Original | Odaily Planet Daily

Author: Azuma

It is really difficult to speculate in cryptocurrencies. Altcoins keep falling and PVP fails over and over again. Instead of continuing to persist, it is better to turn back.

As the difficulty of market operations rises sharply, more and more users are turning their attention to more controllable money-making opportunities. In response to this demand, Odaily Planet Daily decided to open the column "U-standard financial management strategy more suitable for lazy people". This column will cover the current market's relatively low-risk (systemic risk can never be ruled out) income strategies based on stablecoins (and their derivative tokens), aiming to help those users who hope to gradually increase the scale of funds through U-standard financial management to find more ideal interest-earning opportunities.

This column is tentatively scheduled to be updated weekly. If readers provide high feedback, we will also release relevant strategies for BTC, ETH, and SOL later.

Here's a "hot" piece of knowledge. In the past 20 years (from October 15, 2004 to October 14, 2024), the average annualized rate of return of "stock god" Buffett was about 10.96%. In the cryptocurrency market where financial systematization and structuring are still in their early stages, every ordinary person can "easily" break through this number.

Base rate (least efficient)

The so-called base interest rate is tentatively planned to cover the single-currency financial management solutions of mainstream CEX, as well as mainstream on-chain lending, DEX LP, RWA and other DeFi deposit solutions.

CEX side

Binance : USDT single-currency investment (apy) is temporarily reported at 2.7%, with an additional 5% bonus for 0-500 USDT; USDT single-currency investment is temporarily reported at 1.89%, with an additional 7% bonus for 0-500 USDC;

OKX : USDT single-currency financial management is temporarily reported at 2%; USDC single-currency financial management is temporarily reported at 2%;

Bitget : USDT single currency investment is currently reported at 4.12%, with an additional 8% bonus within 0-500 USDT.

On-chain

Ethereum

Aave: USDT 4.18%; USDC 4.27%; DAI 5.13%;

Fluid: USDT 9.43%; USDC 8.07%;

Ethena: sUSDe 9%;

Sky: sUSDS 8.75%;

Solana

Kamino: USDT 4.72% %; USDC 6.53%; PYUSD 6.56%; USDS - USDC LP 11.24%;

margin.fi: USDT 5.69%; USDC 5.87%; PYUSD 6.41%;

Base

Aave: USDC 5.04%;

Aerodrome: USDC - USDT LP 13.88%.

Pendle Zone (Core Strategy)

If you want to maximize the yield of stablecoins, you basically cannot avoid structured or leveraged products. Considering the security and liquidity conditions, Pendle is undoubtedly the most suitable place.

