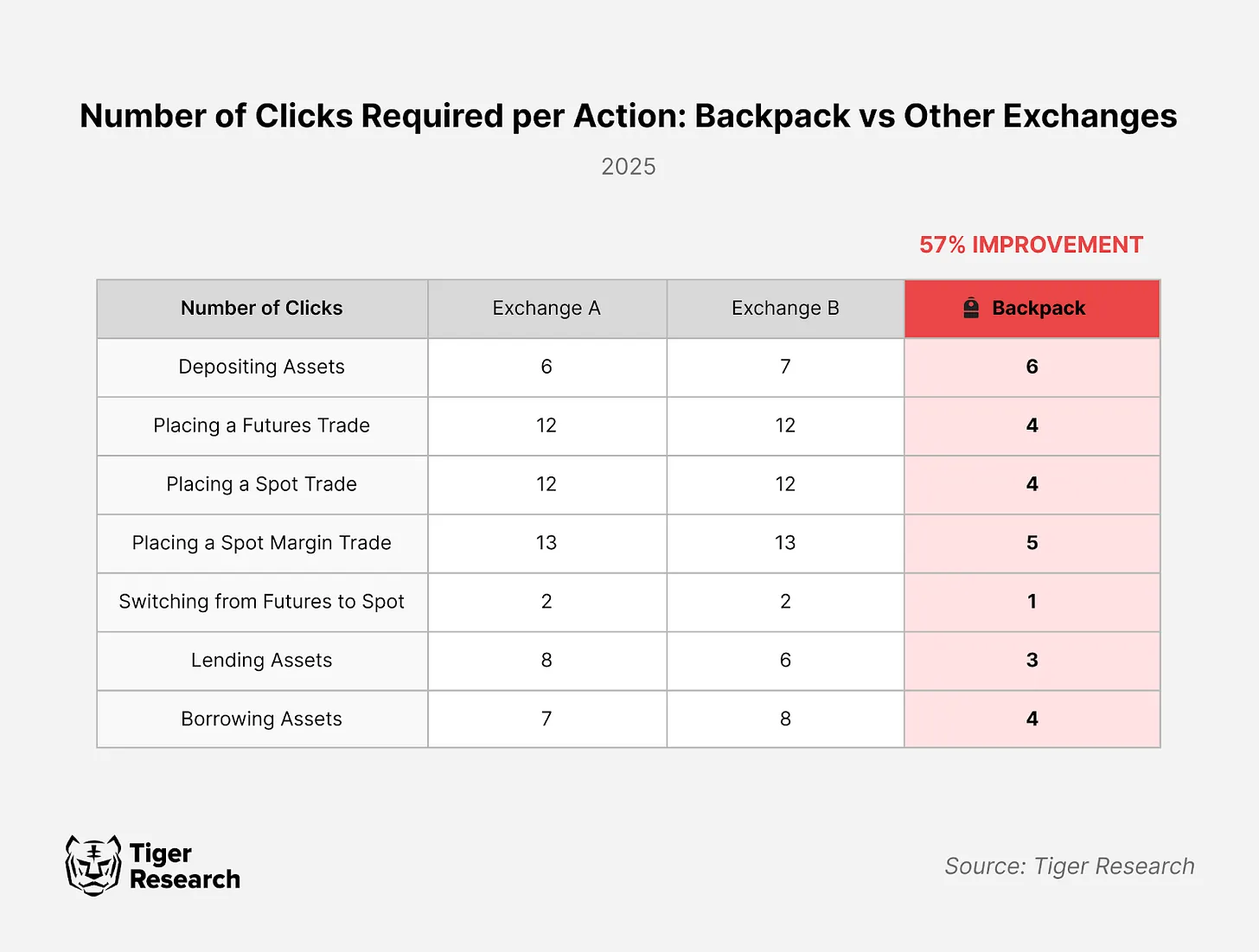

Backpack Exchange innovatively realizes unified management of all accounts, eliminating the fragmented experience of traditional platforms where spot and futures transactions require separate transfers, which is as cumbersome as managing multiple bank accounts.

Significant efficiency improvements: Futures and spot trading operations only require four clicks, which is a significant improvement over the more than ten clicks required on traditional exchanges. Similar improvements extend to mortgage management and fund transfers, marking a major breakthrough in the fragmented product interface of traditional platforms.

Backpack reshapes margin trading by automating wallet creation and collateral management. The platform automatically identifies all user assets as collateral and provides instant trading access. This balance of automation and flexibility meets the needs of both new and experienced traders.

