In March 2024, the U.S. Securities and Exchange Commission (SEC) ended its investigations into Web3 gaming giants Immutable and Crypto.com. The two companies had one thing in common: they had received a "Wells" notice from the SEC, which meant they might face prosecution, but now the alarm has been lifted and the case ended with "no charges."

Immutable said that this is "progress in clear regulation", and the pace of "progress" has changed the fate of crypto companies that were previously targeted by the SEC. Previously, the SEC had reached a settlement agreement with Ripple to refund a $75 million fine, putting an end to the three-year legal battle; after the SEC withdrew the lawsuit against Coinbase, the stock price of the US-listed exchange soared, and the number of compliant tokens launched online increased threefold in two weeks.

This series of actions is in stark contrast to the style of former SEC Chairman Gary Gensler, who "replaced regulation with law enforcement." Although these incidents may seem isolated, they actually marked the beginning of the SEC's shift in regulatory strategy—from the confrontational logic of "law enforcement is regulation" to a collaborative framework of "rule-based guidance." A series of meetings on regulatory rules are already on the way.

The driving force behind this change is the restructuring of the power map in Washington. The Trump administration's re-election has pushed crypto policy to a historic turning point: Bitcoin has been included in the national strategic reserve, national banks have been allowed to custody crypto assets, and the GENIUS Stablecoin Act has put a compliance grid on the industry; Paul Atkins, who holds a crypto-friendly stance, was nominated by Trump as the new chairman of the SEC.

The policy relaxation has allowed the sensitive crypto market to smell opportunities. Traditional financial institutions such as Franklin Templeton and VanEck have also rushed to apply for spot ETFs of crypto assets such as SOL. The wave of institutionalization is reshaping the structure of the crypto market at a visible speed.

SEC "loosens restrictions" on several crypto companies

The first quarter of 2025 has just passed, and the U.S. Securities and Exchange Commission (SEC) has quietly changed its regulatory style in the crypto field - from tough enforcement to prudent balance. This transformation has gradually become clear through a series of landmark events.

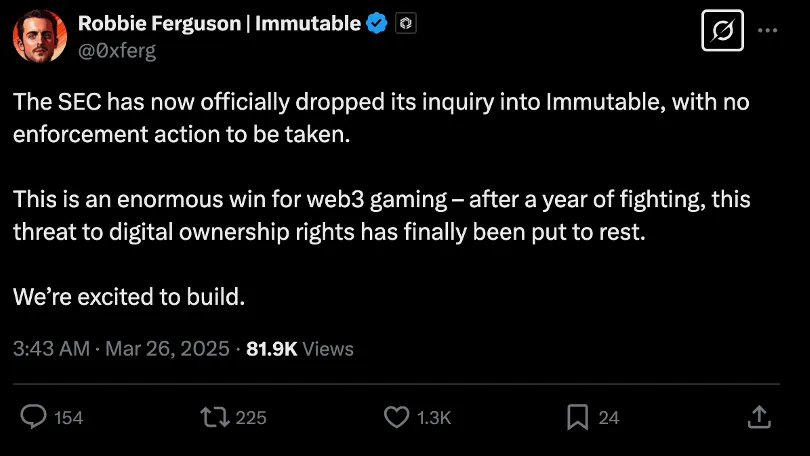

On March 25, the U.S. SEC officially ended its 17-month investigation into Australian Web3 gaming giant Immutable, confirming that the issuance and sale of its IMX tokens in 2021 did not violate securities laws. The investigation, which began with the "Wells Notice" (SEC enforcement action warning notice) in November 2024, was ultimately concluded with "no charges."

Ferguson's stance on X

Robbie Ferguson, president of Immutable, said bluntly, “This move brings regulatory clarity to the Web3 gaming industry and is expected to drive more institutional investment.”

Immutable is not the only one to benefit from the "relaxation".

On March 26, the SEC agreed to refund $75 million of the $125 million fine imposed on Ripple by the court last year, retaining only $50 million to close the case. This years-long legal tug-of-war ended with a compromise that not only retained regulatory authority but also sent a signal of easing.

In fact, since the beginning of the year, the SEC has intensively terminated a number of controversial investigations, including a long list of crypto companies including Robinhood, OpenSea, and Yuga Labs. As a result, the investigations were either withdrawn or suspended.

In February, the SEC withdrew the additional penalty on Kraken’s “collateral as a service” business (the SEC had reserved the right to pursue liability after the exchange paid a $30 million settlement in 2023); in March, it reached a settlement with an anonymous DeFi protocol, requiring it to register only some functions and pay a small fine; even in the field of privacy tools, the SEC abandoned securities law charges against Tornado Cash developers and instead worked with the Treasury Department to develop a technology-neutral regulatory plan.

During the same period, the SEC dropped its lawsuit against Coinbase, pushing its stock price up 4% in early trading. The market reacted sharply to this, and the issuance of compliant tokens surged within two weeks after the Coinbase lawsuit was dropped. According to data from the analysis company Kaiko, Coinbase added 10 new tokens in February, and an average of 2.3 new tokens per month in 2023 and 3.4 new tokens per month in 2024.

The profound change in regulatory logic is more reflected in the redefinition of emerging fields. In December 2024, the SEC withdrew its lawsuits against NFT projects such as Impact Theory and Stoner Cats, retaining only the prosecution of Ponzi-type projects that clearly promised returns. In January 2025, the SEC ended its investigation into a case related to former executive Hinman’s speech that “Ethereum is not a security”, avoiding making new rulings on ETH attributes and retaining flexibility for token classification.

