By Peng SUN, Foresight News

The 2024 airdrop season has started. In addition to potential big names such as Cosmos, EigenLayer, Renzo, Berachain, etc., Foresight News has selected more than 10 airdrop projects worth paying attention to in the near future, covering Layer2, DeFi, Sui, Bitcoin, wallets, RWA, Cosmos game chain and other fields. Let's see what other opportunities you have to participate in these projects?

OP Mainnet

Community user OP Michael said that before April 2023, perhaps 20 million OPs will be used for airdrops. So far, three airdrops have been made, with a total of 19,411,313 OPs.

To obtain the fourth OP airdrop, you may still need to delegate OP to an active delegator. But at the same time, since the last airdrop was entirely focused on OP staking, the fourth airdrop may also adopt other standards, such as interacting with other OP super chains such as OP Mainnet, Base and Zora.

Scallop

The Sui ecosystem has experienced explosive growth in the past six months, with TVL exceeding $300 million, surpassing Bitcoin to become the third largest non-EVM chain. SUI also saw a strong rally some time ago, with the highest price rising to 1.45 USDT on January 15.

For an interpretation of Sui’s ecology, see Haotian: “Behind Sui’s brilliance: the “bloodline advantage” of the Move public chain and the new DeFi ecology that is expected to explode.”

Scallop is a lending protocol on Sui and a recent open airdrop project on Sui. Scallop TVL is now $61.4 million, ranking first in the Sui ecosystem. It is also the first DeFi project to receive funding from the Sui Foundation and has received investments from Comma 3 Ventures and OtterSec.

Scallop token SCA can be used for governance and voting, liquidity mining and loan interest fee discounts. The total supply of SCA is 250 million, 45% is used for liquidity mining, 18.5% is allocated to Scallop project contributors, 4% is used for development and operations, 2% is allocated to consultants, 11% is allocated to strategic partners, 7.5% is allocated to the ecosystem/community/market, 5% is used for liquidity, and 7% is allocated to the treasury.

On January 1, 2024, Scallop launched the airdrop points system and completed the first phase snapshot to reward Scallop's early supporters. Users can earn points based on their activity and participation in Scallop, and can use points to generate Mysterious Pearls. Mysterious Pearls are divided into different levels such as bronze, silver, gold, platinum, diamond, and legendary. After the token is launched, you can receive the airdrop.

However, the value of the second phase airdrop seems to be higher. The project owner said that the points in the first phase are different from those in the second phase, and the number and value of pearls that can be exchanged in the two phases will also be different. At the same time, most of the airdrops will be awarded to users in the second phase. Scallop has launched the second phase airdrop on January 16, which will last for 2 weeks.

- First, eligible borrowers who provided a time-weighted value of more than $100 on Scallop before the second phase of the airdrop can receive point rewards;

- Secondly, starting from January 16, users who provide liquidity and lending on Scallop during the second phase will also receive points. Snapshots will be taken every day, and points will be updated every 48 hours.

- A few days after the event ends, users can redeem points for mysterious pearls.

In addition, Scallop has been migrated from Solana to Sui. Early Solana voters and NFT holders of the previous Scallop DAapp will be rewarded in a separate reward pool, but will not be able to participate in the Scallop Mystery Pearl.

NAVI Protocol

NAVI Protocol is also a lending protocol on Sui. Its TVL is now $54.55 million, ranking second only to Scallop. NAVI Protocol is one of the 4th phase projects of OKX Web3 wallet Cryptopedia. On December 8, OKX Web3 wallet also launched the NAVI interest rate hike event, attracting a lot of liquidity.

NAVI Protocol has not yet announced the details of the airdrop, but has launched Leaderboard, which distributes points to users every week based on the total liquidity provided, lending volume, weekly activity, and Zealy points. According to the roadmap, NAVI Protocol utility tokens and governance tokens NAVI will be released in the first and second quarters of 2024.

StakeStone

Recently, under the leadership of EigenLayer, AltLayer, and Renzo, LST and LRT have become popular again. In this field, another project worth paying attention to is StakeStone.

StakeStone is a one-stop full-chain LST staking protocol, benchmarked against Lido, which can bring native staking income and liquidity to Layer2. It not only supports the top staking pool, but is also compatible with re-staking, and will integrate EigenLayer. StakeStone supports ETH beacon chain re-staking and LST re-staking, aiming to become the leading protocol in the re-staking track.

