Original title: TON Part 2: A win-win outcome from one year of partnership

By Animoca Brands Research

Compiled by: Mensh, Chaincatcher

Key questions:

- How is TON progressing towards its goal of introducing 500 million users to cryptocurrency?

- What strategies does the TON Foundation adopt to push the ecosystem to a higher level?

- What benefits did Telegram gain from its partnership with TON?

Table of contents

Introduction

Three-step strategy

- Step 1: Promote the “Click to Earn” social game and introduce users to Telegram Mini Apps

- Step 2: Convert Mini-App players into cryptocurrency holders through token airdrops

- Step 3: Retain cryptocurrency users through DeFi applications

- Notcoin, Hamster Kombat, and Catizen

Growth of the TON blockchain

- Activity

- Total Value Locked (TVL)

- Comparison with other Layer 1

Summary of TON

Telegram’s success

- Functions related to TON cooperation

- The growth of Telegram platform popularity

- Impact on Telegram’s profitability

Conclusion

TL;DR

- In September 2023, the TON Foundation and Telegram announced a strategic partnership with the goal of bringing 30% of Telegram's active users into the TON ecosystem by 2028. As an infrastructure layer, TON uses the Telegram Mini-App to cover and attract Telegram's huge user base.

- The success of Notcoin paved the way for the activation of Mini-App users through social games. Subsequently, users gradually came into contact with cryptocurrencies through airdrops of game tokens and meme coins. To support this growth, the Foundation used TON Grants, The Open League, and offline events to achieve its goals.

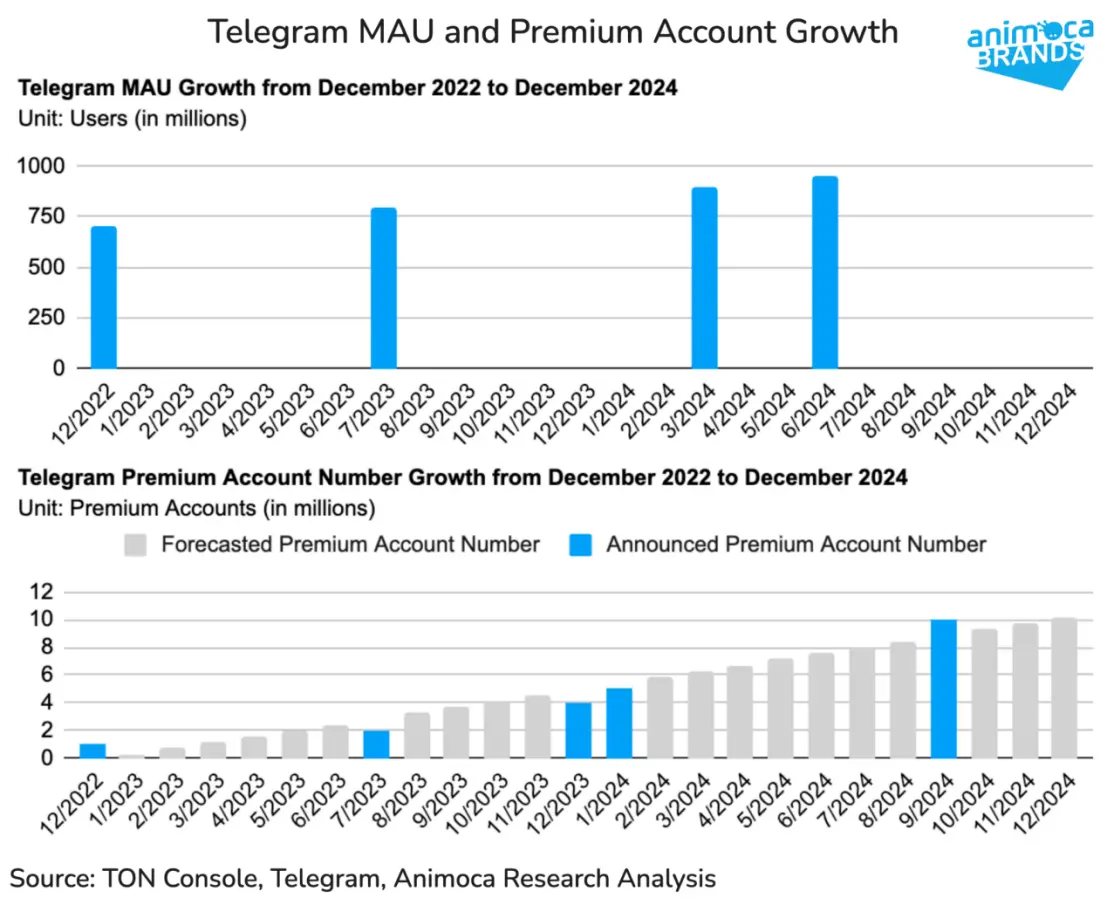

- In July 2024, Telegram Mini Apps monthly active users (MAU) reached 500 million, pushing Telegram's overall MAU to a new high of 9.5 million. As of October, 30 million of these users have successfully entered the cryptocurrency field.

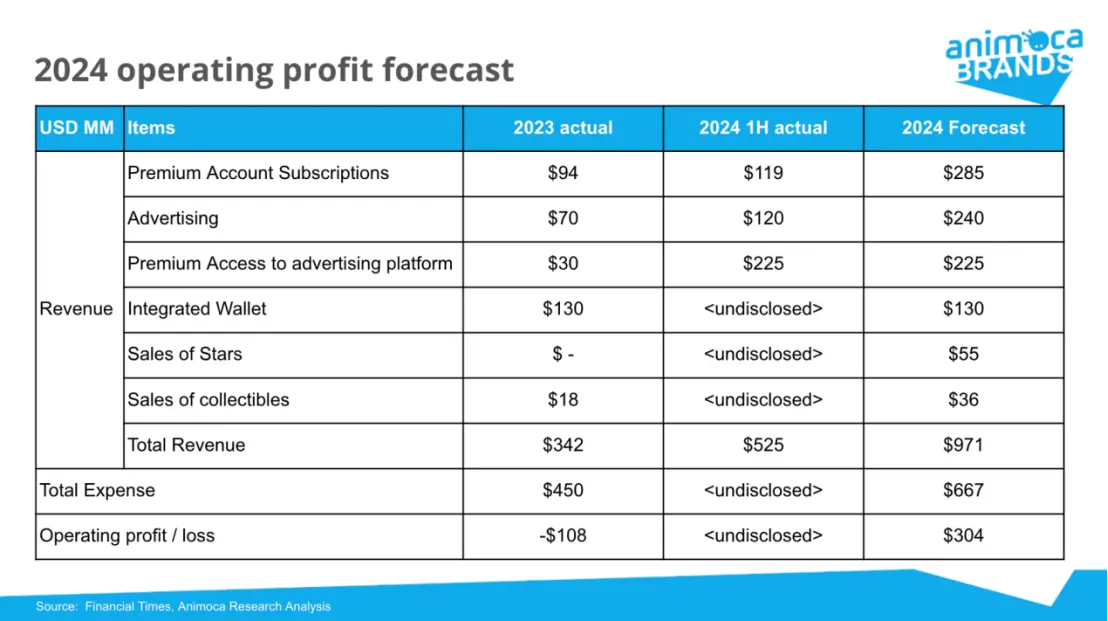

- The high interaction rate of Telegram Mini Apps not only enhances user engagement on the Telegram platform, but also significantly increases platform revenue, especially by increasing premium account subscriptions and the exclusive use of Toncoin in the advertising platform. Telegram is expected to achieve its first profitable year in 2024, with full-year revenue potentially reaching $1 billion.

