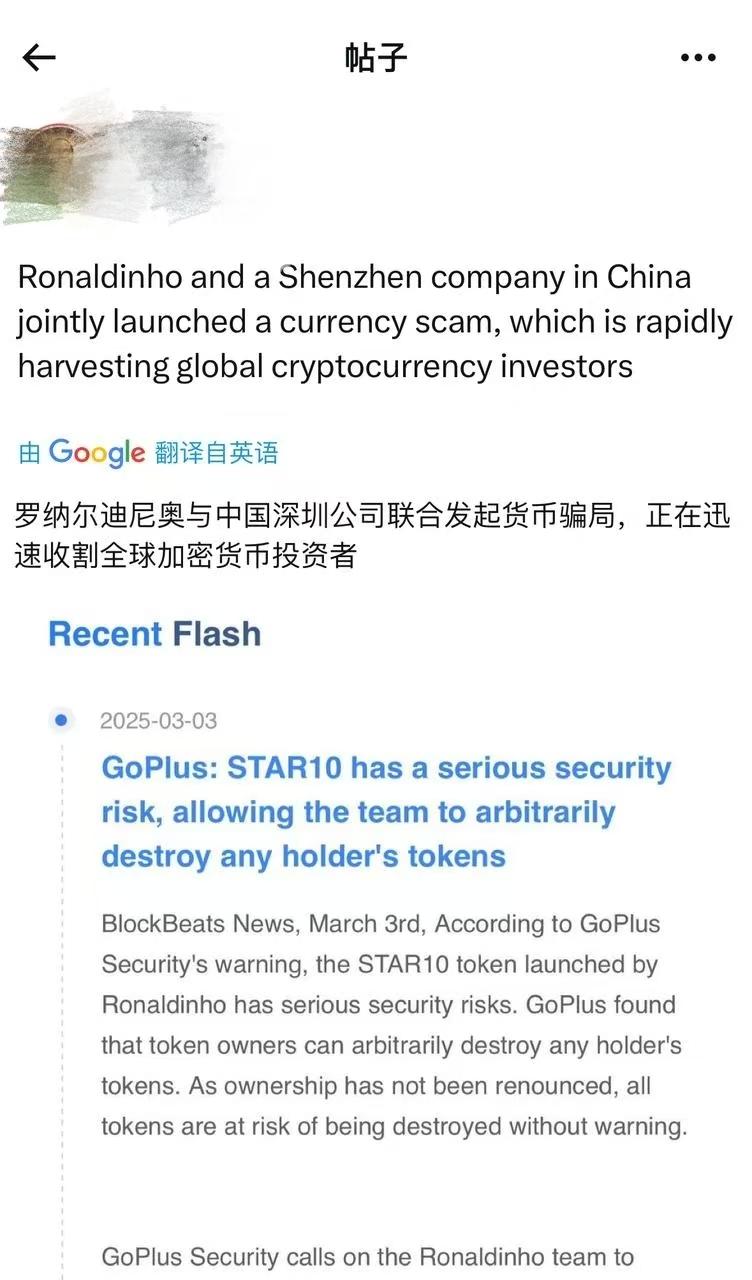

Recently, an incident has caused a stir again! According to the X platform user @R10coin_, football superstar Ronaldinho is suspected of "turning over" - he first signed a $6 million token cooperation agreement with a team and received a deposit of $3 million, but then turned around and sold his X account to a Shenzhen "coin factory" for $5 million to help them promote another cryptocurrency. What's even more outrageous is that this Shenzhen company is accused of issuing more than a dozen "meme coins" every month, relying on exaggerated publicity to deceive investors, and then pulling up and smashing the market, harvesting within an hour and running away. This plot is more exciting than the "man-ball separation" on the court!

As a Web3 lawyer, I will tell you today whether this “coin factory” routine is a scam or not? Is it a criminal offense? And how can ordinary investors keep their eyes open to avoid being harvested?

The routine of the "coin factory": it sounds like a scam and looks like a scam

Let's first talk about the operation of this Shenzhen company: they launch a dozen "meme coins" every month, use exaggerated propaganda (such as "the next Dogecoin" and "the express train to wealth and freedom") to attract people to spend money, and then quickly raise the price of the coin, and wait for investors to rush in, then they will slam the market and run away with the money. Does this "quick pull and quick smash" model sound familiar?

Yes, it is what is commonly known in the cryptocurrency circle as “cutting leeks”.

