By Stacy Muur, Web3 Researcher

Translation: Golden Finance xiaozou

1. Trump and Melania Timeline

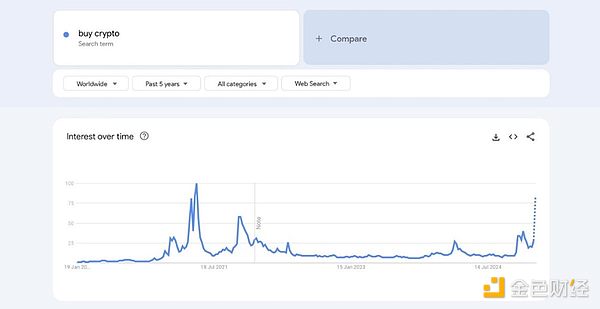

The TRUMP narrative began even before its contracts were deployed to Solana, with Trump posting a tweet confirming his association with the meme coin.

If we were to list a timeline of major events in Trump and Melania, it would probably look like this:

- December 21, 2024: The domain name gettrumpmemes.com is purchased.

- January 17, 2025: First coinage.

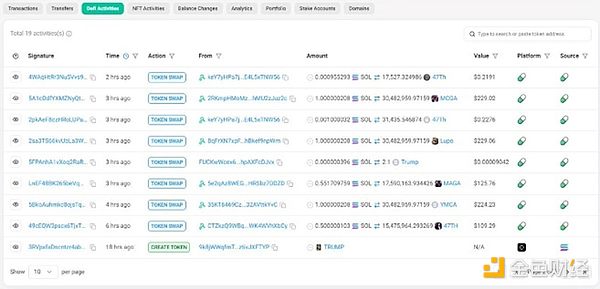

- January 18, 2025: DEX trading pairs are created around 2am UTC.

- 45 minutes later, Donald Trump issued an official tweet.

- On the same day, the domain name melaniameme.com was purchased.

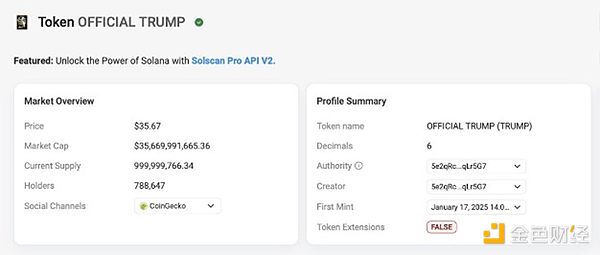

- January 19, 2025: At 11:30 AM UTC, TRUMP reaches its all-time high price of $76.

- Ten hours later, the MELANIA DEX trading pair was released, triggering a massive sell-off by TRUMP holders.

- 40 minutes later, Melania Trump posted proof of her memecoin ownership.

- January 20, 2025: MELANIA reaches its all-time high price of $13.6.

There are some interesting patterns to note in this space:

- The launch of TRUMP was long planned.

- The launch of MELANIA was spontaneous, and its domain name was purchased after the successful launch of TRUMP.

- Neither meme coin ownership proof is released immediately after the trading pair is created.

I don’t want to delve too deeply into insider trading. They are just meme coins, and they reflect the industry.

While the launch of TRUMP could theoretically be about culture, MELANIA appears to be primarily a money-making machine.

2. Expected and unexpected negative impacts

Bitcoin draining liquidity from the wider crypto market, reaching new all-time highs, the solidification of the “Ethereum for storing money, Solana for trading” narrative, and deregulation — these topics were covered in depth in many insightful articles during the early days of the Trump meme coin craze. I intend to avoid repeating what others have already discussed.

I want to highlight here some of the less obvious potential negative effects of Trump memecoin, most of which have no solutions.

The Legality of Meme Coin

If the President of the United States can officially release a memecoin that drops 45% on a 15 minute candlestick chart, then anyone can do it.

Prior to TRUMP’s launch, several celebrity meme coins had been launched, most of which slowly fell to zero in price. Many believed that one day the wild west of DEXScreener would end as the SEC finally focused on the unregulated meme coin market, which was rife with scams and insider trading, and the only guaranteed winners were the developers.

Trump has set a legal precedent: anyone can secretly launch a meme coin, then announce their meme coin 40 minutes later and enjoy the process.

This historic move could have several significant negative consequences:

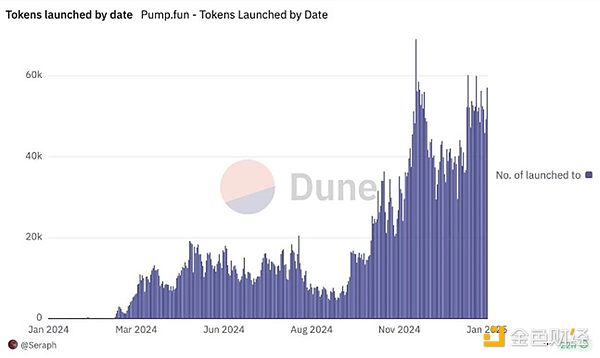

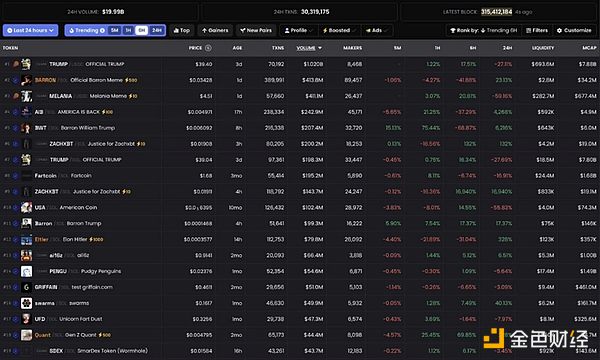

(1) A new wave of memecoins will emerge, with celebrities, politicians, and even companies joining the trend. The only rule? A disclaimer: “X token is intended to express support for and participation in the ideals and beliefs embodied in Y.” So the rich will get richer and the poor will get poorer — this is the universal law of memecoin trading.

(2) The number of meme coins issued will grow exponentially. Many of my friends in the Web2 field have asked me if we should all issue a meme coin together. For me, the answer is always "no" - I am not willing to gamble my reputation for money.

(3) The first step to attract new users will be meme coins with the laws of the Wild West; without previous experience to draw on, the chances of them sticking around are slim. In their view, all cryptocurrencies will be meme coins, and in 90% of cases, the experience will be negative.

(4) After several years of lax policy toward the cryptocurrency industry, overregulation will emerge to minimize fraud and “protect American citizens from crypto wolves.”

(5) Typical Web3 narratives - such as infrastructure, DeFi, and DePIN - will receive less and less attention. In the past few years, the lack of altcoin enthusiasm and the popularity of "low circulation and high FDV" issuance have created extremely challenging conditions for attracting capital and users. This problem is expected to get worse over time. Teams will need to prioritize typical product revenue models that do not require tokens to sustain.

Is this the path to global cryptocurrency adoption we have been eagerly awaiting?

This is a big problem.

But adoption is certain.