- To further accelerate the growth of the ecosystem, the TON Foundation is moving from a centralized governance model to a community-driven funding distribution model through the “Society DAO.” This shift is intended to foster more development and innovation within the ecosystem.

introduction

In September 2023, the TON Foundation and Telegram deepened their cooperation, with the goal of introducing 30% of Telegram's active users into the TON chain ecosystem by 2028. Since the announcement, the TON Foundation has been committed to cultivating the Telegram Mini-App (TMA) ecosystem, positioning Mini-App as the entry point for existing Telegram users to enter the cryptocurrency ecosystem.

This collaboration enables TON to reach more than 900 million Telegram users. For Telegram, the TON Foundation and its organized community activities have become the core market development force of the Mini-App ecosystem, filling the market gap caused by the company's streamlined operations.

This article will explore the journey of both parties since the collaboration and the impact it has had so far.

Three-step strategy

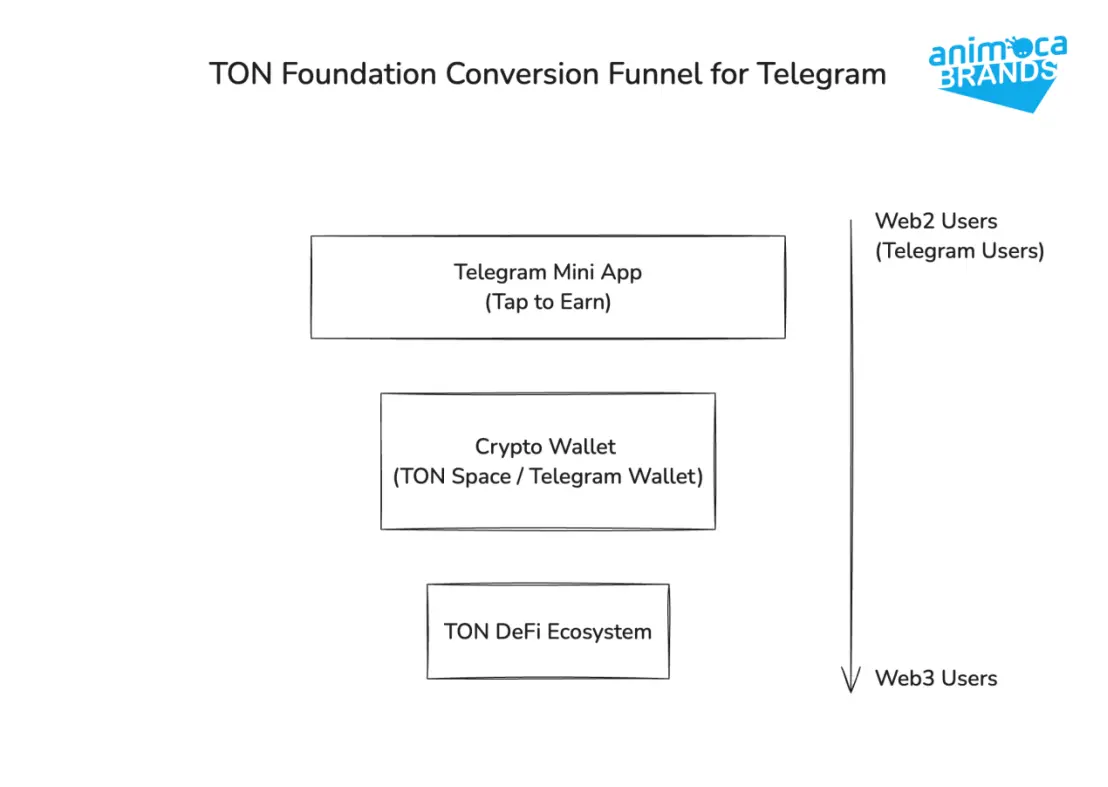

In the cooperation announcement, Mini Apps was proposed as an intermediary layer to connect TON infrastructure with Telegram’s Web2 user base. The successful implementation of this strategy requires solving the following three key issues:

- How to attract Telegram users to Mini Apps?

- How to convert Mini-App users into cryptocurrency users?

- How to retain these cryptocurrency users in the long term?

Jack Booth, former head of market development at the TON Foundation and co-founder of TON Society, shared insights on this strategy in an August 2023 podcast interview:

“We let everyone participate through ‘click to earn’, and then some users can easily realize global cryptocurrency transactions through DM. Then, some of these users will start to use more complex DeFi products on TON. This is the logic of the whole plan.”

In summary, the Foundation’s answers to the above questions are:

- Promote “Click to Earn” social games to attract users to Telegram Mini Apps.

- Convert Mini-App players into cryptocurrency users through token airdrops.

- Retain cryptocurrency users with DeFi applications.

In fact, this three-step strategy is more like a retrospective summary of the community-driven innovation development process than a top-down plan execution. Next, we will explore these three parts in detail.

Step 1: Promote the “Click to Earn” social game to attract users to Telegram Mini Apps

After launching the collaboration with Telegram, the TON Foundation used its community interaction channels to actively promote the development of Mini-App.

