1. Structure and core meaning

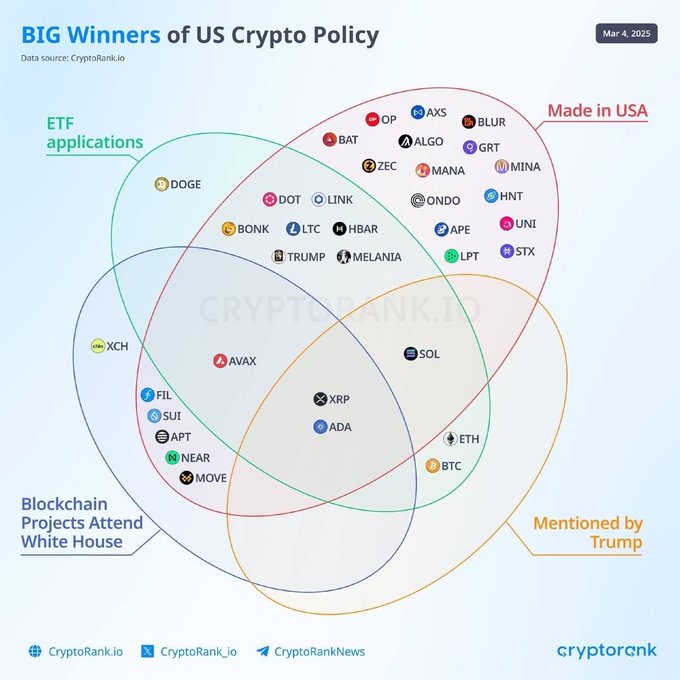

The following chart shows several major benefits of U.S. cryptocurrency policy, including:

1. ETF Applications: Green area. ETF is an important tool in the traditional financial market. The launch of cryptocurrency ETFs means that these projects are more accepted by institutional investors and mainstream financial markets. The approval of Bitcoin and Ethereum spot ETFs in 2024 has proven the role of ETFs in driving market prices and adoption.

2. Blockchain Projects Attend White House: Red zone, this category indicates that these projects may be involved in direct dialogue or policy-making activities with the US government. The attention of the White House usually means that these projects are important in terms of regulatory compliance, technology applications (such as supply chain management, decentralized identity), or national strategy.

3. Mentioned by Trump: Orange area, Trump's attitude towards cryptocurrencies has changed from criticism to support in recent years, especially during the 2024 campaign, when he publicly supported cryptocurrencies and launched his own NFT project and MEME coins. Projects mentioned by Trump may gain market attention and short-term price boost due to their celebrity effect.

4. Cryptocurrency projects headquartered in the United States (Made in USA): Orange area. They may have a natural advantage in policy support, especially in the context of Sino-US technological competition.

2. The significance of overlapping areas

Double overlapping areas: Projects appear in two categories at the same time, indicating that they have advantages in multiple aspects. For example, BTC (Bitcoin) and ETH (Ethereum) are both in the "ETF application" and "Trump mentioned" areas, showing their dual benefits in policy support and public attention.

Triple overlap area: Located in the center of the graph, it includes SOL (Solana), XRP (Ripple) and ADA (Cardano). These projects meet the three conditions of "ETF application", "White House participation" and "Trump mention" at the same time, and are the biggest potential beneficiaries of the US cryptocurrency policy.

III. Classification and analysis of specific projects

1. Triple positive projects (central area: ETF + White House + Trump mentioned)

These projects are located in the overlapping parts of the three regions and are the “core winners” of policy support.

SOL (Solana):

Background: Solana is a high-performance Layer 1 blockchain known for its high throughput and low transaction costs, and is one of Ethereum's main competitors.

Analysis: Solana appears in the center area, indicating that it has received high attention in US policy making, and may be applying for an ETF, while also receiving Trump's approval. Solana's high performance makes it widely used in DeFi (decentralized finance) and NFT (non-fungible tokens), which may have attracted the government's interest, especially relying on the leading edge of MEME coins to obtain a larger share of active users on the chain. )

XRP (Ripple):

Background: Ripple is mainly used for cross-border payments, and its token XRP has long been in legal dispute with the U.S. Securities and Exchange Commission (SEC) (starting in 2020).

Analysis: XRP's presence in the central area may indicate that its legal issues are being resolved or that its position at the policy level has been improved. The SEC's regulatory attitude towards cryptocurrencies has eased in 2024, and if XRP can pass the ETF application, it may usher in a large-scale inflow of funds.

