Blockchains

are full with data. The same can be said of crypto derivatives data which are

not stored on blockchains. And there a ton of blockchain protocols. The same

can be said of exchanges that offer derivatives of crypto. So on and so forth.

By now you get the point we are stressing here that crypto usage has increased

at the expense of having trusted, transparent data, which will continue to get

convoluted.

In a

conversation with PANews, Bobby Ong of CoinGecko has opined on this:

“I think crypto analytics is moving in the right direction but it will get more

complex. Just look at Ethereum 2.0 for example, how are we going to measure the

activities going on in multiple shards.”

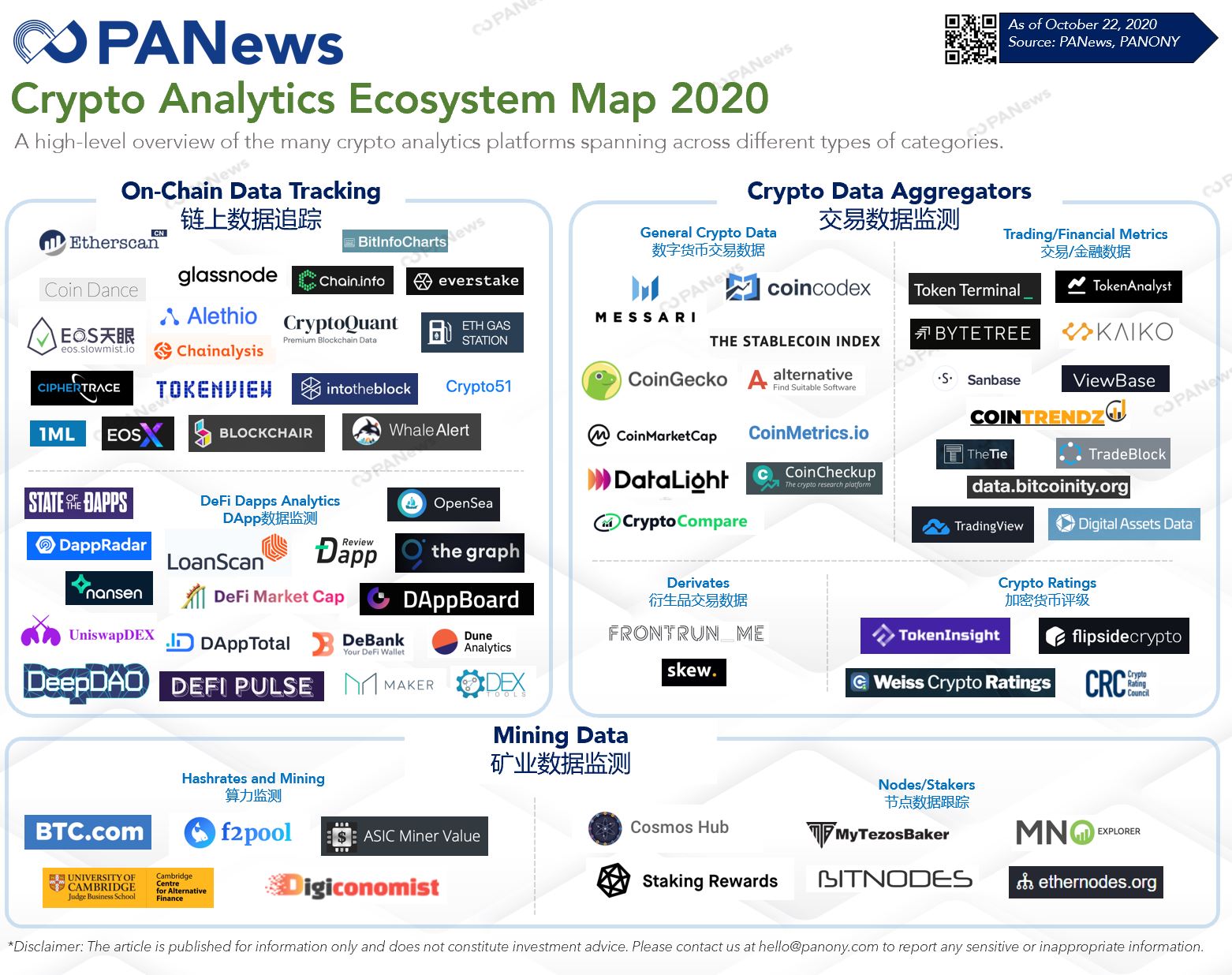

The

number of platforms and teams providing actionable crypto data has multiplied

over the years with a myriad amount of options to choose from depending on what

type of data you are looking for. The field is wide and deep with no standout

market leader…yet. But PANews has put together a current ecosystem map of the

more popular crypto data analytics providers and the type of category they

would fall into. Be advised that this is not an exhaustive covering and some

providers may overlap with other categories. But it’s a good snapshot of what

we have in the offerings.

On-Chain

Data Tracking

The bulk of

these platforms are on-chain data analytics for Bitcoin and Ethereum.

Considering these two are the most popular blockchains currently, there are a

few that provide data for what’s going on in EOS and other blockchains that

would make up the top 10 in most rankings. Some of these adhere to financial

regulators for preventing money laundering activities such as CipherTrace and

Chainanalysis. A sub-category of DeFi Dapps Analytics providers was also

created to give way for the DeFi boom we saw this past year. a good chuck of

DeFi activity is on Ethereum, but they do deserve their own attention.

Crypto Data Aggregators

This category

in general can come off a bit too general so we broke it down into 4

sub-categories: General Crypto Data, Trading/Financial Metrics, Derivatives,

and Crypto Ratings. This delineation may be subjective but we tried to base

these on what stood out the most on these provider’s platforms.

General

Crypto Data

This

sub-category is quite self-explanatory. Providers such as CoinGecko, Messari,