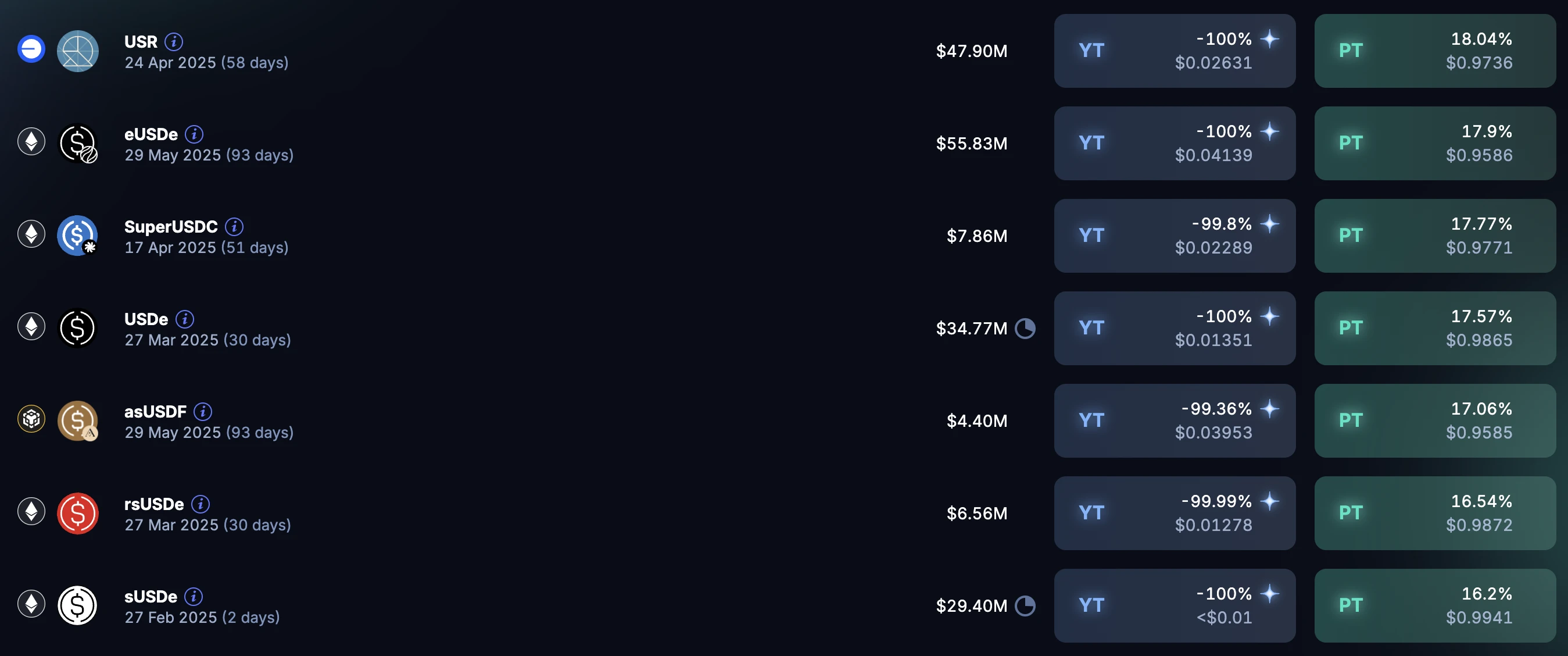

As shown in the above figure, the PT yields of multiple stablecoins on Pendle can reach 15% or even higher, which is significantly higher than the industry's basic interest rate level.

The hot pool recently is the eUSDe (Ethreal's USDe deposit certificate) pool that expires on May 29. The current price for directly buying PT corresponds to an apy of 17.9%, and the corresponding yield on the maturity date is approximately 4.56%.

You can also choose to become the LP of the pool (eUSDe - eUSDe PT). Although the corresponding rate of return will drop to 7.546% (it will increase to 9.09% if there is sufficient PENDLE pledge), you can get an additional 1.6 times the Ethreal points bonus and 50 times the Ethena Sats points bonus - there will be impermanent losses if you withdraw early, but the losses will be gradually offset if you hold the position until maturity.