2.2. Innovation in Perpetual Futures Trading

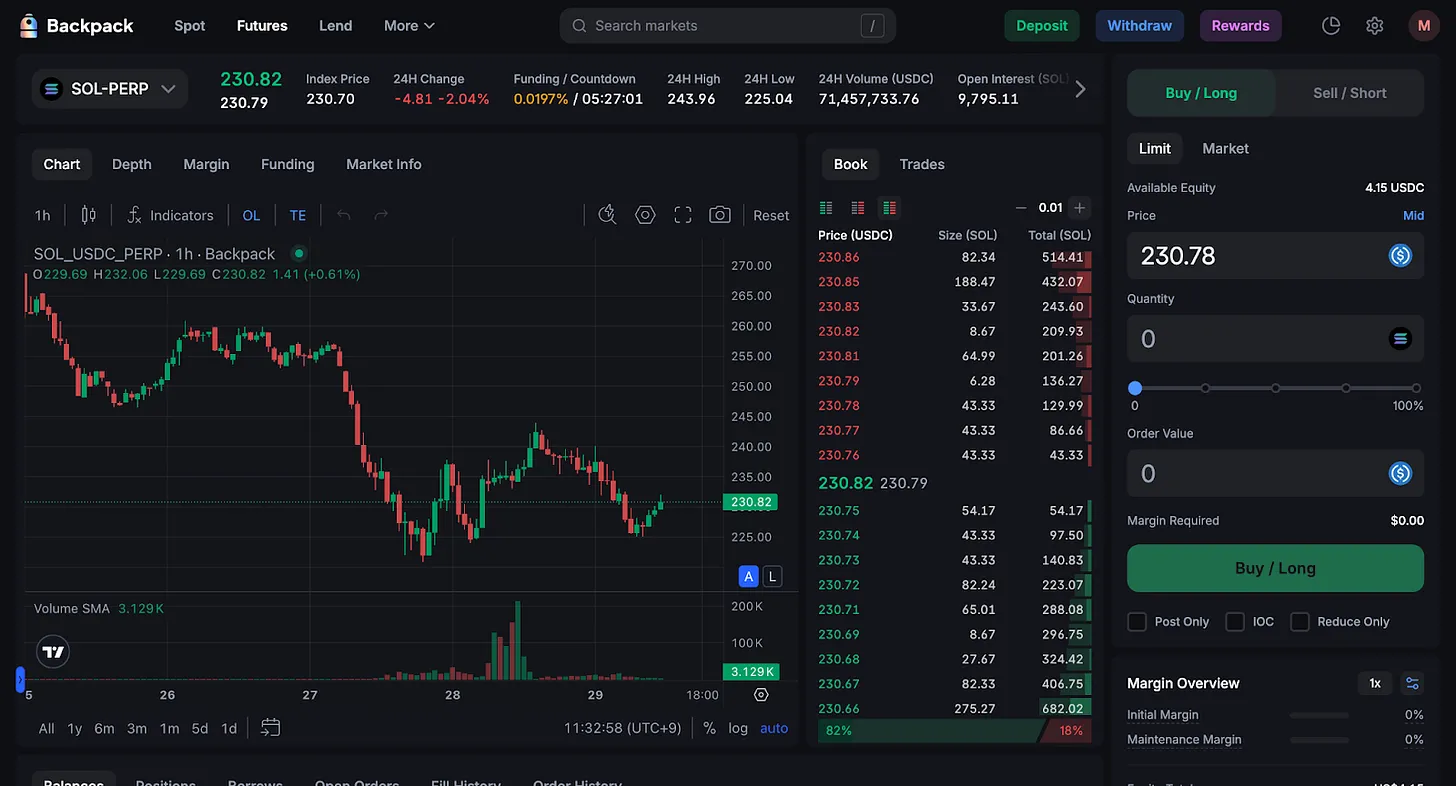

Backpack has innovatively upgraded the perpetual futures contracts unique to cryptocurrencies and launched a breakthrough trading system.

