1. Market observation

Keywords: tariffs, ETH, BTC

After a brief rebound, the U.S. stock market fell into panic again. On Thursday, the three major indexes fell by at least 5%, the S&P 500 index almost triggered the circuit breaker mechanism, and the Dow Jones index closed down more than 1,000 points. Under such market uncertainty, investors turned to safe-haven assets, pushing the price of gold above $3,210 per ounce, setting a record high. The domestic gold jewelry market also rose accordingly, with the price of most gold shops exceeding 990 yuan per gram, approaching the 1,000 yuan per gram mark. Peter Schiff, founder of Euro Pacific Capital, analyzed that the Trump administration's tariff policy would not only fail to solve the problem, but would aggravate the trade deficit. In the face of an uncertain economic outlook, gold, as an alternative to "sound money", has attracted more and more investors' attention.

At the same time, the cryptocurrency market is also facing severe tests. Glassnode data shows that Bitcoin has fallen below several key technical indicators, including the 111-day moving average ($93K) and the 200-day moving average ($87K), and even touched the 365-day moving average ($76K). Currently, the price of Bitcoin fluctuates between $131K and $72K, but is close to the lower limit of $72K. Glassnode analysts are worried that if it falls below this level, it may cause a collapse in investor confidence and lead to further price declines. Although the market is under short-term pressure, there are still optimistic factors. QCP Capital pointed out that investors are still buying December $100,000 call options, indicating that the market still has hope that Bitcoin will return to $100,000 by the end of the year. In addition, the market trading activity has declined significantly. CryptoQuant data shows that the spot trading volume of Bitcoin has dropped from $44 billion in early February to $10 billion at the end of the first quarter, a drop of 77%; the trading volume of altcoins has shrunk from $122 billion to $23 billion, a drop of more than 80%. These data show that investors have reduced their participation due to market uncertainty.

In terms of regulation, the US SEC approved Ethereum spot ETF options trading, involving institutional products such as BlackRock, Bitwise and Grayscale. The SEC also issued a guide to securities issuance and registration disclosure in the crypto asset market to provide guidance for further clarifying the applicability of federal securities laws in the crypto asset market, covering equity and debt securities related to networks, applications and crypto assets, including disclosure requirements for crypto assets as part of investment contracts. In addition, Trump has signed a joint congressional resolution to formally revoke the IRS crypto tax rules (DeFi broker rules) passed at the end of the Biden administration, which originally required "custodial brokers" to collect and report user data to tax authorities. According to Solid Intel, there are currently 100 listed companies in the world that hold Bitcoin on their balance sheets, covering multiple industries such as cryptocurrency, mining, technology, media, energy, finance and healthcare.

From a macro perspective, market concerns about a U.S. recession are intensifying. Goldman Sachs' latest research report shows that the U.S. stock bear market may last longer, and the current event-driven bear market caused by tariffs can easily evolve into a cyclical bear market. Bridgewater Fund founder Ray Dalio warned that Trump's tariff policy has caused "permanent trauma" and that the unusual movement of U.S. bonds has exposed signs of capital flight. He asserted that "someone will definitely be liquidated" and emphasized that "another frightening market trend will eventually appear." Federal Reserve officials have also expressed concerns. Boston Fed President Collins pointed out that inflation caused by tariffs may delay further interest rate cuts. Her staff estimated that an effective tariff of more than 10% on imported goods would increase the Fed's preferred basic inflation indicator by 0.7 to 1.2 percentage points cumulatively. In addition, former U.S. Treasury Secretary Summers also warned that the United States may be heading towards a recession, which could cause about 2 million Americans to lose their jobs and each family would face at least $5,000 in income losses. Amid this uncertainty, investors are moving away from U.S. assets and turning to safe-haven assets such as gold, Swiss francs and yen.

