Author: Asher, Odaily Planet Daily

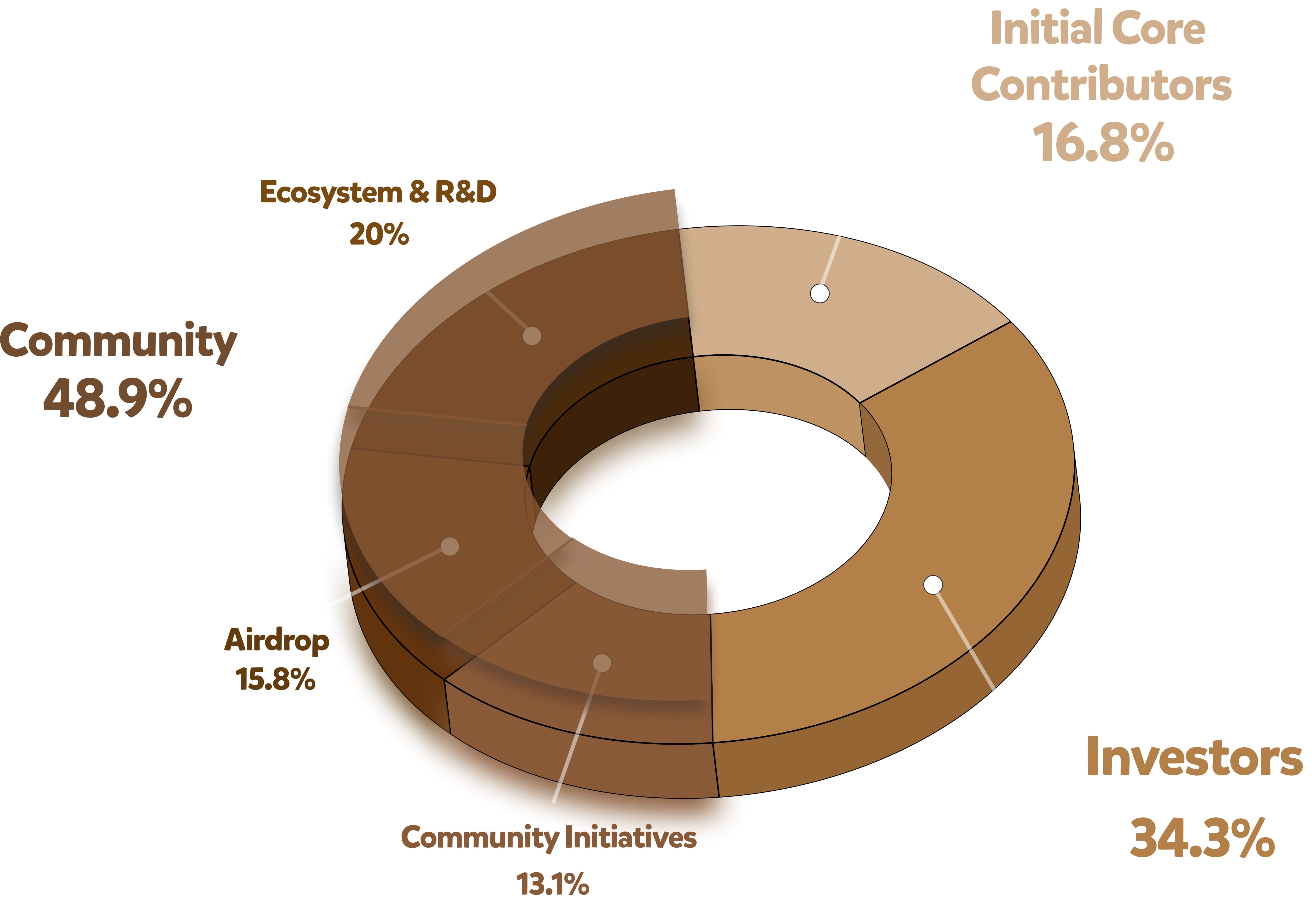

This morning, Berachain officially announced that the airdrop checker has been launched (airdrop query link: https://checker.berachain.com/) and the BERA token economic model has been launched. According to official documents, the initial total supply of Berachain's official token BERA is 500,000,000 tokens, and the maximum supply of tokens is unlimited (the annual inflation rate is about 10%). The specific distribution ratio is as follows:

- Initial core contributors: 84,000,000 BERA, accounting for 16.8% of the initial total supply, which will be distributed to advisors and Big Bera Labs members;

- Investors: 171,500,000 BERA, accounting for 34.3% of the total initial supply, which will be allocated to Berachain Seed, Series A and Series B investors;

- Community: 244,500,000 BERA, accounting for 48.9% of the total initial supply. This part of the tokens is subdivided into three parts: 1) Airdrop, accounting for 15.8% of the total initial supply, including testnet users, Berachain NFT holders, ecosystem NFT holders, social supporters, ecosystem dApps, community builders, etc.; 2) Future community initiatives, accounting for 13.1% of the total initial supply, will be used exclusively for applications, developers and users through incentive programs, grants, etc., and through snapshots, etc.; 3) Ecosystem and R&D, accounting for 20% of the total initial supply. 9.5% of BERA tokens will be unlocked during the token TGE for ecological growth, developer tools/infrastructure, liquidity configuration, etc.