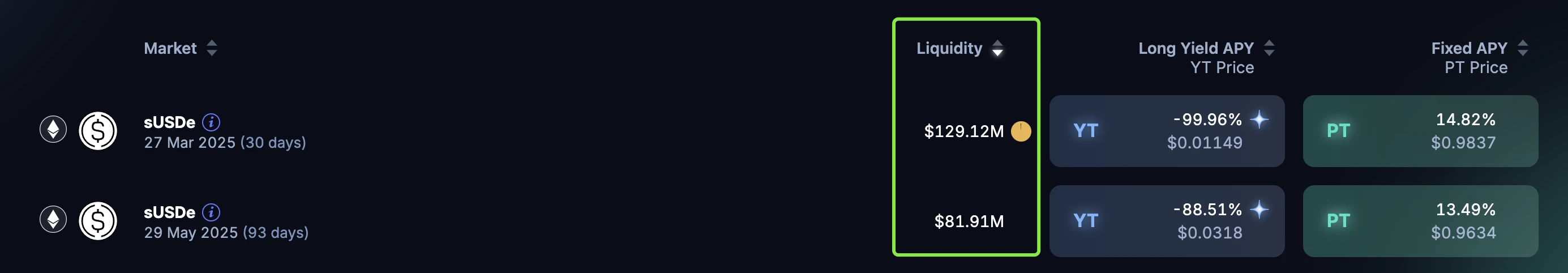

In addition, the "old gold pool" sUSDe (Ethena, USDe after pledge) is still very popular. The pool that expires on March 27th directly buys PT at the current price, corresponding to an apy of 14.8% (sUSDe's base rate of return on expiration date is 1.21%), and the pool that expires on May 29th directly buys PT at the current price, corresponding to an apy of 13.49% (sUSDe's base rate of return on expiration date is 3.44%), and combined with the 9% apy of sUSDe itself, the combined apy can exceed 20%.

Ecological incentives (opportunities and fluctuations coexist)

This section mainly covers the currently popular ecosystems, especially those that are implementing incentive plans in various forms. The common characteristics of these ecosystems are that the early paper yields are often extremely high, but the rewards are generally in the form of ecosystem tokens or protocol tokens within the ecosystem, and the final yield is linked to the performance of the currency price.

For example, the currently popular Sonic, taking the mainstream DEX protocol Shadow in this ecosystem as an example, the apr (note that it is apr here, not apy) of USDC.e - scUSD LP on this DEX is temporarily reported at 38.2%, and the apr of USDC.e - USDT LP is as high as 57.3%.

However, the rewards of this type of pool are mainly based on xSHADOW and GEMS incentives. It takes 6 months for xSHADOW to be unstaked 1:1 to SHADOW. GEMS is Sonic's future airdrop certificate, but according to official disclosure, the end of the first season will have to wait until around June 2025. Overall, although the revenue figures are attractive, there is still some uncertainty in the realization of incentives.

