Author: BitpushNews

Financial markets were volatile on Thursday, but generally positive. The dollar index and the 10-year U.S. Treasury yield retreated, opening the door for inflows into risky assets.

The latest employment data from the U.S. Department of Labor showed that the number of applications for unemployment benefits fell to 227,000 last week, revised up to 242,000 the previous week, while the number of unemployed people hit a three-year high. Market observers believe that these data indicate that the Federal Reserve will continue to cut interest rates at the November FOMC meeting. The CME FedWatch tool currently shows that the probability of a 25 basis point rate cut in November is 96%, up from 88% last week.

As of the close of the day, the S&P 500 and Nasdaq both rose, up 0.21% and 0.76% respectively, while the Dow Jones fell 0.33%.

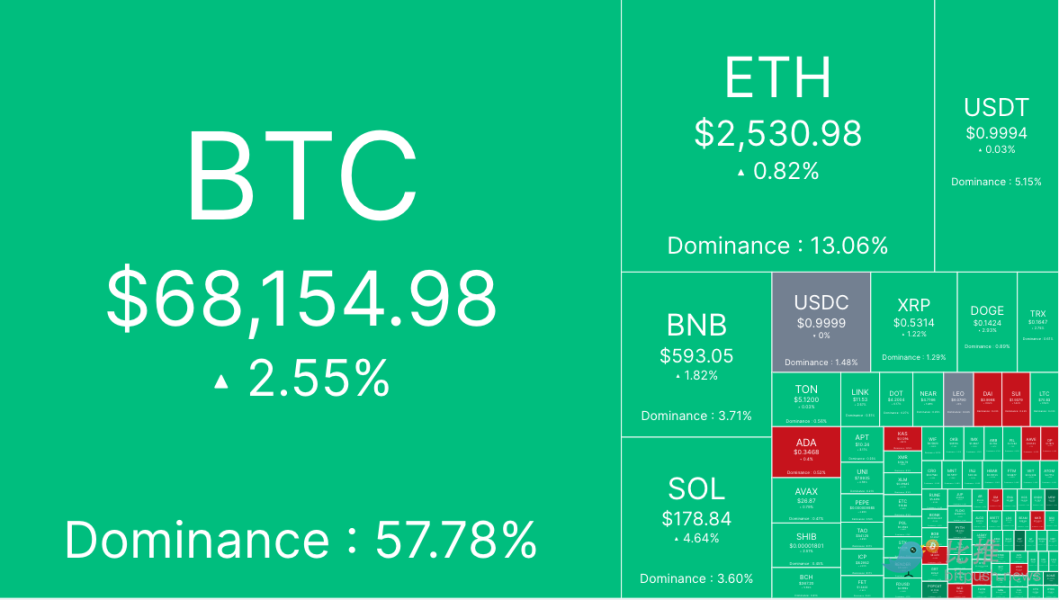

In the crypto market, Bitpush data showed that Bitcoin broke through the $68,000 resistance level after midday, and bulls are accumulating strength to hit $69,000. As of press time, Bitcoin is trading at $68,154, up 2.55% in 24 hours.

The top 200 altcoins by market capitalization all rose. Safe (SAFE) had the largest increase, up 44%, followed by cat in a dogs world (MEW) up 24%, and Ravencoin (RVN) up 17.3%. ZetaChain (ZETA) led the decline, down 5.7% in 24 hours, ApeCoin (APE) down 5.1%, and BinaryX (BNX) down 2.7%.

The current total market value of cryptocurrencies is $2.33 trillion, with Bitcoin accounting for 57.8% of the market share.

Golden Cross Potential Excites Bitcoin Bulls

Technical analysts point out that the Bitcoin trend chart is about to see a golden cross, which is when a shorter-term moving average (MA), such as the 50-day moving average (50MA), crosses upwards over a longer-term moving average (such as the 200MA). This technical indicator usually indicates that bullish forces are increasing and market sentiment is optimistic.

As shown in the chart provided by X user Elija, the last golden cross occurred in November 2023, when BTC was trading around $33,000. After the golden cross appeared, Bitcoin rose all the way and hit a record high of around $74,000 in March this year.

The chart tracked by TradingView analyst TradingShot shows: "Bitcoin is in front of a major bullish pattern, most likely next Monday, when it will form a golden cross on the 1D timeframe, the first such pattern since October 29, 2023. As previously analyzed, it is no coincidence that a new 1D golden cross appears a year later, as seasonality and long-term cycles play a key role for BTC."

The analyst believes that Bitcoin has shown strong bullish signals recently. Last week, the price of Bitcoin successfully broke through the upper track of the long-term falling channel and has recently made an effective retracement confirmation, which shows that the bulls are gradually strengthening. If this retest is established, then this is the best short-term signal for a new high.

More importantly, Bitcoin prices have been in a continuous upward channel since 2005, setting new historical highs. This long-term upward trend provides a solid foundation for the current rally.

Combined with the recent 1-day golden cross, the market's bullish sentiment on Bitcoin has further heated up. TradingShot believes that Bitcoin is expected to challenge the historical high of $73,800 and may even achieve this goal before the upcoming election day.