The collapse of US consumers:

Original author: The Kobeissi Letter

Original source: https://x.com/

Translated by: Daisy, Mars Finance

The collapse of the American consumer:

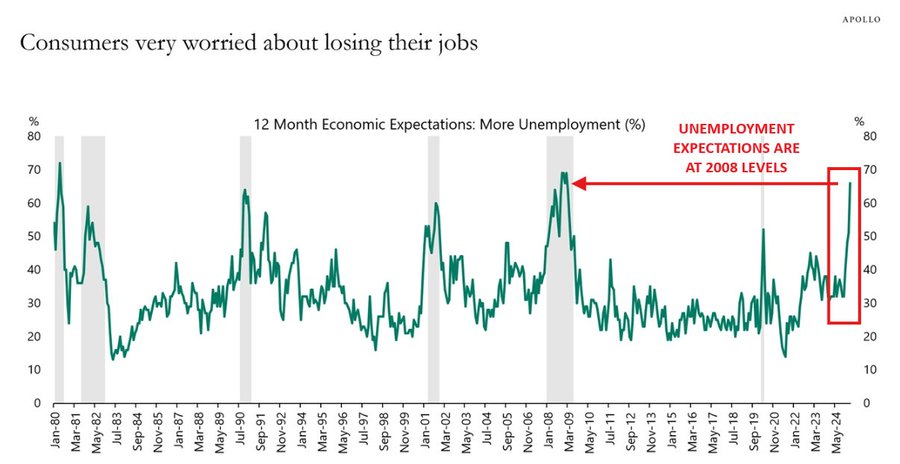

Unemployment expectations in the United States have now surpassed 2020 levels and are at their highest point since 2008.

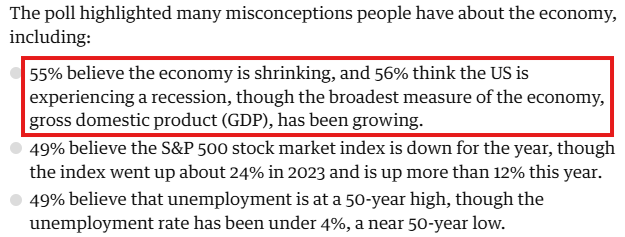

A 2024 survey showed that a whopping 56% of Americans believed the United States was in a recession.

Is the U.S. heading for a recession?

Here’s a Harris Poll survey from May 2024, just before the election:

56% of Americans believe the U.S. is in a recession, and 49% believe the S&P 500 is down year to date (YTD).

However, in reality, US GDP growth was "strong" at the time and the S&P 500 index rose 12% for the year.

Today, consumers are even more pessimistic.

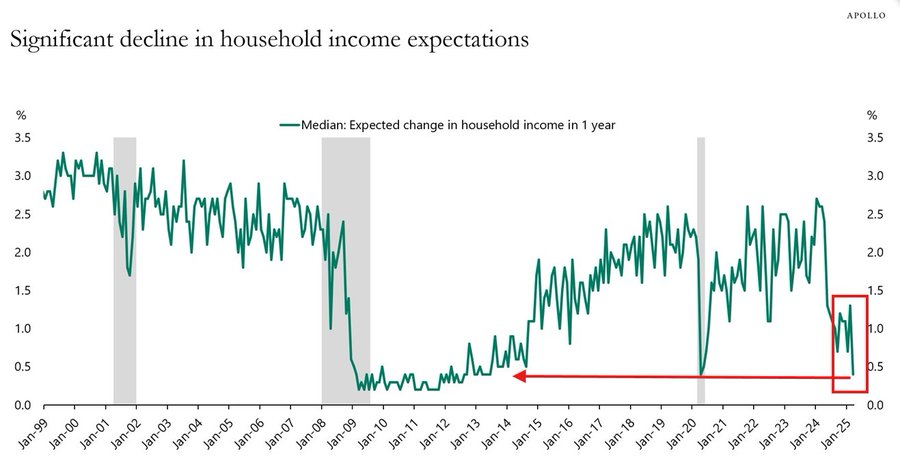

The median expected change in household income over the next 12 months has fallen sharply.

In fact, current expectations have fallen to their lowest level since the global economic lockdown in March 2020.

Inflation makes the situation worse:

