1. Market observation

Keywords: BNB, ETH, BTC

The BSC ecosystem and the Solana ecosystem continue to compete for on-chain popularity. CZ began to promote ecological projects and used BNB to buy mubarak in APX Finance, which caused APX and mubarak to rise sharply. It is worth noting that Wintermute may become the market maker of the BSC ecological meme coin mubarak, and has withdrawn a total of 6.04 million tokens from Gate in the past four days.

Solana ecosystem can't sit still. Moonshot has quietly launched three new MEME tokens, TITCOIN, FAT, and ROUTINE, after a long period of inactivity. Trump called out TRUMP and complained that his portrait was too ugly. Then Downald tokens appeared on the Solana chain, with a market value of about $14.5 million. Bitcoin ended last week with a positive line, closing at about $86,000, but market opinions are still divided. In terms of short-term outlook, Bitget Research chief analyst Ryan Lee pointed out last weekend that $85,000 will be a key psychological barrier. If the closing price this week cannot break through this position, the price of Bitcoin may face further downward pressure next week. In terms of medium-term outlook, BitMEX co-founder Arthur Hayes proposed the view of "first rise and then fall", predicting that Bitcoin will first test $110,000 and then pull back to the level of $76,500. However, trader Eugene said that the market has entered the fifth stage, characterized by long losses, price consolidation, and shrinking trading volume and volatility. At this stage, some of the stronger altcoins have reached bottom, but it is still uncertain whether the bottom has arrived for most assets.

Regulatory developments have also attracted much attention. Senator Cynthia Lummis's 2025 Bitcoin Act advocates that the United States obtain 1 million Bitcoins within five years, accounting for about 5% of the total supply. Thursday's SEC chairman qualification hearing is worth paying attention to, which may involve cryptocurrency-related content. Matthew Sigel, director of digital asset research at VanEck, mentioned that Bloomberg Legal analysts believe that the federal government has a 30% chance of purchasing Bitcoin this year.

At the macroeconomic level, the market is closely watching several key indicators. Nexo analyst Iliya Kalchev stressed that the consumer confidence index, fourth-quarter GDP, initial jobless claims, and the upcoming PCE inflation data will all affect the Fed's interest rate cut decision. The Fed hinted at its March 18-19 meeting that it would ignore short-term inflationary pressures, laying the foundation for possible future easing policies. Nansen research analyst Nicolai Sondergaard said that global tariff concerns will continue to put pressure on the market until tariff-related issues are resolved between April 2 and July.

2. Key data (as of 13:30 HKT on March 24)

Bitcoin: $86,928.38 (-7.13% year-to-date), daily spot volume $17.58 billion

Ethereum: $2,050.00 (-38.54% year-to-date), with a daily spot volume of $9.255 billion

Fear of corruption index: 45 (neutral)

