Written by: TechFlow

Even a powerful company like Binance cannot ignore the rise of Meme Coin.

Creating a Meme Pandemic, How Did This Super Cycle Come About?

Recently, Binance Research released a report titled " Understanding the Rise of Meme Coins ", which comprehensively analyzed the rise of memes, the macroeconomic factors behind them, their value propositions, and their potential impact on the cryptocurrency industry.

TechFlow has compiled and interpreted the report to help everyone quickly understand the key points.

Key Takeaways

- Big picture: Global money supply expansion and investment behavior

Against the backdrop of a rapid expansion of global money supply, high-risk investments have become more attractive. This phenomenon can be divided into the following levels:

Most of the money went into traditional assets, such as the S&P 500 and real estate. Some of the money went into major cryptocurrencies, such as Bitcoin (BTC) and Ethereum (ETH).

At the far end of the risk spectrum, memecoins emerge as high-risk, high-return investment vehicles, attracting some of the excess capital.

- Micro-environment: Retail investors seek new ways to grow their wealth

Many retail investors are exploring new avenues for wealth creation, reflecting a changing view of traditional finance.

Meme Coin seeks to embody these principles by reducing internal advantages and increasing equal accessibility to investors around the world.

- Trend: Financialization of Internet Culture

Memes have demonstrated virality and community-driven appeal since the early days of the internet, a phenomenon that is now extending to the financial sector through crypto, enabling the financialization of memes.

- Inspiration: Take the essence

Key features such as fair launch and low circulation token economics have been successfully demonstrated by well-known meme coins; these features are worthy of consideration for any project planning a future token launch.

Meme Macro Data

What does the meme represent? The other side of the industry that has always existed: more focus on financial profits than technological progress.

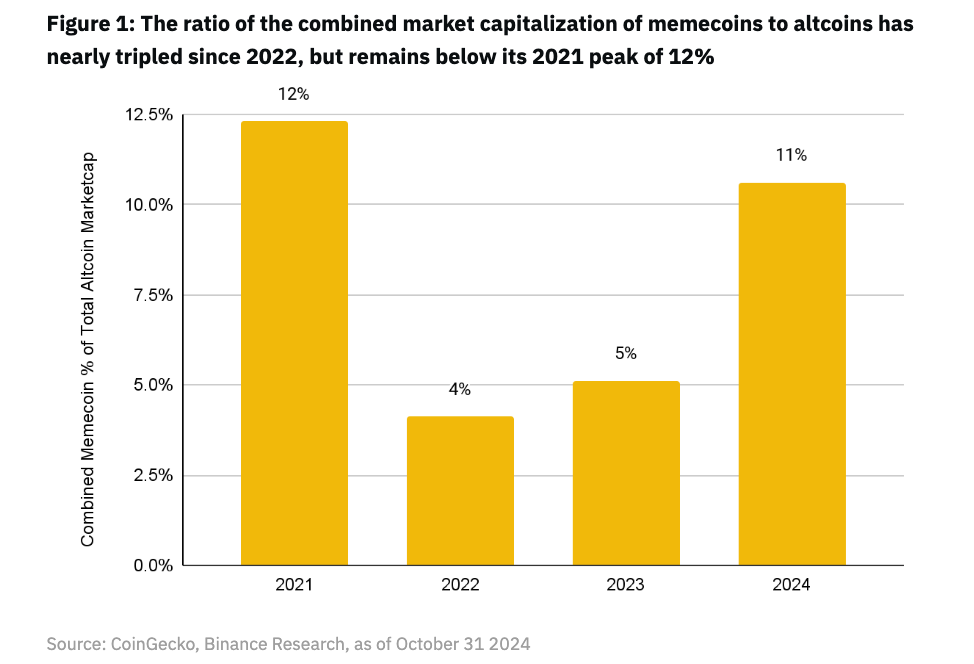

- Since 2022, memecoin’s share of the total market capitalization (excluding BTC, ETH, and stablecoins) has increased from 4% to 11% in 2024.

- This ratio is still lower than the peak in 2021, when the market capitalizations of $DOGE and $SHIB reached $80 billion and $39 billion, respectively.