BERA Token Economic Model

So far, many centralized exchanges including Binance, OKX, Bybit, Bitget, Korean exchanges Upbit, Bithumb, etc. have announced that they will launch BERA spot trading at 9 pm Beijing time today. In addition, it is worth mentioning that Binance will provide BERA airdrop rewards to users who subscribe BNB to SimpleEarn products between January 22 and January 26.

Berachain was listed on Binance and Upbit at the first launch. Will it become the next "king-level" project? Below, Odaily Planet Daily will take you to understand Berachain, which is defined by institutions as a new generation of super L1 public chain that breaks the liquidity dilemma of public chains.

Project Introduction: Highly funded L1 public chain

Berachain is an L1 public chain compatible with the Ethereum Virtual Machine (EVM), built on the Cosmos SDK, and originated from the Bong Bears NFT series in 2021. The project was first jointly initiated by several old OGs active in the top DeFi community. Although the founding team has deep experience and keen market insight in the DeFi field, developing a public chain requires a lot of technical support. It was during this process that the Berachain team established contact with the Polaris team, which focused on EVM compatibility development, and quickly reached a cooperation. The two teams worked together to promote the development of Berachain, and eventually formed the current public chain architecture.

On the technical level, Berachain will adopt the technical solutions provided by the Polaris team to build a high-performance public chain compatible with EVM, based on the Cosmos architecture. In terms of mechanism design, Berachain adopts a unique PoL (Proof of Liquidity) consensus mechanism to promote the prosperity and development of the DeFi ecosystem by incentivizing on-chain liquidity, aiming to create a more efficient and dynamic decentralized financial platform.

According to ROOTDATA data, Berachaina has completed two rounds of financing with a total amount of US$142 million. The specific information is as follows:

- On April 20, 2023, Berachain announced the completion of a $42 million Series A financing round, led by Polychain Capital, with participation from OKX Ventures, Hack VC, Dao5, Tribe Capital, Shima Capital, Robot Ventures, Goldentree Asset Management, former Dragonfly Capital partner and Celestia founder Mustafa Al-Bassam, Tendermint co-founder Zaki Manian, and 20 other DeFi project founders;

- On April 12, 2024, Berachain announced the completion of a $100 million Series B financing round, led by Brevan Howard Digital's Abu Dhabi branch and Framework Ventures, with participation from Polychain Capital, Hack VC, Tribe Capital and other institutions.

With its high financing background, the news of Berachain token inquiry immediately triggered heated discussions in major "money-making" communities. Users who had previously participated in the interaction went to check the number of tokens they received, but followed by various grievances on social media...

A "LuMao Studio": Over 1 million addresses participated in the test network interaction and only received more than 1,000 BERA tokens

