Highlights of this issue

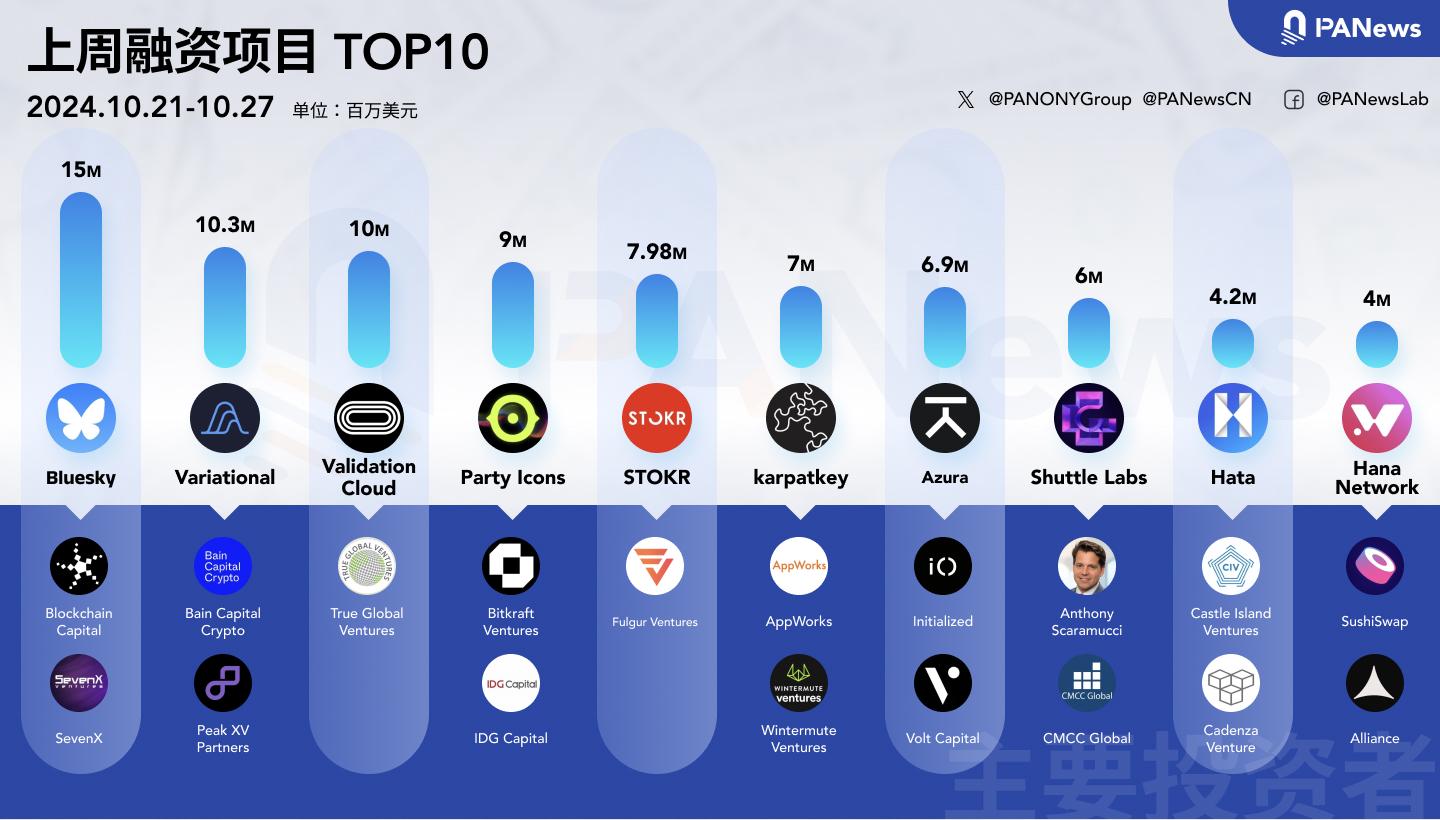

According to incomplete statistics from PANews, there were 26 blockchain investment and financing events around the world last week (October 21-27), with a total funding amount of over US$100 million. The funding amount has decreased to some extent. The overview is as follows:

- DeFi announced 8 investment and financing events, among which the DeFi platform Azura completed a $6.9 million seed round of financing, led by Initialized;

