By Sander Lutz

Translation: Blockchain in Vernacular

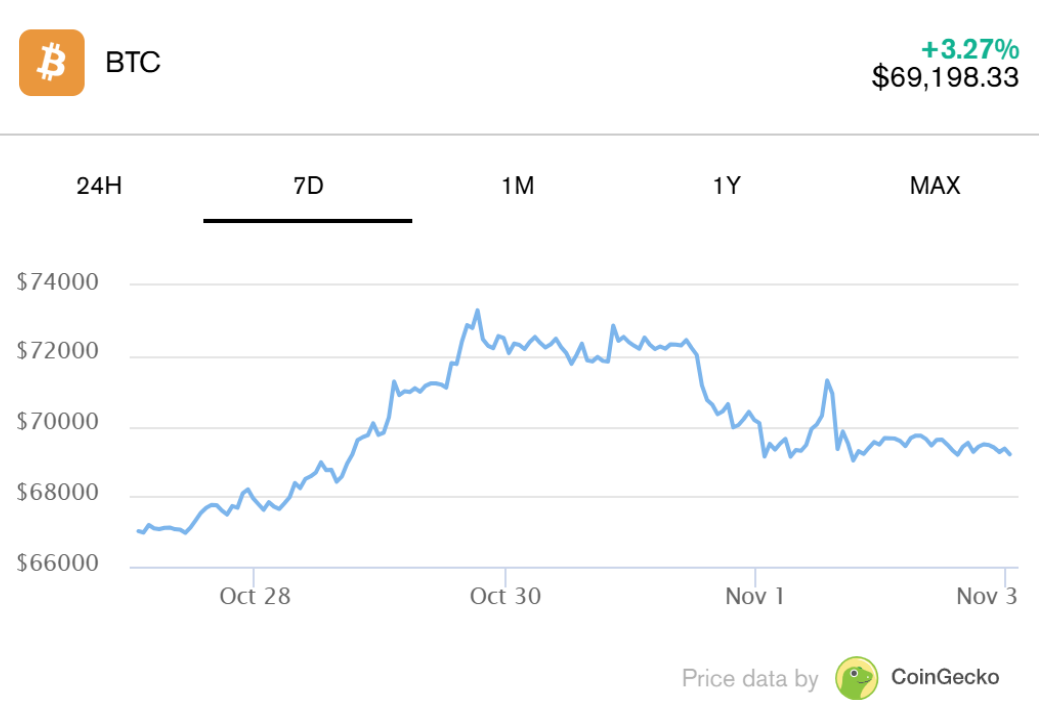

The U.S. crypto industry had a lot to celebrate this week: Bitcoin came within inches of its all-time high, crypto ETFs hit a new milestone on Wall Street, and next week's presidential election looks set to boost the ecosystem regardless of victory or defeat.

Yet you can hardly see that all this masks a tough week for the top crypto companies in the United States. On Tuesday, Ethereum software giant Consensys laid off 20% of its global staff. A few hours later, New York-based decentralized crypto trading platform DYdX cut the size of its team by 35%. The next morning, Kraken, one of the largest crypto trading platforms in the United States, also laid off 15% of its staff.

As the week came to a close, Coinbase released a disappointing third quarter earnings report that missed expectations and saw an overall decline in customer activity. What exactly is going on?

Experts told Decrypt that a variety of factors are likely at play — ranging from short-term election and regulation-related anxieties that may be resolved quickly to deeper questions about the place of crypto-native companies in an industry increasingly dominated by traditional financial giants.

“This is absolutely the most bearish bull run in history,” Alex Tapscott, managing director of digital asset management at Ninepoint Partners, told Decrypt.

While bullish headlines about the cryptocurrency rally seem to be everywhere, that statement really only applies to Bitcoin, which Tapscott said is “becoming increasingly unique.”

Even Bitcoin’s strength no longer necessarily means gains for the crypto industry.

“Yes, the price of Bitcoin has gone up a lot, but where is all this money going?” Owen Lau, senior analyst at investment firm Oppenheimer & Co., told Decrypt. “This money is going to traditional financial companies, not crypto-native companies.”

As Wall Street giants like BlackRock buy billions of dollars in bitcoin trades through their exchange-traded funds, relying on brand trust and ultra-low fees, crypto exchanges like Coinbase and Kraken are being left out in the cold, Lowe said. He added that companies associated with weak cryptocurrencies like Ethereum, like ConsenSys, are in a worse situation. (Disclaimer: ConsenSys is one of Decrypt's 22 investors, but Decrypt is editorially independent.)

Concerns related to regulatory uncertainty and the upcoming presidential election may have largely suppressed crypto activity and investment — at least for now.

Kristin Smith, CEO of the Blockchain Association, told Decrypt that while she is optimistic that both the Trump and Harris administrations can bring regulatory clarity and support to the crypto industry, the SEC’s current hostility toward the industry has caused significant damage to business and will not be alleviated until at least next year.

“I think a lot of capital is still on the sidelines and is nervous about entering this space until they see more clarity,” Smith said. “So I do think that regulatory issues and political issues are a big factor in all of this.”

Earlier this week, the Blockchain Association launched an initiative to track how much money leading crypto companies have spent on lawsuits filed by the SEC. The organization said the figure has exceeded $400 million. When ConsenSys announced a 20% layoff on Tuesday, CEO Joe Lubin said the layoffs were related to the "millions of dollars" ConsenSys spent defending itself in court.

Still, some experts insist that even if the U.S. government accepts the crypto industry, its plight will not go away. Oppenheimer’s Law believes that the current landscape of crypto-native companies, especially CEXs, is too crowded, and many of these companies will eventually either die or be acquired by traditional financial companies.

“I don’t know why the market would allow 200 exchanges in the world,” he said. “It doesn’t make sense to me.”

Meanwhile, Ninepoint’s Tapscott believes that simply removing SEC Chairman Gary Gensler will not be enough to unleash a true crypto bull run.

“This isn’t just about the election,” he said. “If you look at past cycles, there’s always some new app or new feature that people are excited about.”

Tapscott noted that landmark innovations such as decentralized applications (dapps) and NFTs have driven the crypto market to unprecedented highs.

“Is there anything that’s going to motivate people this time around like it did before?” he said. “I think the answer is, not yet.”

While the prospect of politicians and Wall Street embracing crypto is undoubtedly exciting, Tapscott added that the development is not enough to kickstart a true bull run for the industry, nor is it a substitute for the enthusiasm generated by genuine new blockchain use cases.

“How do you use this technology to do something that wasn’t possible before?” he said.