Author | @resdegen

Compilation|Baidu Blockchain

Financial management is not only a combination of skills and luck, but also a comprehensive test of personal psychological quality and discipline. Only by keeping this in mind can you be invincible in the long-term market game.

In today's fast-changing and highly competitive market, how traders stay calm, rational and develop sound strategies has become the key to gaining a foothold in the market and making continuous profits.

Below are 8 psychological frameworks that combine market practices with psychological principles to help you penetrate market noise, improve your decision-making ability, and become a more discerning, focused, and logical investor.

01. Conduct the “100% Cash Test”

What is the "100% cash test"? The "100% cash test" means assuming that all of your configuration is converted into cash (for example, 100% is USDT), and then ask yourself: If you reallocate your funds now, will you still buy the current assets in the same proportion?

If the answer is no, it means your configuration may need adjustment.

So, ask yourself: if your allocation became 100% USDT today, would you choose to reallocate funds to the exact same position as it is now?

For most people, the answer is probably no. Yet, many people find it difficult to take action. Why? Because of the following psychological factors:

Sunk cost fallacy

Emotional dependence

Fear of admitting mistakes

The sunk cost fallacy is a cognitive bias where people continue to invest time, money, or energy even when it no longer makes sense logically (this also applies to relationships, projects, etc.). In trading, this means holding on to underperforming positions because “too much has been invested” (whether financially or emotionally) instead of cutting losses and reallocating to better opportunities.

Going back to the question at the beginning, if the answer is no, you need to take action.

It may feel overwhelming at first, but start small, such as choosing a position and asking yourself: If it were today, would I buy this token in the same amount? Then, move on to evaluating a second position.

While selling can be emotionally difficult and feel like closing the door on potential, holding on to a position based on hope or fear will only lead to stagnation and poor decision making.

Face the problem bravely, adjust the configuration decisively, avoid the wrong perception of not wanting to lose the sunk costs, and remember, sunk costs do not participate in decision-making.

02. Keep your configuration structured

More efficient management through clear classification:

1) Core positions

A core position refers to a high-conviction investment, which means that you can hold the token for a long time despite the severe price fluctuations.

This does not necessarily require you to hold for the long term, because in this market the opportunity cost is very high and the rotation is frequent. But if you think you can accurately grasp every market fluctuation, you are deceiving yourself, and you still need to believe in the long-term value of something.

2) Trading positions

This is a short to medium term opportunity to capture a specific trend or price movement.

This position provides more flexibility, allowing for faster rotation and tighter stops. Everyone's trading style may be different, and this is not limited to perpetual contract accounts.

For example, I could buy an on-chain opportunity, do a 4x swing trade ($5m to $20m), and exit. Even if it continues to go up, I wouldn’t care because I knew what type of trade I was doing before I traded.

If I think it has the potential to reach $1 billion (e.g. due to the uniqueness of the project), it will be included in the core position. I can accept a 50% retracement because I know that this volatility is the price to pay for the excess return.

3) Clarify the classification to avoid confusion

Mixing core positions with trading positions often leads to confusion and emotional decision making. By separating them, you can more clearly understand the purpose of each position, thus reducing unnecessary regrets.

Therefore, classification management not only helps you stay rational, but also improves the overall efficiency of configuration and the confidence of decision-making.

03. Fewer, more focused layouts

This is an underrated skill that only the best traders can truly master. Perhaps this is the secret to moving from one level (like 6 figures) to another level (like 7 figures).

1) Key points

It turns out that increasing your position with conviction and achieving growth through compound interest is more likely to help you retain wealth in the long term and become a true millionaire than just speculating on a Memecoin. Every trade should have a valuable impact on your configuration, otherwise it is not worth doing.

