Author:Haotian

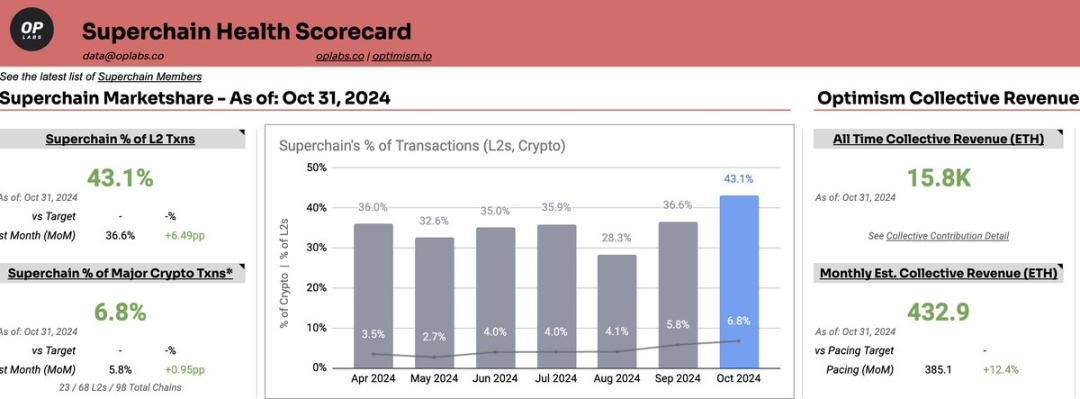

After looking at @OptimismSuperchain's profit and ecosystem data for the past year, I extracted a few key indicators to share:

1) OP Superchain has earned a total of 15,849 ETH so far, of which @base contributed 2,878 ETH. The income structure is: OP Mainnet's on-chain net profit + OP Stack chain's 15% on-chain net profit share/2.5% of total income); since this data is not directly compared with other L2's income data, it will not be evaluated.

2) The OP Superchain ecosystem has expanded to 35 chains, including 33 L2 chains and 2 L3 chains. The statistics may not be complete, as more than half have not yet been launched, but it shows that the OP Stack is developing rapidly.

3) Base chain is the best developed chain in the Superchain ecosystem, with 6.9M daily Txns and 205M monthly Txns, which is 10 times the 22M of OP Mainnet. It can be seen that the decision to incorporate Base into the Superchain was very successful.

4) In April, when the market conditions were good, Superchain earned 1,189 ETH in a single month, of which Base accounted for 48.4%, OP Mainnet accounted for 51%, and other chains accounted for 0.6% in total; it can be seen that the strategic effect of OP Stack is currently manifested on the Base chain, and other L2 alliances have not yet gained momentum.

5) The 48.4% revenue that the Base chain contributes to the Super Chain only accounts for 15% of its total revenue, while the 51% contributed by OP Mainnet is all of its net profit, which shows that the actual revenue of the Base chain is quite considerable, about 6 times that of OP Mainnet.

In general, this data can truly reflect the current development status of OP SuperChain. It is still in its early stages. Only the Base chain has been launched, and other chains are still in their infancy.

Strangely, this table does not list OP Superchain’s expenses, but we can make a rough estimate through other public data.

Recently, OP provided 25 million OP tokens to Kraken to develop the new OP Stack layer2 network Ink, which is a big deal. Its six consecutive rounds of RetroFund have also distributed more than 60M OP tokens. The OP tokens it promised to the Base network account for 2.75% of the total supply (given in six years), plus its occasional sponsorship or resource replacement expenses for some specific networks. This part of the expenditure is not small: (The following is a rough estimate, inaccurate for reference only)

Not to mention the investment in incentives for developers and the community ecosystem, let’s just take Base as an example and calculate the input and output.

Investment: 4.3 billion OP * 2.75% = 118 million OP % 6 = 20 million OP / year; Income: Contributed 2,500 ETH in the past year (Since Base has been online for 15 months, a total of 2,878 ETH minus 3 months of income). Based on the current prices of ETH and OP, it is equivalent to an investment of $30 million in cost and a return of $6.25 million.

In literal comparison, it is definitely a "losing" business. Of course, if the OP Foundation does not regard $OP expenditure as "cost"...

I still don’t understand why layer2 has reached a development deadlock. This question is too difficult to answer, but the problem may lie in these data details.