- From 2022 to 2024, the market capitalization share of memecoin almost tripled.

Meme’s global economic context: massive money printing and young people’s financial nihilism

Fiat money printing, global money supply increases

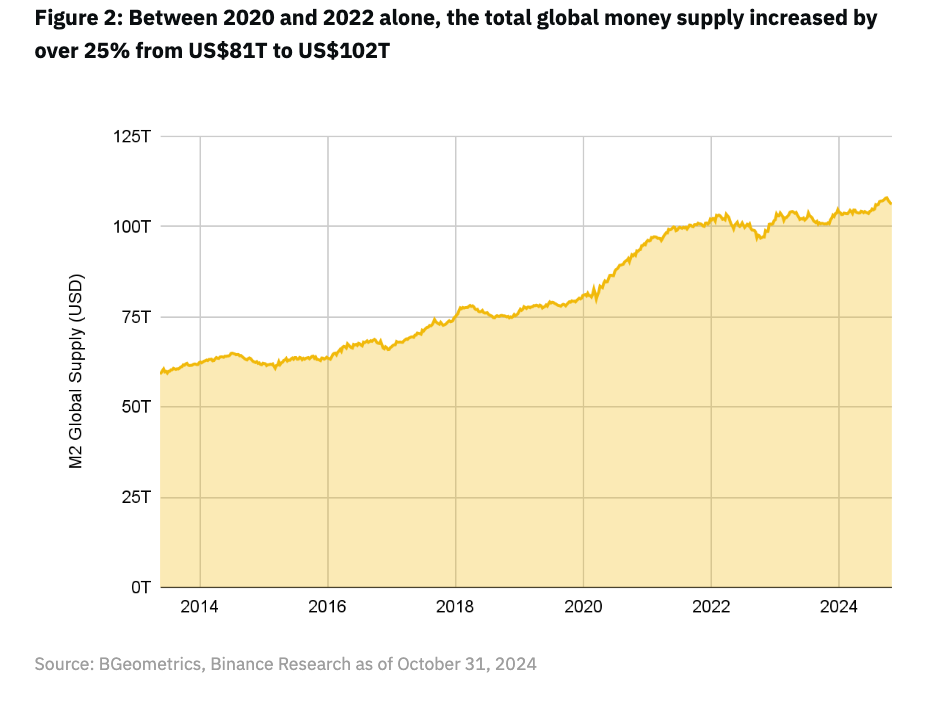

- During the 2020 COVID-19 crisis, central banks around the world increased fiat money supply at an unprecedented rate.

- Figure 2 shows that between 2020 and 2022, the total global money supply increased from US$81 trillion to US$102 trillion, an increase of more than 25%.

