Compiled by: Yuliya, PANews

After the DAO fundraising platform Daos.fun launched by ai16z became popular, Daos.World, a so-called innovative DAO fund launch platform, has attracted widespread attention recently. The platform is deployed in both the Base and Solana (daos.fun) ecosystems, and through its operating model and mechanism, it has created a new paradigm for decentralized investment management. This article will analyze the characteristics, potential and risk points of this emerging platform from multiple dimensions such as platform architecture, operating mechanism, and participation methods.

Platform core architecture

Daos.World adopts a three-tier architecture system:

- Fund management : The platform uses smart contracts to manage funds, ensuring fund security and transparent operations. All funds are managed by smart contracts to ensure that assets are not centrally controlled.

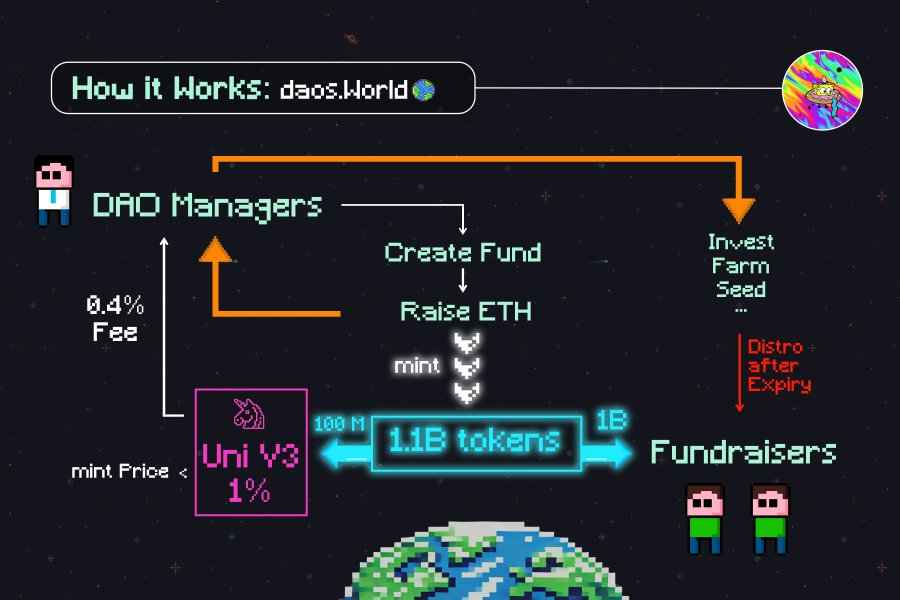

- Token economy : The platform issues a total of 1.1 billion ERC20 tokens, of which 1 billion are allocated to fundraising participants and 100 million are used to establish the Uniswap V3 liquidity pool, building a complete token ecosystem. The price of the liquidity pool has a lower limit protection to ensure that the value of the assets in the pool will not be lower than the amount of ETH raised, providing basic protection for investors.

- Governance level : The platform introduces a fund expiration mechanism. When the fund expires, all trading activities will be suspended, and the assets in the fund pool will be distributed to investors according to the proportion of token holdings. At the same time, fund managers have flexible management authority and can extend the fund's expiration date to ensure that investors' rights and interests are protected in specific circumstances.

How it works

The platform's operating process is designed to be simple and efficient, and is mainly divided into the following steps:

1. Fundraising and fund management : ETH is raised as the initial capital of the fund through pre-sale, and all funds enter the fund pool controlled by the DAO manager. The manager has full autonomy and can conduct transactions and investment operations according to market conditions.

2. Liquidity pool design : After the launch of Uniswap V3, a unilateral liquidity pool design is adopted, that is, the liquidity pool only contains fund tokens to ensure the effectiveness of the price discovery mechanism. Tokens are traded through this liquidity pool, and the platform charges a 1% transaction fee, of which 0.4% is allocated to the fund manager and 0.6% belongs to the platform. The fund's trading activities will affect the "real" price of the token, thereby helping traders make more informed investment decisions.

3. Transaction fees and incentives : Fund managers receive a 0.4% handling fee from token trading volume, and the platform charges 0.6%. In addition, fund managers may receive additional profit sharing when the fund expires, depending on the performance of the fund.

4. Liquidity pool lower limit protection : The design of the liquidity pool has a price lower limit protection to ensure that the total value of assets in the pool will not be lower than the amount of ETH initially raised, avoiding the problem of serious asset shrinkage caused by market fluctuations.