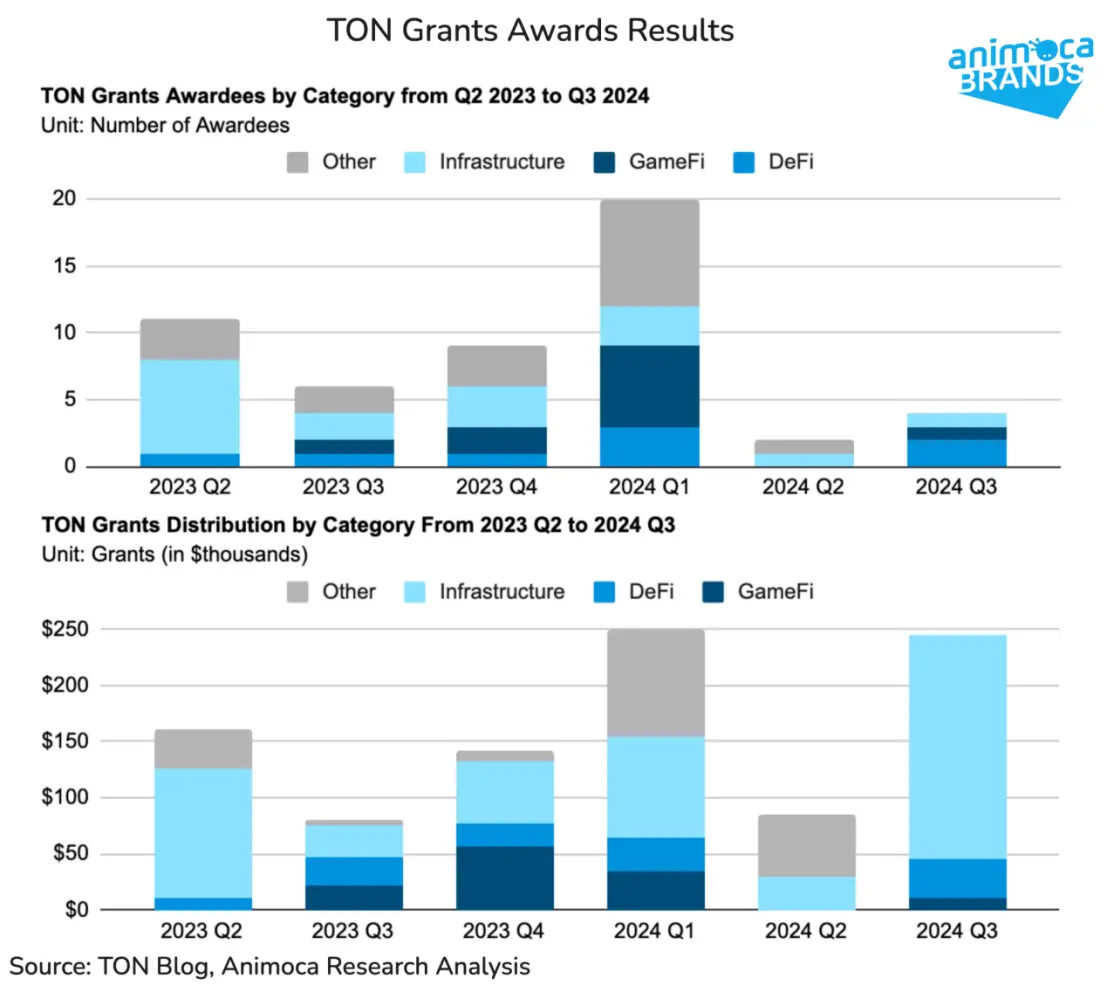

In the third quarter of 2024, GameFi projects began to appear among the TON Grants recipients, alongside traditional on-chain functional projects. This change shows that the Foundation has realized the important potential of game development in promoting the popularization of Mini-Apps.

In January 2024, the first phenomenal Mini-App game Notcoin was launched. This "click to earn" social game quickly became a hot topic on Telegram, attracting 35 million users before TGE. Interestingly, Notcoin was entirely a community innovation and was not initially included in the Foundation's plan. However, its success prompted the Foundation to include social games in its key funding areas.

The number of funded GameFi projects continued to increase in the first half of 2024. For example, Hamster Kombat and Catizen were launched in March 2024 and attracted 300 million and 39 million users respectively before TGE.

By the end of May 2024, Telegram Mini Apps had reached 400 million monthly active users (MAU), and increased to 500 million in July. Considering that Telegram's total MAU during the same period was about 950 million, this means that more than half of Telegram users interact with Mini Apps every month. The achievement of this milestone in less than 10 months is undoubtedly a great success for the TON Foundation.

Step 2: Convert Mini-App players into cryptocurrency users through token airdrops

The launch and airdrop of tokens became a key step in converting Web2 players into cryptocurrency users. Points earned through the “click to earn” mechanism are converted into on-chain tokens with real market value, thus incentivizing users to explore and participate in crypto trading.

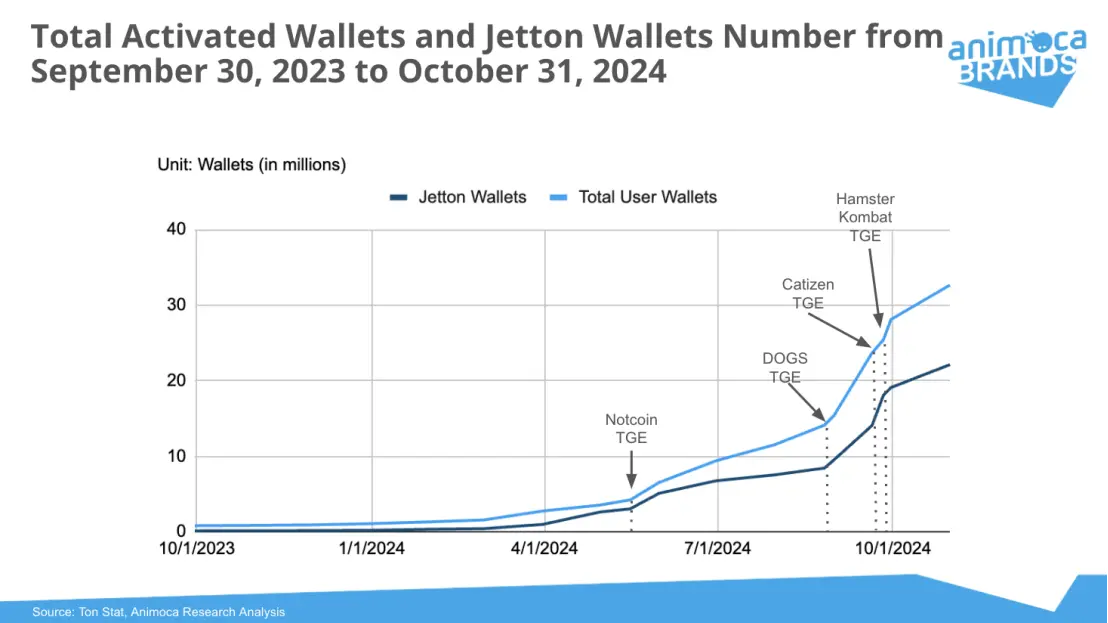

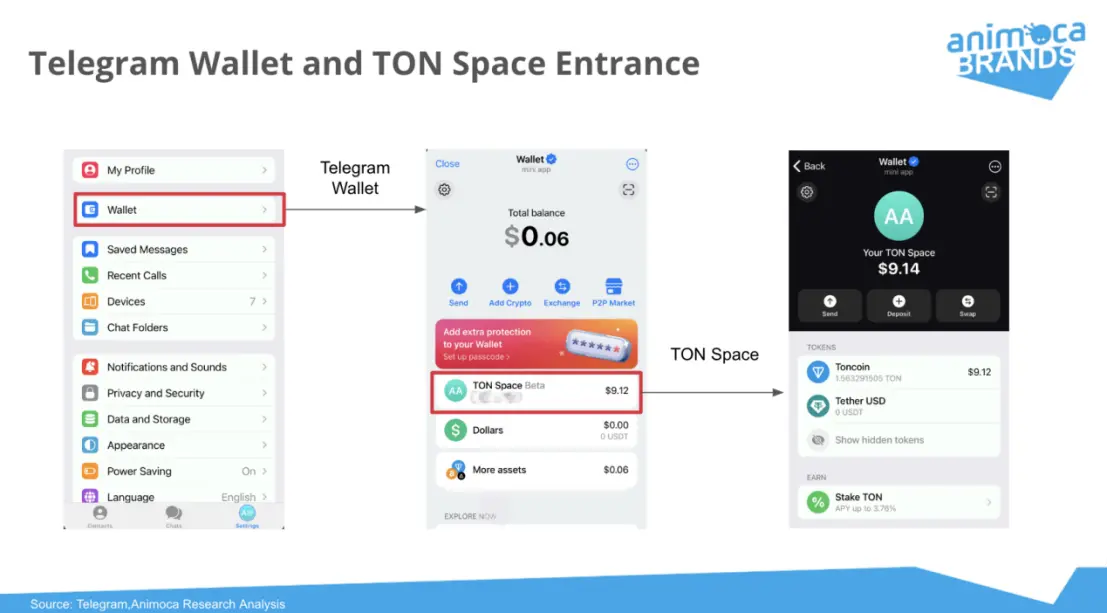

The infrastructure to support this transition is already in place on Telegram. By November 2023, the Telegram Wallet and the non-custodial TON Space Wallet were integrated into Telegram, enabling users outside the United States to receive Jettons (a fungible token standard on the TON blockchain).

