Original article: 《ETHPoW vs ETH2》 by BitMEX Research

Compiled by: czgsws, 0x711, wzp, BlockBeats (Any opinions expressed below should not form the basis of an investment decision, nor should they be interpreted as a recommendation or suggestion for investment transactions.)

summary

In this article, we discussed the feasibility of splitting into a new chain when Ethereum merges, thereby generating an ETH2 Token and a new ETHPoW Token.

In terms of token price and economic chain usage, it is almost certain that ETHPoW will be the minority supported chain.

While the ETHPoW chain may face many technical challenges and have questions about long-term viability, its existence may provide exciting opportunities for traders and speculators in the short to medium term.

Overview

After several delays, it looks like Ethereum will finally begin the merge in September 2022. Ethereum core developer Tim Beiko suggested Monday, September 19, 2022 as a possible merge date during a developer call on July 14, 2022. The first major part of the merge is to stop proof-of-work (PoW) mining. The consensus part of Ethereum chooses which blockchain to follow, and will then move to the already existing proof-of-stake beacon chain. However, the date of September 19, 2022 is far from finalized, and clients with merge time parameters have not yet been released. Until then, there is still a lot of uncertainty about the specific time of the merge.

After the merger, two Ethereum clients need to be run, namely the consensus layer client and the execution layer client, such as Geth, which will still verify and process Ethereum smart contracts and transactions. It is worth pointing out that even after the merger, stakers will not be able to withdraw their staked Ethereum to the execution layer, and the "second merger" may take another 6 to 12 months.

When discussing the merger, many reported that there is broad support in the Ethereum community for shutting down PoW. In a recent meeting, Vitalik mentioned that if someone doesn’t like it, they can always use Ethereum Classic (ETC, a product of the 2016 DAO Wars). However, as one might expect, PoW miners will definitely not support shutting down PoW. Why would they? They will be completely shut out of the Ethereum system. EIP-1559 is nothing compared to this, and this time their chances of earning income from Ethereum are reduced to zero. For months, some miners have been making noises against the merger behind the scenes, expressing the desire for “someone to stand up and do something.” Finally, on July 29, 2022, one of the largest players in the Chinese mining ecosystem, “Bao Erye” (Guo Hongcai), said that he may plan to continue mining on the Ethereum PoW chain.

If the PoW chain survives and continues to scale, there is speculation that the coin might be called ETHPoW. Whether this chain makes any economic sense is an open question in our opinion. There is an argument that this chain could survive for the long term. PoS may have some weaknesses compared to PoW (such as staking derivatives becoming a natural monopoly) that ultimately make PoS chains less attractive than PoW chains for certain use cases. All competing smart contract platforms to Ethereum (with the possible exception of ETC) have gone the PoS route, so the emergence of a new PoW smart contract chain might be able to gain a lot of traction. There are no real candidates other than ETHPoW.

Regardless, ETHPoW looks like it might generate some interest among market participants amidst nostalgia for the 2016/17 Bitcoin and Ethereum split era.

