- Important information from last night and this morning (April 26-April 27)

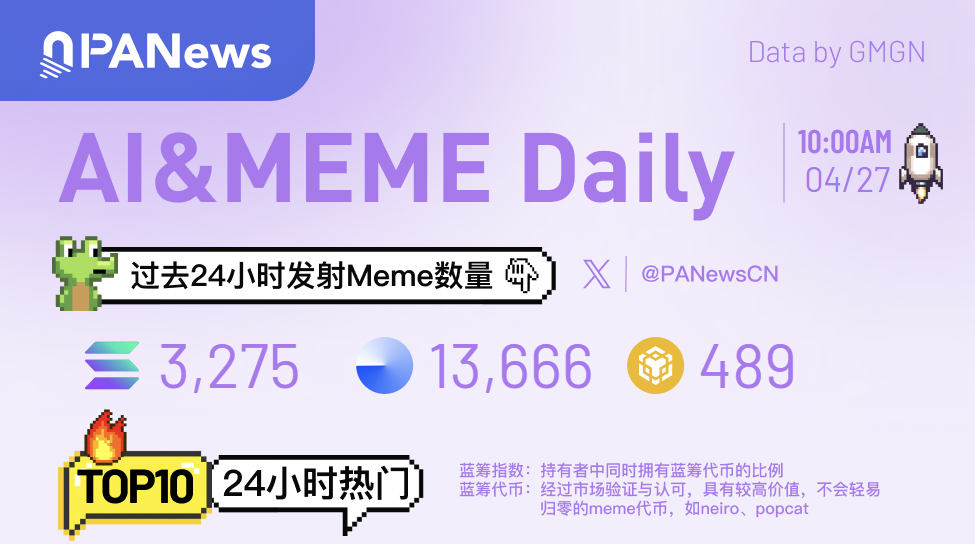

- Ai&Meme Daily, a picture to understand the popular Ai&Memes in the past 24 hours (2025.4.27)

- PA Daily | Binance announces listing and delisting standards; BlackRock has purchased $1.2 billion worth of Bitcoin this week and currently holds 2.77% of the total BTC supply

-

DAOSquare · 44 minutes ago

AngelList on the chain: a new era of Crypto private equity investment and financing

DAOSquare · 44 minutes ago

AngelList on the chain: a new era of Crypto private equity investment and financingThis article attempts to introduce on-chain private investment and financing tools from a technical perspective, as well as its positive significance in promoting the standardization and development of the Crypto private investment and financing industry.

-

Vitalik Buterin · 2 hours ago

Vitalik's blog post: Open source and closed source, the "annual ring model" reveals the reversal of the AI competition between China and the United States

Vitalik Buterin · 2 hours ago

Vitalik's blog post: Open source and closed source, the "annual ring model" reveals the reversal of the AI competition between China and the United StatesThis article will bring Vitalik’s “Cultural and Political Tree Ring Model” and his in-depth analysis of the current global artificial intelligence and technology regulatory landscape.

-

PA一线 · 2 hours ago

CZ responds to the question of "CEX should not have a coin listing process": Users should not be prevented from choosing their freedom, and evildoers should be prevented

PA一线 · 2 hours ago

CZ responds to the question of "CEX should not have a coin listing process": Users should not be prevented from choosing their freedom, and evildoers should be preventedRegarding Binance co-founder CZ's view that "CEX and DEX should not have a listing process", some community users questioned CZ, "Always emphasizing that the most important thing is to protect users, but emphasizing that CEX should list coins without permission like DEX. CEX has greatly relaxed the listing of coins, and a bunch of relatively bad projects have emerged, and even arbitrary manipulation has occurred. How to protect users?" In response, CZ said: "Users' freedom of choice should not be blocked, but those who attempt to harm users should be strongly stopped."