2. Key data (as of 12:00 HKT on April 9)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

Bitcoin: $80,532.05 (-13.76% year-to-date), daily spot volume $42.347 billion

Ethereum: $1,539.43 (-53.73% year-to-date), with a daily spot volume of $20.674 billion

Fear and Corruption Index: 25 (panic)

Average GAS: BTC 2.01 sat/vB, ETH 0.48 Gwei

Market share: BTC 62.4%, ETH 7.2%

Upbit 24-hour trading volume ranking: XRP, AERGO, BTC, GAS, UXLINK

24-hour BTC long-short ratio: 1.0708

Sector gains and losses: AI sector rose 3.68%, DePIN sector rose 2.89%

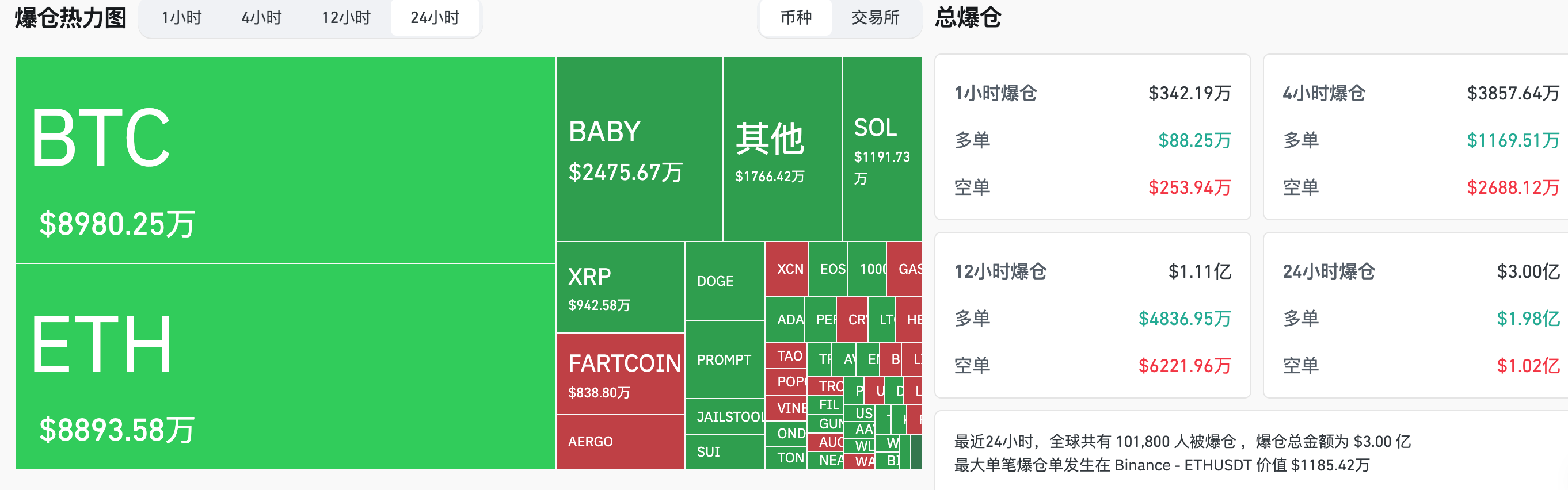

24-hour liquidation data: A total of 101,800 people were liquidated worldwide, with a total liquidation amount of US$300 million, including BTC liquidation of US$89.8 million and ETH liquidation of US$88.93 million

BTC medium and long-term trend channel: upper channel line ($82180.69), lower channel line ($80553.35)

ETH medium and long-term trend channel: upper channel line ($1706.34), lower channel line ($1672.55)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of April 10 EST)

Bitcoin ETF: -$150 million

Ethereum ETF: -$45.22 million

4. Today’s Outlook

FTX will conduct the second distribution on April 11

Axie Infinity (AXS) will unlock 8.43 million tokens on April 11, worth approximately $24.2 million

Aptos (APT) will unlock 11.3 million tokens on April 12, worth approximately $58.4 million

Cheelee (CHEEL) will unlock approximately 20.81 million tokens on April 13, worth approximately $161 million;

U.S. PPI annual rate in March (April 11, 20:30)

Actual: To be announced / Previous value: 3.2% / Expected: 3.3%

The biggest increases in the top 500 stocks by market value today: GPRO up 108.27%, XCN up 67.04%, AERGO up 64.06%, SWFTC up 39.66%, and ZRC up 34.15%.

5. Hot News

One address sold CryptoPunk NFT for about $6 million, losing tens of millions of dollars

Trump signs bill to revoke Biden administration crypto tax rules

A whale who previously sold ETH to pay off his loan sold another 9,000 ETH

White House: Tariff levels will be reduced to a general 10% during negotiations

Binance Wallet to Host Mind Network (FHE) Token Generation Event

Tether Treasury issues 1 billion USDT on Tron chain, and has issued 8 billion USDT so far this year

glassnode: If BTC falls below $72,000, it may face greater downside risks