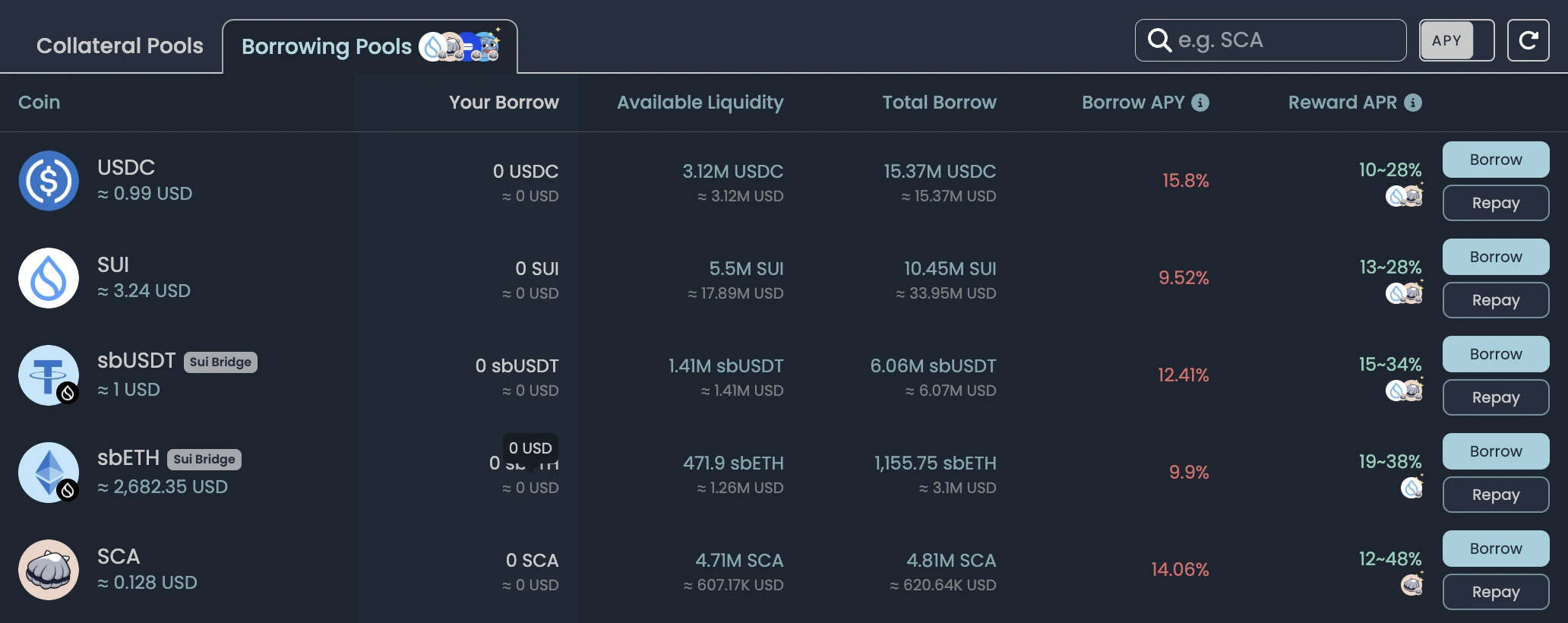

Another interesting ecosystem is Sui. Sui recently opened incentive subsidies to some protocols within the ecosystem, resulting in a relatively rare phenomenon of inverted borrowing costs and returns in lending protocols such as Scallop - that is, the additional incentives for lending funds are greater than the borrowing costs. As shown in the figure below, without taking the pledge boost increase, the lending incentives of SUI, sbETH, and sbUSDC in Scallop are all higher than the borrowing interest rate cost, which means that users can make profits through both deposits and borrowing.

Blind mining opportunities (suggestion of "killing two birds with one stone")

This section mainly focuses on projects that have not yet launched TGE but have opened deposit channels. Since the size of the future prize pool (airdrop) is uncertain, the return of this strategy fluctuates greatly. Relatively speaking, it is more recommended to invest in projects that have a certain interest-bearing ability and can also take into account the "kill two birds with one stone" opportunity of airdrops.

For example, Ethreal mentioned above, the community likes to call it the "son" of Ethena. Currently, depositing USDe directly in Ethreal can obtain the voucher token eUSDe, but this plan cannot generate interest and there is no point acceleration. It is recommended that long-term depositors (actually only three months) switch to Pendle LP.

Other opportunities that I am currently participating in include 1) Symbiotic, which mainly uses the sUSDe form, and can accumulate points while consuming 9% apy; 2) Soneium has just been launched, and on the one hand, I hope to earn the upcoming ASTR incentives, and on the other hand, I hope to gain potential airdrops; 3) Berachian also deposited some sUSDe through Concrete, but I regret it now. First, there are too many people and too little meat, and second, the withdrawal is temporarily restricted; 4) Perena also put some in the LP pool before, but has withdrawn recently due to low apy; 5) Others have also put some funds in Meteora to brush points, but are not limited to stablecoins.

Financing ratio

There are always risks in the crypto world, so never put all your eggs in one basket (although these baskets are often in one car...). My current stablecoin configuration plan is as follows, for reference only.

There is still about 30% of the base interest rate, part of which is in CEX and part of which is on popular chains such as Solana, mainly for the convenience of trading at any time;

Pendle is currently the main battlefield, with an investment scale of about 40%, but it will be distributed in different pools, and both PT and LP will take some;

The investment in the ecosystem is relatively small, less than 10%. I personally have some prejudices against the past of AC and Fantom, so I will probably not invest heavily in Sonic.

About 20% is left for blind mining of major projects. The specific investment ratio depends on the project status (basic rate of return, team background, audit status) and personal preference.

There may be further adjustments in the near future, so please follow up in the subsequent updates.