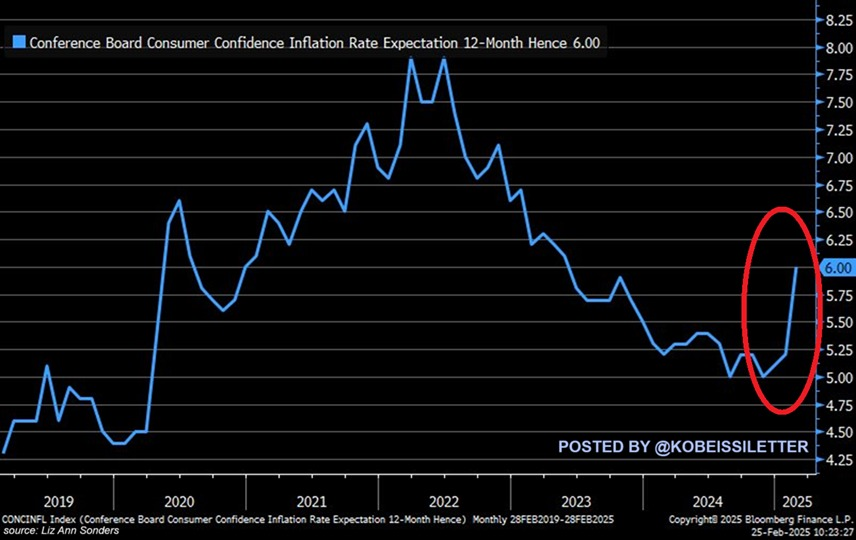

U.S. consumers believe inflation will rise to 6.0% over the next 12 months, the highest level since May 2023.

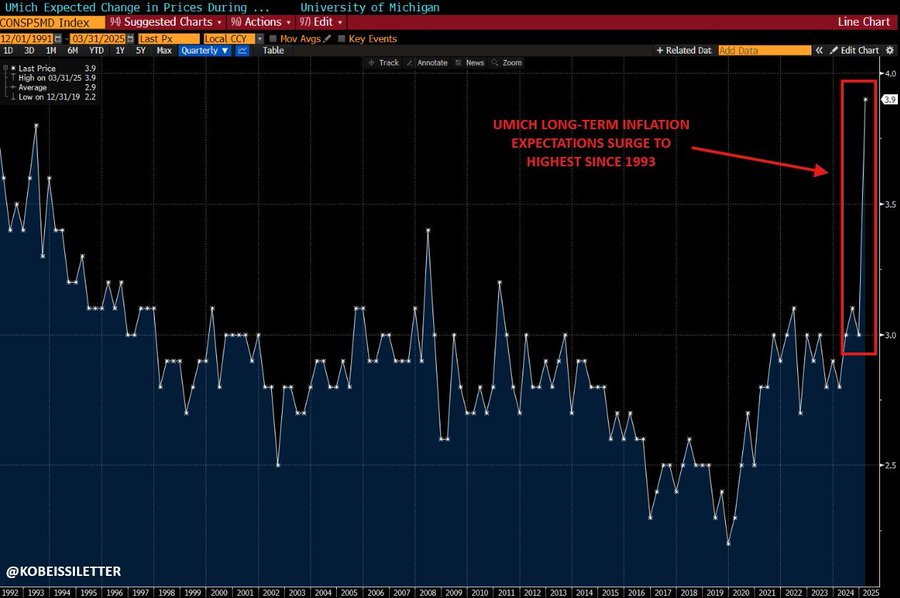

Americans expect the average annual inflation rate over the next five to ten years to be 3.9%, a 30-year high.

We are actually experiencing the effects of inflation that have accumulated over many years.

Long-term inflation expectations in the United States have officially reached their highest level since 1993.

As President Trump introduced a massive tariff policy, economic uncertainty increased and inflation expectations also rose.

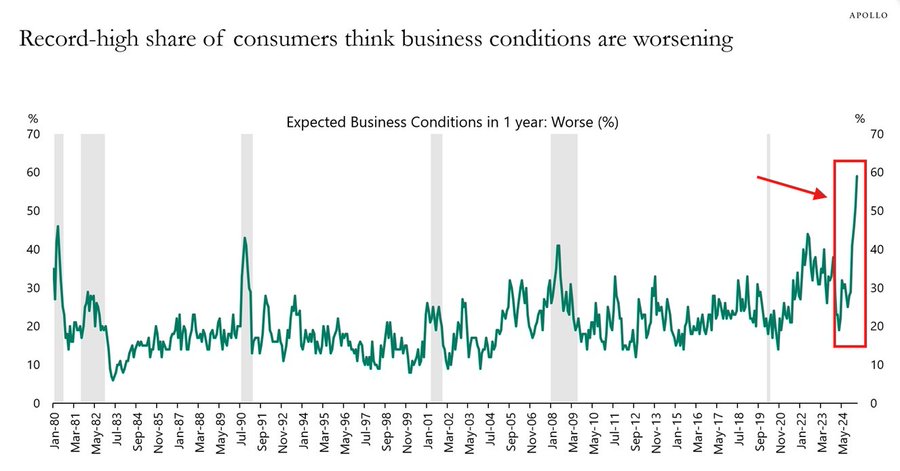

The result was a severe collapse in consumer confidence.

A record 60% of U.S. consumers expect business conditions to deteriorate over the next 12 months.

Even during the worst of the 2008 housing crash, the indicator peaked at around 42%.

It's safe to say that American consumers are more pessimistic than ever before in recent history.

