Author: Azum, Odaily Planet Daily

Raydium (RAY), the mainstream DEX protocol on Solana, plummeted today. The direct cause was that pump.fun seemed to be testing its own AMM liquidity pool. The market speculated that this move might lead to the fact that pump.fun-related tokens would no longer build pools on Raydium after they were out of the "internal market" in the future, but would be directly intercepted within the pump.fun protocol, which would lead to a reduction in Raydium's trading volume and a corresponding reduction in revenue and repurchase volume.

The logic line of RAY's decline (readers familiar with the relevant logic can skip this)

Let’s briefly sort out the relationship between Raydium and pump.fun.

As the most mainstream meme token launchpad platform on Solana, pump.fun's token issuance needs to go through two stages: "internal market" and "external market". After the token is issued, it will first enter the "internal market" trading stage, which relies on the pump.fun protocol's own Bonding Curve for matching. When the transaction volume reaches US$69,000, it will enter the "external market" trading stage. At that time, the liquidity will be migrated to Raydium, and a pool will be established on the DEX and trading will continue.

Next, let’s look at Raydium and RAY.

Raydium currently charges a 0.25% handling fee for each transaction, of which 0.22% is allocated to Raydium's liquidity providers (LPs) and 0.03% is used for RAY repurchase and ecological support. In short, Raydium's trading volume will indirectly affect the price of RAY through handling fee income.

So the current situation is that if pump.fun builds its own AMM, liquidity will no longer be migrated to Raydium in the future, thereby reducing the latter's trading volume and handling fees, and further affecting the value performance of RAY.

How much does Raydium rely on pump.fun?

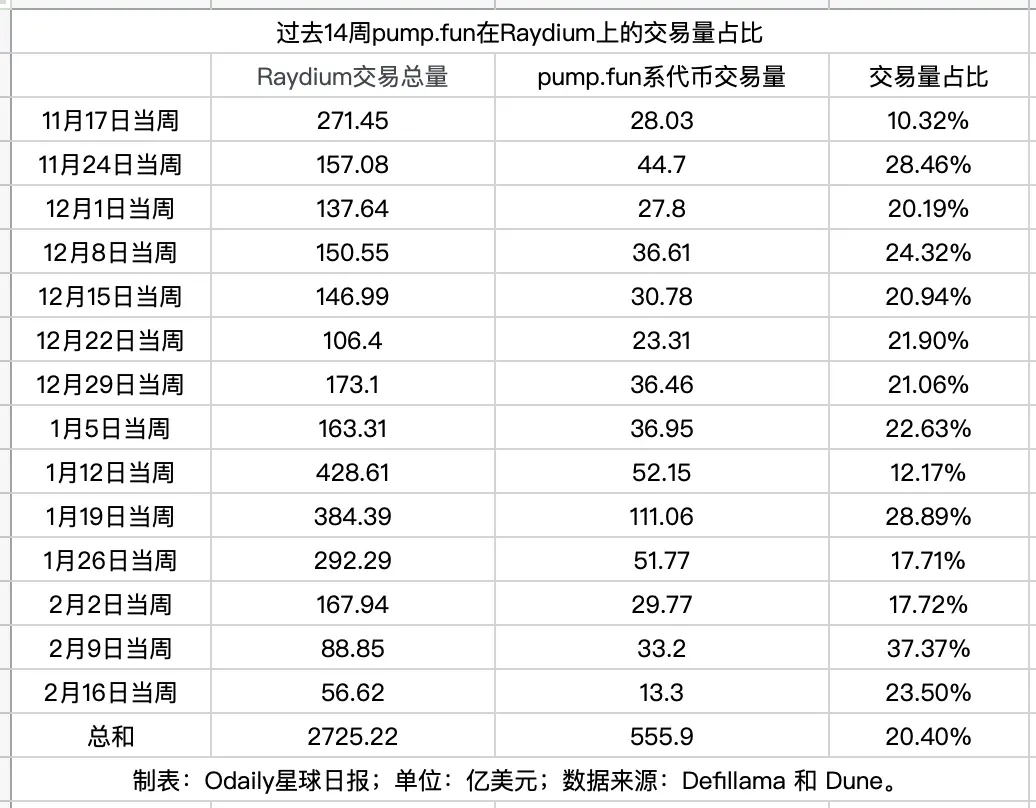

There have been many analyses of the above in the market today, but it seems that no one has carefully sorted out how much Raydium relies on pump.fun in terms of trading volume. For this reason, we queried some data sources on Deflama and Dune, and the conclusion is shown in the figure below.

As can be seen from the above figure, in the past 14 weeks, the trading volume of pump.fun tokens on Raydium accounted for about 20%, which means that if pump.fun really intercepts Raydium by building its own AMM in the future (not considering the autonomous liquidity migration activities due to the uncertain platform fee differences), Raydium is expected to experience a 20% reduction in trading volume.

Is it oversold?

Back to the market, OKX market shows that RAY fell to as low as $2.82 today, corresponding to a drop of more than 30% (the data was pulled too late, and in hindsight there was indeed a certain amount of oversold at this time). The current price has gradually recovered to $3.15, corresponding to a drop of 25.43%.

Considering that SOL itself also fell by 5.8%, RAY's current decline is basically within a reasonable range, that is, the market has already priced in pump.fun's interception behavior in advance.

Finally, let me end with the words of Fluid COO DMH:

The plunge of RAY once again proves to us that "distribution >>> tech". There are countless examples in the traditional world (Microsoft) and the crypto field (Metamask) that if you have a large enough user base, your product is not that important.