Ice Age

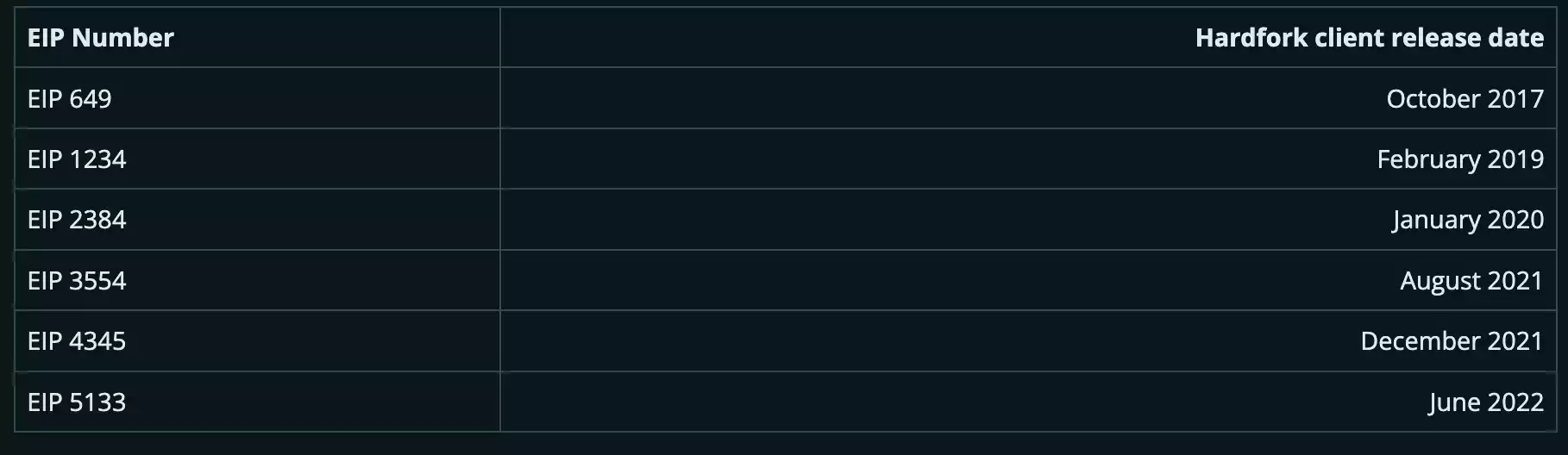

More than seven years ago, when Ethereum's PoS system was just a series of weird and broken ideas on the drawing board, Vitalik had foreseen this potential problem. And proposed a solution for it, called "Ice Age". In this system, the difficulty of PoW mining the network increases exponentially over time, and eventually it becomes impossible to effectively scale the chain. After the original Frontier client, Ethereum's first major network upgrade was called "Ice Age", which included the first difficulty bomb. This bomb would "explode" in 2017, when the Serenity upgrade would transition the network to PoS. But in the end, the PoS upgrade was delayed, and so the bomb was delayed by the hard fork.

In fact, the difficulty bomb has been a "dud" many times in the past. For example, in early October 2017, the average block time of Ethereum was about 30 seconds. After that, the difficulty bomb system was reset and the average block time fell back to the normal 13 seconds. The difficulty bomb has been reset 6 times in the history of Ethereum, with six hard forks.

The most recent reset was proposed in June 2022, and the bomb is now expected to "explode" in mid-September 2022, which is the perfect time to switch to PoS, as originally planned back in 2015. Although the bomb will be in September, based on the timing of previous bomb explosions, the impact on the average block interval may take several months to become noticeable. Calculations estimate that it may take 175 days for the average block time to reach 30 seconds, after which the situation should get exponentially worse.

Another interesting factor is that this transition to PoS is "really coming". The price of ETHPoW may be low compared to ETH and may fluctuate wildly. This may reduce miners' desire to mine ETHPoW, so it may be very challenging to accurately assess the situation during the Ice Age.

New ETHPoW Hard Fork Client

With the arrival of ice age, the previous PoW chain may only survive for a few hundred days after the fork. If the PoW chain is to exist for a long time, it needs to hard fork a new client to permanently remove the effect of ice age. This brings some problems to ETHPoW, and perhaps this is the meaning of the existence of ice age. It denies the legitimacy of ETHPoW to a certain extent. ETHPoW will not be able to claim to be the orthodox or original rule-compliant chain. It also requires a hard fork. However, there may not be many Ethereum users who really care about this today, which seemed to be more valued seven years ago.

At the same time, any ETHPoW community will need to find developers with the technical expertise to write a new client. They will also need to solve a schelling point problem, agreeing on a new client and new parameters to remove the ice age and activate the hard fork. The community will then need to convince trading platforms and custodians to run and support this new client, which may be slightly more difficult than convincing them to continue running old Geth nodes next to the new ETH2 infrastructure. However, in practice, these problems can be easily overcome, and the size of the ETHPoW community is unlikely to be particularly large, so this should not be a major problem. Perhaps there will be some large miners funding the entire operation behind the scenes.

Locked staked ETH

Currently, there are approximately 13.2 million ETH staked on the beacon chain, and if the actual balance (Ethereum obtained through staking plus any deposits above the 32 ETH threshold) is included, it is close to 14 million. As we understand it, in the initial stages of the ETHPoW chain, these funds will be lost forever if a hard fork does not occur. In contrast, on the ETH2 chain, these ETH can be sent back to the execution layer at some point in the future. This has several consequences for the ETHPoW chain. First, some people may think that because a portion of the ETH supply on the ETHPoW chain is reduced, this may push up the price of ETHPoW. Alternatively, because users have lost a lot of funds, this may reduce the credibility of the chain and damage ETHPoW.

If a new ETHPoW client is hard forked, in order to solve the ice age problem, the community will face a choice on how to deal with these staked ETH. This is a dilemma. One possible result is that since it is a PoW coin, the community can lock the staked Token forever. In the ETHPoW world, staking is the wrong choice. At least the cumulative staking income of about 800,000 ETH obtained before the merger should be considered completely illegal on the ETHPoW chain. Therefore, if you are a validator or own stETH, you may not get additional income on the ETHPoW chain.

Stablecoin

Many speculate that if a contentious Ethereum fork occurs, the decision will no longer belong to the Ethereum Foundation or Vitalik. They believe that the new kingmakers in this case may be the custodians of Stablecoins. These custodians have to choose a chain to support, and considering the popularity and prevalence of these Stablecoins, as well as their interconnectedness with Defi, their decision will determine the winning chain. Therefore, perhaps Jeremy Allaire (CEO of Circle, issuer of USDC) is the most powerful person in Ethereum, not Vitalik.

Of course, Jeremy is the CEO of a company and he has to respond to his customers, and not doing so could mean he is not acting in the best interests of his shareholders, which could be illegal, so he may not really have the power to do so. However, if the authorities order Circle to support one chain or another for some regulatory reason, that would be a different story. This is also a potential weakness of Ethereum at the moment.