Inflation and rising commodity prices

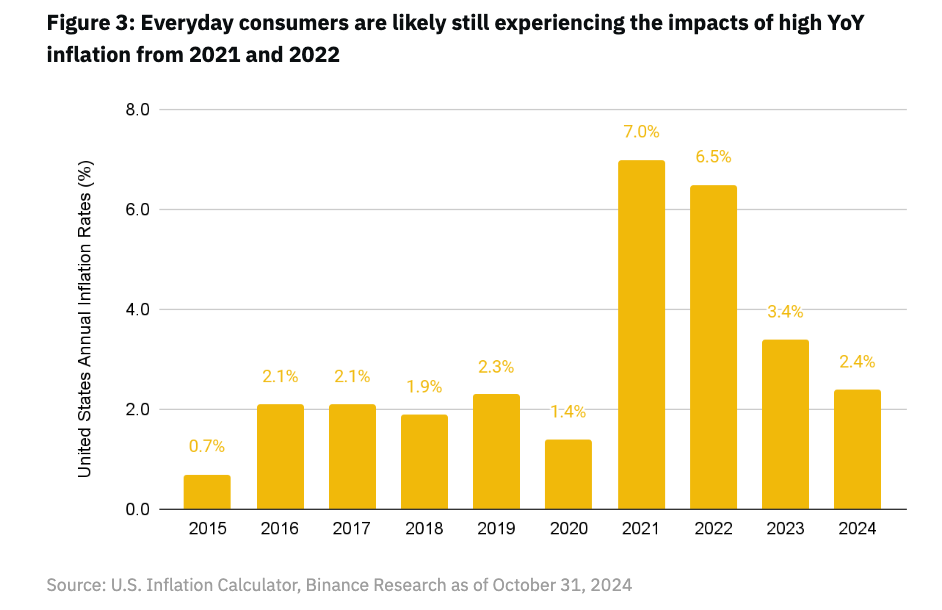

- The US inflation rate reached 7% in 2021 and 6.5% in 2022.

- Faced with currency depreciation, rational actors put money into assets that are perceived to have long-term value.

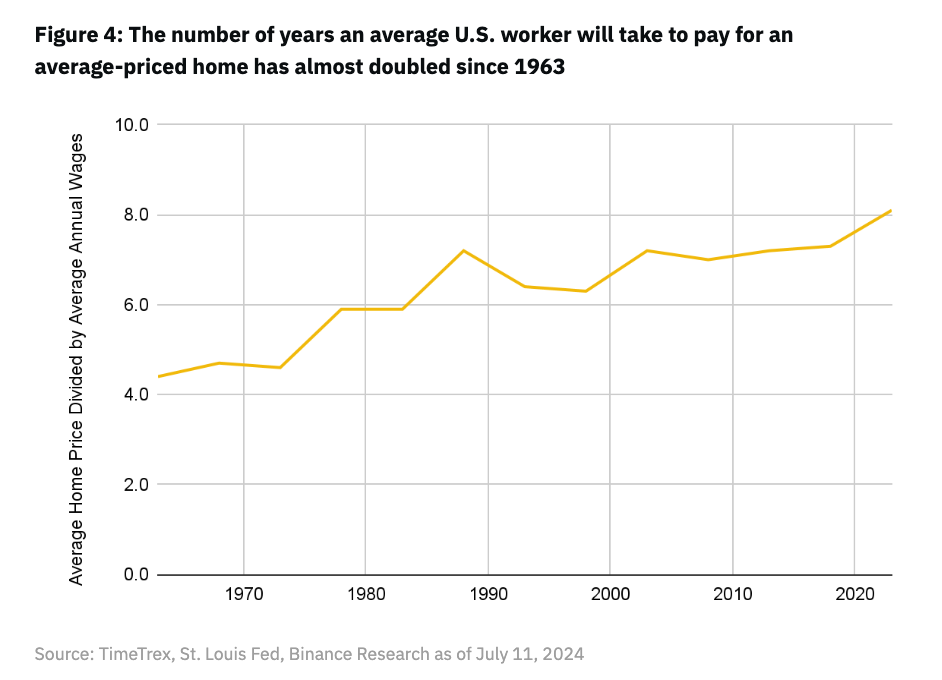

- Wage growth has not been able to keep up with the pace of house price increases. Figure 4 shows that the average number of wage years required to purchase an average-priced home has nearly doubled from 4.4 years in 1963 to 8.1 years in 2021.