- The Web3 gaming track announced four investment and financing events, among which the Web3 mobile gaming platform Party Icon completed a $9 million seed round of financing, led by Bitkraft Ventures;

- The AI sector announced two investment and financing events, among which Web3 data and AI company Validation Cloud announced that it had received $10 million in financing from True Global Ventures;

- The Infrastructure and Tools track announced four financings, among which Karpatkey, an on-chain asset management solution provider, completed a $7 million financing, with AppWorks and others participating in the investment;

- Other blockchain/crypto applications announced 6 financings, including social media platform Bluesky's $15 million Series A financing led by Blockchain Capital;

- The centralized financial sector announced two financings, among which the Malaysian digital asset exchange Hata completed a $4.2 million seed round of financing

DeFi

Variational, a crypto derivatives trading protocol built on Ethereum’s Layer 2 network Arbitrum, has raised $10.3 million in a seed round led by Bain Capital Crypto and Peak XV Partners (formerly Sequoia India and Southeast Asia), with participation from Coinbase Ventures, Dragonfly Capital, North Island Ventures, Hack VC, and other investors.

According to reports, Variational was founded in 2021. The company began raising seed round funds in the third quarter of that year, ended in December, and began operations in January 2022. Variational initially operated in stealth as a proprietary market maker for two years, and later turned to building its own DeFi protocol. Now that the company has launched a testnet and is preparing for the mainnet, it has decided to announce a seed round of financing. Lucas Schuermann, co-founder and CEO of Variational, said that Variational's invitation-based mainnet will be launched before the end of this year, and the public mainnet is expected to be launched in the first quarter of 2025; the protocol's token is also scheduled to be released next year, but it will be launched sometime after the public mainnet goes online. Although Variational was initially launched on Arbitrum, the protocol can be expanded to other blockchains in the future.

DeFi platform Azura completes $6.9 million seed round of financing, led by Initialized

DeFi platform Azura officially launched on Tuesday after raising $6.9 million in a seed round led by Initialized. Other investors include Volt Capital, Winklevoss Capital, Solana co-founder Raj Gokal, etc. The funds will be used to expand the scale of applications, including increasing company salary expenses, improving software, and purchasing better servers.

According to reports, Azura provides market data access, full transaction lifecycle support and DeFi asset transactions. It will connect various crypto wallets, blockchains, exchanges and other protocols within an interface layer. Azura also reduces trust risks by eliminating middlemen and returning control to users. Azura was launched a year ago as a private invitation-only closed beta under the name Thunder. This is a product test in which only a selected group of users can participate. It is reported that all Thunder users will migrate to Azura.

Shuttle Labs, a self-custodial digital trading company, announced that it has completed a $6 million seed round of financing, with participation from Anthony Scaramucci, CMCC Global, SALT Fund, Flow Traders and several former FTX employees. Shuttle Labs also announced the launch of the beta version of the self-custodial digital trading platform Genius, which aims to solve a series of problems that led to FTX's bankruptcy, such as security, user control and decentralization, and explore the use of the self-custodial model to eliminate the risks of third-party custody and ensure that users always hold their own private keys.

Fluid Protocol has completed a $3.9 million seed round of financing, with Bloccelerate, Animoca Ventures, CMS Holdings, Maelstrom, Veil VC, Builder Capital, Infinity Ventures, RockTree Capital, Wise3 Ventures, Stake Capital, Relayer Capital and others participating in the round. Angel investors participating in this financing include Meltem Demirors, Kartik Talwar, Cami Ramos Garzon, Mike Silagadze, Alan Curtis and Ben Lakoff. The seed round of funds will accelerate the development and launch of Fuel Network's native stablecoin USDF, fund security audits to ensure the security of the protocol and expand the team. According to reports, Fluid Protocol is an over-collateralized, decentralized lending platform built specifically for Fuel Network. The flagship product USDF is an over-collateralized native stablecoin soft-pegged to the US dollar. Fluid is expected to be launched on the mainnet soon.

