1. Market observation

The Federal Reserve's monetary policy is at a complex crossroads caused by trade tariffs. Chairman Powell admitted that the Fed might have cut interest rates if the Trump administration's tariff plan had not undermined the gains in inflation control. Although he left all possibilities for the July rate decision, his remarks implied that policy flexibility is increasing and the threshold for rate cuts may be lowered if employment data is weak in the future. At the same time, the US government's fiscal policy has also added new variables. The highly anticipated "big and beautiful" tax and spending bill narrowly passed the Senate with a narrow margin of 51 votes to 50. The House of Representatives will debate and vote on the Senate version on Wednesday, and Trump hopes to sign it into law before Independence Day on July 4. The bill is far-reaching. It plans to cut taxes and reduce social safety net spending while increasing military and immigration enforcement budgets. This move is expected to add up to $3.3 trillion to the US national debt over the next decade. On the trade front, President Trump took a tough stance, making it clear that the July 9 tariff deadline will not be postponed, and specifically targeting Japan as a target of pressure, exacerbating tensions and uncertainties in global markets. It is worth noting that due to the Independence Day holiday, the U.S. stock market will close early at 1 a.m. Beijing time on July 4 and will be closed all day on July 4. The market will enter a brief period of silence before the policy storm.

Yesterday, Hong Kong celebrated its 28th anniversary of its return to China. Against this backdrop, the offline experience booth of HashKey Exchange, Hong Kong's first licensed virtual asset exchange, was officially unveiled at the West Kowloon High Speed Rail Station, providing the public with convenient service channels and experiences. Jeffrey Ding, chief analyst at HashKey, said that the development of Web3 is not only an iteration of technology, but also a reshaping of the efficiency and trust paradigm. 2025 is seen as an important node for Hong Kong to start anew with digital sovereignty and institutional innovation. Against the backdrop of the improvement of on-chain efficiency and the acceleration of the institutionalization of digital assets, Hong Kong is believed to play a leading role in the new global financial order.

Bitcoin fell to $105,000 this morning. Bitfinex analysts pointed out that Bitcoin's upward momentum showed signs of weakening for the first time, and it may enter a consolidation phase or a local top. At the same time, the spot trading volume declined and the profit-taking behavior increased. The cost price of $98,700 for short-term holders became a key support. Historical data shows that Bitcoin usually performs weakly in the third quarter, with an average return rate of 6%. It is expected that price volatility will further decrease in the future, and the trend may continue to fluctuate in the range. Matrixport statistics show that Bitcoin has recorded an increase in seven Julys in the past decade, with an average increase of 9.1%. Historical data supports the market's expectations of challenging the $116,000 mark. CryptoCapo, a relatively pessimistic analyst, warned that the real sell-off has not yet begun. He predicted that the price of Bitcoin may fall below $100,000 to the range of $92,000-93,000. If it falls further, it may hit the potential bottom of $60,000-70,000. He also pointed out that if this trend is realized, altcoins may face a further decline risk of 50%-80%.

The on-chain market is still relatively cold recently, and there are no hot fast-passes. The prices of $USELESS on Bonk and $STARTUP on Believe have hit record highs. However, the recent stock on-chain craze set off by Robinhood and xStocks has brought some highlights. Robinhood's stock price hit a record high yesterday, reaching $99.18, and it also led to the resurrection of the Meme coin stockcoin on the Solana chain. The market value has soared from 14,000 to 4.4 million US dollars in the past three days, an increase of 1,400% in 24 hours.

2. Key data (as of 12:00 HKT on July 2)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

Bitcoin: $106,465 (+13.8% YTD), daily spot volume $26.059 billion

Ethereum: $2,439.94 (-26.88% YTD), with daily spot volume of $14.38 billion

Fear of Greed Index: 63 (greed)

