Original title: The REAL reason markets are crashing:

Original author: The Kobeissi Letter

Original source: https://x.com/

Translated by: Daisy, Mars Finance

The real reason for the market crash:

Over the past two months, the S&P 500 and cryptocurrencies have collectively lost more than $5.5 trillion in market value.

We have just witnessed one of the most abrupt sentiment shifts since 2020.

What happened? Let us explain.

Let's start with a timeline:

The market had already foreseen the trade war coming as early as mid-2024.

In December, tariff threats intensified, and we have since seen the S&P 500 hit multiple all-time highs.

Even after the trade war officially began on February 1st, we still saw more all-time highs.

Since February 20, a staggering $4.5 trillion in market value has been wiped off the S&P 500.

Over the past 13 days, this equates to a loss of about $350 billion in market value every day.

The Nasdaq is now just 8% away from entering a bear market for the first time since 2022.

What is changing so rapidly?

The trade war is just a scapegoat.

The real reason for the market's decline is the sudden shift in risk appetite.

We went from extreme greed to extreme fear in just a few days.

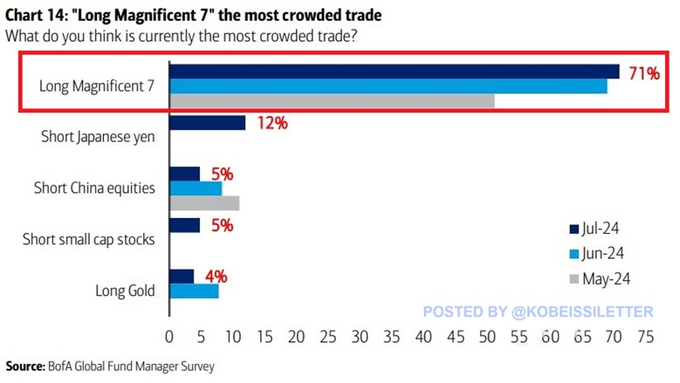

The market positioning was so extreme that we had completely shifted in the opposite direction.

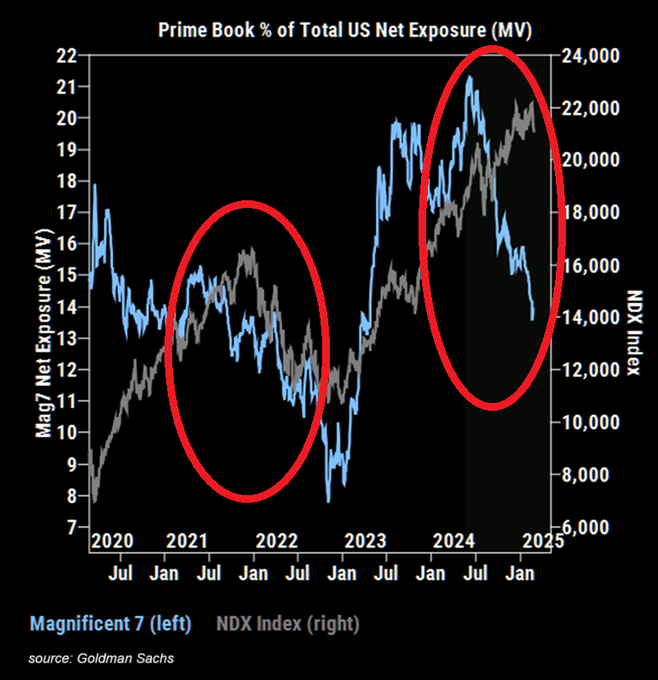

What’s even more interesting is that institutional capital had already withdrawn before the tech stocks fell.

Heading into 2025, hedge fund exposure to the "Big Seven" stocks fell to a 22-month low.

Look at the divergence between the Nasdaq and fund positions.

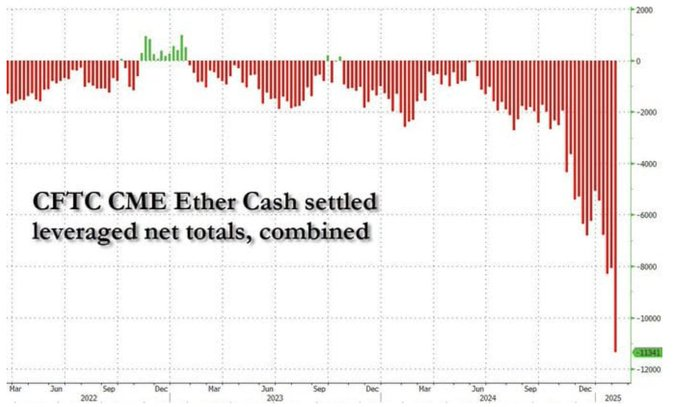

On February 9, institutional investors established the largest Ethereum short position in history.

At the same time, retail investors have flocked to the cryptocurrency market in hopes of the introduction of a strategic reserve in the United States.

Even if nearly all of Trump’s bullish promises were fulfilled, the cryptocurrency market would still be down more than $1 trillion.