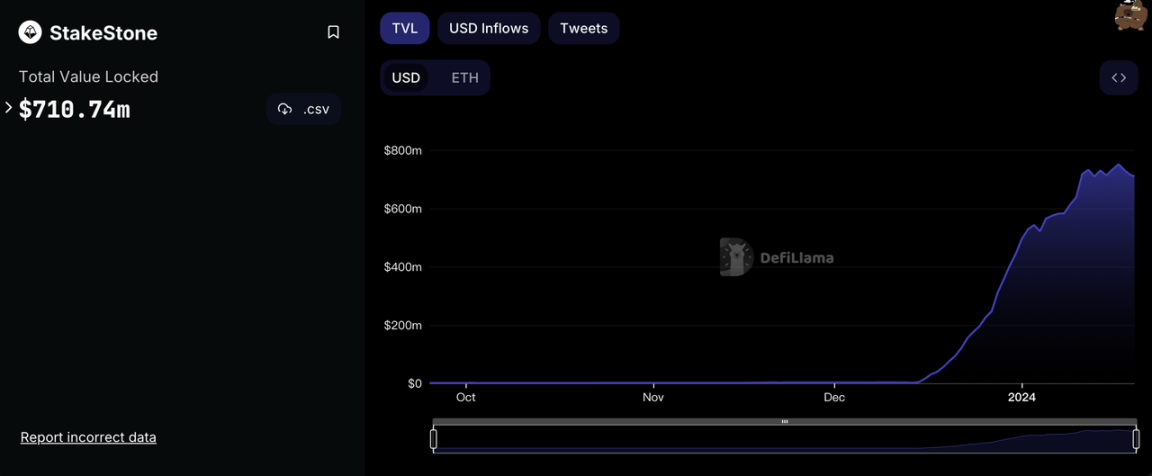

According to DefiLlama data, from December 15, 2023 to January 3, 2024, in just three weeks, StakeStone TVL soared from $4.17 million to $542 million, and the current TVL is $710 million. StakeStone is also deeply involved in Manta's incentive activities. In Manta New Paradigm's $900 million TVL, StakeStone provided $720 million in liquidity.

StakeStone's native LST is STONE, which has now been officially upgraded to a full-chain LRT. STONE is a LayerZero-based OFT that can be seamlessly used in multi-chain liquidity markets through STONE-Fi, such as DEX, AMM, lending, stablecoins, derivatives, GameFi, SocialFi, etc. STONE does not use a rebase mechanism, but is similar to Lido's wstETH in terms of generating revenue. In other words, the number of STONEs will not change with the changes in the revenue generated by ETH staking, but its value will increase with the increase in ETH staking revenue.

StakeStone has not yet issued a token, and the team is expected to launch airdrop-related activities. Currently, users can stake ETH in StakeStone and earn income from the STONE-Fi ecological protocol.

Kelp DAO

Another popular project in the re-staking track is Kelp DAO, which is also a multi-chain liquidity staking platform. Its founder previously founded the liquidity staking protocol Stader Labs. Stader is the second largest LSD protocol on Polygon and BNB Chain. According to DefiLlama data, Kelp DAO TVL is now US$167 million.

Kelp DAO is currently building an LRT solution on EigenLayer, and its re-staking token is rsETH. Currently supported LSTs include ETHx (Stader), sfrxETH (Frax) and stETH (Lido). Users can re-stake the above assets in exchange for rsETH. The reETH price is currently the base price for various rewards and staked LST. rsETH can be used in other DeFi protocols.

Currently, Kelp DAO has launched Kelp Miles incentives. Kelp Miles is used to track users' contributions to Kelp and to determine future reward distribution ratios. Kelp Miles depends on the user's LST re-staking amount and the number of days staked. Users who previously staked LST from December 12, 2023 to January 1, 2024 can receive 1.25 times Kelp Miles in the next 3 months. Users who stake LST after January 1 will receive Kelp Miles rewards as usual.

In addition, all users who re-stake on Kelp before the EigenLayer deposit cap is closed are eligible to receive EigenLayer Points, which will be distributed based on the amount of LST deposited by the user.