2) Reduce layout and optimize management

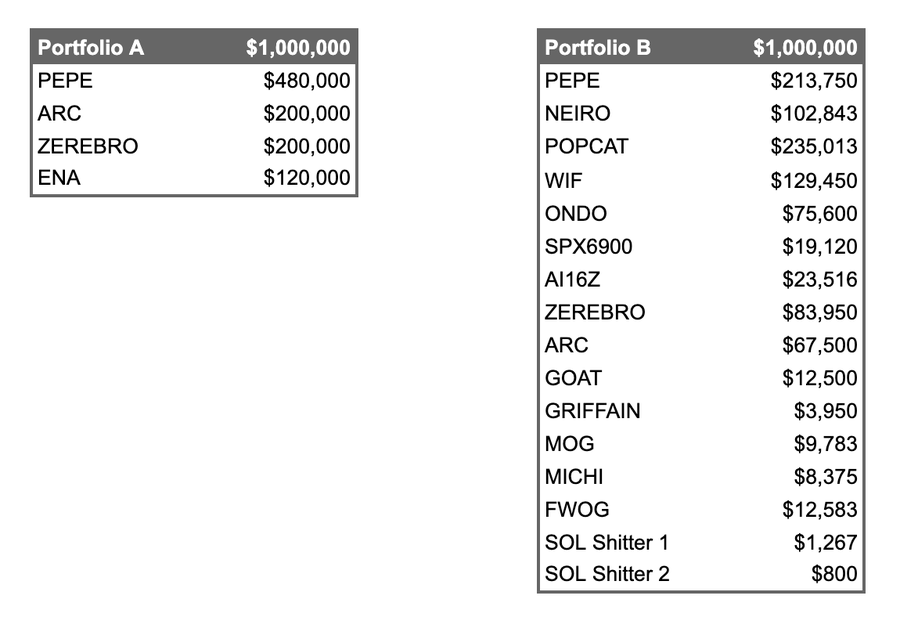

Reducing the number of targets will help you manage your allocation more efficiently while avoiding the biggest enemy in trading - indecision.

When you need to handle 15 different positions at the same time, the psychological burden will make you feel exhausted. However, if you limit your holdings to a few targets (for example, a maximum of 5), you will be more cautious and start to think seriously: "Is this randomly recommended token really worth investing in?"

Of course, there are also some opportunities that are extremely asymmetric bets (for example, taking a 1-2% risk may bring a 20-40% portfolio return). The key is not to spread your funds arbitrarily, but to stay concentrated and focused to bring greater returns.

3) Less is more

A few people have achieved wealth growth through streamlined layout, while others are obsessed with "collecting" meaningless short-term gains. I call these people "gain collectors."

In short: Either choose a very asymmetric bet, or increase your position decisively on the basis of conviction and take advantage of compounding. It is difficult to achieve real success if you are in between these two strategies.

04. Build your configuration based on your goals

Your allocation should always revolve around your financial goals.

If your goal is to grow your assets from $200,000 to $2 million during this bull market (which may not be enough to retire on, but is still a worthy goal for most people), then every decision you make should bring you closer to that goal. Ask yourself:

Does this transaction materially contribute to achieving my goals?

Or am I just blindly chasing the market because I’m afraid of missing out?

1) Stay focused and avoid errors of judgement

Lack of focus can impair your judgment. It may seem tempting to bet $5,000 on each opportunity, but consider the costs:

This investment may have a negligible impact on your overall allocation.

It consumes a disproportionate amount of your time and energy (e.g., spending 20% of your attention managing an investment that only accounts for 1%).

2) Abandon unrealistic fantasies

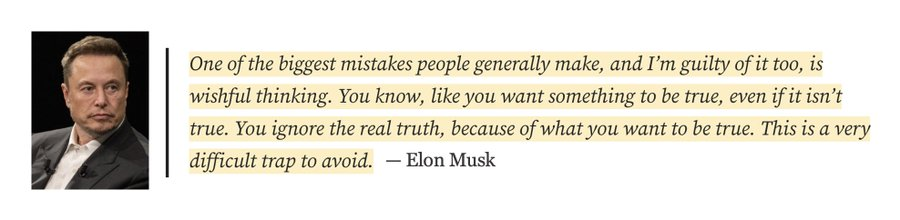

Most people buy into a token just in the hope that it will reach the “magic number” in their minds: “I need this token to increase 10 times.” This wishful thinking will only hinder your judgment and will not help you achieve your goals.