Average GAS: BTC 1.47 sat/vB, ETH 0.43 Gwei

Market share: BTC 60.7%, ETH 8.7%

Upbit 24-hour trading volume ranking: AUCTION, XRP, W, ZETA, BTC

24-hour BTC long-short ratio: 1.0496

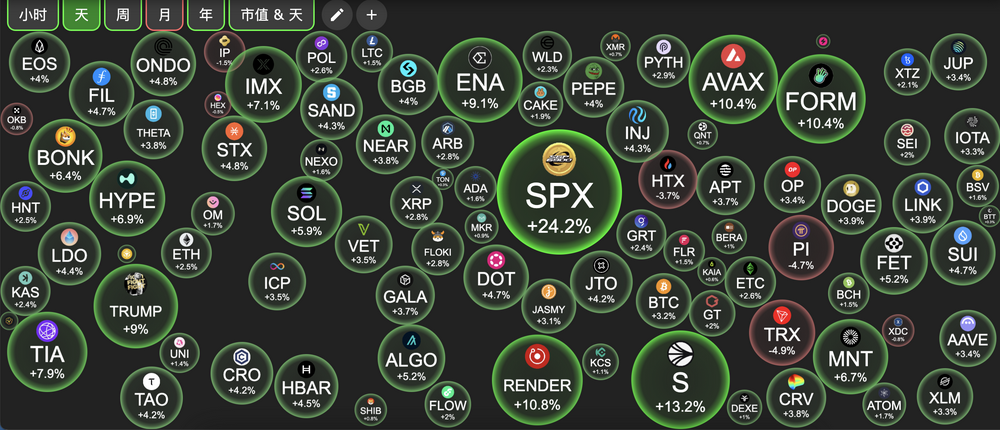

Sector gains and losses: AI sector rose 5.57%, DePIN sector rose 4.73%

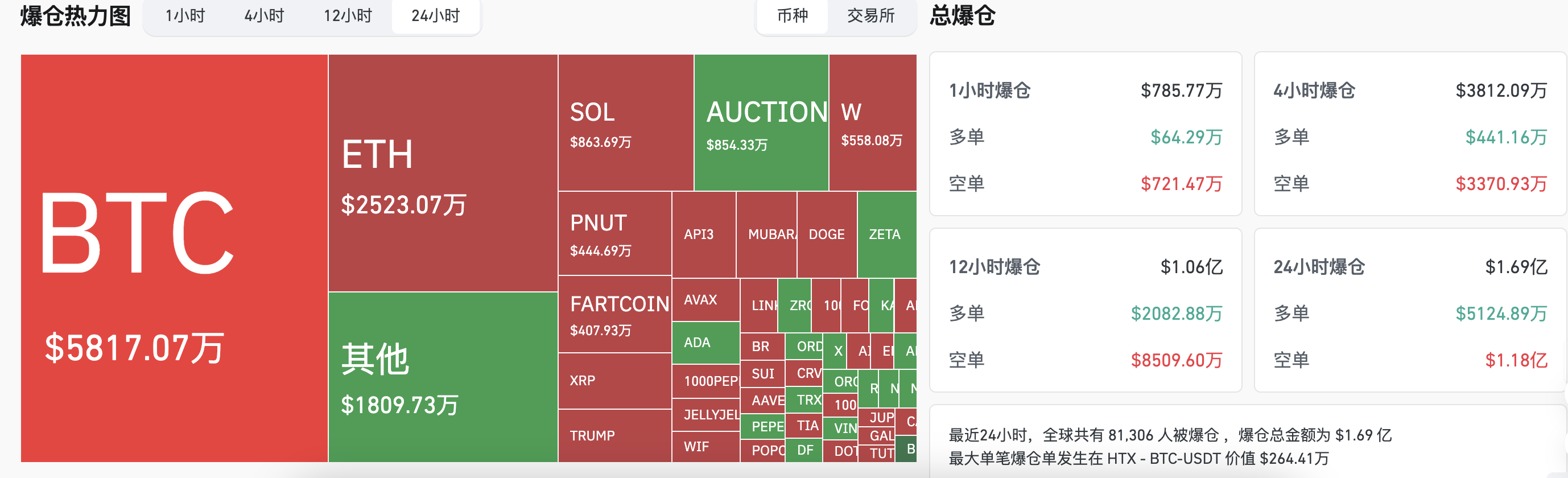

24-hour liquidation data: A total of 81,306 people were liquidated worldwide, with a total liquidation amount of US$169 million, including BTC liquidation of US$58.17 million and ETH liquidation of US$25.23 million

3. ETF flows (as of March 21 EST)

Bitcoin ETF: $83.09 million

Ethereum ETF: -$18.63 million

4. Today’s Outlook

Binance and Huobi HTX launch Nillion (NIL) spot trading pairs

Babylon Genesis Pre-Launch Meetup: Taipei (feat. Zeus Network) will be held on March 24, 2025

Bithumb plans to end trading support for Bitcoin Gold (BTG) and VALOR tokens

The biggest gainers in the top 500 by market value today: BugsCoin (BGSC) up 36.16%, Mubarak up 26.52%, Ankr (ANKR) up 25.43%, SPX6900 up 23.01%, StormX (STMX) up 22.63%

5. Hot News

Michael Saylor releases Bitcoin Tracker information again, and may disclose holdings data next week

Wintermute may have become a market maker for the Meme coin mubarak

Suspected Binance Wallet employee made over $110,000 in profit by trading UUU on the BSC chain

Data: This week, the US Bitcoin ETF bought 8,775 BTC, while miners produced only 3,150 BTC