Decentralized Ordinals Marketplace Ordzaar Completes $2 Million Seed Round

Ordzaar, a decentralized Ordinals marketplace, has completed a $2 million seed round led by LongHash Ventures, with participation from SORA Ventures, GSR, Bitcoin Frontier Fund, PG Capital, and OIG Capital. The Ordzaar team said that 42% of the total tokens will be distributed directly to loyal users and early supporters through a comprehensive airdrop event in the first season and the upcoming second season, ensuring that the community plays a core role in the future development of the ecosystem. In addition, only 10% of the tokens will be allocated to key strategic investors, with a vesting period of 28 months. Ordzaar is committed to enhancing community interaction and participation through the Rune ecosystem driven by SocialFi.

BulbaSwap Completes $1.3 Million Seed Round, Led by Foresight Ventures

Decentralized trading platform BulbaSwap announced the successful completion of a $1.3 million seed round of financing, led by Foresight Ventures, with participation from Morph L2, MEXC Ventures and Kronos Research. The funds will be used to promote BulbaSwap to build a high-throughput, low-latency decentralized exchange (DEX) on the Morph ecosystem, focusing on strengthening deep liquidity and cross-chain interoperability.

Echo Protocol Completes Pre-Seed Round of Financing, with ABCDE Capital and Others Participating

Echo Protocol officially announced that the project has completed the Pre-Seed round of financing. Investors include Spartan Group, ABCDE Capital, Maelstrom Fund, Selini Capital, Web3Port, Auros, Presto Labs, Sats Ventures, Aptos, Movement Labs, B² Network and other well-known institutions.

Echo Protocol is the first Bitcoin liquidity re-staking and yield infrastructure layer based on MoveVM. It currently locks 2,000 BTC and integrates with DeFi projects such as Cellana and Aries. Users can convert BTC to aBTC through Echo and deposit it to obtain an annualized APT yield of up to 12%, while also receiving rewards such as Echo Points and B² Points. Echo will open its first public offering vault on October 28, and only whitelisted users can participate in BTC staking.

Sui-based art RWA project ARTOO receives strategic investment from Sui Foundation

Arttoo will launch a real-world asset (RWA) art project based on the Sui blockchain. As a leading force in democratizing art ownership, Arttoo is transforming the high-end art market by building the financial infrastructure required for a decentralized on-chain art trading platform. By bringing masterpieces by iconic 20th-century artists such as Henri Matisse and Claude Monet to the Sui ecosystem, Arttoo will enable individuals to invest in and trade fragmented equity in these artworks.

Web3 Games

Web3 mobile gaming platform Party Icon completes $9 million seed round led by Bitkraft Ventures

Bitkraft Ventures leads $9 million seed round for Web3 mobile gaming platform Party Icons. This round also includes participation from IDG Capital and Sebastien Borget, co-founder of The Sandbox. The funds will be used to drive the development of Party Icons' games and social experiences and strengthen its Web3 infrastructure. Bitkraft partner Jonathan Huang said that Party Icons' goal is to combine the social elements of party games with the tension of shooting games. Party Icons currently offers three different modes, hoping to become a platform for players to not only play games, but also a space for social interaction. Although crypto games have had difficulty breaking into the mainstream market in the past, investors continue to support Web3 gaming projects.

Web3 game developer Opti Games completes $2 million in financing, with YGG and others participating

Opti Games, the developer of the Web3 game Sparkball, has raised $2 million to support the launch of Season Zero. This round of financing was led by L1D, with participation from CMS Holdings, Impossible Finance, Yield Guild Games (YGG), Monad, etc. The company is also developing on the blockchain platform Monad and has received support from Monad CEO Keone Hon.

According to reports, Sparkball is a 4v4 online sports fighting game where players can choose unique heroes and aim to score goals for the opposing team. Opti Games began developing Sparkball 9 years ago, and Season Zero of the game is expected to be launched in the near future, expanding the game's reach and consolidating the existing community in its early development.

Solana Ecosystem Web3 Gaming Social Platform LOScoin Successfully Completes $2 Million in Financing, Led by Solana Foundation

LOScoin, the first Web3 gaming social platform based on Telegram Bot in Solana ecosystem, has completed a $2 million financing. This round of financing was led by Solana Foundation, with participation from well-known institutions such as CMS Holdings, Impossible Finance, Yield Guild Games (YGG) and Monad. LOScoin project's token LOS was issued on AI_MINT, the innovative protocol launch platform of Solana chain, and received strong support from AI_MINT CEO Keone Hon. LOScoin_Games is committed to deeply integrating the innovative interactive experience of Web3 with the enthusiasm of LOScoin's MEME community, building a highly interactive, interesting and economically active DAO community, and bringing users a new gaming and social experience.