If a chain fork occurs after the merger, it seems that Circle, Tether, Binance and other stablecoin custodians will all support ETH2. Therefore, even excluding the strong support of the Ethereum Foundation and the community for ETH2, the result of this split is clear, ETH2 will be the winner and ETHPoW will be the loser. On ETHPoW, many Defi Apps that rely on USD stablecoins will collapse in a catastrophic way economically. However, this stance of stablecoin issuers has some other implications, which we will discuss later in this article.

Selling ETHPoW

Many Ethereum maximalists strongly support the transition to PoS and therefore will not like ETHPoW. They may hope that the ETHPoW chain will die quickly.

Then there is a layer of thought on top of this. Ethereum maximalists should actually (somewhat perversely) hope that the ETHPoW chain survives, at least for a while, so that they can sell their ETHPoW tokens on the market and get more ETH (or USD). This way they can make money from what they consider to be "stupid" ETHPoW supporters before ETHPoW slowly dies in the next few years. Therefore, many people may sell their ETHPoW tokens as quickly as possible, and the price may be weak.

There is another layer of thought on top of this, the third layer. What everyone should actually do (whether they have Ethereum or not) is to buy ETHPoW Tokens as soon as possible after the merger occurs. I will explain this below.

The value of ETH fork token

In order to sell ETHPoW to get ETH, you need to wait for centralized exchanges to support ETHPoW after the merger. Although centralized exchanges like FTX and Binance may launch related products soon, it will still take some time, at least a few hours or days, to support ETHPoW deposits. No matter how well prepared they are, the computing power and block time on ETHPoW may be unstable, and they need to protect themselves from double-spending attacks.

On the other hand, in theory, no matter what happens, once the merger occurs, users should be able to buy ETHPoW on the chain's decentralized exchange platform. Whatever your opinion on ETHPoW, you must think that this token is better than all other ERC-20 tokens on the ETHPoW chain?

Let’s think about some of the tokens on Ethereum today:

USDC on ETHPoW – worthless, as Circle will choose ETH2 and thus the token will not be redeemable, as explained above.

USDT on ETHPoW – also worthless

Wrapped Bitcoin on ETHPoW – worthless because the custodian will choose ETH2, so the token will not be redeemable for Bitcoin

BNB on ETHPoW – worthless as Binance will choose ETH2

Uniswap on ETHPoW – The long-term viability of tokens on the ETHPoW chain is questionable. Tokens may collapse faster than ETHPoW

stETH on ETHPoW – Since there is no collateral on this chain, these tokens are likely worthless, as mentioned above

All other ERC-20 tokens on ETHPoW — may have very limited value on the ETHPoW chain

Therefore, the best strategy may actually be to buy as much ETHPoW as possible before it is traded on centralized exchanges. Then sell ETHPoW on centralized exchanges. This is like a free call option on ETHPoW.

Merger Trading Strategies

As with these past potentially contentious blockchain forks, the Ethereum merger presents an exciting trading opportunity. A possible “risk-free” trade idea is as follows:

1. Convert all your USD to USDC in your own Ethereum wallet before merging

2. After the merger, immediately sell your USDC on the ETHPoW chain and exchange it for ETHPoW Token on decentralized exchanges such as UniSwap or Curve.

3. Once the centralized exchange opens ETHPoW deposits, sell all ETHPoW for USD

4. Get Profit

By placing the above trades, you have the potential to make money with almost zero risk. Zero risk is when only certain types of risk (such as price fluctuations) are considered.

Of course, actually executing the above trade is actually quite complex and risky, and there are several issues that need to be managed:

Trades need to happen in a short time frame as there may be a race to take advantage of the opportunity. The liquidity pool supporting the sale of ETHPoW may be depleted quickly.

You need to manage your own keys rather than using a custodian. It is unlikely that any third-party custodian will support ERC-20 tokens on ETHPoW soon after the split, if at all.

· Basically the infrastructure used to interact with decentralized exchanges is likely to be merge-enabled and run only on ETH2. Therefore, you may need to run your own Ethereum node and interact directly with the exchange smart contracts on ETHPoW. This may be quite complex for some traders, but this difficulty is where profit opportunities may arise. It may take practice before the ETH1 fork.

You may need to ensure that your USDC sell/swap orders are not made again on the ETH2 chain. May need to create a split smart contract.

Liquidity providers may realize this potential risk very quickly around the merger and withdraw liquidity. However, some liquidity providers may not do so, creating opportunities.

Many DeFi protocols rely on price oracles and it may not be clear how these will handle the ETHPoW chain.

There may be more advanced strategies to try in DeFi, including leverage, lending, or providing liquidity, which we will not discuss for now.

in conclusion

Any chain split that occurs when Ethereum merges could be an interesting throwback to the 2016/17 era. While ETHPoW faces many technical challenges, as long as the chain survives, there will be a positive narrative around its token, and leading centralized exchanges will likely open it for trading. The crypto space remains full of narratives and noise. There will be a lot to be excited about with ETHPoW, and we predict that the ETH/ETHPoW trading pair will be a popular trading pair post-split, at least until another interesting dynamic emerges. Let the race begin!