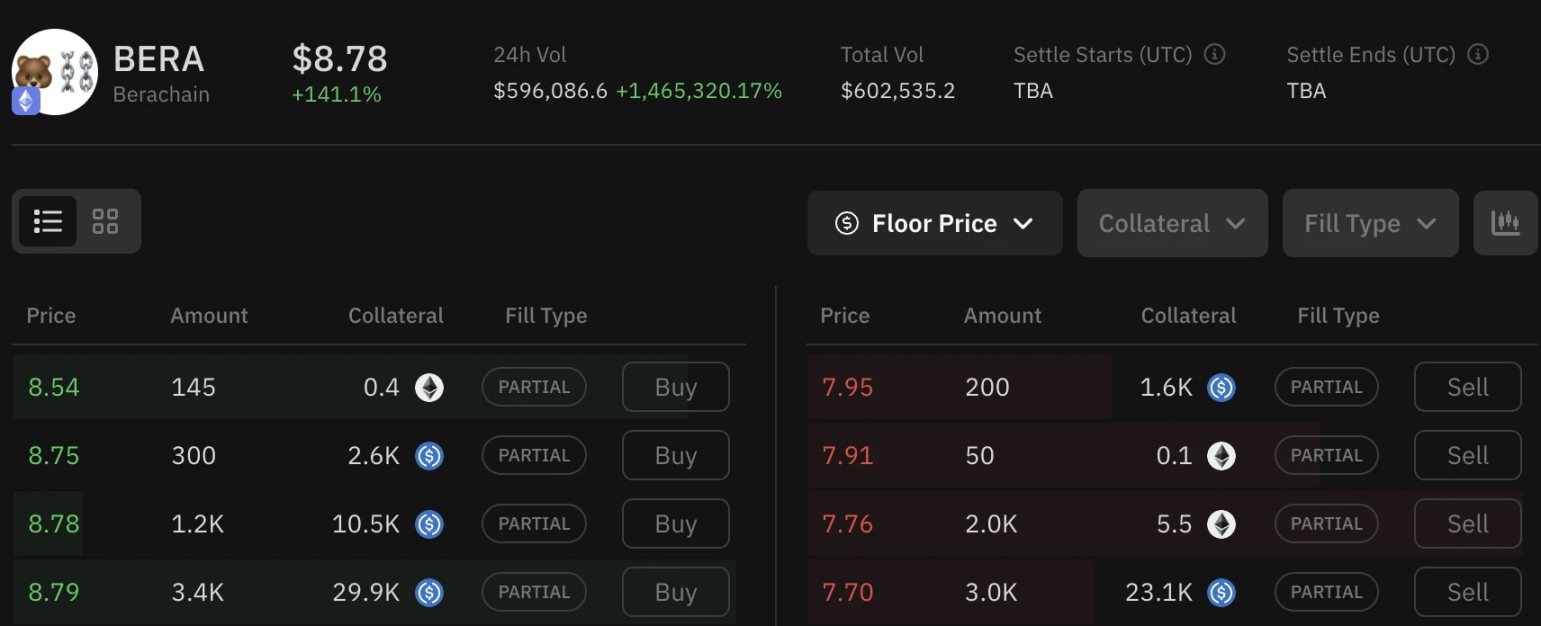

In response to the complaints from various communities about not receiving BERA token airdrops after participating in the Berachain testnet interaction, Odaily Planet Daily communicated with several "momo studios". It is understood that one of the studios complained: about more than 1 million testnet addresses were interacted, but in the end only more than 1,000 BERA token airdrops were obtained. According to Whales Markets data, the pre-market price of BERA tokens was about $8.8, which means that their earnings were only about $10,000, far below their expectations.

BERA pre-market price on Whales Markets

According to the interviewee, many “money-grubbing studios” were “wiped out” in the Berachain testnet interaction. They participated in many testnet interactions, but the tokens they ultimately received were not as many as those given by holding BNB. Therefore, you will see many “money-grubbing big players” posting on the X platform to ridicule themselves for “making too much money” to express their dissatisfaction with the project’s airdrop rules.

Not only did I not get the airdrop, but I was also forced to lock up my position for 3 months

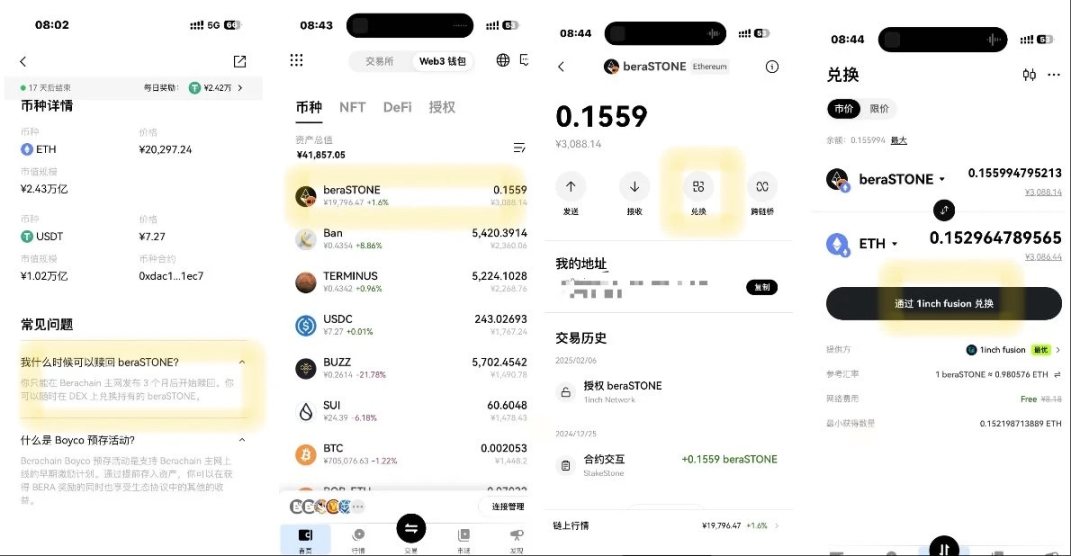

Not only the "money-grabbing party" who participated in the test network interaction, but also the users who participated in the Berachain pre-deposit were not spared and encountered "reverse-grabbing". Many users reported that they deposited funds on the first day of opening the pre-deposit channel despite the high gas fee, but when they checked today, there was no token at all.

What is even more frustrating is that the official announcement said that the withdrawal channel for pre-deposits will not be open until after the mainnet goes online (that is, three months from today), which has made many users extremely disappointed, as if they had "lost both the wife and the army."

If you admit the loss, you can also get back the ETH you previously deposited. According to community feedback, if you don’t want to wait until 3 months after the Berachain mainnet is launched to redeem the previously deposited ETH through the official channel, you can also exchange beraSOTNE for ETH through the unofficial pool right now. Currently, 1 beraSTONE can be exchanged for approximately 0.98 WETH, so excluding transaction fees, the net loss of exchanging back to ETH is about 2%.

So, will Berachain, which was first listed on Binance and Upbit, rise against the trend tonight amid the dissatisfaction of the "money-grabbing party", or will there be a situation where no one takes over and the opening price is at a high point? Odaily Planet Daily will continue to report.