-

PA一线 · 2 hours ago

Important information from last night and this morning (April 26-April 27)

PA一线 · 2 hours ago

Important information from last night and this morning (April 26-April 27)Macro outlook for next week: Super data week is coming, non-agricultural and PCE will follow one after another; BONK launches Meme coin issuance platform Letsbonk.Fun; Analyst: Bitcoin faces strong resistance in the range of US$94,125 to US$99,150.

- PA Daily | Binance announces listing and delisting standards; BlackRock has purchased $1.2 billion worth of Bitcoin this week and currently holds 2.77% of the total BTC supply PA Daily | ARK Invest raises Bitcoin's target price to $2.4 million in 2030; Binance Alpha will launch Sign PA Daily | Binance will delist ALPACA, PDA, VIB and WING; Bitcoin spot ETF had a net inflow of US$917 million yesterday

PA一线 · 2 hours ago

Arbitrum exits Nvidia accelerator program after it refuses to work with crypto firms

PA一线 · 2 hours ago

Arbitrum exits Nvidia accelerator program after it refuses to work with crypto firmsThe Ethereum Layer 2 network Arbitrum Foundation announced its withdrawal from the Nvidia-backed Ignition AI accelerator program because the chip giant requested that the cooperation not be mentioned in crypto-related announcements. Previously, the two parties had planned to reach an exclusive cooperation, and Arbitrum would become the only Ethereum ecosystem representative in the AI acceleration program. A spokesperson for the Arbitrum Foundation said that Nvidia recently changed its position and was willing to maintain cooperation but prohibited public disclosure, which showed its lack of long-term commitment to the crypto field. The accelerator program would have provided Arbitrum with AI development guidance and cloud service points. It is worth noting that another public chain, Aptos, still maintains a cooperative relationship with the accelerator. The foundation emphasized that the decision to withdraw was based on commercial considerations, and in the future it will choose "partners who fully support blockchain innovation."

-

Meme日报 · 3 hours ago

Ai&Meme Daily, a picture to understand the popular Ai&Memes in the past 24 hours (2025.4.27)

Meme日报 · 3 hours ago

Ai&Meme Daily, a picture to understand the popular Ai&Memes in the past 24 hours (2025.4.27)BONK launches Meme coin issuance platform Letsbonk.Fun

-

PA一线 · 4 hours ago

Alpaca, an API platform focused on stock and cryptocurrency trading, completes $52 million in Series C financing

PA一线 · 4 hours ago

Alpaca, an API platform focused on stock and cryptocurrency trading, completes $52 million in Series C financingAlpaca, an API platform focusing on stock, options and cryptocurrency trading, announced the completion of a $52 million Series C financing round. 850 Management, Derayah Financial, National Investments Company, Portage Ventures and Unbound participated in the investment.

-

区块律动BlockBeats · 4 hours ago

"Operation Choke Point 2.0" has ended. What does the bank's relaxation mean for the crypto market?

区块律动BlockBeats · 4 hours ago

"Operation Choke Point 2.0" has ended. What does the bank's relaxation mean for the crypto market?Bank regulation has shifted under Trump.

-

PA一线 · 5 hours ago

Market News: IMF says El Salvador has stopped using public funds to invest in Bitcoin

PA一线 · 5 hours ago

Market News: IMF says El Salvador has stopped using public funds to invest in BitcoinThe International Monetary Fund (IMF) says El Salvador has stopped using public funds to invest in Bitcoin.

-

金色财经 · 5 hours ago

Citibank Research Report: Stablecoins Have ChatGPT Moment

金色财经 · 5 hours ago

Citibank Research Report: Stablecoins Have ChatGPT MomentIt is expected that stablecoin supply will still be mainly denominated in US dollars (about 90%), while non-US countries will promote the development of their own CBDCs.