The launch of Notcoin and its airdrop was the first major step in this transformation process. In the first week of the Notcoin token airdrop on May 16, 2024, 2.7 million of the 35 million users received Notcoin tokens, and by August this number reached 11 million. This impact is reflected in the key indicators of the TON ecosystem: the number of activated wallets doubled from 4.2 million to 8.5 million in the first month of the token launch, and the number of wallets with non-zero balances increased from 3 million to 6 million during the same period.

This success was replicated by subsequent social games such as Hamster Kombat (TGE September 26, 2024) and Catizen (TGE September 20, 2024). They brought 3.2 million and 1.8 million on-chain token claims respectively, driving further growth in the number of wallets with non-zero balances in October.

GameFi-driven wallet adoption lays the foundation for broader cryptocurrency use cases on TON. For example, the meme coin DOGS became the first popular meme coin on the TON network, and its launch in late August 2024 triggered a new wave of wallet activations, paving the way for subsequent game token issuance. This success was entirely driven by the TON community, which was unexpected but had a significant impact.

As of November 1, 2024, the number of registered users of TON Space (Telegram's non-custodial wallet) has reached 100 million, and the total number of activated wallets on the TON blockchain (including TON Space and third-party on-chain wallets) has reached 34 million.

Step 3: Retain cryptocurrency users through DeFi applications

After attracting Telegram users to the Mini-App and getting exposed to cryptocurrencies, how to keep these users in the ecosystem becomes the main task of the project and the foundation.

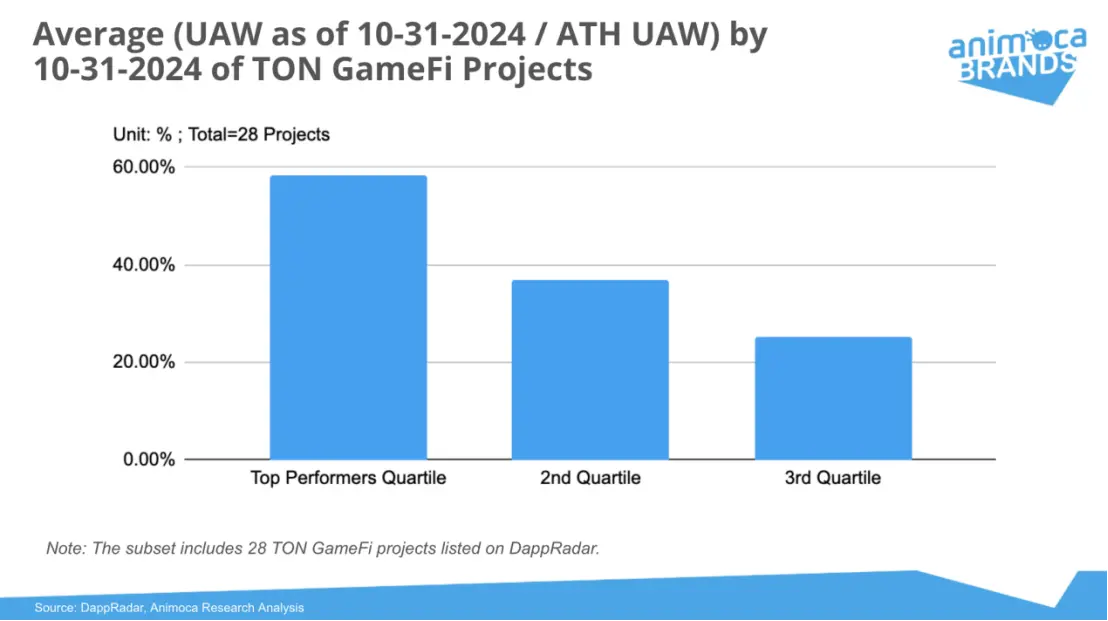

The challenge of user retention can be illustrated by the performance of the GameFi project on the TON chain. Measured by the number of daily active unique wallets (UAW), the best performing projects can still maintain about 60% of their daily activity after their peak activity. However, for medium and low performing projects, the retention rate drops sharply: projects in the second tier can only retain 37%, while projects in the third tier can only retain 25% of their activity.

Measures to deal with user churn

To solve this problem, the TON Foundation and project owners have strengthened user retention through the following methods:

- DeFi tool integration: Introducing tools such as decentralized exchanges (DEX), staking, and liquidity mining to provide users with more crypto asset management and income opportunities.

- Optimization of reward mechanism: Through airdrops and in-game economic design, users are encouraged to participate in on-chain activities for a long time.

- User education and support: Help users become familiar with more complex DeFi applications through Mini-App embedded tutorials and interactive communities, lowering the learning threshold.

- Ecosystem linkage: Introducing GameFi users into other application scenarios, such as NFT markets, DAO participation, and on-chain payments, to further expand the value network of the TON ecosystem.

Although there is still room for improvement in retention rates, the Foundation’s initiatives are gradually consolidating users’ long-term engagement and laying the foundation for the sustainable development of the TON ecosystem.