Behind this series of actions is the SEC's strategic transformation from "law enforcement and supervision" to "rule-based guidance."

On January 21 this year, the SEC formed a cryptocurrency task force, led by the commission's acting chairman Mark T. Uyeda, in an attempt to listen to advice from industry insiders and experts to help the SEC draw a clear regulatory path, provide a practical registration path, develop a reasonable disclosure framework, and wisely deploy law enforcement resources.

The SEC held a roundtable discussion on crypto asset regulation in March this year.

On March 21, the working group discussed the key area of crypto regulation on the topic of "Defining Security". Troy Paredes, founder of consulting firm Paredes Strategies LLC, hosted the roundtable. The experts invited to participate in the discussion were mainly leaders and scholars from legal, financial, and venture capital companies who have been involved in the blockchain and crypto asset industries, many of whom have worked at the SEC.

Hester M. Peirce, head of the SEC’s Cryptocurrency Working Group, said, “The Cryptocurrency Working Group Roundtable provides us with an opportunity to hear from experts on regulatory issues and what the Commission can do to address them.”

Multiple crypto asset spot ETFs are on the way

The turning point lies in the political chess game.

With Donald Trump's re-election as US President, "Bitcoin" has once again entered the public eye as a hot word. The Trump 2.0 era vows to establish a more deterministic crypto regulatory policy.

The second-time president changed his previous skeptical attitude towards cryptocurrencies and signed an executive order to "establish a strategic reserve of Bitcoin" in early 2025, declaring that he would convert confiscated assets into a national digital asset inventory.

At the same time, the U.S. Congress promoted the GENIUS Stablecoin Act, requiring stablecoins to be 100% backed by reserve assets, providing compliance templates for in-game payment tokens, abolishing the SAB 121 accounting standards that hinder traditional financial institutions from custodial crypto assets, and allowing national banks to participate in node verification and asset custody.

The Trump administration’s personnel arrangements are also further reinforcing the shift in encryption policy.

In January this year, Trump nominated Paul Atkins as the new chairman of the SEC. Atkins has long advocated guiding the development of the industry by formulating clear regulatory rules rather than relying on litigation. During his tenure as a SEC commissioner, he repeatedly criticized the SEC's "enforcement as regulation" strategy for the crypto industry, believing that this approach created uncertainty and hindered innovation.

Acting Chairman Mark T. Uyeda advocates for loose regulation, which is consistent with Atkins' crypto-friendly stance. For example, Uyeda terminated the lawsuits against Kraken and Coinbase during the time of former Chairman Gary Gensler. During Atkins' nomination confirmation process, Acting Chairman Mark Uyeda has already promoted a number of policy adjustments, including the establishment of a cryptocurrency working group led by "Crypto Mom" Hester Peirce, with a focus shifting from "catching violations" to "setting rules."

From the president to the chairman of the SEC, people have changed, and the United States' administrative attitude towards the crypto industry has also changed, with "regulatory easing" and "accelerated construction" taking place at the same time.

Following the Bitcoin (BTC) spot ETF and Ethereum (ETH) spot ETF, Solana (SOL), Avalanche (AVAX) and other crypto assets have also entered the ETF application sequence, and Ripple CEO said that XRP ETF may be launched in 2025. Traditional financial institutions have heard the news and old asset management companies such as Franklin Templeton and VanEck have rushed to the beach.

On March 12, 2025, Franklin Templeton submitted an application for the spot SOL ETF, becoming one of the first traditional asset management giants to enter the Solana ETF. In addition to SOL, the company also applied for the Polkadot (DOT) ETF. On March 25, 2025, the Chicago Board Options Exchange (CBOE) submitted a 19b-4 application document for the spot SOL ETF to the SEC on behalf of Fidelity, planning to list it on the BZX exchange.

Grayscale plans to convert its Solana Trust Fund into a spot ETF. If approved, it will be listed on the New York Stock Exchange under the code GSOL. The application has now entered the SEC review stage. In addition, VanEck, 21Shares, Bitwise, Canary Capital and many other companies have submitted applications. The market expects that the probability of SOL ETF being approved in 2025 is over 70%.

Avalanche (AVAX) has also entered the ETF application line. In March 2025, VanEck submitted the S-1 application documents for the Avalanche spot ETF. The SEC has not yet publicly accepted its opinion, but the market speculates that its approval rhythm may refer to the SOL ETF, and it is expected to enter the key review period in the second half of 2025.

The SEC, which has the power to investigate, punish and initiate civil litigation in the field of securities regulation, has begun to show a friendly face towards crypto assets, resolving the legacy issues of the previous leadership through settlement, withdrawal of lawsuits or termination and suspension of investigations, and plans to hold a meeting this year to specifically discuss crypto asset market regulation.

SEC will hold four roundtable meetings in the first half of the year to discuss crypto asset regulation

According to official news from the SEC, four roundtable meetings will be held in April, May and June this year to discuss crypto asset regulation. The topics of the meetings will cover specialized regulation, cryptocurrency custody, on-chain transfer of tokenized assets, and DeFi. Each roundtable meeting will be open to the public at the SEC headquarters and will be broadcast live on SEC.gov.

With the loosening of US policies and the intensive entry of traditional financial institutions, crypto assets have reached the historical turning point from "fringe experiments" to "mainstream introduction", and an era of dynamic balance between "regulation and innovation" is opening up.

How do you think the SEC’s shift in stance will impact the market?