(Updated October 29, 2024: Venture capital firm CMS Holdings clarified on the X platform that the company has no relationship with LosCoin and has never heard of LosCoin.)

DMM Crypto Completes a New Round of Strategic Financing, Led by Neoclassic Capital

DMM Crypto, the blockchain game and NFT division of Japanese cryptocurrency exchange operator DMM, announced the completion of a new round of strategic financing, led by Florida-based Neoclassic Capital. The parties did not disclose the amount of financing. In addition, DMM Crypto also established a strategic partnership with Singapore's quantitative trading company and liquidity provider Presto. The new funds intend to support DMM Crypto in developing a "Web3 economic ecosystem" called Seamoon Protocol.

AI

Web3 data and AI company Validation Cloud completes $10 million in new round of financing

Web3 data and AI company Validation Cloud announced that it has received $10 million in financing from True Global Ventures. The company plans to use the funds to expand its AI products and enable seamless access to Web3 data.

According to reports, the company's product platform consists of three parts: staking, node API, and data and AI. In terms of staking, Validation Cloud's staking assets have exceeded $1 billion. Some of Validation Cloud's customers include Chainlink, Aptos, Consensys, Stellar, and Hedera. Earlier in February, it was reported that Validation Cloud completed a $5.8 million financing led by Cadenza Ventures .

Coinbase Ventures and a16z Crypto Startup Accelerator (CSX) announced new strategic funding for Skyfire, an AI-focused payment company. The new investment brings Skyfire's total seed round funding to $9.5 million from $8.5 million previously . According to reports, Skyfire is building infrastructure that enables AI agents to make payments autonomously and avoid human intermediaries. Skyfire provides AI agents with a unique digital wallet in which users can pre-load stablecoins USDC or traditional bank currencies. AI agents are programs driven by artificial intelligence that can perform tasks or answer questions.

Infrastructure & Tools

Stripe acquires stablecoin payments platform Bridge for $1.1 billion

Payment company Stripe has acquired stablecoin payment platform Bridge for $1.1 billion, marking the largest acquisition in the crypto industry to date. Bridge previously received $58 million in financing and was valued at $200 million. Founded by Sean Yu and Zach Abrams, the platform provides companies with software tools to accept stablecoin payments. Stripe's acquisition also represents the largest deal in its history, showing the company's expansion into the crypto payment space. Previously, Stripe restored the ability to use USDC for crypto payments in the United States and worked with Coinbase to integrate its Base Layer 2 network. (Note: The acquisition amount is not included in last week's total financing)

STOKR Completes $7.98 Million in Funding and Plans to Develop Native Bitcoin Layer 2

European digital asset platform STOKR has completed a $7.98 million financing, and plans to use most of the funds to establish one of the first corporate Bitcoin reserves in Europe. This round of financing was led by Fulgur Ventures and included 100 bitcoins (about $6.78 million) and 1.2 million euros in cash (a total of 7.4 million euros). STOKR said it will follow MicroStrategy's strategy and actively expand its Bitcoin reserve in the next few years. In addition, the company plans to launch Bitcoin-based tokenized assets and develop institutional tokenization infrastructure on native Bitcoin Layer 2 technology (such as Liquid Network). Arnab Naskar, co-CEO of STOKR, said that the establishment of a Bitcoin reserve is an important step in the development of the platform in the field of Bitcoin derivatives tokenization.

On-chain asset management solution provider karpatkey announced the completion of a $7 million financing round. This round of financing attracted the participation of more than 40 angel investors and investment funds, including AppWorks and Wintermute Ventures, ConsenSys founder Joe Lubin, Avara's Stani Kuchelov, Balancer Labs' Fernando Martinelli, GnosisDAO's Stefan George, Friederike Ernst and Martin Koeppelmann, Nexus Mutual's Hugh Karp, Rotki's Lefteris Karapetsas, and ACI's Marc Zeller.

Karpatkey focuses on decentralized autonomous organizations (DAOs) and financial institutions. This financing will help Karpatkey expand its solutions to more DAOs while accelerating its market expansion to traditional funds and institutions. Karpatkey was originally established in 2020 to manage Gnosis's finances, and now provides a range of complex financial solutions to many successful crypto organizations, including Aave, Balancer, CoW, ENS, Lido, and Safe.

