Author: Weilin, PANews

As stablecoins and payments have gradually become the hottest crypto narratives of this round, leading crypto centralized exchanges (CEXs) have begun to lay out their plans for users' daily consumption payments, and the ecological layout around crypto credit cards, debit cards, and App payments has become increasingly fierce.

From Coinbase, Gemini, Crypto.com, to Kraken, Bybit, Bitget, Gate, KuCoin, etc., major trading platforms have launched or upgraded payment products to compete for the connection channel between crypto assets and the real world. Most crypto payment cards support major markets such as the European Economic Area and the United States, and many platforms provide 2%-10% crypto cashback benefits.

In this article, PANews will introduce the latest crypto payment cards or payment apps launched by these exchanges.

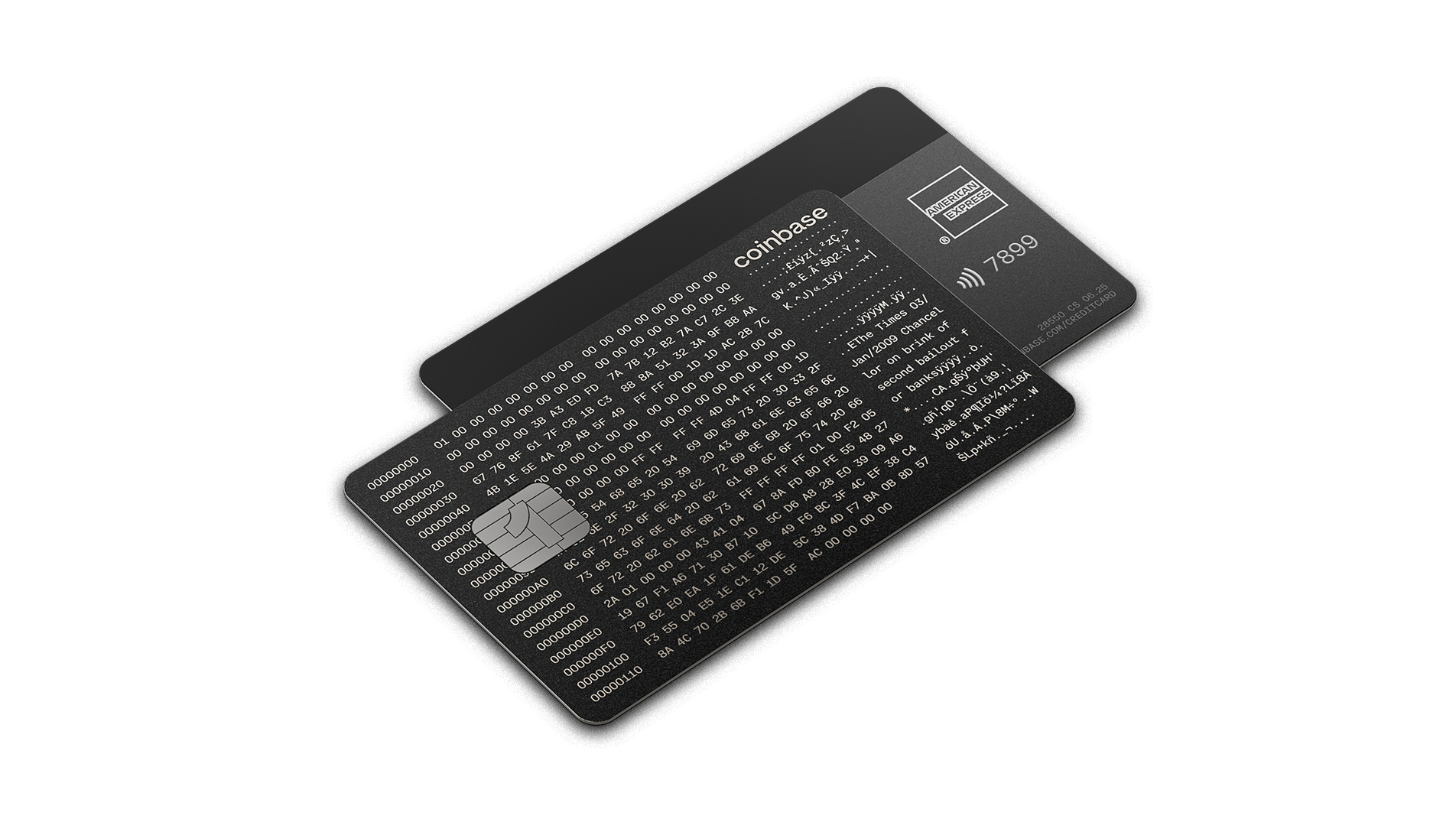

Coinbase: Leveraging the American Express network to launch Coinbase One Card

On June 13, Coinbase announced the launch of Coinbase One Card, which will be available only to U.S. members of Coinbase One. Coinbase One is the cryptocurrency platform's monthly subscription product that offers zero transaction fees, higher staking rewards, and other benefits. In addition, Coinbase has also launched a lower-priced "Basic" subscription package, powered by the American Express network, and Coinbase One Card is scheduled to be available in the fall of 2025.

Cardholders will be able to earn 2% to 4% back in Bitcoin, and users can enjoy experiences, protections and other benefits offered in conjunction with the American Express network. Coinbase One costs $29.99 per month, while the basic tier, which offers less Bitcoin back, costs $4.99 per month or $49.99 per year.

This is the first time Coinbase has launched a crypto credit card. It previously partnered with Visa to launch a crypto prepaid debit card in 2020.

Gemini: Return cryptocurrencies by consumption category, emphasizing instant reward mechanism