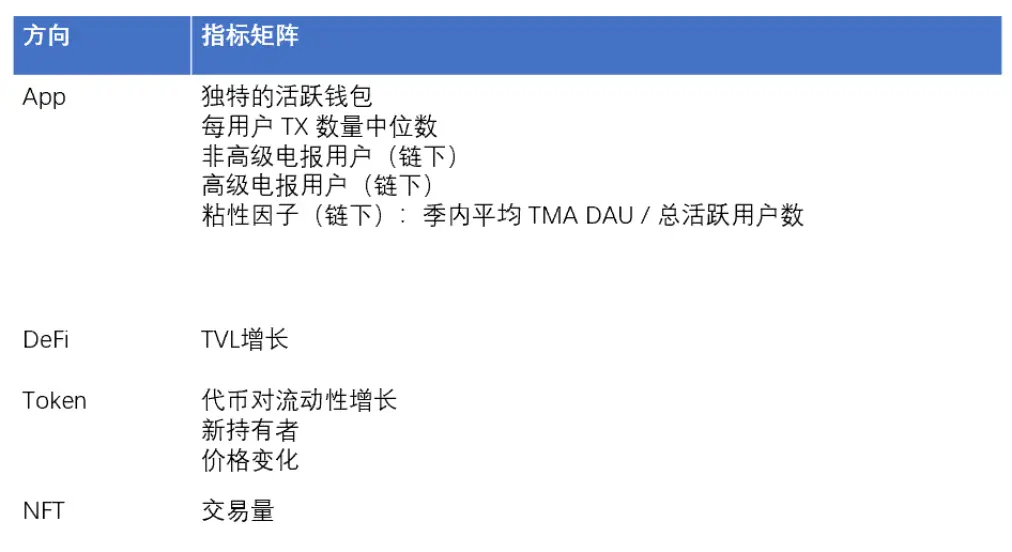

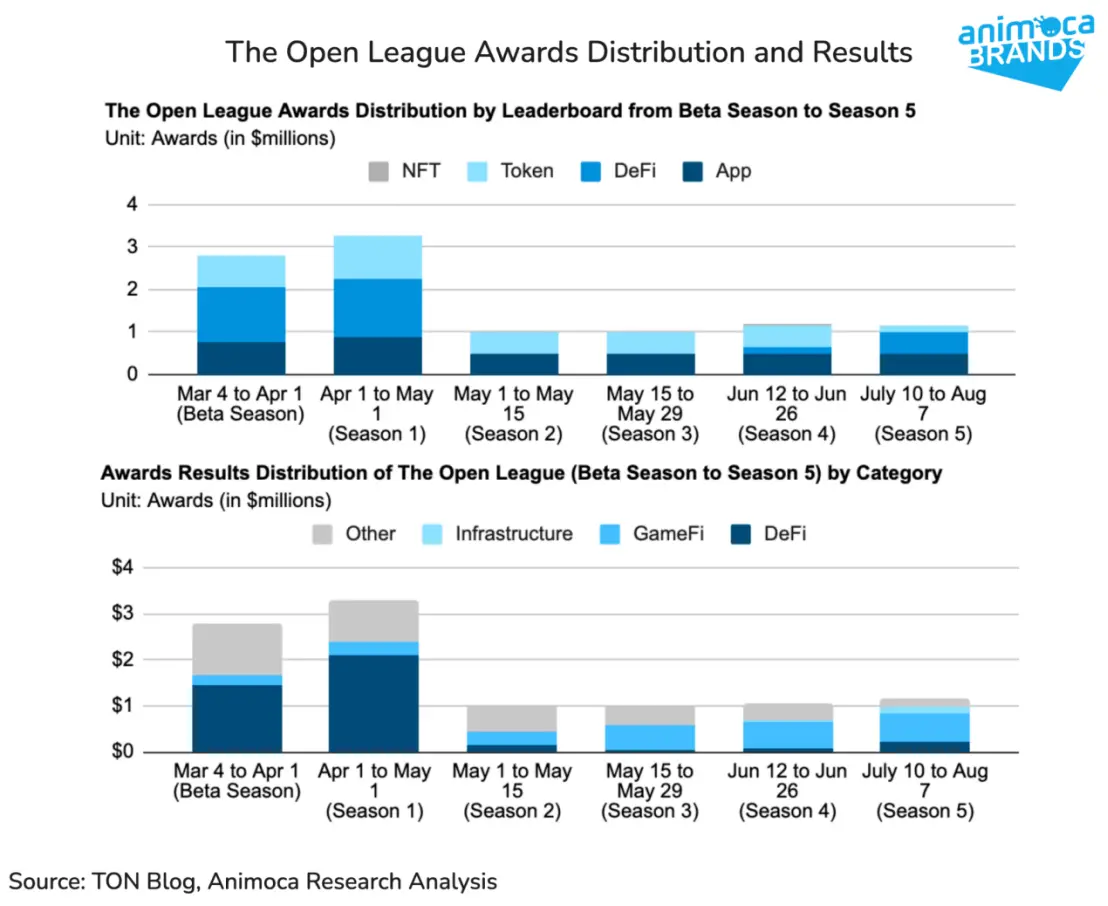

While the TON Grant program is primarily focused on supporting the initial development of applications within the ecosystem, The Open League (TOL) has emerged as a more effective alternative to promote user retention. Launched by the TON Society in January 2024, TOL is an incentive program designed to reward the best performing projects over a specific period of time. Unlike grants that emphasize project potential, TOL focuses on rewarding actual results. The program is divided into four competition categories: App, DeFi, Token, and NFT. Each category uses specific metrics to evaluate the performance of a DApp or token. Seasons typically last from two weeks to two months, enabling the foundation to adjust incentives based on rapidly changing dynamics.

Specifically in the App category, Telegram Mini Apps are evaluated based on a range of on-chain interaction metrics (such as unique active wallets and transactions per user), as well as online metrics, including the number of Telegram users and user stickiness of the Mini-App.

While all four categories play an important role in strengthening the ecosystem, the shift in emphasis between them reflects the evolving priorities of the TON Foundation. Tokens and Applications have always been important reward categories. DeFi stopped receiving rewards after the first two seasons, but regained attention in Season 5.

The TON Foundation made a major adjustment to the TOL model in Season 6. Instead of providing Toncoin rewards to projects that attract user interest, users who can bring more activity to the project will be directly rewarded. This new approach includes two main initiatives:

- Normie Airdrop: Encourage users to explore DApps by granting them “Normie Scores” that can be redeemed for Toncoin tokens or project airdrop rewards.

- Degen Airdrop: Rewards are provided to traders based on the “Degen Score” to assess their trading activity and liquidity.

The shift from funding developers to incentivizing on-chain users, especially those who drive more transactions and liquidity, reflects the TON Foundation’s belief that promoting user engagement broadly across Telegram Mini Apps and DApps will be more impactful than focusing on a few best-performing projects.

Additionally, the TON Foundation supported the launch of Memelandia in October, a community support organization that aims to promote the growth of memecoins in the TON ecosystem. This shows that the Foundation recognizes the important role of memecoins in driving community participation and on-chain activity. Early success stories include DOGS, which has 17 million holders and a peak daily transaction volume of 14.4 million transactions.

Although Jack cited DeFi as the primary user retention tool in his August comments, the actual development trajectory shows a greater diversification trend. GameFi, Memecoin, and DeFi are becoming important contributors to maintaining an active and engaged TON-Mini App community.

At the same time, the TON Foundation has gradually transitioned to a more decentralized governance structure, especially in promoting community-driven initiatives. This shift was reflected in the independent operation of TON Society in August and the introduction of Society DAO in December. Through this decentralized decision-making framework, community members are able to autonomously explore and take advantage of emerging opportunities in different areas of the TON ecosystem, further accelerating its growth.

Notcoin, Hamster Kombat, and Catizen

As one of the most successful categories of this collaboration, it is worth analyzing in depth the three highlight projects: Notcoin, Hamster Kombat and Catizen.

In the user conversion path mentioned above, it can be seen from the clear support of TON Grants and the achievements of TOL that the GameFi project, especially the project adopting the "tap-to-earn" model, is the "engine" of the entire conversion path.

These three mini-games allow users to participate and earn points through simple gameplay (such as clicking). Users can also participate in the social referral program and invite friends to join the game to earn extra points, thereby rapidly expanding the user base. After the token generation event (TGE), the points can be exchanged for airdrop rewards, thereby activating the user's wallet.

These three mini-games allow users to participate and earn points through simple gameplay (such as clicking). Users can also participate in the social referral program and invite friends to join the game to earn extra points, thereby rapidly expanding the user base. After the token generation event (TGE), the points can be exchanged for airdrop rewards, thereby activating the user's wallet.

After going through the Sybil detection process used to identify and prevent fake players, it was found that about 40% of the players of Hamster Kombat and Catizen were eligible for airdrops. Despite this, the actual number of players of these games still exceeded 10 million, with Hamster Kombat even exceeding 100 million users. This level of engagement is comparable to mainstream mobile games.

