Articles More

-

Tim · 10 hours ago

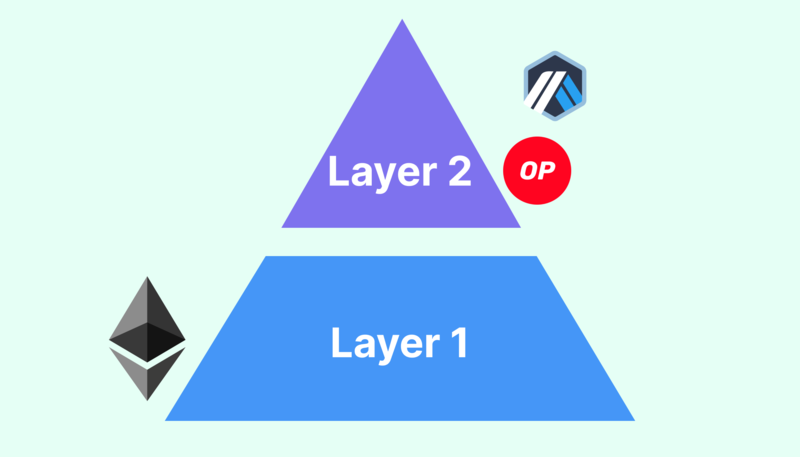

From trust mechanism to valuation logic, in-depth analysis of the subtle "father-son relationship" between L1 and L2

Tim · 10 hours ago

From trust mechanism to valuation logic, in-depth analysis of the subtle "father-son relationship" between L1 and L22025 Cognitive Compulsory Course: What is the difference between L1 and L2?

-

PA日报 · 10 hours ago

PA Daily | Ghibli's market value exceeds $40 million; Terraform Labs will open a crypto asset claims portal on March 31

PA日报 · 10 hours ago

PA Daily | Ghibli's market value exceeds $40 million; Terraform Labs will open a crypto asset claims portal on March 31Binance announced the results of the first batch of voting for listings: Mubarak, CZ'S Dog, Tutorial and Banana For Scale will be listed; Binance Alpha has launched GhibliCZ (Ghibli) and Ghiblification (Ghibli); the US SEC ended its investigation into Crypto.com without any enforcement action.

-

bitsCrunch 研究 · 19 hours ago

Thinking behind GPT-4o image generation: When NFT becomes a style of painting

bitsCrunch 研究 · 19 hours ago

Thinking behind GPT-4o image generation: When NFT becomes a style of paintingWill the era come when style equals ownership and ownership equals value?

-

PA日报 · 2 days ago

PA Daily | GameStop includes BTC in the company's reserve assets; Grayscale adds new IP, SYRUP and GEOD as potential tokens for Q2

PA日报 · 2 days ago

PA Daily | GameStop includes BTC in the company's reserve assets; Grayscale adds new IP, SYRUP and GEOD as potential tokens for Q2Grayscale report: IP, SYRUP and GEOD are added to the Top 20 list, and the development of blockchain + AI and other fields is optimistic; USDC Treasury minted 300 million new USDC on Ethereum early this morning; Ripple will recover a court fine of US$75 million from the SEC.

-

bitsCrunch 研究 · 03-25 14:06

Is the future of AI centralized or decentralized?

bitsCrunch 研究 · 03-25 14:06

Is the future of AI centralized or decentralized?The ultimate proposition of the development of artificial intelligence is not to create an omniscient and omnipotent "God model", but to reconstruct the distribution mechanism of technological power.

-

Flash News More

-

PA一线 · 11 hours ago

Zhu Su: RWA is the “hidden startup pool” of the US dollar

PA一线 · 11 hours ago

Zhu Su: RWA is the “hidden startup pool” of the US dollarZhu Su, co-founder of 3AC, wrote that the interest of institutional investors in real-world assets (RWA) stems from their hope that every $1 of RWA total locked volume (TVL) can be converted into a certain proportion of the token market value. For example, with $1 billion of RWA, after tokenization, the protocol token may reach a market value of $100 million. He further pointed out that just as Bitcoin L2 and Ethereum restaking are considered "hidden launch pools", RWA can essentially be considered a "hidden launch pool" for the US dollar.

-

PA一线 · 12 hours ago

Matrixport: Liquidity indicators may be difficult to accurately predict BTC trends, and we should pay attention to crypto-native driving factors or policy impacts

PA一线 · 12 hours ago

Matrixport: Liquidity indicators may be difficult to accurately predict BTC trends, and we should pay attention to crypto-native driving factors or policy impactsAccording to Matrixport analysis, there are certain limitations to the correlation between rising global liquidity and rising Bitcoin prices. Although the global liquidity index, measured by the total money supply of 28 central banks (normalized to US dollars), is visually correlated with Bitcoin price movements, its predictive accuracy is questioned due to the non-stationarity of the time series and differences in scale. The analysis points out that although money supply growth may have a lagged effect on the Bitcoin market, there is no strong theoretical support for this lag time. In addition, although the correlation between Bitcoin and Nasdaq has increased slightly in recent years, it is still lower than the 60% high during the COVID period, indicating that Bitcoin trading is more driven by its own laws rather than being a proxy asset for technology stocks. Matrixport believes that the broad consolidation of Bitcoin prices may continue, and relying solely on liquidity indicators to predict market trends may not be reliable enough. In contrast, it may be more valuable to focus on macro variables that are native to cryptocurrencies or have direct policy implications, such as political leaders who support cryptocurrencies. Although market perceptions may have mathematical flaws, their widespread acceptance may still have a real impact on market behavior.

-

PA一线 · 13 hours ago

Opinion: Less than 100 projects out of about 37 million tokens in the crypto market are aligned with macro trends such as AI and RWA

PA一线 · 13 hours ago

Opinion: Less than 100 projects out of about 37 million tokens in the crypto market are aligned with macro trends such as AI and RWAMiles Deutscher, a crypto analyst, tweeted that there are about 37 million tokens in the crypto market, of which 99.9% are "air projects". He believes that there are less than 100 projects that meet the following conditions: having an experienced team, a long-term bullish attitude towards their own tokens (more net buying than net selling), a clear business model and a roadmap to achieve sustainable profits, finding a real product-market fit or a clear path, being able to deliver continuously regardless of market conditions, having real competitive barriers, and being consistent with macro trends (such as AI, RWA, stablecoins, etc.). He emphasized that the task of investors is to find these protocols with long-term potential among many projects and make long-term bets.

-

PA一线 · 14 hours ago

CZ: Listing a coin should not affect the price, and the long-term price depends on the development of the project

PA一线 · 14 hours ago

CZ: Listing a coin should not affect the price, and the long-term price depends on the development of the projectThe DEX model allows all tokens to be freely listed and selected by the market. This approach is more in line with the state of free game.

-

PA一线 · 17 hours ago

PANONY x Web3.com Ventures Live Space “East-West-Tech” Episode 1: “Stablecoin” Live Broadcast

PA一线 · 17 hours ago

PANONY x Web3.com Ventures Live Space “East-West-Tech” Episode 1: “Stablecoin” Live BroadcastAn in-depth conversation across 12 hours of time zones to explore stablecoins and more recent hot topics in the crypto industry! How are they reshaping the financial system? What innovations are emerging in the industry? What challenges will be faced in the future? We will analyze them for you one by one!

-