Gemini attracts users with a more flexible consumption rebate structure. Its annual fee-free credit card supports more than 50 cryptocurrencies as cash back. If users are approved for a credit card before June 30, 2025 and spend at least $3,000 within the first 90 days after opening an account, they can receive a $200 cryptocurrency reward.

A Mastercard that offers several benefits through the network, including points for Instacart and Peacock Premium, Gemini credit cardholders earn rewards in the form of optional cryptocurrency. Gemini offers rewards on the following types of spending:

- 4% back on the first $300 of gas and electric vehicle charging spending each month, and 1% back on the excess; the spending cycle resets on the 1st of each month

- 3% cash back on dining expenses

- 2% back on grocery purchases

- 1% back on all other eligible purchases

Gemini supports more than 50 cryptocurrencies, including mainstream currencies such as Bitcoin and Ethereum. Users can change the type of cryptocurrency they earn through consumption at any time. When applying for this credit card, you need to open a Gemini trading account.

Unlike many other credit cards, the rewards earned on the Gemini card cannot be used directly to pay off a loan. In addition, the Gemini credit card does not charge an annual fee or foreign exchange fees. However, if you sell or convert cryptocurrency rewards, you still need to pay the relevant transaction fees. The annual interest rate (APR) for loans on this card is 17.24%–29.24%, the late payment fee is up to $8, and the penalty for failed repayment is up to $35.

Crypto.com: Tiered cashback to create a crypto credit card incentive system

PANews introduced crypto.com's prepaid card in May, which is similar to a debit card and requires top-up. In June this year, crypto.com launched the Crypto.com Visa Signature credit card specifically for the US market.

The annual percentage rate (APR) for this card is 18.24%–32.24%, which fluctuates based on your credit status and the Prime Rate at the time of account opening; the balance transfer fee is 5% of the transfer amount or $10, whichever is higher; the foreign currency transaction fee is 3% of the transaction amount, calculated in US dollars.