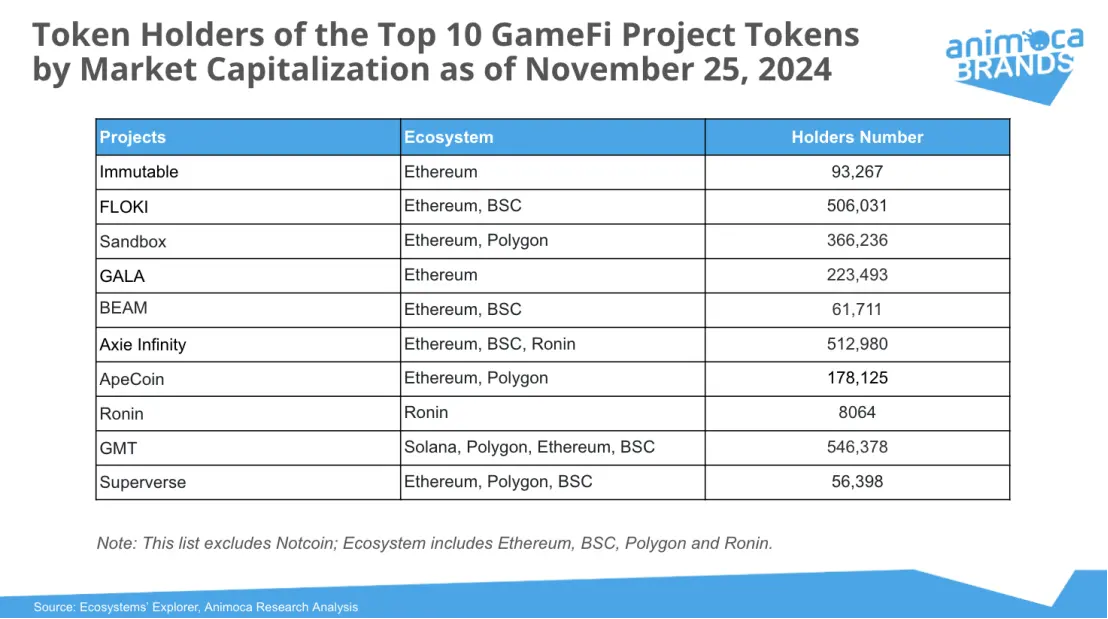

The activity on the chain proves the effectiveness of attracting users' interest in cryptocurrencies. As of November 16, 2024, the number of holders of Notcoin, Hamster Kombat, and Catizen were 2.9 million, 1.3 million, and 1.6 million, respectively, which have exceeded the number of holders of mainstream GameFi tokens.

From one month after TGE to November 8, 2024, the percentage of non-zero addresses (defined as addresses holding Jetton balances) to the total addresses that have ever held Jetton is:

- Notcoin: about 40%

- Hamster Kombat: about 80%

- Catizen: about 70%

These differences suggest that users of Hamster Kombat and Catizen show higher loyalty as holders, which may benefit from the implementation of Sybil detection processes.

Growth of the TON blockchain

The TON blockchain has experienced significant growth as it has been successful in attracting and converting Telegram users.

Activity data

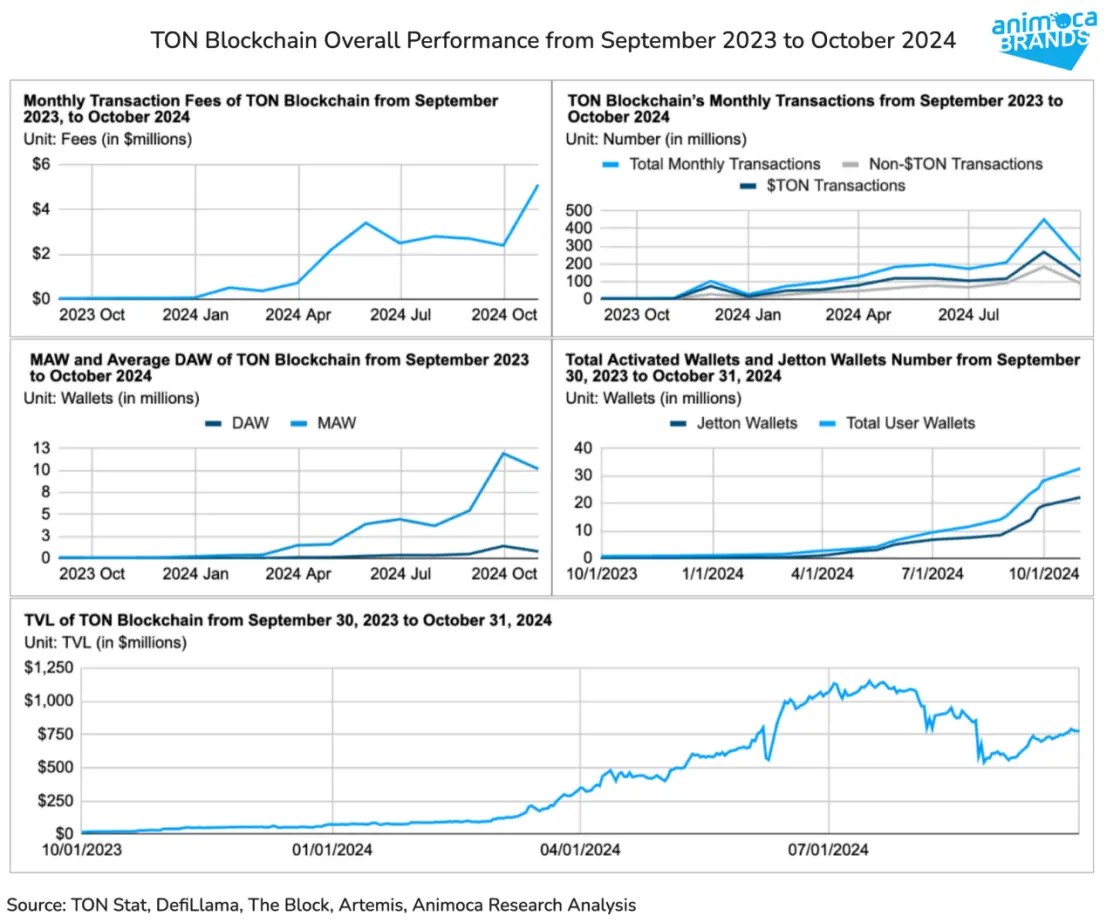

- Wallets: As of October 2024, the number of activated wallets increased 39 times from 800,000 in September 2023 to 32 million. In addition, the number of Jetton wallets with non-zero balances also increased to 22 million, indicating that a large number of activated wallets are actually being used.

- User engagement: Monthly active wallets (MAWs) reached 10 million in October, and daily active wallets (DAWs) were 800,000. Both figures have increased by more than 90 times compared to 14 months ago.

Cryptocurrency usage

- On-chain transaction volume: Monthly on-chain transaction volume (measured by number of transactions) reached 200 million in October 2024, a 30-fold increase from September 2023, of which approximately 60% of transactions involved Toncoin transfers.

- Transaction Fees: Monthly on-chain transaction fees increased to $5.1 million, demonstrating the high level of activity in the TON ecosystem.

Total Value Locked (TVL)

Total TVL: As of October 2024, the total value locked (TVL), including liquid staking, reached $726 million. This growth is mainly attributed to the expansion of decentralized exchanges (DEX) and liquidity staking protocols. Driven by the support of TON Grants and the early season of TOL, liquidity staking protocols and DEXs reached $335 million and $342 million in TVL respectively. STON.fi and DeDust.io have grown into the two leading DEXs on the platform.

