Agintender

417Followers46Articles

The Rise and Fall of Binance's Dominance: From BUSD's "Unification" to $U's "Conquering the World"—The Stablecoin Wars

From FDUSD to BFUSD, and then to United Stables ($U), Binance has not given up on stablecoins. Instead, it has evolved through failures, shifting from a hegemonic unification to an aggregate-based absorption, and even paving the way for the AI economy.Agintender10 hour ago

When tokens are the only product and source of revenue: A Fujian businessman's shovel can't make a 25-year-old counterfeit sickle.

Who exactly has contributed to the current situation of high FDV and low circulation? Who is shaping the token into the ultimate product/service?Agintender2025-12-09 12:00

The deadly trap behind the exorbitant profits of IPO subscriptions: How can retail investors use a "chain of traps" to fight against the snipers of market manipulators?

The ultimate victory for retail investors lies in taking multiple defensive measures to transform the risk of liquidation from a "certain event" into a "cost event," until they can safely exit the market.Agintender2025-11-21 07:00

How to prevent a repeat of the 2011 stampede in the stock market? Circuit breaker mechanism construction and algorithm design under low liquidity conditions.

This paper proposes a circuit breaker mechanism algorithm based on composite quantitative indicators, using price deviation, order depth, and large-scale liquidation exposure as triggering reference conditions.Agintender2025-11-18 04:00

The cascading liquidations caused by extreme leverage using altcoins as collateral are a systemic risk triggered by external shocks when the market is structurally fragile. This article will analyze the underlying mechanisms from the perspective of market makers and large investors pledging altcoins to borrow stablecoins.

Agintender2025-10-14 01:00

The most stable leverage creates the most chaotic situation: Trump started the fire, why should my account pay the bill?

Although the crash was ignited by Trump, its catastrophic destructive power stems from the high-leverage environment within the native financial system of the crypto market.Agintender2025-10-13 07:00

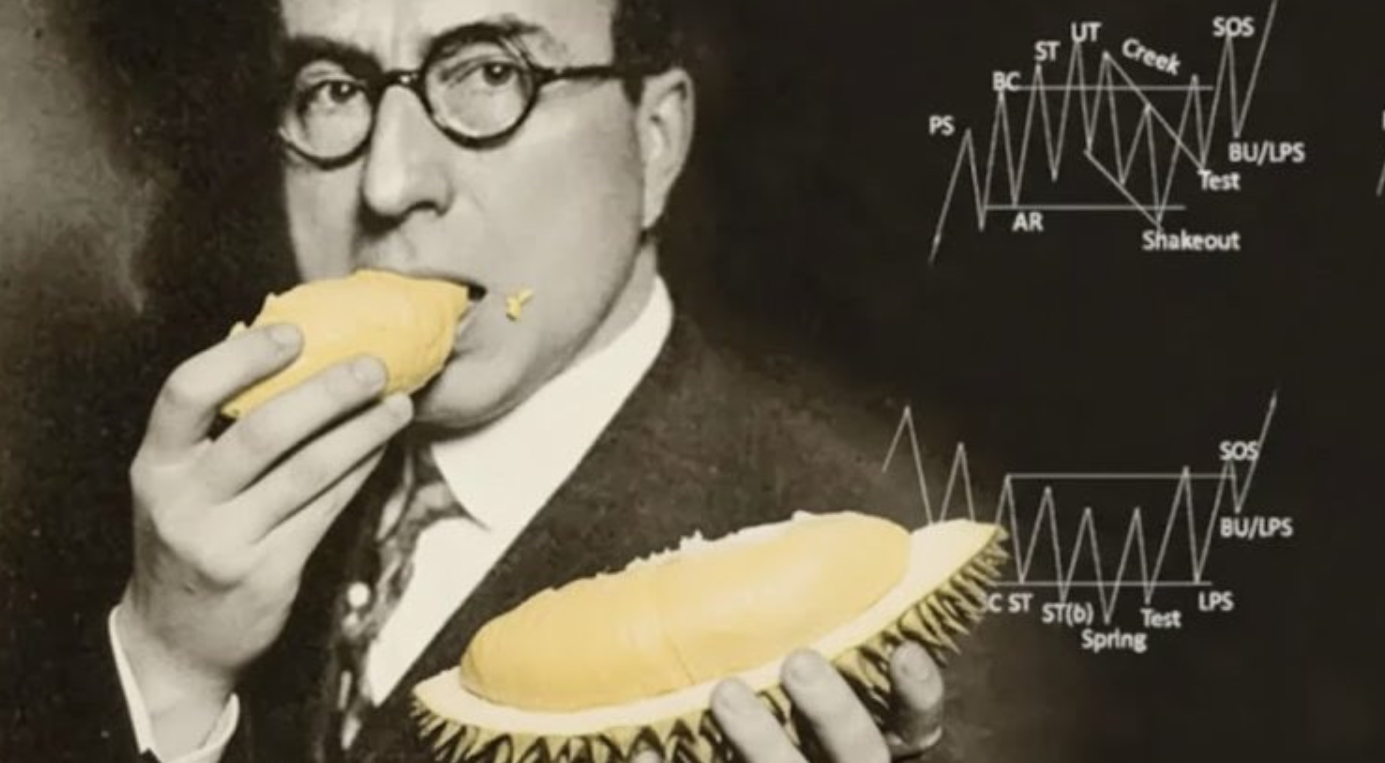

Unveiling the New Coin Listing Strategy: How the "Low Circulation, High Control" Spot + Contract Combination Became the New Musang King

This article provides a technical, quantitative, and objective mechanistic analysis to help sophisticated market participants identify and potentially mitigate related risks.Agintender2025-10-08 06:20

WLFI Eagle: An alchemical coronation feast that fuses political capital and crypto-financial engineering

From the day it was founded, World Liberty Financial has deeply tied its core values to Trump's political brand, demonstrating that its strategic intention is not technological innovation, but to leverage its strong brand identity for market penetration and capital raising.Agintender2025-09-02 02:00

The Mathematical Essence of the Long-Short Game in Perpetual Contracts: Emotional Imbalance Under Balanced Positions

In any perpetual contract market, every transaction is a matching transaction between a buyer and a seller. In a market where long and short positions correspond one to one, why does an imbalance of power between long and short positions occur?Agintender2025-08-26 10:00

Columns