How to participate

The platform has designed differentiated profit plans for different types of participants:

- Fund managers : In addition to earning income through transaction fees, fund managers may also receive additional profit sharing when the fund matures.

- Early investors : Get lower-risk investment opportunities through pre-sales. Pre-sale participants can obtain corresponding token shares based on the amount of ETH raised. At the same time, investors can choose to participate in liquidity provision and obtain additional benefits.

- Liquidity Providers (LP) : Due to the low initial liquidity of the platform, liquidity providers (LP) may obtain considerable annualized returns, which may even exceed 1000%. However, liquidity providers need to pay attention to the risks brought by market fluctuations, which may affect the trading timing and returns of the liquidity pool.

Technological innovation

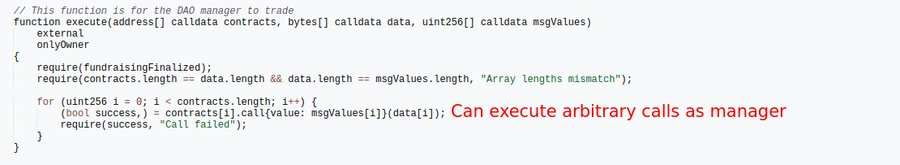

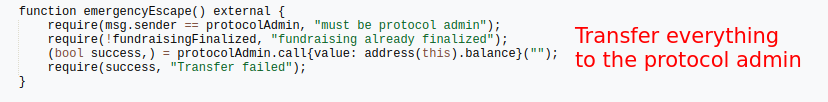

From a technical perspective, the platform uses smart contracts for fund custody. Fund managers execute investment operations through the onlyOwner execute() function and can call other smart contracts to implement DeFi strategies. Uniswap V3's liquid NFT remains locked before the fund expires to ensure liquidity stability. The emergency exit function is a safety mechanism in the early stage of the platform. It can be triggered when a vulnerability is found during the fundraising period to prevent capital loss. Once the pre-sale ends and the token is launched, the platform will not be able to intervene in the flow of funds, which requires the platform to improve its security mechanism after further stabilization.

The platform also supports fund managers to call various smart contracts on the blockchain according to market conditions, providing broad space for the implementation of DeFi strategies. This includes but is not limited to leveraged trading, cross-protocol arbitrage, yield farming and other strategies, which expands the possibility and flexibility of investment, allowing fund managers to quickly adjust investment strategies according to market changes and improve investment efficiency.

Risks and Outlook

Although the platform shows good development prospects, investors still need to be wary of multiple risk factors:

- Risks of fund managers’ investment decisions : Fund managers’ investment decisions may bring greater risks, especially when selecting immature or underperforming assets. For example, if a fund manager invests funds in high-risk assets such as Meme coins that have fallen sharply, it may cause the fund’s underlying value to return to zero and the token to depreciate.

- Potential technical risks of smart contracts : Although the platform’s smart contracts have been audited, there may still be unknown loopholes or technical defects. Investors need to be cautious when participating.

- Liquidity risk caused by market fluctuations : Due to the low liquidity of the platform in the early stage, market fluctuations may have a significant impact on the price and trading timing of tokens. Liquidity providers (LPs) need to bear the risks brought by market fluctuations.

Despite this, the platform has effectively solved many problems faced by traditional Meme coins through innovative mechanisms, especially in ensuring basic value and preventing online sniping. In the future, with the further improvement of the platform and the expansion of the ecosystem, it is expected to provide a more mature solution for decentralized fund management.

Emergency exit function

The platform’s smart contract includes an emergency exit function , which is effective during the fundraising period and is used to protect funds when contract loopholes or other abnormal situations are discovered. This mechanism ensures that investors can exit safely when problems arise, but it should be noted that this function will no longer be applicable after the pre-sale ends, so investors need to pay attention to the security of the platform during the contract period. As the platform matures and is further developed, this function may be gradually improved in the future to improve overall security.

Summarize

Daos.World represents an innovative attempt at decentralized fund management, achieving a balance between efficiency, security and flexibility through a carefully designed mechanism. The platform provides cryptocurrency investors with a variety of profit opportunities through a unique token economy, flexible fund management and a diversified income mechanism. However, investors should fully understand the platform's operating mechanism before participating, weigh various risk factors, and invest rationally.