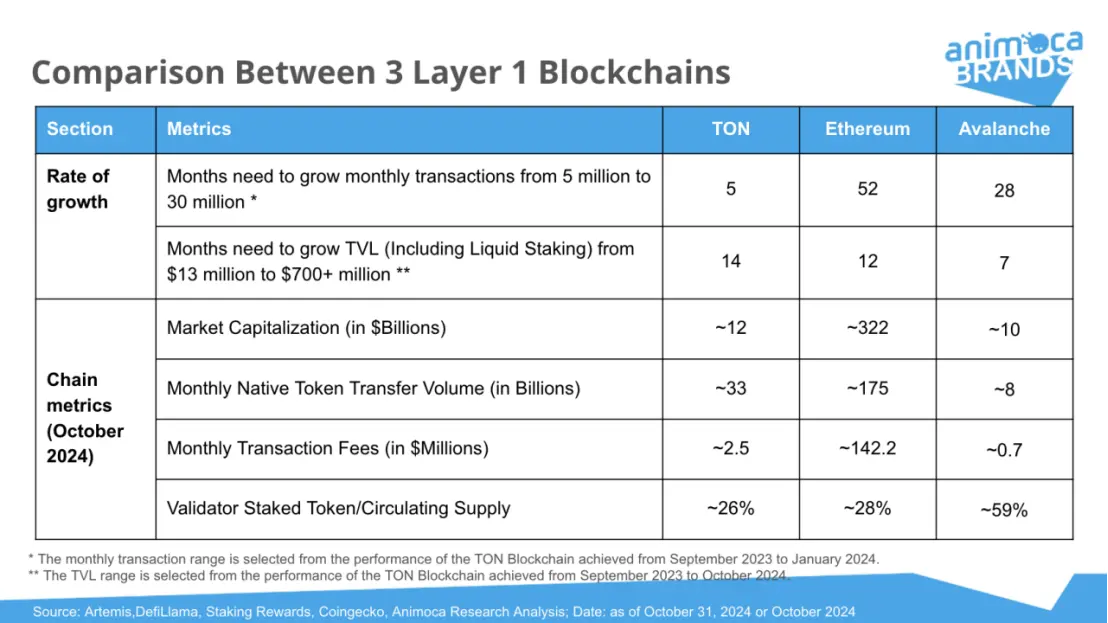

Comparison with other Layer1

To put this data in perspective, TON’s activity metrics and TVL can be compared to other major Layer 1s. While TON still has room to grow in terms of the absolute size of on-chain usage, its trajectory is impressive.

- It took Ethereum 52 months, Avalanche 28 months, and TON only 5 months to increase monthly transaction volume from 5 million to 30 million.

- Judging from the growth rate of TVL, TON is comparable to other Layer1s.

In recent scale-related metrics, TON's transaction fees and native token transfer volume are still smaller than Ethereum. However, compared with infrastructure projects with similar market capitalization (such as Avalanche), TON has taken a leading position in transaction fees and native token transfer volume. The volume of Toncoin transferred on-chain has reached 20% of Ethereum, a ratio that highlights the widespread use of Toncoin as a digital currency in the TON ecosystem.

Summary: TON’s challenges still exist

TON’s partnership with Telegram has greatly enhanced TON’s ability to attract developers and stimulate community vitality. The early success of the social game Notcoin catalyzed the exponential growth of Telegram Mini App usage, and subsequent initiatives such as airdrops and the introduction of meme coins like DOGS successfully introduced a large number of Telegram Mini App users to the Web3 ecosystem. This rapid expansion is an achievement unmatched by other major first-layer protocols.

However, challenges remain. Whether TON and Telegram Mini Apps can maintain user stickiness after the initial craze remains to be seen. Games, memecoins, and DeFi all have the potential to cultivate a sustainable Web3 user base, but achieving the key goal of attracting 500 million users by 2028 still requires a 20x increase from the current baseline of about 30 million activated wallets.

To address these challenges, the Foundation has shifted from a top-down governance model to a more community-driven approach to resource allocation. This shift aims to empower the TON community to better explore and seize growth opportunities. It can be expected that new TON initiatives from communities around the world will continue to flourish. Ultimately, a thriving ecosystem is built on diversity and adaptability.

Telegram’s success

Telegram, a messaging platform with 950 million monthly active users, operates with an extremely lean team of just 30 engineers and 50 employees. This lean structure enables the company to focus on scalable technology development, such as core messaging features and developer SDKs, or high-impact partnerships, such as integrating wallets and stablecoins into the platform. However, for labor-intensive activities, such as developer engagement or advertising operations, Telegram needs to rely on outsourcing or handing these opportunities to external parties.

This operating philosophy is reflected in Telegram's cooperation with Mini Apps. Mini Apps were originally launched as "Web Apps" when Telegram Bot API v6.0 was released in April 2022, allowing developers to launch rich web experiences (such as games and media) directly through Telegram robots. In June 2023, with the release of API v6.7, Web Apps were officially renamed Telegram Mini Apps. Despite the upgraded functionality, Mini Apps did not attract much attention in the first 18 months.

It was during this period that the TON Foundation became Telegram's ideal partner for promoting Mini Apps. With its established global developer community and its ability to use the Toncoin reserve to issue incentive programs, the Foundation played a key role in driving the adoption of Mini Apps.

The success of Telegram Mini App not only strengthens the platform's user base, but also provides Telegram with the opportunity to monetize through increased user interaction. Revenue streams like premium accounts, digital collectibles, and advertising are directly tied to the growing ecosystem. With Telegram planning an IPO by 2026, it is critical for Telegram to achieve profitability by riding this wave of platform growth.

TON cooperation related functions

Since the partnership began, Telegram has been rolling out features related to TON and Mini Apps that either lay the foundation for integrating cryptocurrencies into the Telegram ecosystem or support the growth and adoption of Mini Apps.

TON Wallet: In November 2023, Telegram released its native wallet in collaboration with third-party developer The Open Platform (TOP). The wallet uses a custodial format, where crypto transactions are recorded on a central server, similar to a centralized exchange. It also includes a non-custodial wallet option, TON Space, which is integrated into the wallet interface and provides direct on-chain transactions like MetaMask.

USDT on TON: In April 2024, Tether USD (USDT) — the largest stablecoin by market cap — launched its TON version. With this move, Telegram users can trade crypto-to-USD directly through native or third-party wallets. While this feature seemed like a natural move for the TON Foundation, it was actually the Telegram team that secured this partnership.

Telegram Stars: Launched in June 2024, Stars is Telegram's online points system that enables users to purchase digital goods and services. Users can purchase Stars with fiat currency through the Apple and Google stores, or with Toncoin through Fragment. For businesses and channel owners on Telegram, Stars can serve as an additional feature to help them gain value from users. For example:

- Set up a paywall using Stars as a payment method.

- Receive donations directly from users.

- Buy ads at a discount of about 35% (eg Stars worth $0.013 can buy ads for $0.02).

Although Stars are non-refundable, accounts holding more than 1,000 Stars can withdraw Toncoin funds through Fragment. There is no peg to any fiat currency value when purchasing or refunding.

Mini-App Store: In August 2024, Telegram launched "Apps" as a new category in its search box, simplifying the discovery process of Mini Apps. Although this feature is more like a search tool in an app store than a standalone app store, it provides users with a high-level entry point for easy access to Mini Apps. Regardless of the difference in naming, this update complements the Telegram Apps Center (a Mini-App style Mini Apps store) launched earlier by the TON Foundation.

Telegram Mini-App 2.0: On November 17, 2024, Telegram released a major update to the Mini-App functionality. New features such as full-screen mode, geolocation access, and exercise tracking are designed to enhance the user experience. These additions provide developers with more tools and inspire new use cases for Mini Apps, driving further adoption and innovation.

Telegram platform growth

Telegram hit a record of 950 million monthly active users (MAUs) in July 2024. Telegram and Pavel Durov had previously reported that the platform reached milestones of 700 million, 800 million, and 900 million monthly active users (MAUs) by the end of 2022, the first half of 2023, and April 2024, respectively.

Meanwhile, Mini Apps also achieved significant growth, reaching 400 million monthly active users in April 2024 and 500 million in June. This means that about half of Telegram users actively participate in Mini Apps.

Another fast-growing indicator is the number of Telegram Premium subscribers. Telegram Premium, which offers features that enhance the user experience, such as no ads, real-time translation, unlimited cloud storage, etc., reached 1 million subscribers in December 2022. Since the start of the partnership, growth has accelerated significantly, reaching 5 million in January 2024 and doubling to 10 million in September 2024.