B² Network Completes New Round of Financing, Led by Alliance and Others

Modular Bitcoin Layer2 solution B² Network announced the completion of a new round of financing, led by Spartan Group, Animoca Brands, Alliance and P2 Ventures, with participation from Cypher Capital, Candaq Ventures, Future Money Group, Skyland Ventures, TPC and Maxx Capital. The specific amount of financing was not disclosed. B² Network stated that the newly raised funds will be used to optimize B² Network performance, enrich the B² Network ecosystem, support the ecosystem fund Squared Ventures, explore more BTCFi opportunities, and expand B² Network's influence in the global market.

other

Social Media:

Social media platform Bluesky completes $15 million Series A financing led by Blockchain Capital

The social platform Bluesky has completed a $15 million Series A financing round, led by Blockchain Capital, with participation from Alumni Ventures, True Ventures, SevenX, Pivot Global, etc. Despite the support of crypto venture capital, Bluesky has made it clear that it will not "over-financialize" the platform through tokens, NFTs, etc.

Currently, Bluesky has more than 13 million users and plans to use the new funds to strengthen community building, invest in trust and security, and support the AT Protocol developer ecosystem. The platform will also develop a subscription model to provide users with functions such as video uploading and personalized configuration. At the same time, Bluesky will build payment services for creators and explore voluntary monetization channels to support the growth of more Web3 applications.

Web3 social data portal Port3 Network completes new round of financing, OOKC Group participates in the investment

Web3 social data portal Port3 Network announced on X platform that it has completed a new round of financing, with OOKC Group participating in the investment, and the specific investment amount has not been disclosed. Port3 Network previously disclosed that it had received investment from DWF Labs, and also received grants from Binance Labs, Mask Network and Aptos.

Consumer entertainment:

Hana Network, a company focused on “hyper-casual finance”, completes $4 million in financing

Hana Network, which focuses on "hyper-casual finance", has completed a $4 million financing round. Investors in this round include SushiSwap, Alliance and Orange DAO. The specific valuation of this round of financing has not been disclosed. Hana was founded by Kohei Hanasaka and provides an entry-friendly crypto-financial experience by combining social network effects. Hana Network launched Hana Gateway in January 2024, a trustless crypto asset up and down channel. It is currently focused on developing "hyper-casual finance" and realizing user-led distribution through social platforms, such as attention incentives, social rewards and P2P financing. The main network is divided into four phases. The launch of the first phase card game "Hanafuda" has been completed. Users can get rewards through the game. In the future, more interactive experiences will be gradually introduced, and it is committed to providing a simple and easy-to-understand entry for crypto novices.

Fitness app Moonwalk Fitness completes $3.4 million seed round of financing, led by Hack VC

Fitness app Moonwalk Fitness has completed a $3.4 million seed round of financing, led by Hack VC, with participation from Binance Labs, Reciprocal Ventures and Solana co-founder Raj Gokal. It is reported that Moonwalk Fitness is an application that encourages healthy habits by rewarding users with cryptocurrency. The app allows users to challenge friends, family or strangers to daily competitions, thereby "gamifying" fitness. Users who set up challenges can specify parameters, including how many days the competition lasts, daily step goals, and how much money each player must deposit to participate. Players can submit deposits in USDC, Solana or Bonk. Those who fail to meet the standards will lose part of their bets, and the rewards will be distributed to the winners.

Web3 live broadcast launchpad platform UniLive successfully completed its seed round of financing, with multiple institutions participating in the investment

UniLive, a Launchpad live broadcast platform supporting Web3 projects, announced the completion of its seed round of financing on X. Investors include BitMart, EMURGO, Taisu Ventures, JuCoin, Adaverse, AC Capital and Moore Labs, as well as DePINX as a strategic investment partner, which jointly provide strong support for its ecological expansion and global promotion of the live broadcast coin issuance ILO model. UniLive innovatively provides support for Web3 projects to raise funds through live broadcast coin issuance ILO. This financing will accelerate the platform ecosystem construction and promote its comprehensive development in the Web3 field.