From a legal perspective, this kind of behavior is likely to be suspected of "fraud". What is the core of fraud? Simply put, it is "deceiving people into paying money (deceptive means + subjective intent) + others losing money + social harm". Specifically, according to the provisions of China's Criminal Law on fraud, fraud refers to "the act of defrauding public or private property by fabricating facts or concealing the truth for the purpose of illegal possession". Let's break it down:

1. Fabricating facts or concealing the truth : These "meme coins" often have little actual value, and don't even have a decent technical white paper. They rely entirely on "celebrity endorsements" and "dreams of getting rich quickly" to deceive people. The propaganda is exaggerated, but in reality it is nothing. Isn't this "fabricating facts"?

2. Purpose of illegal possession : to increase the price to attract people to buy, then dump the price and run away. This is obviously for personal profit rather than a genuine project.

3. Defrauding property : Investors’ money goes into their pockets, but the coins turn into air, resulting in a total loss of all their money.

If the evidence is irrefutable, this behavior would definitely constitute fraud! Not to mention the possibility of "illegal fundraising" or "pyramid schemes" - after all, this "recruiting people" and "quick in and quick out" model is a twin of pyramid schemes.

Ronaldinho’s “platform crash”: unintentional aid and abetment or deliberate “promotion”?

Let's talk about Ronaldinho again. If the above-mentioned information is true.

He first signed a contract with @R10coin_, then secretly cooperated with a Shenzhen company, and sold the X account to others as a "promotional tool". Is there any legal risk in this matter?

If Ronaldinho knew that the other party was a fraud gang and helped to attract people to the platform, he would be an "accomplice" and could be held jointly responsible for the crime of fraud. But what if he just took the money and tweeted without knowing anything? Then he is at most a "tool man" and may not be directly held accountable in law. However, he cannot escape civil liability - if the contract was signed more carefully, @R10coin_ could sue him for breach of contract and demand compensation for losses.

But then again, would an international superstar really not know the tricks of these "meme coins"? Friends who have been in the cryptocurrency circle know that this "celebrity effect" is often a common trick used by fraud gangs. Investors see celebrities on the platform and pay money out of excitement, but the idols just walk away, leaving a mess behind. It seems that now everyone wants to use the cryptocurrency circle as an ATM.

So, regardless of whether Ronaldinho did it on purpose or not, his "crash" reminds us that celebrity endorsement does not mean reliability!

Having said that, the cryptocurrency world has been messed up like this, and the regulatory authorities have no choice but to clean it up.

What should investors do? Don’t let the “dream of getting rich quickly” blind you

Seeing this, you may ask: "Lawyer, I just want to make some quick money, what are the "anti-cutting secrets"?" Don't worry, I will give you a few tips to protect the safety of your wallet:

1. Don’t believe in the “celebrity effect” : Whether it’s Ronaldinho or other big Vs, the platform does not mean it is reliable. Check the project background, look at the white paper and the technical team, don’t just listen to the bragging.

2. Beware of “quick pull and quick dump” : If a coin skyrocketed right after it was launched, and the promotional slogan is “miss this opportunity, miss it”, it is probably a trap. Real projects are not so urgent.

3. Play for fun, don’t go all in : You can play if you want, but don’t bet your entire fortune. Invest some pocket money, if you lose, take it as a lesson, if you win, take it as extra money.

4. Call the police if you are cheated, don't delay : If you find that you have been cheated, don't hesitate, call the police directly. Keep the transfer records, chat screenshots, and get as much evidence as possible, as the police rely on these to solve the case.

Conclusion: The cryptocurrency world is a long one, so be cautious

Ronaldinho's "coin issuance scandal" is just a microcosm of the chaos in the cryptocurrency circle. Those "coin issuance factories" have cheated countless dreamers by relying on false propaganda and quick harvesting.

Although the law has a "tight ring" - various charges are fully applicable to certain behaviors, China's attitude towards cryptocurrency investment is "at your own risk". Many scammers are also taking advantage of this loophole. If you invest in cryptocurrencies such as USDT, there is no guarantee that you will be able to get it back even if you report it to the police.

Therefore, investors' own awareness of prevention is the first line of defense.

Friends, at a time when many people regard the cryptocurrency world as an ATM, we should not become a "IQ tax" harvesting site. If you buy lottery tickets for entertainment, you can, but don't take the "dream of getting rich quickly" seriously. Open your eyes, hold your wallet tightly, and don't let your hard-earned money become someone else's sports car and mansion. After all, Ronaldinho on the court can knock down his opponent, but in reality, you should not be confused by the "coin factory".