- Crypto Circulating Market Cap (7d)$3,073,597,652,705Market CapFear and Greed Index (Last 30 Days)Extreme Fear1 Days(3.33%)Fear20 Days(66.67%)Neutral5 Days(16.67%)Greed4 Days(13.33%)Extreme Greed0 Days(0%)

PA一线 · 6 hours ago

Loopscale, a lending protocol, was attacked, and about 5.7 million USDC and 1,200 SOL were stolen

PA一线 · 6 hours ago

Loopscale, a lending protocol, was attacked, and about 5.7 million USDC and 1,200 SOL were stolenLoopscale, a Solana on-chain lending protocol, disclosed on the X platform that at 11:30 am EST today (23:30 Beijing time on April 26), the pricing function of Loopscale's RateX PT token was manipulated, resulting in the theft of approximately 5.7 million USDC and 1,200 SOL from the Loopscale USDC and SOL vaults. Currently, all Loopscale markets have been temporarily suspended to allow the team to further investigate. The funds involved in this security vulnerability incident account for approximately 12% of Loopscale's total funds and only affect depositors who deposited funds into Loopscale's USDC and SOL vaults. Borrowers and revolving loan users were not affected. We are working hard to restore the repayment function as soon as possible to avoid unforeseen liquidations. The team is working closely with law enforcement officials, security experts, and investors to recover the funds. Once more information and a complete technical analysis report are obtained, it will be released immediately.

-

PA一线 · 16 hours ago

The value of the Trump family's crypto project WLFI portfolio has fallen by more than 50%, and the current loss has reached about $2.1 million

PA一线 · 16 hours ago

The value of the Trump family's crypto project WLFI portfolio has fallen by more than 50%, and the current loss has reached about $2.1 millionPANews reported on April 26 that according to Cointelegraph, World Liberty Financial (WLFI), a crypto project supported by the Trump family, is still facing problems of shrinking portfolios and limited liquidity after completing two rounds of token sales totaling US$550 million. WLFI was launched in September 2024 and mainly raised funds by selling non-transferable WLFI tokens.

-

PA一线 · 17 hours ago

Analysis: BTC could rise to $285,000 by 2030 if Citigroup predicts a surge in stablecoin supply

PA一线 · 17 hours ago

Analysis: BTC could rise to $285,000 by 2030 if Citigroup predicts a surge in stablecoin supplyPANews reported on April 26 that according to Coingape, Citibank predicted in its latest report that the total supply of stablecoins will grow to $1.6 trillion by 2030 in the baseline scenario and $3.7 trillion in the optimistic scenario. Analysts believe that if Citigroup's forecast is realized and the regulatory momentum under Trump's policy continues, Bitcoin is expected to enter the price discovery stage, based on the historical ratio of stablecoin growth to BTC price appreciation - a 6.7-fold increase in stablecoins may translate into a 3- to 5-fold increase in Bitcoin, and the price of Bitcoin may reach $285,000 in 2030, with a more optimistic upper limit of close to $475,000 per coin.

-

PA一线 · 17 hours ago

Next week's macro outlook: Super data week is coming, non-agricultural and PCE will follow

PA一线 · 17 hours ago

Next week's macro outlook: Super data week is coming, non-agricultural and PCE will followPANews reported on April 26 that this week can be seen as a positive week as concerns about the independence of the Federal Reserve and ongoing trade frictions at the beginning of the week dissipated. On Friday, U.S. stocks were largely flat as market participants continued to wait for more information on the tariff war. Looking ahead to next week, although the Federal Reserve has entered a "quiet period" and the domestic market is about to enter the May Day holiday, there are still many important schedules, including but not limited to non-farm data, U.S. first quarter GDP data, PCE inflation data, and the Bank of Japan's interest rate decision... The following are the key points that the market will focus on in the new week: Monday 22:30, U.S. Dallas Fed Business Activity Index for April Tuesday 22:00, U.S. JOLTs Job Vacancies in March, Conference Board Consumer Confidence Index in April Wednesday 09:30, China's official manufacturing PMI in April Wednesday 09:45, China's Caixin Manufacturing PMI in April At 17:00 on Wednesday, the preliminary value of the Eurozone's first quarter GDP annual rate will be released at 20:15 on Wednesday, the US ADP employment number for April will be released at 20:30 on Wednesday, the US first quarter labor cost index quarterly rate, the preliminary value of the first quarter real GDP annualized quarterly rate, the preliminary value of the first quarter real personal consumption expenditure quarterly rate, the preliminary value of the first quarter core PCE price index annualized quarterly rate will be released at 22:00 on Wednesday, the US March PCE price data, the March personal expenditure monthly rate, the March existing home sales index monthly rate will be released on Thursday at 19:30, the number of layoffs of US Challenger companies in April will be released at 21:45 on Thursday, the final value of the US S&P Global Manufacturing PMI for April will be released on Friday at 20:30, the US April seasonally adjusted non-farm payrolls and April unemployment rate, the ADP employment report known as the "small non-farm" will also be released next Wednesday, along with the latest PCE inflation and consumption data.