Instead, it’s important to understand your goals and determine whether you are on track to achieve them. This is so important that it cannot be stressed enough.

In summary, before investing, clarify your goals first and ensure that every decision serves your goals rather than being led by market sentiment.

One of the biggest mistakes people make, and one I've made myself, is wishful thinking. You know, the kind of mentality where you want something to be true even though it's not. You choose to ignore the facts because you prefer to believe that it fits your expectations. It's a trap that's hard to avoid. -- Elon Musk

One of the biggest mistakes people make, and one I've made myself, is wishful thinking. You know, the kind of mentality where you want something to be true even though it's not. You choose to ignore the facts because you prefer to believe that it fits your expectations. It's a trap that's hard to avoid. -- Elon Musk

05. Focus on your strengths

You’ve made it this far because you’re leveraging your strength—perseverance.

For example, I have made significant improvements to my allocation through several successful on-chain allocations and with the help of compound interest growth. As the size of the portfolio increases, liquidity may become a challenge, but turning to higher-market-cap assets is not necessarily the best solution.

1) Maintain your core strengths

As you progress through the market, you will find yourself up against competitors who have sharper, more specialized advantages in the larger markets. Don’t assume that having a larger allocation automatically makes you a perpetual contract trader.

If your success comes from on-chain configuration, then continue to dig deeper into this area. Unless your configuration scale reaches a very high level (such as more than 5 million to 10 million US dollars), liquidity is usually not a problem. For example, a 7-8 digit liquidity pool and a 7-8 digit 24-hour trading volume can fully support your operation.

Similarly, if you excel in Memecoin or AI themes on Solana and Base chains, there is no need to switch to liquidity staking on Sui chain. Focusing on your strengths will allow you to achieve growth more steadily.

2) Avoid straying from familiar territory

Assuming that the market trend continues without a clear turning point, rashly entering unfamiliar territory often leads to the following problems:

Low Conviction: Due to lack of sufficient knowledge about the new field, you tend to be risk-averse, thereby allocating less capital and reducing potential returns.

High cost: Exploring a new area requires learning its rules and how it works, which takes up a lot of time and energy and distracts you.

Not only will these issues undermine your efficiency, they may also reduce your overall returns.

The key next is how to focus more on one's own areas of strength and leverage existing successful experiences to further enhance competitiveness and achieve more stable asset growth.

06. Don’t try to trade against the trend

The reason why reversal trading is attractive is that those who can successfully catch market turning points often win a high reputation, such as accurately judging the high point of LUNA, the top of the market cycle, or the bottom of SOL. However, reversal trading can only bring benefits at key turning points.

In a bull market, the market momentum is strong. What you need to do is to follow the trend and add to the support of the market, rather than trying to "put out the fire."

Unless you are George Soros or GCR - but obviously, you know whether you are or not.

1) Why is it difficult to trade in the opposite direction?

Trying to catch every market inflection point is not only exhausting, but also likely to backfire. Statistically, the probability of success is extremely low. Let's be realistic - otherwise you wouldn't be here reading this article.

Rather than obsessing over predicting every turn, focus on market trends, take steady steps, and amplify your results through compound interest.

2) It is wise to follow the trend in a bull market

In a bull market, it is wise to follow the trend. The trend is your friend, don't try to fight it. Follow the trend and decisively take profits when the trend ends. The market is not for heroes, but for rational people to achieve steady growth of assets. Your goal is not to become a "market prophet" in people's mouths, but to keep your income increasing.

In other words: instead of trying to accurately predict every turning point, it is better to follow the trend. Even if you endure occasional retracements, you can still confirm the trend and seize opportunities.