Cryptocurrencies further strengthen our argument:

Take a look at all the bullish cryptocurrency developments over the past two months.

Even the U.S. Bitcoin reserves have become a “sell the news” event.

So, what has changed?

Obviously, there is a sudden shift in risk appetite.

In December 2024, market sentiment was so bullish that Apollo released a risk assessment for 2025 that predicted a 0% chance of a U.S. recession.

At the same time, they predict there is a 90% chance that tariffs will be implemented in 2025.

The market has long been aware of the tariffs, and the market's decline is not entirely due to the tariffs.

The Fear and Greed Index for cryptocurrencies and stocks has fallen this month to its lowest point since the 2022 bear market.

Last year, the cryptocurrency greed index reached over 92; now it has dropped to the exact opposite, 17.

Sentiment is the ultimate driver of price in any market, regardless of the fundamentals.

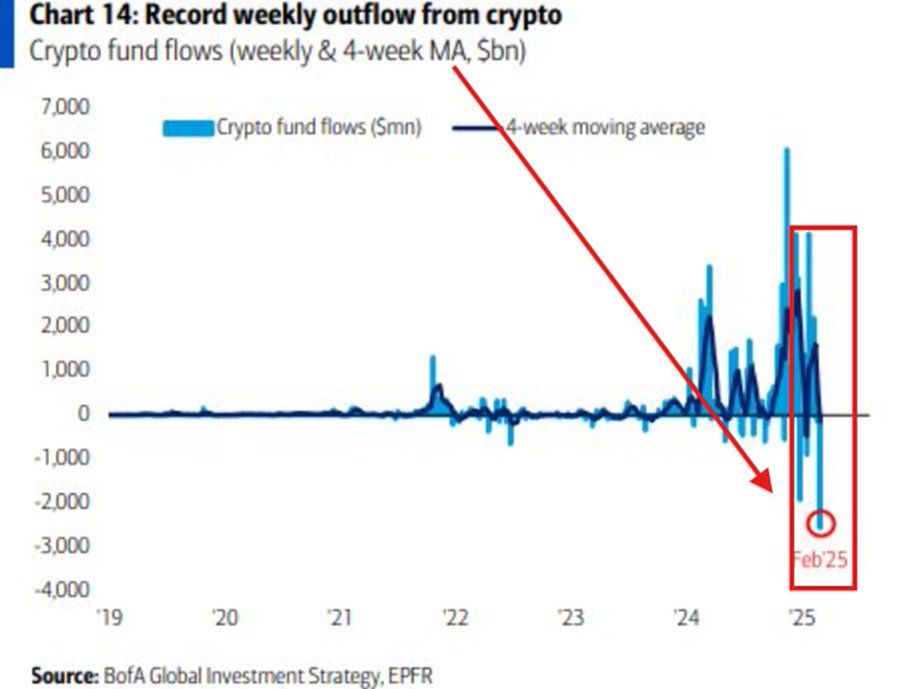

When sentiment shifts so quickly, outflows reach record highs, leading to the “flash crash” we’ve seen.

Cryptocurrency funds saw record outflows of $2.6 billion in the last week of February.

This figure is about $500 million higher than the previous record set in 2024.

U.S. small-cap funds saw outflows of $3.5 billion last week, the most since December 18.

Mid-cap funds saw outflows of $2.1 billion.

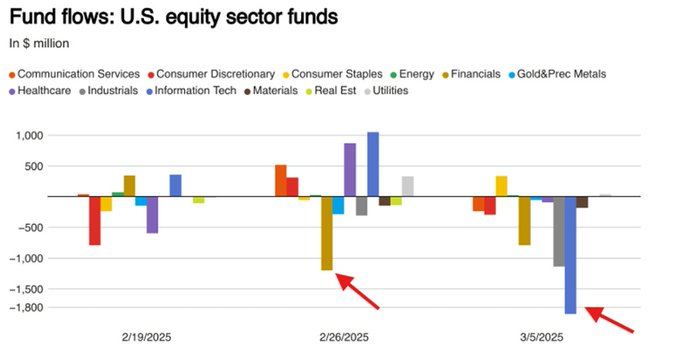

Industry funds saw outflows of $4.5 billion, with technology industry funds alone seeing outflows of $1.9 billion.

There was another shift in positions.

This means that acting ahead of a sentiment shift will be the most profitable strategy in 2025.

Market volatility is set to increase as the Volatility Index ($VIX) surged more than 70% in a month.

We expect the Dow Jones to see swings of more than 1,000 points and this to become the norm.

We have been trading these swings through both technical and fundamental analysis.

Stocks, commodities, bonds, and cryptocurrencies are all great to trade right now.

Want to see how we trade?

Please subscribe to our premium analysis and alerts via the link below:

Finally, the movement of cryptocurrencies and stocks has become increasingly one-sided.

Down days are deep red and vice versa, another sign of a change in risk appetite.

Sentiment is the ultimate driver of price.