Source: Backpack

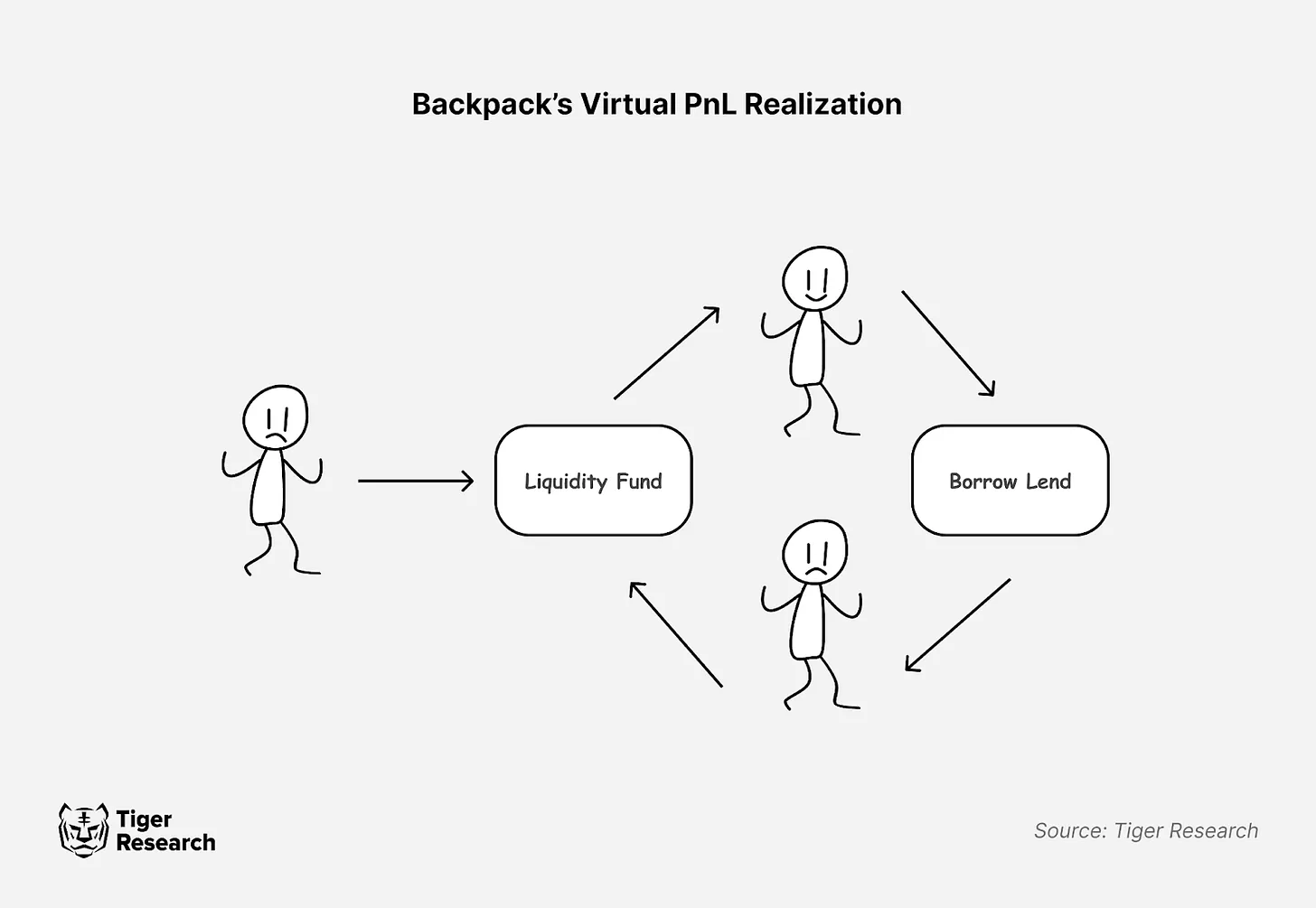

The core is the Backpack Liquidity Fund, a professional pool of funds that centrally manages all trading gains and losses. When a trader buys Bitcoin at $200 and makes a profit of $50 at $250, the fund will pay out the proceeds. Its essence is an insurance system that balances long and short positions.

Backpack achieves innovative breakthroughs through the virtual profit and loss settlement mechanism. Unlike traditional exchanges that force settlement of unrealized profit and loss, this system introduces the concept of virtual lending. Traders can manage their positions freely, and the key is that it will not affect the margin ratio.

The platform's dual safety mechanism suspends new lending when utilization reaches 100% and enables continuous profit and loss settlement when liquidity funds are exhausted. Millions of dollars of liquidity buffer provide additional system protection.

The system is particularly beneficial to basis trading strategies. For example, when the spot price of Bitcoin is $50,000 and the futures price is $51,000, traders can capture a $1,000 price difference by buying spot and selling futures. Backpack keeps the original cryptocurrency form of income (rather than forcing USD settlement) to improve strategy efficiency, while the interest-bearing function of mortgage assets enhances comprehensive income.

These innovations prevent exchange fund manipulation while optimizing trading conditions. The platform retains the traditional real-time settlement mechanism to meet institutional needs. Since the beta version was launched in January, Backpack Exchange has achieved a trading volume of more than US$250 million in three perpetual contracts within 24 hours to verify the effectiveness of the system.

This system maximizes capital efficiency without sacrificing security, setting a new benchmark for crypto derivatives trading.

2.3. Licensing strategy layout

Regulatory pressure reshapes the exchange landscape. Leading platforms such as Binance and KuCoin have withdrawn from key markets due to compliance challenges - Binance has withdrawn from Europe and the United States, and KuCoin has suspended European services due to anti-money laundering violations. Backpack achieves differentiated competition by prioritizing compliance.