Kinza Finance

Kinza Finance is a decentralized lending protocol on BNB Chain. It uses the ve(3,3) model to handle protocol incentives and governance issues, allowing users to withhold collateral from borrowers, limiting trading risks, short selling opportunities, and governance manipulation. Kinza's core revenue comes from the interest paid by borrowers, most of which is paid to lenders who initially provide liquidity. Kinza's native token is KZA, and users can pledge KZA in exchange for xKZA, which can be used to vote and bribe the fund pool. xKZA, bribery, and voting functions will be launched after TGE.

According to DefiLlama data, Kinza Finance TVL rose from a peak of $1.89 million on November 1, 2023 to $78.06 million on January 15, 2024, and is currently $64.26 million.

In August 2023, Kinza Finance received investment from Binance Labs as one of the best performing projects in the sixth season of the MVB Accelerator Program. It is worth noting that in this MVB Accelerator Program, the other three projects invested by Binance are the Ethereum expansion project AltLayer, the perpetual DEX project KiloEx, and the AI blockchain-based virtual companion game Sleepless AI. Currently, AltLayer and Sleepless AI are available on Binance Launchpool.

The total supply of KZA is 100 million. The KZA airdrop will be conducted after the TGE (date has not yet been announced), and the team will allocate 5% of the total supply of KZA (5 million) for airdrop. In addition, 10% of the total supply of KZA will be allocated to the team, 12% to investors, 3% to advisors, 5% for reserves, 10% to the ecosystem, and 55% to the community.

Kinza has launched an airdrop points system, which will calculate the number of airdrops that can be obtained in the future based on the TVL deposited and the time they provide liquidity in the protocol. The longer the user provides liquidity, the more points they will receive, and the more eligible airdrops they will generate. Points and KZA are not exchanged 1:1. Kinza has provided an additional 10% reward to users who provided liquidity before the launch of the airdrop points system. New participants can participate in Kinza's airdrop referral program, and both the referrer and the referee will receive a 10% reward of the recommended user's airdrop allocation.

KiloEx

KiloEx is a sustainable DEX project on BNB Chain, opBNB and Manta. According to DefiLlama data, KiloEx TVL is currently $14.51 million.

KiloEx's native token is KILO and its custody token is xKILO. The total supply of KILO is 1 billion, 10% of which will be airdropped to early adopters, 34% to the ecosystem, 10% for staking rewards, 20% to the team, 10% to private sales, 10% to strategic investors, 5% to advisors, and 1% to liquidity providers.

KiloEx has launched the points airdrop plan V1.0. Points can be obtained through transactions, financial management, inviting new users, signing in, obtaining OAT, etc. on the three main networks of BNB Chain, opBNB and Manta. KiloEx Genesis NFT holders can receive xKILO token airdrops.

ZeroLend

ZeroLend is the largest native stablecoin lending protocol on zkSync and the third largest on Manta Network, with a current TVL of $22.23 million. ZeroLend is based on Aave V3, similar to Radiant Capital, supports account abstraction, provides ONEZ stablecoins, and will support RWA lending in the second quarter of 2024. It is planned to integrate the zkSync Hyperchain privacy layer in early 2025 to complete transaction privacy under compliance.

According to official documents, the total supply of ZeroLend's native token ZERO is 100 billion, of which 30% is allocated to private sales, 10% is used for liquidity, 5% is allocated to the team, 10% is allocated to the treasury, 7% is allocated to consultants, 3% is used for airdrops, and 35% is used for community incentives.

ZeroLend has launched the airdrop points platform Zero Gravity, where users can earn points by participating in on-chain interactions or inviting new users to earn points. The initial supply of ZeroLend token ZERO is about 10% to 18% of the total supply (official documents show 18.8%), of which 1% to 2% will be used for airdrops, accounting for about 10% of the circulating supply at launch.

In addition, ZeroLend stated that users who participate in Zero Gravity will also be eligible to participate in possible future airdrops such as PYTH, MANTA, and ZKS.

Halo Wallet

Halo Wallet is a DeSoc wallet developed by the former Web3 team of KuCoin. It has been integrated with Lens Protocol to access the user’s social graph and analyze on-chain transactions.

Halo Wallet has launched the XP points system, and users can purchase Genesis Pass to participate in wallet transactions, top up, like, etc. to obtain points. Points will be linked to future airdrops, and the airdrop plan is expected to be announced in the first half of the year.

