Securitize, a leader in the tokenization of real-world assets (RWAs), today announced a partnership with blockchain oracle service provider RedStone to provide data support for existing and future tokenized products including the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), Apollo Diversified Credit Tokenized Fund (ACRED), and Hamiltonland Preferred Credit Opportunities Feeder Fund.

Using tokenized RWA to promote the traditional financial chain

By 2025, the global securities market is expected to be valued at $300 trillion, in stark contrast to the current decentralized financial market size of about $90 billion, and also highlights the huge growth potential of the on-chain economy. With the inherent advantages of blockchain technology over the traditional closed financial system, traditional financial giants are increasingly interested in asset tokenization and access to the DeFi ecosystem. As a pioneer in RWA tokenization, Securitize is working with top global asset management institutions such as BlackRock, Apollo, Hamilton Land and KKR to jointly promote the on-chain migration of the $300 trillion securities market.

Carlos Domingo, co-founder and CEO of Securitize, said: "To fully realize the potential of blockchain technology, tokenized securities must thrive on permissionless public chains such as Ethereum, which are the most efficient settlement layer for value transfer. Partnering with RedStone not only allows us to trade tokenized securities on-chain, but also integrate them into existing DeFi infrastructure and develop new financial primitives, achieving a deep integration of traditional financial giants and crypto-native applications."

How Securitize leverages RedStone

New assets on the chain cannot be used directly in DeFi protocols. They need to build secure price streams through blockchain oracles to reflect the market value of tokens in real time to ensure that they can be safely integrated into DeFi applications. As the official oracle partner of Securitize, RedStone will provide price data for tokenized RWAs such as BUIDL. Securitize selected RedStone as the first oracle service provider to create price streams for its assets.

The initial cooperation will cover the net asset value (NAV) data stream (using both push and pull modes) and daily interest rate data streams from networks such as the Ethereum mainnet. These data streams will enhance fund transparency and stability and increase investor appeal. RedStone's services will greatly expand the application scenarios of underlying assets, such as building a tokenized asset money market trading platform or as DeFi collateral, opening up new use cases for the DeFi market and attracting on-chain economic participants who focus on improving the utility of RWA.

Why RedStone is the best solution for RWA

The Securitize and RWA sectors require accurate, reliable, and adaptable data infrastructure, and RedStone is the ideal choice. With the deepest price discovery capabilities and high-fidelity data, RedStone has maintained a zero-pricing error record since its launch, ensuring unparalleled accuracy and credibility. Its modular architecture supports customized pricing plans for RWA providers, providing the flexibility required for seamless integration.

RedStone provides secure and high-quality data flow, easily supports EVM and non-EVM chains, and safeguards Securitize's unlimited growth in the DeFi field. Users can get trust, compliance and reliability under the endorsement of the highest security standards. By choosing RedStone, Securitize has gained the cornerstone to accelerate the adoption of RWA and reshape the future of DeFi.

Marcin Kazimierczak, Co-founder and COO of RedStone, said: "Securitize has established itself as a leader in the tokenized asset space. After months of due diligence, we are honored to be the first oracle partner to support their expansion into the DeFi ecosystem. RedStone has become the fastest growing blockchain oracle based on its modular infrastructure, and we will help Securitize accelerate its product penetration into DeFi and on-chain finance."

On-chain finance is the future

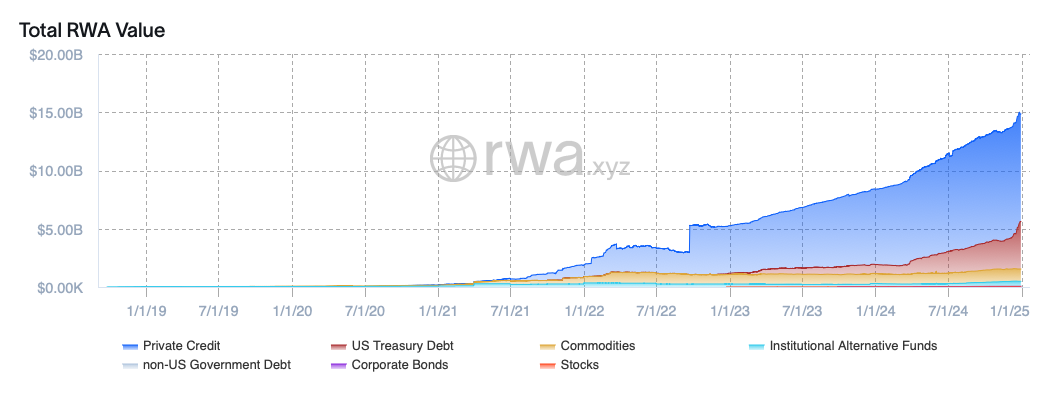

As an emerging sector of the on-chain economy (excluding stablecoins), RWA currently has a total market value of approximately $15 billion. The demand for crypto assets by institutions is self-evident - Bitcoin ETF is hailed as the most successful ETF issuance in history, and products such as BUIDL highlight the market's desire for tokenized assets. These trends are strengthening the legitimacy of DeFi. (Data source: rwa.xyz)

As the technology attention and DeFi potential increase, it may usher in exponential growth in the next few years. Securitize has seized the demand for tokenized assets with its unique positioning, and RedStone is honored to be its oracle partner to promote the deep integration of traditional finance and DeFi in a unified on-chain financial environment.

About RedStone

RedStone is a modular oracle focused on DeFi and on-chain financial interest-bearing assets, especially serving value-accumulating stablecoins, liquid pledge and re-pledge tokens. It provides secure, reliable and customizable data streams for more than 60 chains and is trusted by institutions such as Ethena, Securitize, and Morpho.

About Securitize

As a leader in RWA tokenization, Securitize has promoted the global asset chain through tokenized funds through cooperation with top asset management institutions such as Apollo and BlackRock. Its subsidiaries hold SEC-registered brokers, digital transfer agents, and fund administrators, operate SEC-regulated alternative trading systems (ATS), and were selected as one of the top 50 global financial technology companies in 2025 by Forbes.

Compliance Statement

Securities are issued through Securitize Markets, LLC, a FINRA/SIPC member broker-dealer. Securitize Markets and its affiliate Securitize Capital (an exempt reporting advisor) do not participate in the RWA tokenization service. Digital assets are high-risk speculative assets with poor liquidity and market manipulation risks. Securitize, Inc. is a technology provider, its affiliate Securitize, LLC is an SEC registered transfer agent, Securitize Markets operates an alternative trading system, and Securitize Capital is a Florida registered exempt advisor.