ADA (Cardano):

Background: Cardano is a blockchain project that focuses on academic research and layered architecture, and is known for its scientific approach and sustainability.

Analysis: Cardano’s position in the central region indicates that it has gained more recognition in the US market and may play a role in policy making or government cooperation. Its technical strength may make it a candidate project for government support.

2. Double-benefit projects

ETF Application + Trump Mention (Green + Orange Area)

BTC (Bitcoin):

Background: Bitcoin is the cryptocurrency with the largest market capitalization and is regarded as digital gold. In early 2024, the United States approved a Bitcoin spot ETF, which boosted its price and institutional adoption. In 2025, BTC will be actively promoted to become a strategic reserve currency in the United States and even in various countries and major listed companies.

Analysis: Bitcoin appears in both the "ETF application" and "Trump mentions" areas, indicating that its market position is solid. Trump's mention may further enhance its public image and attract more retail investors.

ETH (Ethereum):

Background: Ethereum is the second largest cryptocurrency, supporting smart contracts and the DeFi ecosystem. In May 2024, the Ethereum spot ETF was approved.

Analysis: Ethereum’s position in this area reflects its dual advantages in policy and public attention. The wide application of the Ethereum ecosystem makes it a focus of institutional investment.

White House involvement + Trump mentions (red + orange areas)

TRUMP:

Background: Probably a Trump-related meme coin or token, common in celebrity-driven projects.

Analysis: Its appearance in this area shows that it is more based on Trump's personal influence than technical strength. Such tokens are usually more volatile and suitable for short-term speculation.

MELANIA:

Background: Possibly a token or project related to Trump’s wife Melania.

Analysis: Similar to TRUMP, the MELANIA token may also be based on the celebrity effect and lacks long-term technical support.

HBAR (Hedera):

Background: Hedera is an enterprise-grade blockchain that uses a hashgraph consensus mechanism and is suitable for use cases such as supply chain management and decentralized identity.

Analysis: Hedera's presence in this area indicates that it may have in-depth cooperation with the US government and has attracted the attention of Trump. Its enterprise-level applications may give it long-term development potential with policy support.

ETF Application + White House Involvement (Green + Red Area)

There are no projects in this area, indicating that there are currently no projects that meet both the "ETF application" and "White House involvement" conditions that were not mentioned by Trump.

3. Single Category Project

3.1 ETF Application (Green Area)

Projects: DOGE (Dogecoin), BONK, XCH (Chia), AVAX (Avalanche), FIL (Filecoin), SUI, APT (Aptos), NEAR, MOVE.

analyze:

Meme coins: DOGE and BONK are meme coins with strong community drive but limited technical applications. Their application for ETFs may be more to attract retail investors.

Layer 1 blockchain: AVAX, SUI, and NEAR are high-performance Layer 1 blockchains that, similar to Solana, may seek to enter traditional financial markets through ETFs.

Storage and Infrastructure: The technologies of projects such as FIL (decentralized storage) and XCH (green blockchain) have wider applications, and ETF applications may reflect institutions’ optimism about their long-term value.

3.2 White House involvement (red area)

Projects: LTC (Litecoin), LINK (Chainlink), DOT (Polkadot).

LTC: Litecoin is a fork of Bitcoin with faster transaction speeds and may be of interest in government payment or settlement scenarios.

LINK: Chainlink provides decentralized oracle services and is a key infrastructure for the DeFi ecosystem. Its White House involvement may be related to data credibility.

DOT: Polkadot is a cross-chain protocol designed to connect different blockchains, and its technology may attract government interest in interoperability.

3.3 Trump mentioned (orange area)

Projects: OP (Optimism), AXS (Axie Infinity), BAT (Basic Attention Token), ZEC (Zcash), MANA (Decentraland), ONDO, APE (ApeCoin), LPT (Livepeer), UNI (Uniswap), STX (Stacks).

analyze:

Diversity: This area includes various types of projects such as Layer 2 solutions (OP), DeFi (UNI), games (AXS), privacy coins (ZEC), metaverse (MANA), etc., reflecting the breadth of projects mentioned by Trump.

Speculative: Trump's mention may be more for market speculation rather than based on technical evaluation. These projects may rise in the short term due to increased attention, but their long-term value depends on their fundamentals.