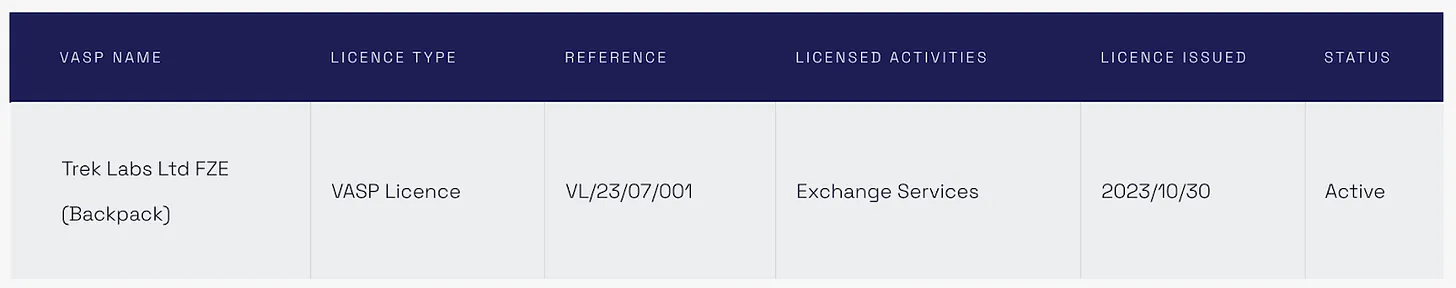

Source: VARA

In Dubai, Backpack obtained a Virtual Asset Service Provider (VASP) license issued by the Virtual Asset Regulatory Authority (VARA). As one of the first exchanges to obtain full market licenses under the new regulatory framework, Backpack has established a strategic fulcrum for expansion in the Middle East and around the world.

Source: JVCEA

Backpack has made a key regulatory breakthrough in Japan, becoming the first new member of the Japan Virtual Currency Exchange Association since Binance was approved two years ago (before the FTX crash). As a Class II member, Backpack is working hard to obtain a full exchange license under Japan's strict regulatory framework.

The $32.7 million acquisition of FTX EU and its MiFID II license makes Backpack the only platform approved for perpetual futures trading in the EU from the first quarter of 2025. This comes at a time when major competitors such as Binance, OKX, and Bybit are exiting the European derivatives market.

These regulatory breakthroughs go beyond market expansion. The stability and reliability of the platform have been verified through strict regulatory review. In the post-FTX era, such compliance qualifications are crucial to building market trust.

3. Backpack Growth Engine: Winning with Agility

Backpack’s growth stems from an unconventional beginning. Originally a Solana NFT project, the company lost $14.5 million (88% of the company’s capital) in the FTX crash in November 2022. Led by Armani Ferrante, the team has proven its resilience by adopting the “cockroach model” - a strategy of survival with minimal resources.

The crisis has shaped Backpack's streamlined architecture. Each product is driven by an elite engineering team of less than 20 people, which is much more efficient than the hundreds or even thousands of people of traditional financial institutions. This focused model supports rapid development and reflects Backpack's mission of "technology simplifies finance."

Source: Mad Lads

Mad Lads, launched in April 2023, became a growth catalyst. The project topped the full-chain NFT list in its first week, revitalizing the Solana ecosystem. As Solana's largest NFT community, Mad Lads is not only the initial growth engine of Backpack, but also continues to strengthen its market position.

In February 2024, Backpack completed a $17 million Series A financing led by Placeholder VC, with a valuation of $120 million. This round of financing validated the Backpack model and supported its continued expansion.

4. The Future of Digital Finance: Backpack Vision

Backpack is evolving from a crypto exchange to a bridge between traditional and digital finance. By bringing in talent from Citi, Stripe, and State Street, the company is building complex financial products that connect traditional and emerging financial systems.

Technological innovation is the core differentiation advantage. Working with the Solana team on account abstraction technology, Backpack has developed enhanced security protocols, transparent asset verification, and institutional-grade trading infrastructure. These advances meet the growing crypto demand of young investors.

Backpack's global expansion targets markets covering 95% of the world's GDP. In addition to existing major market qualifications, the company is applying for Japanese crypto asset exchange and Type I financial instrument licenses, as well as EU MiFID II investment firm qualifications.

Challenges remain: complex regulation, security risks, and industry trust need to be continuously addressed. However, the growing demand for compliance platforms and the increasing interest of institutions in innovative financial services provide growth support for Backpack.

The company's focus on compliance, technological innovation and strategic layout enables it to shape the future of digital finance. This transparent, secure and trusted methodology lays the foundation for sustainable development in the evolving financial landscape.