Author: 1912212.eth, Foresight News

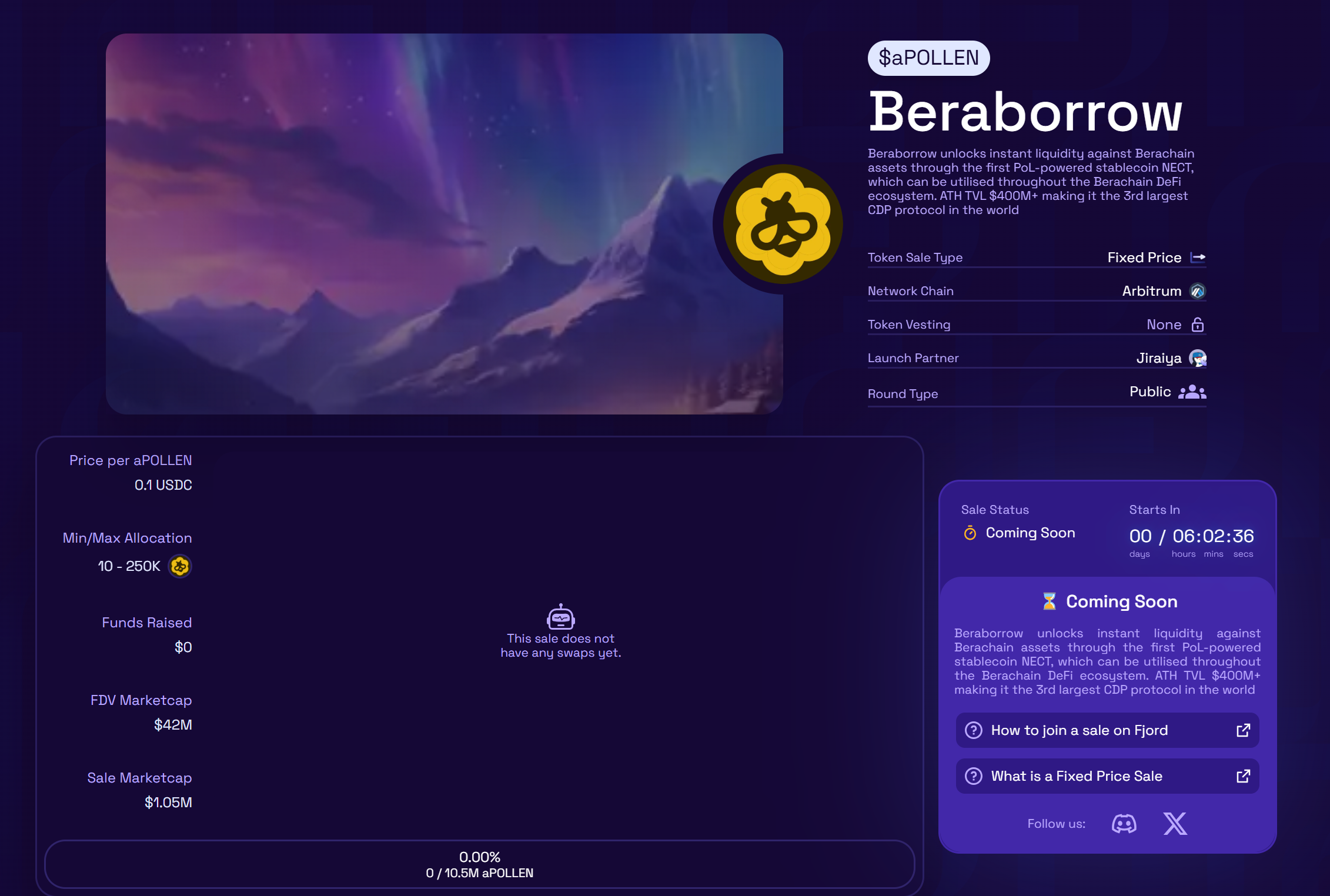

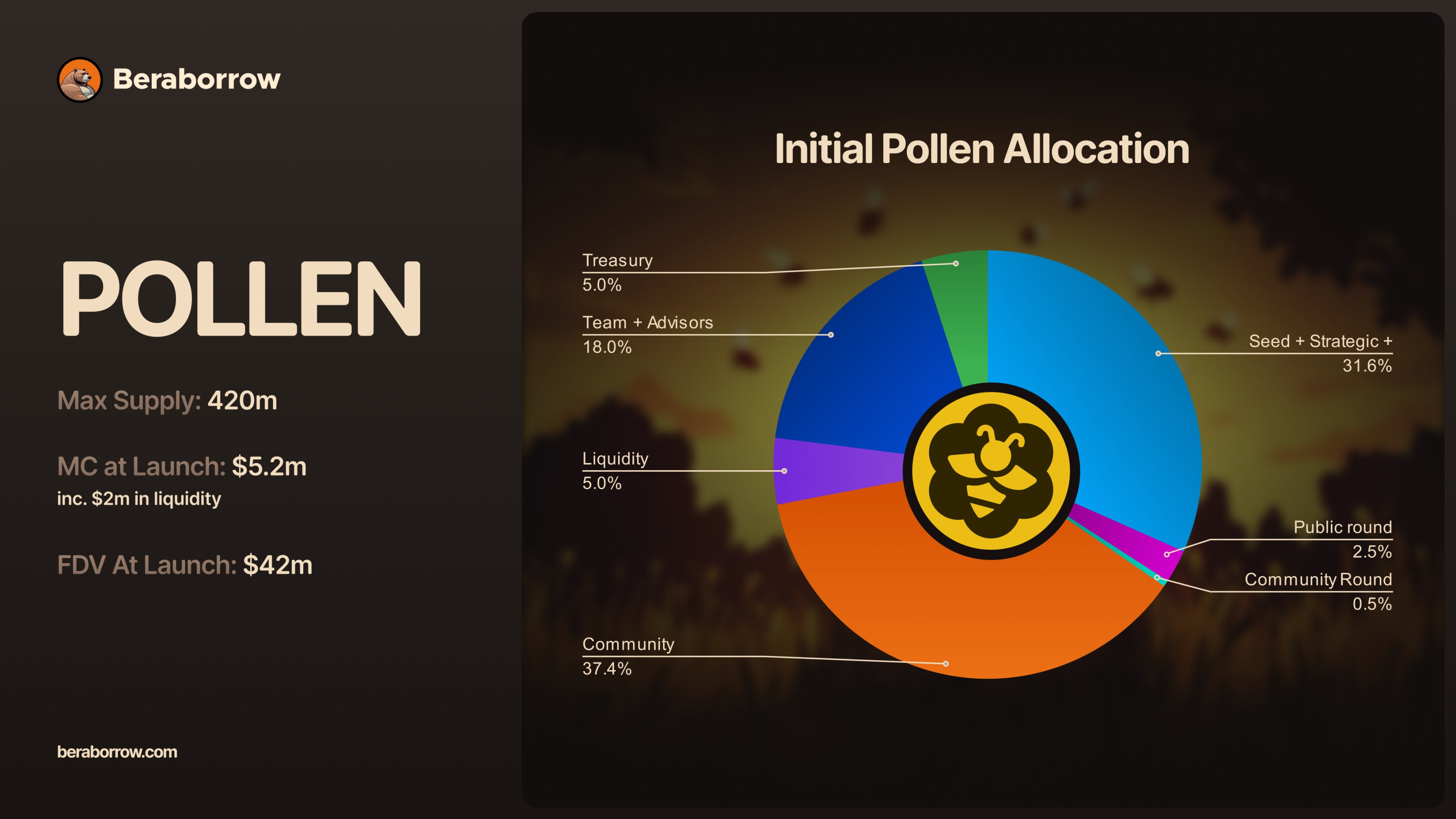

On March 25, BeraChain officially launched Proof of Liquidity (POL), and its coin price also rose from around $5 to the current $8.6, which was particularly eye-catching in the generally falling mainstream coin market environment. After the public chain entered the governance stage, its ecological opportunities also began to attract the attention of keen investors. Beraborrow officially launched the public offering today. 2.5% of the total supply of the token POLLEN will be provided through Fjord Foundry at $42 million FDV. Beraborrow plans to raise $1 million. Users can enter the relevant page of Fjord Foundry and follow the corresponding prompts to participate.