Markets are pricing in a recession:

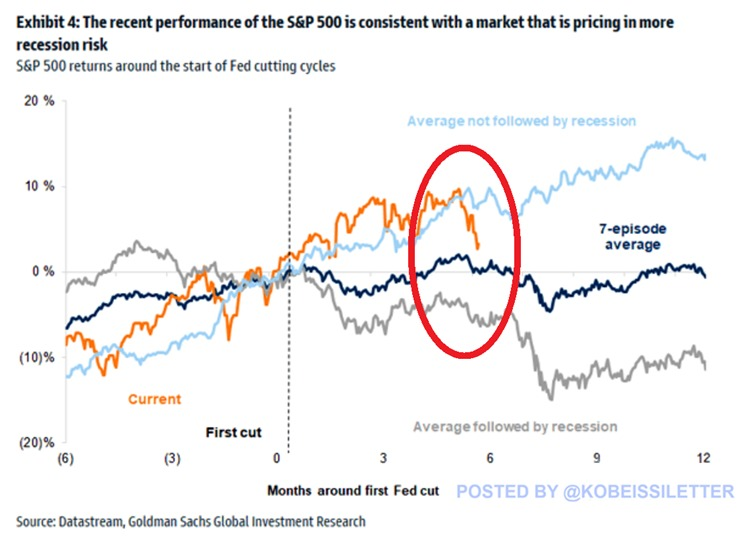

The S&P 500 has fallen 2% since the Federal Reserve began cutting interest rates in September 2024.

In the case of rate cuts during a recession, the S&P 500 typically falls 6% within six months and 10% within 12 months.

Historical data shows that the average six-month return after a policy shift is only 1%.

Moreover, it's not just ordinary consumers who are pessimistic.

In the March CNBC Federal Reserve Survey, which covers fund managers, strategists and analysts, the odds of a recession rose sharply.

The probability of a recession jumped to 36% from 23% in January.

Sentiment among institutional investors has clearly turned pessimistic.

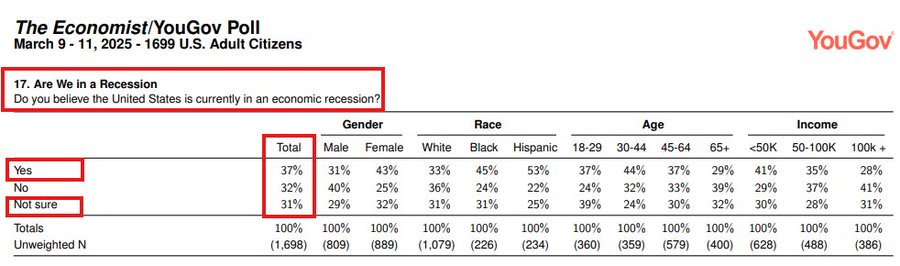

In last week's Economist/YouGov poll, Americans were asked about their views on the economy.

Currently, 37% believe the U.S. is in a recession, while 31% are unsure.

Only 32% believe the U.S. is not currently in a recession.

This is precisely why market expectations for rate cuts have risen sharply.

This time, white-collar jobs have also been hit.

The U.S. professional and business services industry has lost 248,000 jobs since May 2023.

Employment in the industry has fallen for 17 consecutive months, the longest downturn since 2008.

The labor market is weakening.

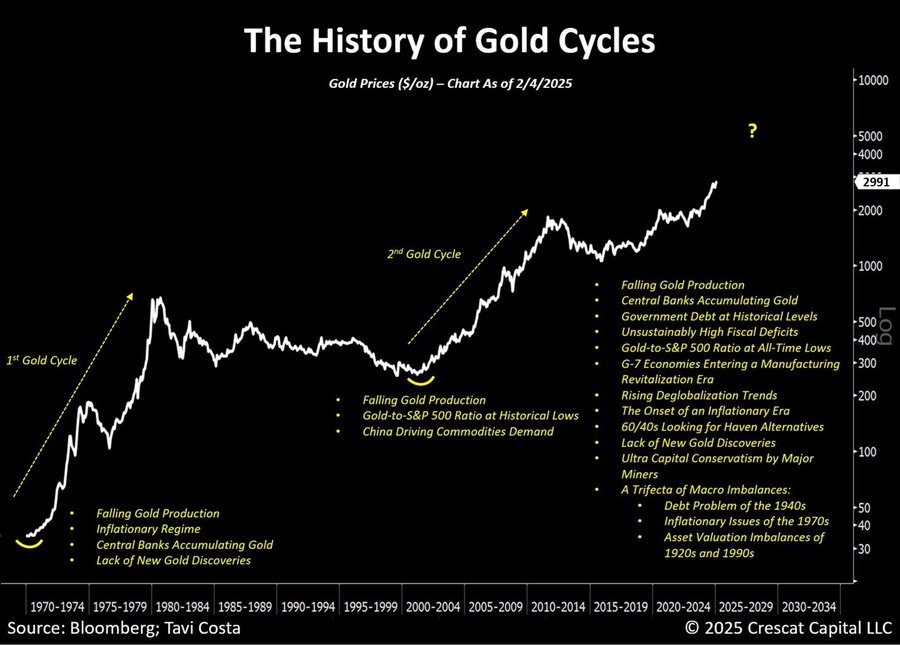

Finally, one of the most indicative signs of the economy is gold.

Gold prices have surged amid the U.S. debt crisis, inflation, trade uncertainty and recession concerns.

We anticipate significant changes in the future.