Average GAS: BTC: 2 sat/vB ETH: 0.7 Gwei

Market share: BTC 64.6%, ETH 9.0%

Upbit 24-hour trading volume ranking: STMX, XRP, CBK, BTC, PENGU

24-hour BTC long-short ratio: 1.1186

Sector gains and losses: AI sector fell 4.48%; RWA sector fell 4.72%

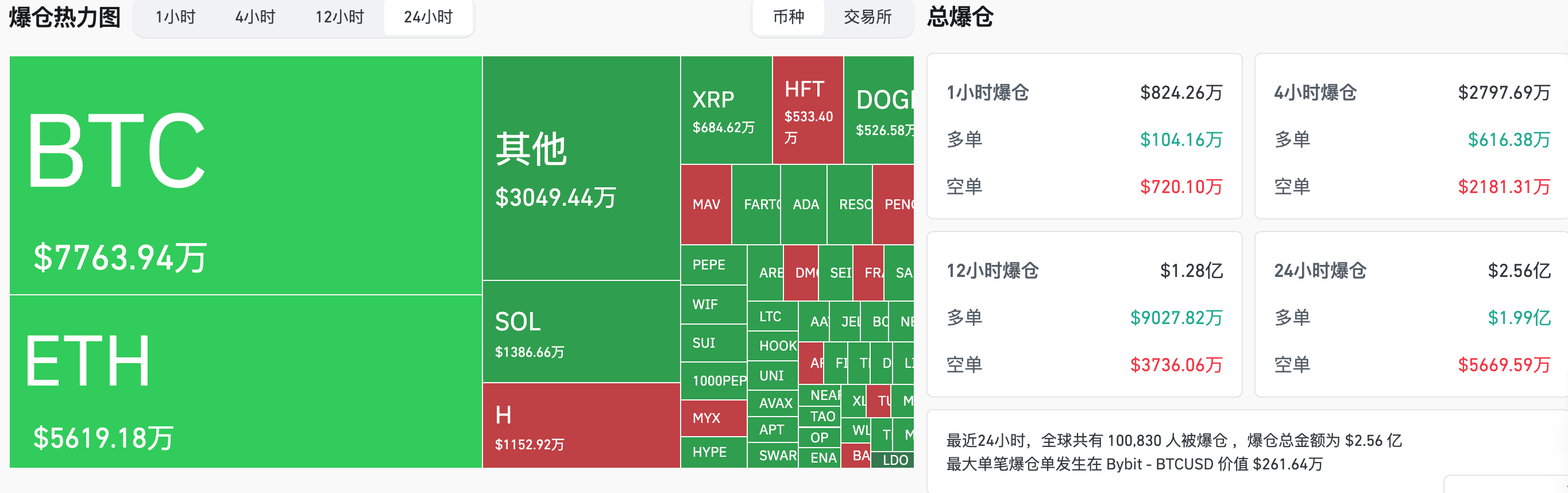

24-hour liquidation data: A total of 100,830 people were liquidated worldwide, with a total liquidation amount of US$256 million, including BTC liquidation of US$77.6394 million, ETH liquidation of US$56.1918 million, and SOL liquidation of US$13.8666 million

BTC medium- and long-term trend channel: upper channel line ($107,151.13), lower channel line ($105,029.32)

ETH medium and long-term trend channel: upper channel line ($2467.39), lower channel line ($2418.53)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of July 1)

Bitcoin ETF: -$342 million (15 consecutive days of net inflows ended)

Ethereum ETF: +40.6798 million USD (net inflow for 3 consecutive days)

4. Today’s Outlook

Due to the U.S. Independence Day, the U.S. stock market will close three hours in advance on July 3 (that is, at 1 a.m. on July 4, Beijing time); the market will be closed all day on July 4.

Rex-Osprey Solana Collateralized ETF Expected to Launch on July 2

U.S. ADP employment in June (10,000 people) : previous value 3.7, expected 9.5 (July 2, 20:15)

U.S. unemployment rate in June : previous value 4.2%, expected 4.3% (July 3 20:30)

U.S. June seasonally adjusted non-farm payrolls (10,000) : previous value 13.9, expected 11 (July 3 20:30)

Ethena (ENA) will unlock approximately 40.6 million tokens at 3 pm on July 2, accounting for 0.67% of the current circulation and worth approximately $10.7 million.

The biggest gainers in the top 500 by market value today: Humanity Protocol (H) rose 106.52%, Cobak Token (CBK) rose 50.90%, Useless Coin (USELESS) rose 24.89%, Quantum Resistant Ledger (QRL) rose 17.70%, and Aleo (ALEO) rose 16.68%.

5. Hot News

London-listed company Anemoi increases Bitcoin investment from 30% to around 40%

Bitfinex Alpha: BTC generally performs weaker in Q3, with an average return of 6%

Nasdaq-listed company LGHL has purchased HYPE, SOL and SUI worth $5 million

Move Foundation Reserve Wallet Receives 45 Million $MOVE from Binance, Currently Holds 168 Million

Trusta.AI announces $TA token economic model, 3% for airdrop

Trump family-related cryptocurrency project American Bitcoin raises $220 million for Bitcoin mining

Katana mainnet is officially launched, and a 1 billion KAT token incentive plan is launched

Circle applies for US banking license to custody USDC reserves

Robinhood plans to launch its own blockchain and launch “stock tokens” in the EU

US Treasury Secretary: Stablecoin legislation may be completed in mid-July

BitMine announces $250 million private placement and launches Ethereum financial strategy

JPMorgan Chase gave Circle an "underweight" rating and set a target price of $80 by the end of 2026

This article is supported by HashKey, the largest licensed virtual asset exchange in Hong Kong and the most trusted crypto asset fiat currency portal in Asia. HashKey Exchange is committed to defining new benchmarks for virtual asset exchanges in terms of compliance, fund security, and platform security.