Decentralized labor benefits provider Craftt completes $2 million seed round led by Superscrypt

The decentralized platform has completed a $2 million seed round of financing, led by Superscrypt, with participation from DCG and several well-known angel investors. Craftt aims to provide universal benefits for the modern workforce, helping independent workers gain financial confidence and achieve work freedom and flexibility.

Craftt's modular platform focuses on providing traditional full-time employee benefits to freelancers, consultants, remote workers, and more. Through decentralized infrastructure, Craftt is committed to simplifying global payments and financial management, and meeting compliance requirements through verifiable credentials. Craftt Pass is now in public beta, and users can get exclusive discounts on global health insurance. Recently, Craftt completed integration with World's digital human identity verification system World ID, enabling its more than 7 million users to log in to Craftt Pass through World ID and enjoy universal benefits. Craftt plans to continue to develop Layer-2 infrastructure, expand ecosystem cooperation, and further enhance users' benefits and income opportunities.

Centralized Finance

Malaysian digital asset exchange Hata completes $4.2 million seed round of financing

Hata Digital Sdn Bhd, Malaysia's fifth licensed digital asset exchange, has successfully raised US$4.2 million (RM18.07 million) in seed funding, which it plans to use to expand new products and expand its user base in Asia. This round of financing was led by US venture capital firms Castle Island Ventures and Cadenza Venture, and also included global cryptocurrency exchange Bybit, Singapore investment company AP Capital, US venture capital firm Plug and Play Tech Center, and crypto accelerator Alliance.xyz. Hata CEO David Low said that the support of internationally renowned institutional investors will help the company build a stronger digital asset trading platform in Malaysia and Asia and enhance user confidence. Castle Island founding partner Nic Carter believes that Southeast Asia is a core market for global cryptocurrency adoption, and Hata has a strong competitive advantage with its differentiated products and compliance strategies.

Blockchain payment company Borderless.xyz completes $3 million Pre-Seed round of financing

Borderless.xyz, a blockchain-based payment company, has completed a $3 million Pre-Seed round of financing, led by Amity Ventures, with angel investors including Talos founder Anton Katz and Fireblocks founder Michael Shaulov. It is reported that Borderless.xyz aims to develop payment infrastructure to allow global fund transactions between stablecoins, real-world assets and other "Internet native currencies" and fiat currencies. The company operates in more than 50 countries and accepts 23 currencies.

Investment institutions

Borderless Capital announced the launch of a $50 million Latin American fund to support Web3 innovation projects in Latin America. The fund will focus on promoting the development of blockchain and decentralized technologies in the region. Ariel Muslera of Borderless Capital said the fund will provide funding for startups to help them grow and expand in the Web3 ecosystem. Matias A., director of finance and investment at Avalanche Foundation, also participated in the launch. He said Avalanche will help Latin American Web3 projects through cooperation and technical support, and provide more resources and opportunities for innovative companies in the region.

GnosisDAO, the decentralized autonomous organization behind Gnosis Chain, has approved a proposal to launch a $40 million venture fund aimed at accelerating early-stage blockchain projects. GnosisDAO will inject $20 million into the fund, and the remaining $20 million will come from external LPs. The fund, called GnosisVC Ecosystem, will prioritize investments in projects engaged in real-world asset (RWA) tokenization, decentralized infrastructure, and financial payment channels.

Australian crypto hedge fund manager JellyC has merged with Singapore's Trovio Asset Management to attract institutional investment, including pension funds. JellyC will become the main shareholder of the merged entity, with the goal of increasing the size of assets under management by 150% to A$250 million by mid-2026. JellyC co-founder Prendiville said that the expansion will help win the favor of large investors in the Asia-Pacific region, especially Australian pension funds. Trovio plans to sell its shares in the merged entity in the future, but did not give a specific timetable.

EU launches "Trusted Investor Network" to promote venture capital in AI and other technology fields

European Commissioner Iliana Ivanova announced the launch of the Trusted Investor Network, an initiative to support startups and promote investment in the tech sector across the EU, during a meeting with Greek Prime Minister Kyriakos Mitsotakis. The Trusted Investor Network focuses on attracting venture capital, especially in the semiconductor sector for biotechnology and artificial intelligence development. The EU has brought together 71 investors on the continent, signing an asset initiative worth more than €90 billion ($98 billion), committing to invest in European deep tech companies.