As a decentralized lending protocol based on the BeraChain public chain, Beraborrow has become one of BeraChain's most watched DeFi projects since the beginning of 2025 with its unique interest-free loan model and innovative Proof of Liquidity (PoL) mechanism.

What is Beraborrow?

Beraborrow is a DeFi lending protocol on the BeraChain chain, which aims to provide users with efficient and flexible asset liquidity solutions. BeraChain itself is known for its unique PoL consensus mechanism, which builds a blockchain network with ecological prosperity as its core by rewarding users who provide liquidity instead of traditional proof of work (PoW) or proof of stake (PoS).

Beraborrow unlocks instant liquidity for BeraChain assets through the stablecoin Nectar (NECT) backed by a Proof of Liquidity (PoL) mechanism. Designed with simplicity and flexibility at its core, Beraborrow aims to maximize opportunities for users without sacrificing yield.

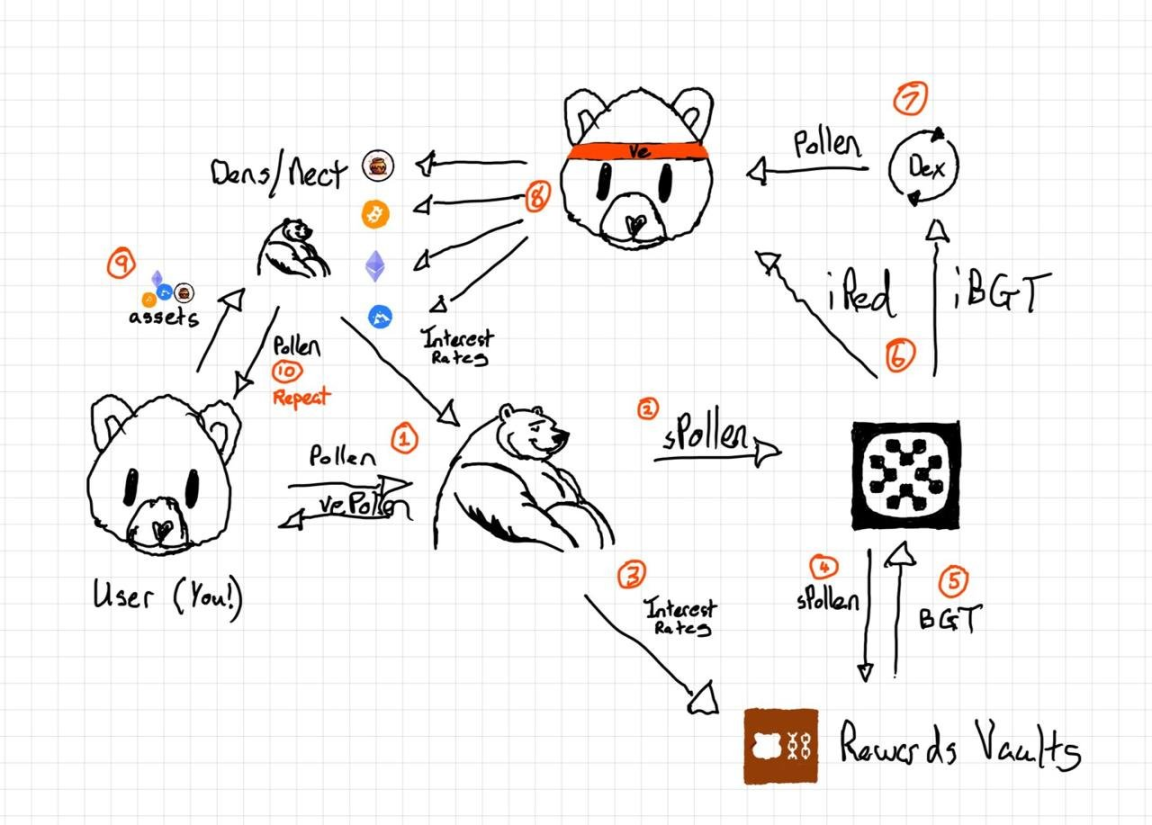

The protocol allows users to deposit collateral assets into Dens, thereby minting the over-collateralized stablecoin NECT. NECT can be used in the BeraChain DeFi ecosystem, unlocking more opportunities while still maintaining exposure to the original asset. Initially, Beraborrow was built mainly around iBGT, but has now evolved into a multi-collateral asset platform that supports BeraChain native tokens, liquid pledge derivatives (LSD), and LP positions as collateral to mint NECT.

The key highlights are as follows

Instant liquidity

There is no need to sell BeraChain assets to unlock liquidity. Users can deposit collateral into Dens to mint Beraborrow's over-collateralized stablecoin NECT while still holding the original assets. After borrowing, NECT can be seamlessly used to participate in various DeFi protocols.

Automatic Leverage

With flash loans, Beraborrow provides users with seamless on-chain leverage. Simply adjust the slider to increase exposure or maximize returns, and the system automatically manages the complexity of synthetic leverage through recursive lending.

Earn profit through liquidation

Participate in the Liquid Stability Pool to fully tap the potential of NECT assets. Stake NECT to receive liquidation rewards and earn fees from other users' operations on Beraborrow.

Automatic Compounding Dens

Dens now supports automatic compounding, and users' earnings will be automatically reinvested into iBGT, increasing the mortgage rate over time to form a self-enhancing earnings mechanism and maximize the earnings of deposited assets.

Tokenised Dens

Beraborrow unlocks new governance and incentive mechanisms through Dens tokenization. These tokenized assets can be deposited into the Infrared vault, and the income generated by the vault will be automatically reinvested, providing users with continuous rewards and continuously optimizing their collateral positions.