-

PA一线 · 19 hours ago

ZKsync founder: If Ethereum maintains its status as the "world computer", value will flow directly or indirectly to ETH

PA一线 · 19 hours ago

ZKsync founder: If Ethereum maintains its status as the "world computer", value will flow directly or indirectly to ETHAlex Gluchowski, founder of ZKsync and CEO of Matter Labs, wrote on the X platform that Ethereum is the world computer and still has product-market fit. There are "decentralized Nasdaq and SWIFT" downstream, but the Ethereum network is the real moat. Ethereum is the foundation of the value Internet, and credible neutrality is its core feature. If Ethereum maintains this status as the world computer, then value will flow directly or indirectly to ETH.

-

PA日报 · 19 hours ago

PA Daily | Binance announces listing and delisting standards; BlackRock has purchased $1.2 billion worth of Bitcoin this week and currently holds 2.77% of the total BTC supply

PA日报 · 19 hours ago

PA Daily | Binance announces listing and delisting standards; BlackRock has purchased $1.2 billion worth of Bitcoin this week and currently holds 2.77% of the total BTC supplyCircle executives denied seeking a U.S. banking license; Trump Meme Coin team refuted rumors of a "$300,000 dinner entry threshold"; BITWISE NEAR ETF was registered in Delaware; decentralized AI startup Nous Research completed a $50 million Series A financing round, led by Paradigm.

-

PA一线 · 20 hours ago

1inch team investment fund sold 70.76 WBTC again about 30 minutes ago

PA一线 · 20 hours ago

1inch team investment fund sold 70.76 WBTC again about 30 minutes agoAccording to on-chain analyst Yu Jin’s monitoring, the 1inch team investment fund sold 70.76 WBTC for 6.676 million USDC 30 minutes ago, with a selling price of $94,346. The 1inch team investment fund spent $44.22 million to purchase WBTC, ETH and 1INCH between February 2 and March 10.

-

Felix · a day ago

Ten thousand words to sort out the history of US tariffs: History will not repeat itself, but it will be copied

Felix · a day ago

Ten thousand words to sort out the history of US tariffs: History will not repeat itself, but it will be copiedIs the Trump administration's imposition of tariffs a stroke of genius or a bad move?

-

PA荐读 · a day ago

In-depth discussion on the focus and impact of EU crypto asset regulation

PA荐读 · a day ago

In-depth discussion on the focus and impact of EU crypto asset regulationStarting from 2025, as MiCA gradually takes effect in European countries, it will greatly promote the compliance development of the global crypto asset market, and will also lead the formulation of crypto asset regulatory policies in other countries and the construction of a global governance coordination system.

-

PA一线 · a day ago

Ethereum spot ETF had a net inflow of $104 million yesterday, and none of the nine ETFs had a net outflow

PA一线 · a day ago

Ethereum spot ETF had a net inflow of $104 million yesterday, and none of the nine ETFs had a net outflowThe Ethereum spot ETF with the largest single-day net inflow yesterday was the Blackrock ETF ETHA, with a single-day net inflow of US$54.425 million. Currently, ETHA's total historical net inflow has reached US$4.114 billion.

PANews - Your Web3 Information Officer

Download PANews to track in-depth articles