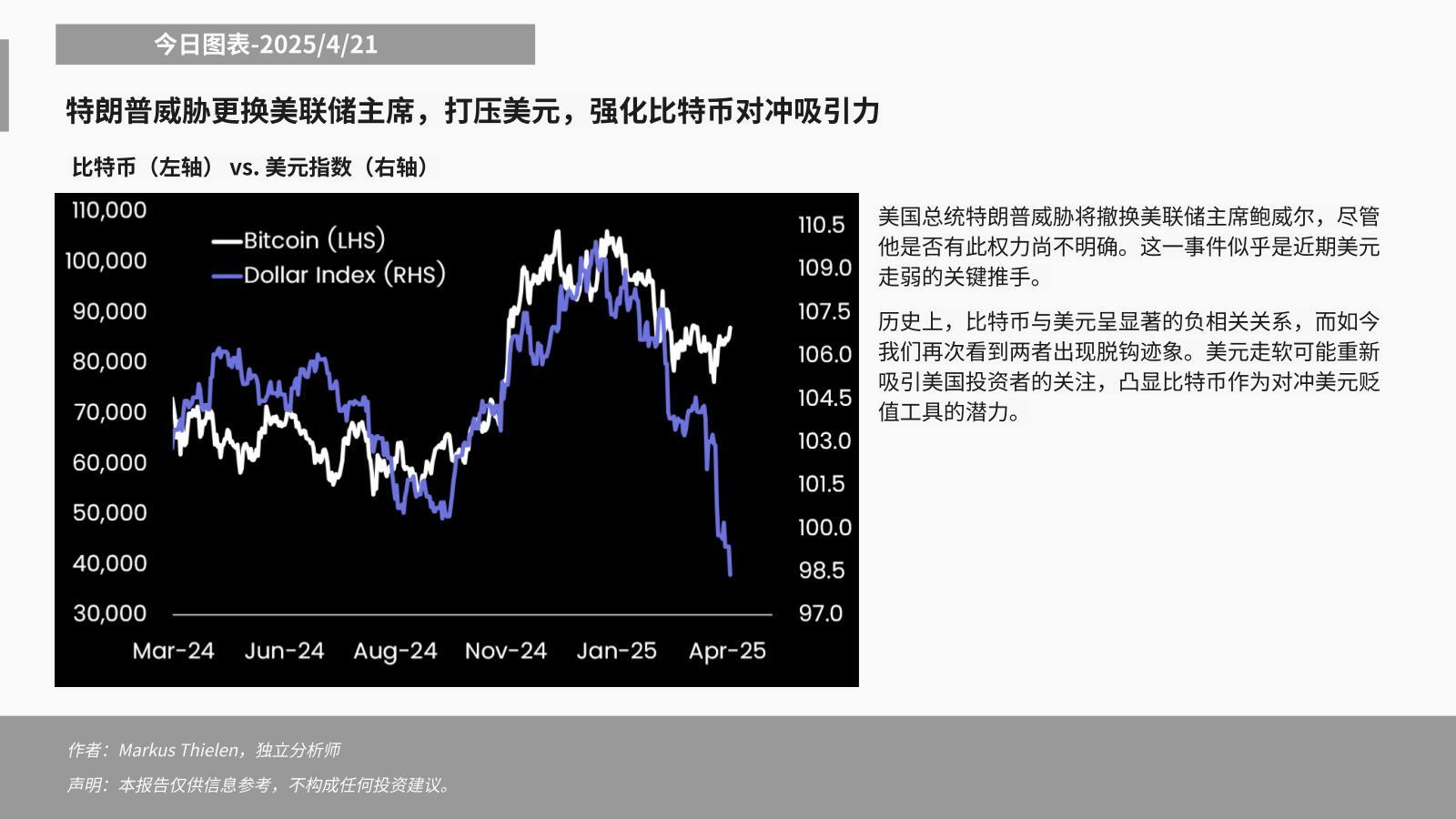

PANews reported on April 21 that according to Matrixport analysis, US President Trump threatened to replace Federal Reserve Chairman Powell, although it is unclear whether he has the power to do so. This event is seen as a key factor in the recent weakening of the US dollar. Historically, Bitcoin has a significant negative correlation with the US dollar. The current weakening of the US dollar may cause US investors to refocus on Bitcoin, highlighting its potential as a tool to hedge against the depreciation of the US dollar.