LP positions as collateral

Beraborrow allows users to use Bex and Berps LP positions as collateral, and can still earn liquidity income while lending funds. This dual income model allows liquidity providers to balance liquidity and income, creating more value.

Arbitrage strategies

Beraborrow's Liquid Stability Pool provides users with arbitrage opportunities. Users can use sNECT to arbitrage between liquidation asset pools and decentralized exchanges, maximizing returns while enhancing the protocol's financial stability.

Token Economics

On March 25, Beraborrow's private sale raised $170,000, and today it will officially launch a public sale at Fjord Foundry. Beraborrow's governance token, POLLEN, has a total of 420 million tokens. POLLEN holders can participate in key decisions of the protocol, such as adjusting collateral types and protocol parameters. Currently, users can accumulate POLLEN points by using NECT to participate in ecological activities (such as providing liquidity in Kodiak Finance or holding NECT), and these points will be exchanged for POLLEN tokens in the future. According to official data, Beraborrow has exceeded $390 million in TVL and more than $100 million in NECT minting since its launch.

It enables the protocol to capture value from Proof of Liquidity without having to create new reward treasuries for each NECT (our stablecoin) use case separately.

More NECT application scenarios encourage more users to use Beraborrow for leverage operations, thereby increasing overall interest rates and fees. These benefits flow to sPOLLEN's BeraChain reward treasury, which is then used to incentivize liquidity and promote further growth of the ecosystem. This cycle repeats itself, forming a "flywheel effect."

37.4% of the total tokens are allocated to the community, 31.6% to seed and strategic round investors, 18% to the team and consultants, 5% to the treasury, 5% to the liquidity pool, 2.5% to the public offering round, and 0.5% to the community round.

It is worth mentioning that the official has stated that after the voting is completed, 60% of the protocol fees will be allocated to the governance plan determined by vePOLLEN holders.

summary

For a popular public chain, the development trend of its ecological infrastructure such as DEX and lending protocols is extremely important. If a representative project can be launched and listed on a major exchange, it will have a positive effect on its ecology and the public chain itself. When investors participate in ecological opportunities, they need to comprehensively consider the market situation and project fundamentals, and pay attention to risk control.