Bool Network

BOOL Network is a decentralized signature protocol established in late 2020. The team has been researching Bitcoin Layer2 solutions and published an academic paper in 2022, Bool Network: An Open, Distributed, Secure Cross-Chain Notary Platform.

BOOL Network is worth paying attention to because this project may be the same team as SatoshiVM, which recently conducted an IDO on Bounce, and the SatoshiVM token SAVM IDO has increased nearly 300 times.

After community users uncovered the relationship between SatoshiVM and BOOL Network, BOOL Network said on Twitter, "The team is working closely with the SatoshiVM team to develop infrastructure in the Bitcoin and EVM fields. No BOOL has been issued yet, and there are no airdrops. However, we are closely monitoring all activities of partner projects, including SatoshiVM, to identify a good holder base."

Currently, according to the white paper on GitHub, the maximum supply of BOOL Network's native token BOOL is 1 billion, and the initial supply is 500 million. Among them, 3% of BOOL tokens will be used for airdrops, 50% will be allocated to miners (nodes), 12% to the team, 15% to investors, 10% to the foundation, and 10% to incentivize testnet users. BOOL can be used for gas fees, governance, and staking.

Tabi

Tabi (formerly Treasureland), an NFT market on BNB Chain, has recently announced that it will launch Tabi Chain, an EVM-compatible gaming blockchain on Cosmos, and will launch a testnet in February this year. According to Tabi, Tabi Chain has features or functions such as Omnicomputing, parallel sharding, supervised sharding (the integrity of the gaming experience is maintained by the Tabi supervisory node), and Tabi Runtime.

In 2023, Tabi completed a $10 million angel round of financing, with investors including Animoca Brands, Binance Labs, Draper Dragon, HashKey Capital, Infinity Ventures Crypto and Youbi Capital, and individual investors including Feng Bo (Dragonfly), Riyad AD (Saudi Arabia) and Suji Yan (Mask Network). This round of financing will be used to develop Tabi's gaming ecosystem and the upcoming on-chain identity protocol.

Tabi’s official website has launched 4 rounds of Voyagers Event, and its official Twitter account stated that completing this series of tasks will earn you airdrops.

Ondo Finance

Ondo Finance is a RWA tokenized investment protocol that has launched a tokenized fund that allows stablecoin holders to invest in bonds and U.S. Treasuries. It now offers three products: the U.S. Government Bond Fund (OUSG), the Short-Term Investment Grade Bond Fund (OSTB), and the High Yield Corporate Bond Fund (OHYG). Last year, Ondo launched the tokenized note USD Yield (USDY), which is backed by short-term U.S. Treasuries and bank demand deposits. Currently, Ondo has expanded to Polygon, Solana, and is listed on Coinbase.

In April 2022, Ondo Finance completed a $20 million Series A financing round, led by Founders Fund and Pantera Capital, with participation from Coinbase Ventures, Tiger Global, GoldenTree Asset Management, Wintermute, Flow Traders, Steel Perlot, and an Ivy League endowment fund. Shortly thereafter, Ondo raised $10 million through a token sale on CoinList, with over 18,000 people participating.

According to Coingecko data, ONDO has a total supply of 10 billion, a circulating supply of approximately 1.44 billion, and a market value of approximately US$390 million.

Recently, the Ondo Foundation has launched the first batch of Ondo Points Program, and the points ranking list is now online. It supports the use of Flux, holding OUSG or USDY to obtain retroactive points, and additional points can be obtained by minting USDY. Points can be obtained by holding mUSD in Mantle Network, etc.

Ondo Finance also supports earning points by providing USDY liquidity on Uniswap on Ethereum through Range Protocol, or providing liquidity on FusionX or Agnidex through Range Protocol on Mantle, or providing liquidity on Orca or Raydium through Kamino on Solana, as well as lending stablecoins overcollateralized by tokenized US Treasuries from Ondo Finance and earning points, etc. Points can also be earned by delegating ONDO or voting on proposals, and CoinList buyers who claim ONDO before March 31 will receive more points based on their stake.

In addition, Ondo will also launch the second batch of points program, and will cooperate with new projects to provide retroactive airdrops to the community.