Earn cryptocurrency rewards every time you spend with your card:

Obsidian: 6.5% in the first year, 5% thereafter

Rose/Icy: 5% return in the first year, 4% return thereafter

Jade/Indigo: 3.5% return in the first year, 3% return thereafter

Ruby: 2.5% in the first year, 2% thereafter

Midnight: 1.5% back

Note: First-year bonus rate is valid for 12 months from the date of tier upgrade or credit card activation.

Kraken: Launches payment app "Krak" to compete with Venmo and Paypal

Kraken, an exchange, entered the payment market in the form of an application. On June 26, Kraken officially released Krak: a new generation of integrated global currency application. Users can seamlessly manage more than 300 different fiat currencies and digital assets.

The Krak app will have the following features:

Peer-to-Peer Payments: Instantly and affordably send money to other Krak app users in 110 different countries. Using Kraktags, a personalized payment ID, users can seamlessly send and request payments across 300+ assets, including cryptocurrencies, stablecoins, and fiat currencies where available, without having to enter bank details or crypto wallet addresses.

Dedicated spending and earning accounts: Pay and earn rewards seamlessly, with no lock-in periods, minimum deposits or subscriptions.

Eligible users can receive up to 4.1% of their USDG stablecoin balance rewards, as well as additional income opportunities of up to 10% on more than 20 digital assets.

Krak's future development plans: Launch physical and virtual Krak cards, enable seamless spending with fiat currency and crypto assets at millions of merchants (online and offline) within the Krak app; a range of prepaid services including lending, loans and credit card programs.

Bybit: Focus on crypto debit cards, high-level users enjoy 10% cashback

The Bybit Card is a Mastercard crypto debit card that allows users to quickly and easily use cryptocurrency funds to spend anytime, anywhere. The Bybit Card is available in both virtual and physical versions and is currently available to users in the European Economic Area (EEA) and Switzerland, AIFC, Australia, Brazil, and Argentina.

The opening fee for a physical card is 10 euros. Users in the Eurozone will be charged a 2% handling fee for withdrawals exceeding 100 euros per month. Transactions using crypto assets will be charged 0.9% above the Bybit spot exchange rate, and foreign currency conversions will be charged an additional 0.5% on top of the Mastercard exchange rate.

When shopping, users can enjoy 2% to 10% cashback, depending on the Bybit VIP level. During the promotion phase of the card, Bybit offered 10% cashback to new Bybit cardholders who registered between January 1, 2025 and March 31, 2025. The fiat currency supported by this card is US dollars. Currently supported cryptocurrencies include: BTC, ETH, XRP, TON, USDT, USDC, MNT and BNB.

Bitget: Dual-card layout, Wallet Card and Credit Card each have their own focus

Bitget Wallet Card is a credit card that allows users to use crypto assets for daily consumption. Currently, the card is jointly issued by Bitget Wallet and Immersve, both subsidiaries of Bitget Exchange, based on the Mastercard network. Activate the card through identity authentication (KYC) to get 5U cashback. When using the card for consumption, non-US dollar consumption will incur a 1.7% fiat currency conversion fee, which will be automatically deducted during the conversion; if you use US dollars for consumption, you do not need to pay.

Currently supports residents of the following countries or regions: European Economic Area and the United Kingdom, Latin America (Argentina, Chile, Colombia, Ecuador, El Salvador, Guatemala, Mexico, Panama and Peru), Australia, New Zealand, and only provides services to whitelisted users.

The card opening fee is $10, which needs to be paid when activating the card. Cards issued by Immersve have no annual or monthly fees, and recharges are free. Currently, it supports recharging USDC on the Base network, and you can directly use the assets in the card for consumption. The daily spending limit is $5,000, and the annual spending limit is $100,000.

It supports binding with mainstream third-party payment platforms, including Apple Pay, PayPal and Google Pay, etc. It can also be used for consumption on many overseas e-commerce and service platforms, including but not limited to: Amazon, TikTok, ChatGPT, Grab, etc.