The attitude of the younger generation: financial nihilism

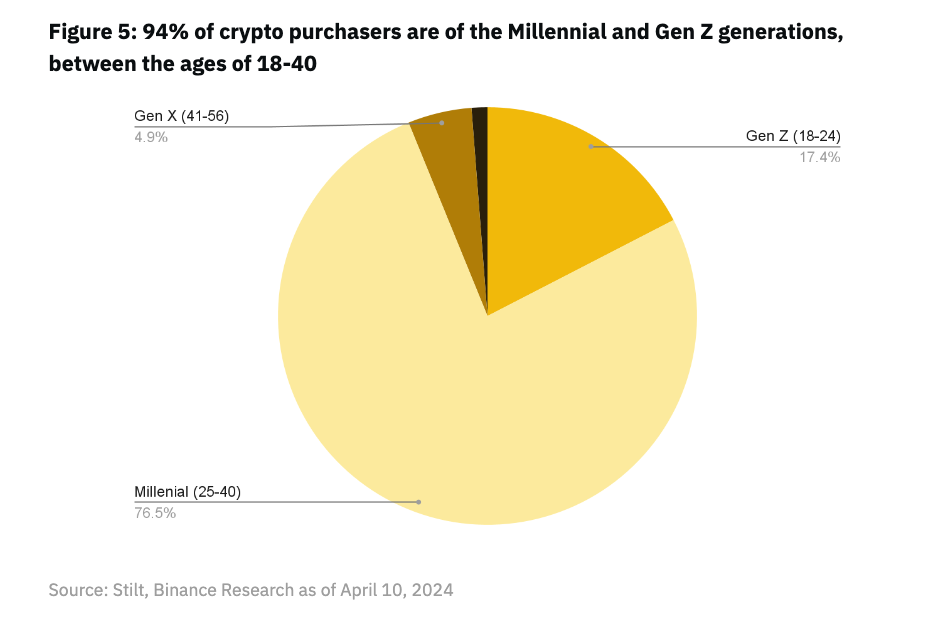

- The macroeconomic situation has put pressure on the younger generation. Young people have lost confidence in the traditional financial system, which is particularly evident in the cryptocurrency market.

- 94% of cryptocurrency buyers are millennials and Generation Z, aged between 18-40.

- Key event: The 2021 GameStop short squeeze reflected young investors' questioning of traditional financial structures.

Memecoin’s value proposition: no utility, but appealing

Memecoins are defined as hypothetical: based on internet culture, memes, or popular trends; usually have no clear utility or intrinsic value.

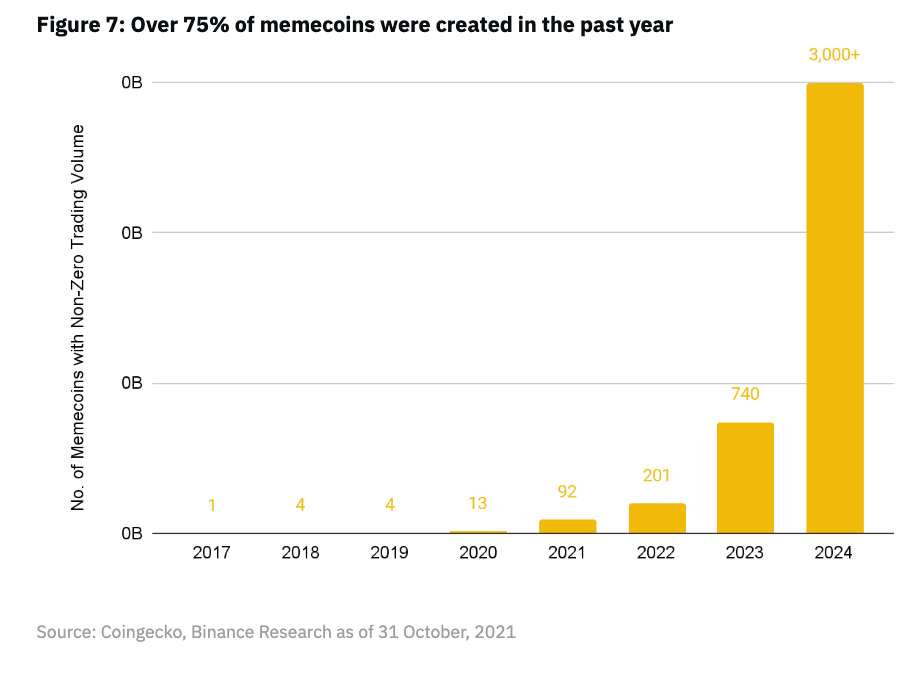

- The number of memecoins has surged since 2020. 75% of memecoins were created in the past year.

Alternative attraction: It represents a newer, fairer and more people-friendly wealth creation opportunity.

- There is no pre-mine, team allocation, or venture capital allocation.

- All tokens are equally available to all participants at the time of issuance.

- There are usually simple, easy-to-understand narratives, making it easier for ordinary investors to understand and participate.

- Driven largely by investor sentiment and group psychology.