These observations, combined with the fact that 70% of the top 50 Telegram channels are dedicated to the TON project (all of which include Telegram Mini Apps), indicate that the TON partnership has significantly boosted user engagement on Telegram. The growing popularity of Telegram Mini Apps has transformed Telegram from an occasionally used tool to an indispensable application for users, driving many to subscribe to premium features to further enrich their experience.

Impact on Telegram’s profitability

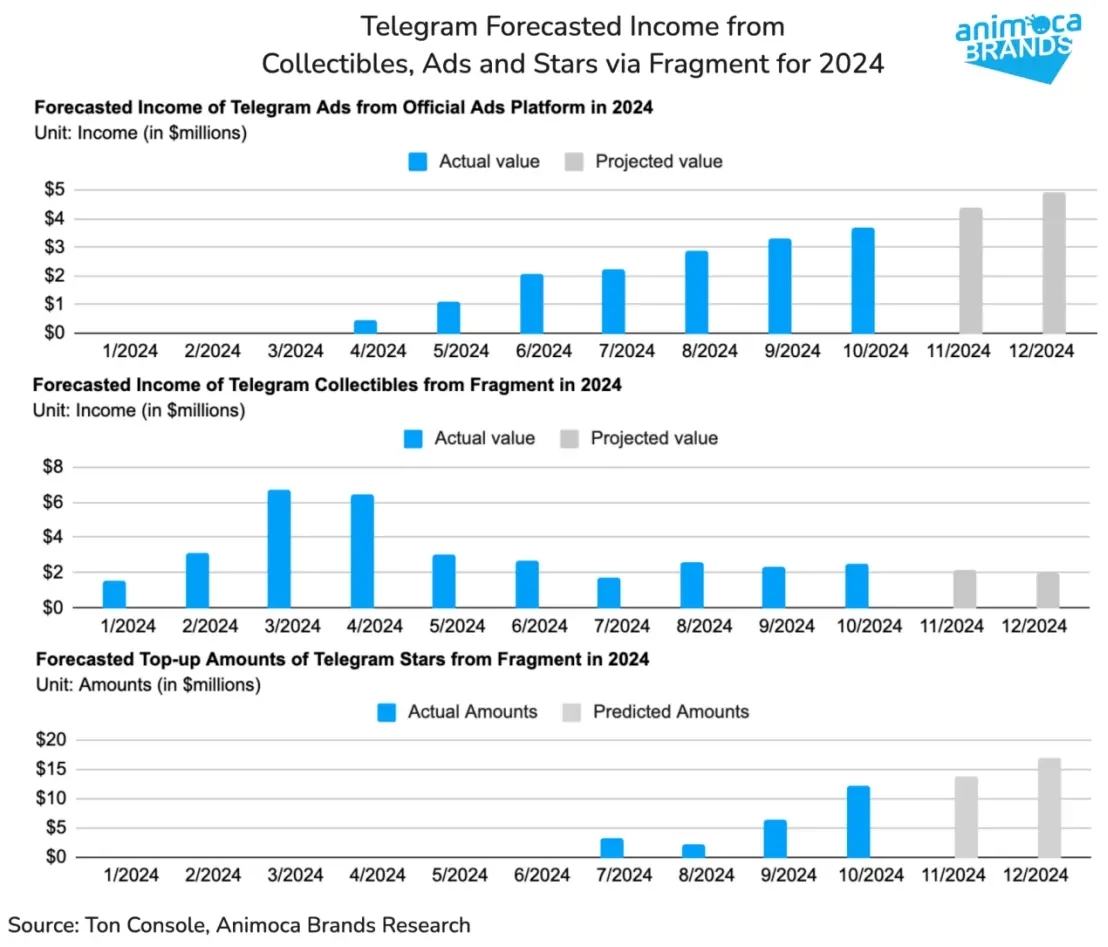

Enhanced user engagement has significantly increased Telegram's ability to generate revenue from its platform operations. Existing revenue streams, such as Telegram Ads, collectibles sales, and premium account subscriptions, have experienced significant growth. In addition, the newly launched Telegram Stars provides an additional revenue stream for the platform.

Telegram Advertising: The Telegram advertising platform moved ad sales to on-chain tracking in April 2024, increasing the transparency of its performance monitoring. In addition, the platform has expanded the scope of ad display to provide display ads to channels with fewer subscribers, allowing new advertisers to participate. According to Telegram's first half 2024 financial report, Telegram advertising generated $120 million in revenue in 6 months, almost double the $70 million in revenue for the whole year of 2023. We expect this advertising momentum to continue, and full-year advertising revenue should reach $240 million.

Collectibles: Collectibles are traded entirely on-chain through Telegram’s Fragment marketplace. Revenue includes Telegram’s primary sales and platform commissions on secondary sales. While revenue surged in March and April, it has since stabilized. We estimate that collectibles revenue will reach $36 million in 2024, an increase of $18 million from last year and more than 100% year-over-year.

Premium Account Subscriptions: As mentioned above, Premium Account Subscriptions experienced significant growth in 2024. In the reported first half of 2024 financial report, Premium Account Subscription revenue was $119 million. Based on the growth trend of the number of subscriptions, we expect full-year revenue to reach $285 million, a year-on-year increase of more than 200%, and will make Premium Accounts the largest revenue source in Telegram's business.

Telegram Stars: Telegram Stars sold as digital goods bring a new revenue stream to the platform. While we lack full visibility into fiat purchases through Apple and Google, on-chain Stars sales through the Fragment marketplace provide a conservative estimate. Based on the results of the first four months, we expect on-chain Stars revenue to reach $55 million in 2024. Total Stars revenue should be higher, but we use this value as a conservative estimate.

TON Direct Revenue: According to the Financial Times, Telegram has generated $225 million in revenue from allowing Toncoin as the only way for small businesses to buy ads. We believe this revenue source effectively replaces the "premium access to the advertising platform" in 2023, which allowed Mini-Apps to purchase ads on Telegram with restrictions. In addition, the fees Telegram collects from its "integrated wallets" are expected to continue due to the exclusive partnership with TON. While there may still be user-generated fees related to transactions and withdrawals from integrated wallets, we expect these contributions to remain small this year.

Based on the information and estimates collected, we predict that Telegram's full-year revenue for 2024 will reach at least $971 million and may exceed the $1 billion mark. The reported first half of 2024 financial results already show revenue of $525 million, including $225 million in revenue recognition from Toncoin advertising visits.

In terms of spending, Pavel Durov revealed in a 2024 interview that “annual spending per user per month is less than 70 cents.” Based on current MAU growth trends, we estimate full-year spending to be $667 million. This would result in full-year operating profit of more than $300 million, marking a significant jump in the company’s profitability.

This will be an important step in Telegram's IPO plan. Telegram raised $2 billion through convertible debt by 2024 and another $330 million this year. These debts are expected to mature in 2026, putting time pressure on Telegram's listing plan. The year-end profit results will undoubtedly help strengthen its preparations for the IPO road.

Conclusion

TON and Telegram's first year of collaboration has proven to be a win-win situation for both parties. TON has seen tremendous growth in popularity, and its governance model has evolved to meet the needs of an active community eager to drive further expansion. Riding this wave of user engagement, Telegram has successfully leveraged its active user base to drive additional revenue, particularly through premium account subscriptions and exclusive rights. Under this mutually beneficial partnership, it is expected that the collaboration will continue to thrive in the coming years.