and CoinMarketCap would fit well into this. These sites in this sub-category

would probably be the go-to sites for new comers in the space as they all give

great easy to understand introductions to tokens, projects, terminology, etc.

Trading/Financial

Metrics

The platforms

in this sub-category would consist of financial or trading data suitable for

crypto traders. Some of them may be more suitable for institutional investors

while some of them can fit well with retail traders. All depending on how much

you want to be for subscriptions of course.

Derivatives

This category,

although small, was appropriate for providers who can more data regarding

derivatives trading.

Crypto Ratings

Although this

category isn’t too data intensive, they do represent a necessary field of

combining qualitative and quantitative measures in ranking crypto/tokens. Each

one of these providers have their own proprietary methodologies in their

ranking systems, but they all do posses similarities in line with those of the

traditional rating agencies such as Fitch or Moody’s.

Mining Data

This category

was broken down into two: Hashrates (General Mining) and Nodes/Stakers. The

former is more applicable to bitcoin mining and asic mining in general. These sites

give data pertaining to mining pools, current total hashrates, ASICs, energy

consumption, etc. Although overlooked at times, mining is an essential part of

decentralizing certain blockchains. The analytics platforms in the latter

category provide information on nodes/stakers for protocols such as EOS,

Cosmos, Tezos, etc. Although Bitnodes and Ethernodes give node information on

Bitcoin and Ethereum, respectively.

In conclusion,

the field of crypto analytics is getting bigger, competitive, and innovative

all for the good of the community. In an exclusive video podcast

with Messari’s Ryan Watkins, he sees it playing out, “for the foreseeable

future, crypto analytic platforms will probably remain fragmented with

specialized data providers, in the longer term, it is definitely a space that

is ripe for consolidation”.

Special thanks to PANews’ data analyst, Carol, for the help in compiling this ecosystem map a year ago in this piece. She highlights the big financing some of these analytic firms received and also on if crypto data is more geared as a B2B or B2C market.