3.4 Made in USA (sub-label in the orange area)

Projects: BLUR (NFT Marketplace), ALGO (Algorand), GRT (The Graph), MINA, HNT (Helium).

analyze:

Made in the USA: These projects originated in the United States and may have an advantage in policy support. For example, ALGO and GRT are infrastructure projects that focus on high-performance blockchain and data indexing, respectively, and may benefit from the government's priority support in the field of technology.

Technology application: The technological innovations of projects such as HNT (Internet of Things) and MINA (lightweight blockchain) may make them more attractive in policy making.

IV. Macro Trends and Policy Background

4.1 Promotion of ETF

Historical background: 2024 is a breakthrough year for cryptocurrency ETFs, with the Bitcoin spot ETF (approved in January) and the Ethereum spot ETF (approved in May) injecting a large amount of institutional funds into the market.

Trend in the figure: More projects (such as SOL, XRP, ADA, AVAX, etc.) are applying for ETFs, indicating that the integration of cryptocurrency and traditional finance is accelerating. The launch of ETFs may significantly increase the market value and adoption rate of these projects.

4.2 Trump’s influence

Background: Trump's attitude towards cryptocurrency has changed from criticism to support in recent years. He publicly supported cryptocurrency many times during the 2024 campaign and even launched his own NFT project.

The figure shows that Trump mentioned a wide variety of projects, including meme coins (TRUMP, MELANIA), DeFi (UNI), games (AXS), etc., reflecting that his influence is mainly concentrated on market hype and public attention rather than technical evaluation.

4.3 White House involvement

Background: The US government's attitude towards blockchain technology is shifting from regulatory pressure to cooperation and support. Projects that the White House is involved in may involve areas such as decentralized identity, supply chain management or financial innovation.

The figure shows that projects such as SOL, XRP, and HBAR are in the White House's participation area, indicating that they may play an important role in policy making.

4.4 Advantages of American Manufacturing

Background: In the context of Sino-US technological competition, the US government may give priority to supporting domestic blockchain projects to ensure technological sovereignty.

The figure shows that projects marked as "Made in USA" (such as ALGO, GRT, HNT) may gain long-term development advantages with policy support.

V. Potential Market Impact

5.1 Central Area Projects (SOL, XRP, ADA)

Market prospects: These projects have become the biggest winners due to triple benefits and may attract more institutional funds and retail investors.

Specific impact:

SOL: Solana’s high performance may make it the first choice in the DeFi and NFT fields, and the approval of the ETF may drive its price further up.

XRP: If its legal issues with the SEC are resolved, ETF approval could trigger massive capital inflows.

ADA: Cardano’s scientific approach may give it an advantage in government cooperation and has great potential for long-term development.

5.2 ETF related projects (BTC, ETH, AVAX, etc.)

Market prospects: The launch of ETFs will bring more institutional funds to these projects and enhance market value.

Specific impact:

BTC and ETH: ETFs have been approved, market position is solid, and Trump’s mention may further attract retail investors.

AVAX, SUI, NEAR: If the ETF is approved, they may become the beneficiaries of the next wave of high-performance blockchains.

5.3 Projects mentioned by Trump (TRUMP, MELANIA, UNI, etc.)

Market Outlook: These projects may rise in the short term due to hype, but their long-term value depends on their fundamentals.

Specific impact:

TRUMP, MELANIA: Meme coins have obvious characteristics and high volatility, making them suitable for short-term speculation.

UNI, OP: DeFi and Layer 2 projects have strong technical capabilities, and Trump’s mention may bring them more attention.

5.4 White House Participation Projects (HBAR, LINK, DOT, etc.)

Market prospects: These projects may obtain more government contracts or policy support and have great long-term development potential.

Specific impact:

HBAR: Enterprise-level applications may give it an advantage in government collaboration.

LINK: The widespread use of oracle services may make it a bridge for DeFi and government cooperation.

VI. Conclusion

Biggest winners: Solana, XRP, and Cardano are the core beneficiaries due to the simultaneous satisfaction of triple benefits, and are likely to excel in terms of policy support and market performance.

Market leaders: Bitcoin and Ethereum continue to dominate, with ETFs and Trump mentions adding more attention.

Policy support: Projects in which the White House is involved (e.g., HBAR, LINK) may benefit from government cooperation in the long term.

Made in the USA: Projects originating in the United States (e.g., ALGO, GRT) may gain competitive advantages with policy support.