Risk Considerations

A life-threatening situation, but control remains unchanged

- 97% of memecoins have failed. Only a few memecoin projects survive and remain relevant in the long term.

- Cabals and rug pulls are everywhere, and you could be “exiting liquidity”.

- Low liquidity can lead to sharp price swings and difficulty exiting investments.

Market saturation and stagnant innovation

- New projects may have difficulty gaining attention and investment, or attention span may be limited

- The memecoin market may be saturated. Its prevalence may divert attention and resources from truly innovative projects, affecting the long-term development and innovation of the entire cryptocurrency industry.

Outlook: Tokenized Software Business vs. Tokenized Concept

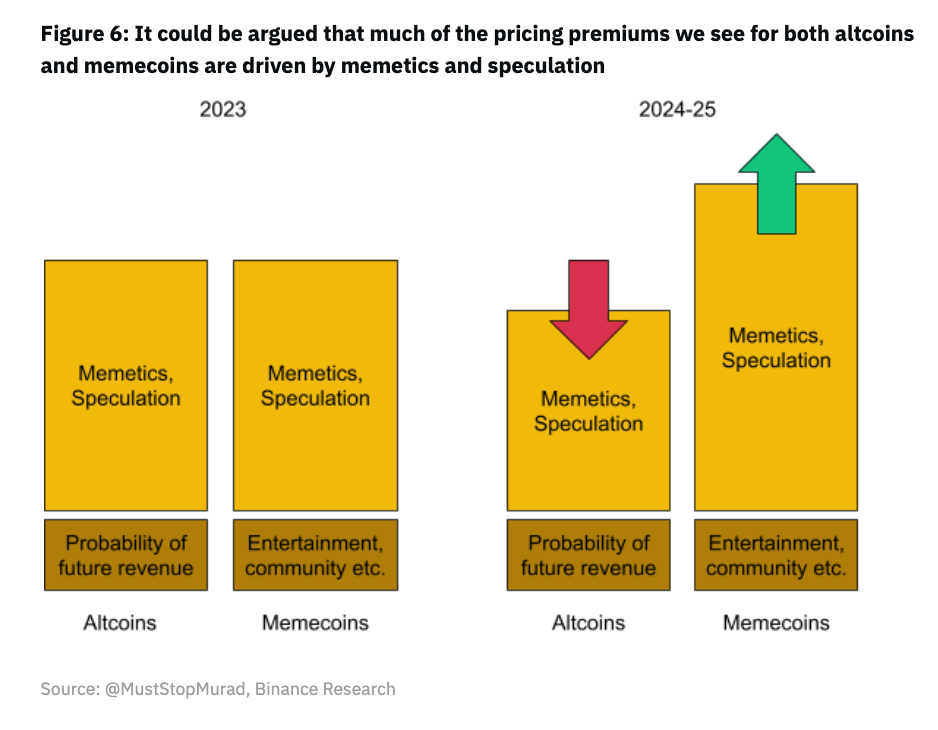

Altcoins vs. Memes

- We can describe technology-driven altcoins as tokenized on-chain software businesses, and memecoins as tokenized ideas and narratives.

- In the long run, the most successful altcoins will need to create and maintain useful, well-differentiated software products with real market fit.

- The most successful memecoins will likely need to create and maintain differentiated, unique narratives and ideas.

Win the users, win the world

- Memecoin demonstrates that there is significant retail demand for tokens that are fairly issued and open to all blockchain participants from day one.

- The brand and connections that established VCs offer (acquired through private token sales) may be attractive to new projects, but it will be retail participants who ultimately make up any product’s user base.

- Giving retail participants the opportunity to invest in a project from the early stages and grow with the team is critical to fostering a strong, loyal community around any crypto asset.

Globalization of price discovery

The rise of memecoins demonstrates that tokens issued in this way can reach market caps in the millions or even billions through organic price discovery driven by the borderless, permissionless nature of decentralized markets.

The rise of memecoins is an exciting new trend that at the very least demonstrates that blockchain technology’s ability to unite individuals on a global scale and foster organic communities around tokenized assets appears to be stronger than ever.