In addition, Bitget Exchange has also launched a crypto credit card based on the Visa network, which is currently only open to VIP users and can be applied for by invitation. There is no annual fee, and the first virtual card and physical card are issued free of charge. The transaction fee is 0.9%, and ATM withdrawals are charged an additional $0.65 plus 2%. Payments for cryptocurrencies are settled in US dollars, and there is no upper limit on Visa card spending. Cardholders must maintain a sufficient balance in their Bitget account to successfully pay. Users can use the Bitget card anywhere Visa is accepted. Currently, the Bitget card only supports Tether (USDT), but support for BTC, ETH, BGB, USDC and other currencies will be added soon.

MEXC: European users can apply, with a clear fee structure

MEXC Mastercard Debit Card supports applications from users in most countries within the European Economic Area. The recharge fee is 1%, the single transaction limit is 3,000 USDT; the monthly transaction limit is 30,000 USDT; the card capacity is 100,000 USDT.

The transaction fee within the European Economic Area (EEA) is 0, and the transaction fee outside the EEA is 2% (minimum 0.60 EUR per transaction). The monthly fee for this card is 1 EUR.

Although MEXC's official introduction to the card is relatively simple, it may become the entry-level choice for many European crypto users in the future due to its stable cost structure and wide applicable areas.

Gate: Rebates are combined with platform benefits to highlight the advantages of consumption scenarios

Gate Card is a crypto credit/debit card product launched by the Gate platform. It aims to make cryptocurrencies serve daily life. Users can trade by recharging cryptocurrencies or directly consuming crypto assets through trading accounts, and at the same time enjoy various rights and interests within and outside the platform.

The card currency is Visa-EUR, and there is no card opening fee for both virtual and physical cards. The payment type is top-up consumption, with a top-up fee of 0.9% and a foreign exchange fee of 0.2% for non-Euros (within Europe) and 2% for non-Euros (outside Europe). The daily spending limit is 25,000 EUR, and Gate Card supports Google Pay /ATM.

In terms of consumption scenarios, users can enjoy 1% USDT cashback for each purchase, 7% cashback for hotels and air tickets, Gate Travel exclusive offers, and 2% cashback for new users. Four cryptocurrencies as cashback: You can choose USDT, BTC, ETH, and GT as cashback.

KuCoin: Exclusive for users in the European Economic Area, supports real-time crypto-to-crypto exchange

KuCard currently supports VISA. KuCard VISA is only available to citizens and residents of the European Economic Area (EEA). It supports 54 different cryptocurrencies (KCS, USDT, USDC, BTC, ETH, XRP, etc.) and one legal currency (EUR). The application for a physical card is 9.99 euros per card. Euro transactions are free, non-euro transactions are charged 2%, ATM withdrawals are charged 2 euros, and international ATM withdrawals are charged 2% of the transaction amount.

KuCard supports instant cryptocurrency to fiat currency exchange, and crypto debit cards provide exclusive rewards and benefits to cardholders, such as shopping cashback, discounts at partner merchants, etc. KuCard sets a monthly cashback cap based on the user's account assets and VIP level. Ordinary users can get up to €30, while high-level VIPs can get up to €250 per month.

The debit card supports multiple cryptocurrencies, ensuring that users can use their favorite digital assets in daily transactions. KuCard supports Apple Pay and Google Pay.

Conclusion:

In general, most of the time in the past, the battlefield of crypto exchanges was mainly concentrated in the fields of spot, derivatives and pledge. Now, the payment track has become a new hot spot. From credit cards and debit cards to integrated payment applications and DeFi services, mainstream exchanges are trying to create a consumption closed loop of "trading is life".

Cooperation with traditional financial institutions (such as Visa, Mastercard, and American Express) is still a feasible path at present, but there are also exchanges trying to build independent wallets and stablecoin ecosystems, such as from Krak to Bitget Wallet. In the second half of 2025, as more exchange cards are officially rolled out, the global competition in crypto payments will enter an accelerated period. Which platform will stand out in the end? Let us wait and see.