The cost of missing out on huge gains in a bull market is often much higher than short-term fluctuations. Let go of your obsession with reverse trading, follow the trend, and focus on achieving your goals. This is the best strategy.

Translation: It is actually easy to be a contrarian, but the difficult thing is to be a contrarian who can make money.

07. Develop trading logic, set stop loss criteria, and stay emotionally calm

Tokens are just tools for financial growth, they are neither loyal nor "care" about you. When evaluating new opportunities, be sure to document your trading logic and strategy.

1) Transaction logic

Make it clear why you bought this token:

What is the reason why you bought it?

Is this a deal based on some catalyst?

Are you betting on information asymmetry, or do you think the market is pricing it fundamentally wrong?

Or is it just FOMO because your favorite KOL is promoting it?

2) Stop loss criteria

Clearly define an exit criteria, whether it is a price target, timing, or change in market conditions.

The key: Take your emotions out of it. Remember, this isn't a personal battle, this is business.

Imagine a scenario like this:

You bought XXX Token at $50,000, and it rose to $200,000, but then fell back to $50,000. At this point, your trading logic has been negated. Your configuration has also shrunk from $500,000 to $350,000 (assuming it was at the local top in December).

At this point, you have two choices:

· Continue to hold losing positions in the hope of a rebound with no clear basis, just to recover the money;

· Decisively stop losses, reallocate funds to more promising opportunities, and seek new growth points.

3) The goal is to grow the configuration, not to be loyal to a certain token

If you find a better opportunity, adjust your position decisively. Even if you regret the previous token, if the new configuration achieves a 2x return, that regret will soon disappear.

The key is the result, not "loyalty" to a certain token.

Let go of promises, hopes, and unrealistic fantasies. Selling a crypto asset doesn’t mean it’s over — you can always buy it back when the time is right.

4) Calm trading is the key to success

It sounds simple, but the crypto market is a place where people have extremely emotional attachments. If you can use this to your advantage, you can take advantage of it. But at the same time, you must always act with the goal in mind: to keep your allocation growing.

No matter which token the income comes from, the important thing is the increase in total assets. Remember: profit maximization > community sentiment.

08. Detach your emotions from the trading results and avoid self-blame

The quality of a transaction cannot be measured simply by the result. A good transaction is based on the best information available at the time and a well-thought-out decision, rather than simply being defined by whether it is profitable in the end.

If your trading is not a gamble, but follows the following elements:

Have clear trading logic

Set clear stop-loss criteria

Have proper risk management in place to understand whether it is a core position or a short-term trade

· Under favorable conditions, such as a good risk-reward ratio or asymmetric potential

So no matter what the final result is, this is a reasonable trading decision.

Also remember to avoid excessive self-blame or internal friction over trading results. After experiencing losses, people tend to fall into a vicious cycle of self-criticism, but this mentality often ignores the importance of rationality in the trading process.

Losses are an inevitable part of trading. Even the most carefully crafted trades fail sometimes, while some thoughtless trades may succeed by chance.

I myself have overly blamed myself for a failure, only to realize later that the trade was actually sound and in line with my strategy. However, this excessive self-blame only creates unnecessary stress, leading to errors in judgment, indecision, and even emotional trading. Eventually, you may fall into a vicious cycle where you begin to doubt yourself "whether you are always making mistakes" or feel that others are always doing better than you.

09. Summary

I write this down after reflecting on my mistakes countless times. It is also a summary and warning to myself. The past is the past, and the only thing we can look forward to is the future. Whether the past decisions are successful or failed, they are to make you do better next time, rather than letting them consume you.

If you’ve done well so far, great. If not, that’s OK too – in this market, you can’t grow without failure. Behind every success story, there’s a price that had to be paid.

Remember: The meaning of trading is not how many waves you "catch up" or even who makes the most money. What really matters is how you respond to each transaction, whether you achieve your goals, and whether you can keep your wealth when the market collapses.